Throughout the years, money has taken on a variety of forms, from basic barter systems to complex financial methods. One type of money with an intrinsic value and function is commodity money, which includes gold and silver coins. Gaining knowledge about commodity money and its origins can help you better understand monetary policy and economic history.

These days, we take credit cards and digital currencies for granted. However, everything was different before. Precious metals and other goods were not employed as currency in prehistoric societies; agricultural produce was the primary source of commodity money, which derives its value from the substance itself, as opposed to fiat money, which depends on confidence in the government issuing it. In this article, we will focus on commodity money’s traits, historical applications, and current economic function. By exploring this concept, you can better understand commodity money’s purchasing power and why it was commonly recognised as a legal tender.

Key Takeaways

- The value of commodity money comes from the materials used to make it.

- Historically, commodity money has been used, demonstrating its acceptance and stability in commerce.

- In contrast to fiat money, which is dependent on confidence in the government issuing it, it has inherent worth.

- Gaining knowledge of commodity money can help you better understand economic history and policy.

What is Commodity Money?

A form of money known as “commodity money” gets its value from the material it is composed of. Commodity money is supported by a tangible good with inherent worth, as opposed to fiat money, backed by a government decree. A few examples are coins made of gold, silver, and other tangible assets. Commodity money is generally accepted in commerce and serves as a store of value and a medium of exchange.

Historically, several civilisations have employed a variety of commodity currencies; let’s take a look at some of them:

- Gold has been a valuable commodity for ages because of its scarcity and resilience. Because of its value as a precious metal, it was a trustworthy store of value and medium of trade.

- Like gold, silver has been used extensively in coinage. Because of its relative availability in comparison to gold, it was a sensible option for regular transactions.

- Tea has been used as a medium of exchange in several cultures. It was useful because of its great worth and commercial attractiveness.

- In some communities, especially those where they were rare and highly prized, alcoholic beverages have functioned as money.

- Because of their distinctiveness and cultural value, seashells were used as currency in many regions of Africa, Asia, and the Pacific Islands.

Early Use of Commodity Money

Trade networks based on the direct exchange of goods for other goods gave rise to commodity money. Due to the drawbacks of barter, namely, the requirement that two distinct desires coincide, some goods became the accepted norm for exchange.

In prehistoric Mesopotamia, barley was a common form of currency. In ancient Egypt, grain, livestock, and valuable metals like gold and silver were used as money. In some areas of Africa and Asia, cowry shells were used as currency, and in other communities, salt held sufficient value to be employed as such.

Commodity money evolved with the development of economies. Due to their limited quantity, durability, and divisibility, gold and silver gained prominence. To facilitate commerce, these metals were struck into standardised coins.

The intrinsic value of commodity money offered a solid basis for commerce and economic relations. However, its physical characteristics, such as storage and transportation problems, also presented difficulties. These restrictions eventually prompted the creation of fiat currencies and representative money, which provided more versatility and usability.

With the simple commodity money definition, it’s evident that it is not very common in the modern era but is an essential aspect of economic history. Gold remains a part of the reserves held by central banks, including the Federal Reserve. In times of financial turmoil or economic downturn, commodity money frequently reappears as a reliable means of transaction.

Characteristics of Commodity Money

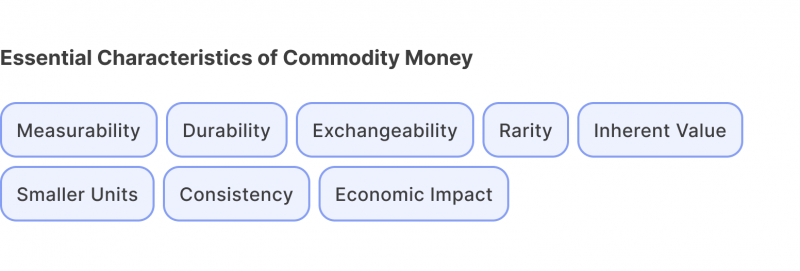

Logically, commodities should have essential characteristics and acceptance in a given economy. Below, we discuss several important aspects:

Measurability

Commodity money needs to be readily measured for it to be appropriately valued. This feature enables users to precisely ascertain the value of tangible commodities such as gold or silver coins or cash. These commodities’ value must be quantified and confirmed for continued faith in the monetary system.

Durability

Commodity money must survive physical wear; therefore, durability is essential. For example, the endurance of gold or silver ensures the commodity can be utilised repeatedly over extended periods without experiencing considerable depreciation. Its durability lends weight to its continuous use as a reliable trade means.

Exchangeability

Commodity money’s ability to be traded easily is crucial to its operation. Exchangeability guarantees that commodities can be easily exchanged for products and services. Facilitating commerce promotes economic growth and renders commodity money a practical choice for various transactions.

Rarity

Commodity money is more valuable when it is in restricted supply. Gold and silver retain their worth over time because they are rare and difficult to duplicate or find in large quantities. Due to their scarcity, these commodities have historically been selected as money.

Inherent Value

Because it represents a physical good, commodity money has inherent worth. It is valued for the commodity itself, as opposed to today’s fiat money, which depends on confidence in the issuing body. Because the commodity’s value is widely acknowledged, it gives the currency a solid base.

Smaller Units

Commodity money is scalable, allowing for smaller denominations to be used for more straightforward transactions. For example, several denominations of gold coins can be produced, facilitating more accurate transactions. This adaptability allows a greater range of economic activities by simplifying transactions with varying values.

Consistency

The physical characteristics of the commodity and the steady demand for it serve as the foundation for the stability of commodity money. Due to its solid form and restricted quantity, commodity money maintains its value in contrast to fiat currency, which is vulnerable to monetary policies and inflation.

Economic Impact

The use of commodities significantly impacts the economy. Since the availability of the underlying commodity influences the quantity of money in circulation, this can impact the money supply. Because of this link, commodity money is an essential part of economic theory, which can affect inflation rates and general financial stability.

Granting Authority

Even if the value of commodity money is derived from the product itself, the function of an issuing body, like a Federal Reserve Bank or central bank, is still crucial. These organisations can control the amount of money in circulation and guarantee the legitimacy and standard of the commodity money in use.

Transition to Fiat Currency

Many economies have switched from using commodity money to fiat currency throughout history. This change allowed the implementation of more flexible monetary policies and printing money to change the money supply in response to economic changes. Nonetheless, the underlying ideas of commodity money still impact economic theory and practice.

Current Significance

Even though fiat money currently rules most monetary systems, commodity money’s qualities still apply. Ideas like inherent value, durability, and exchangeability still shape talks concerning alternative currencies and the future of money. Commodity money’s guiding principles provide essential insights into the growth and stability of monetary systems.

It is believed that the first primitive forms of commodity markets and commodity-based money arose in Sumer between 4500 and 4000 BC.

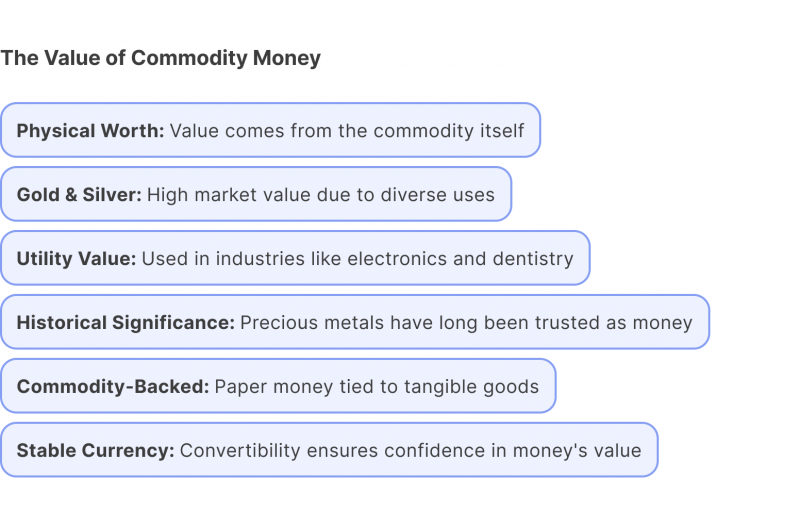

What Gives Commodity Money Its Value

The value of the physical commodity that commodity money symbolises gives it its value. It has intrinsic worth because of the substance itself, as opposed to paper money, which is valued based on confidence in the government that issues it. For instance, a coin made of gold has value because gold is a valuable metal with a high market value.

Commodity money serves as more than just a means of transaction. Silver and gold are examples of commodities with valuable applications in various sectors. While silver is found in solar panels, medical gadgets, jewellery, and electronics, gold is used in dentistry. Their utility value upholds their value as money.

So, everything is straightforward. To once again demonstrate the concept of intrinsic value, consider the historical use of precious metals as money. These metals have this value because of their rarity, durability, and attractiveness. For example, gold has been valued for centuries due to its usage in industrial, electrical, and jewellery applications. Its diverse usage raises its overall value and confirms its status as a trustworthy wealth storage.

Similarly, salt has great intrinsic value and was once a necessary item for food preservation. Its significance in day-to-day living influenced its popularity as a currency in different communities.

Commodity-Backed Money

A system referred to as commodity-backed money was created based on the intrinsic value of commodities. In this system, paper money was correlated with a fixed amount of tangible goods, usually silver or gold. This connection concretely guaranteed the currency’s worth.

For example, during the gold standard, paper money could be exchanged for a set amount of gold. Because the value of the money was tied to the precious metal, direct convertibility guaranteed public confidence in the currency’s stability. Gold produced a stable monetary system because of its value and function as the foundation of money.

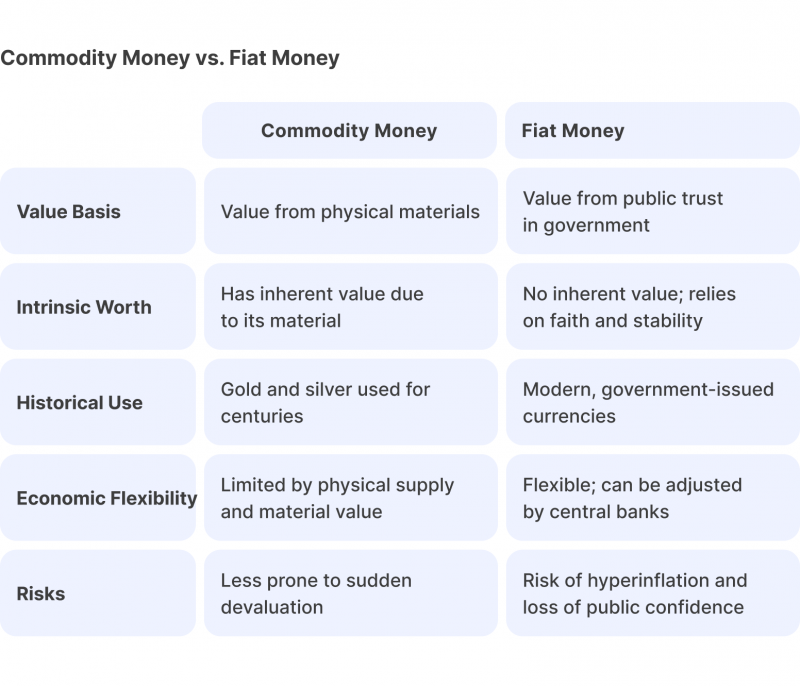

How Commodity Money Differs from Fiat Money

Before comparing commodity vs fiat money, let’s briefly discuss the latter. A government-issued form of fiat money lacks inherent value and is not supported by a tangible asset. Instead, the people’s faith and confidence in the issuing government and its economy is what gives it its worth. The Japanese yen, the euro, and the US dollar are contemporary instances of fiat money. The value of fiat money is wholly dependent on faith. It is upheld by the government’s ability to regulate supply and demand, in contrast to commodity money, which derives its value from the material it is made of.

Comparison of Value Sources

The materials that make up commodity money are what gives it its value. For instance, because gold is a valuable commodity in and of itself, gold coins have intrinsic value. Because of their intrinsic value and scarcity, commodities like tobacco, silver, and even cocoa beans have been used as commodity money throughout history. In ancient times and colonial America, gold and silver were commonly accepted forms of payment, making this kind of money commonplace.

Conversely, fiat money has no inherent worth. The government that issues it and the general confidence of those who use it define its value. Although this trust-based value system allows for more flexibility in controlling the economy, there are also possible risks. The economic policies of the government issuing the money, as well as the degree of public trust in its stability and budgetary responsibility, can affect the value of fiat money.

Risks Associated with Fiat Money

Fiat currency comes with several risks, one of which is hyperinflation. When a government prints too much money, the value of the currency collapses, and prices soar. Germany in the 1920s, Zimbabwe in the 2000s, and Venezuela more recently are historical examples. In these instances, the currency’s value collapsed as a result of excessive money printing that eroded public faith in it.

Another risk is a potential loss of public confidence. Fiat money is based on faith, so any incident that makes people less confident in it could cause it to devalue quickly. Political unrest, inadequate fiscal policies, or economic volatility that undermines confidence may cause people to seek out alternate means of payment or return to a barter economy.

It also relies on the stability of the issuing government. Governments sometimes print additional money to fund their operations during a financial crisis or a war. If the currency entirely loses value, this could result in inflation or an economic catastrophe.

In addition, central banks have the authority to produce money at will and manage and govern fiat money. This authority presents the possibility of poor administration but also permits economic action. Currency devaluation and economic instability can result from central banks’ errors in judgment or careless actions.

Crypto and Commodity Connections

One might wonder what crypto has to do with commodities, but the idea of commodity money has interesting similarities to cryptocurrencies, which are frequently hailed as the financial technology of the future. The two systems aim to establish a medium of exchange and store of value that is not dependent on conventional fiat currencies.

Like their historical ancestors, the design of many cryptocurrencies emphasises scarcity. Just like gold or silver, the quantity of Bitcoin, let’s say, is limited. When demand exceeds supply, scarcity can lead to price appreciation. Furthermore, there have been times of volatility in both commodities and cryptocurrencies, which is a reflection of both external pressures and market dynamics.

However, their physical characteristics make a significant difference. Commodity money is physical, but cryptocurrency money is all digital. Although this digital nature has benefits regarding transferability, security, and divisibility, it also presents particular difficulties regarding acceptance and regulation.

Last Remarks

Historically, steady value has been offered by commodity money during times of economic turmoil. It is essential to understand its background since it clarifies the fundamental ideas of economic systems. Because of its restricted quantity and value, commodity money was more universally accepted than fiat currencies, which were freely issued. Trade and other financial activities were made more accessible by this type of money. Even if they are less prevalent now, the ideas behind commodity money nevertheless impact stability and monetary policy because they provide information about the long-term worth of material possessions.

FAQ

What is the value of commodity money?

It has inherent worth because it is derived from or backed by precious metals. Inflation, however, might result from devaluation or a rise in the availability of certain metals.

What is the value of commodities?

The market value of the material—such as metal—from which money is generated is its commodity value. For example, coins used to be valued according to the value of metal inside them.

What were the first types of currency?

Commodity money was one of the most common forms. It was valuable because of the material it was constructed of.