Solutions

Orchestrate your wallets, transactions, deposits, payouts, stakings and security

Features

Core Functionality

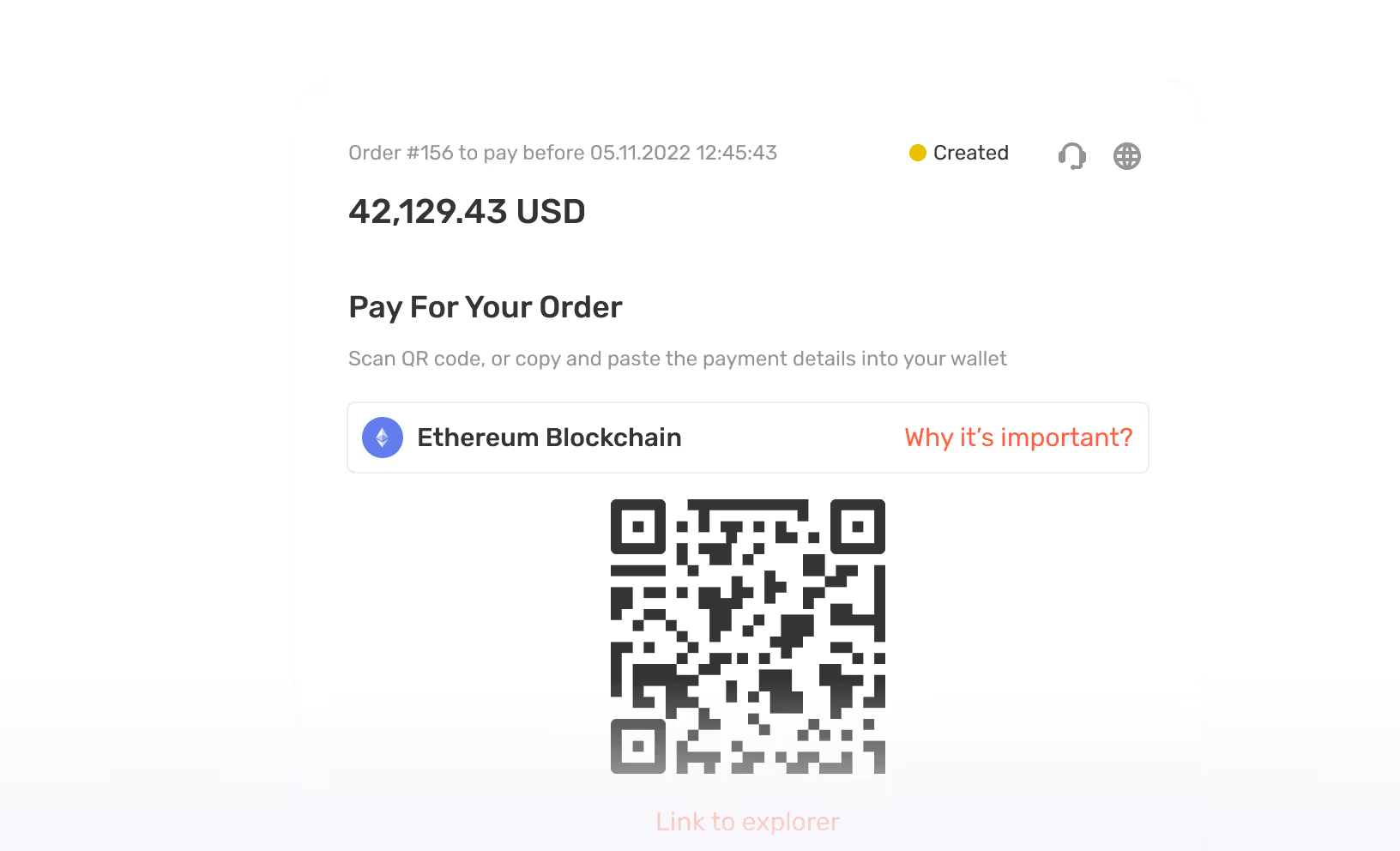

Accept crypto payments in all major coins and exchange it all into fiat, coins or stablecoins

Features

Crypto Payment Processing

Access global equities with single-stock CFDs from a single account

Features

Wallet as a Service

Access deep liquidity with tight spreads, optimal prices, and extensive market depth

Features

Swaps

Features

Staking

Solutions

Customers

Merchants

Reap the benefits of online market by accepting crypto payments

Online Games

Offer users the chance to play using crypto

Travel Industry

Allow clients to make bookings with crypto

FOREX & CFD Brokers

Offer trades a way to top up their accounts with cryptocurrencies

Legal and Consulting Services

Provide your clients a way to pay for your services in crypto

Marketing Agencies

Attract new clients by accepting payments in cryptocurrencies

Gambling

Crypto payments for online gambling industry is worth billions

E-commerce

Offering crypto payments to customers is now the advantage

Hedge / Investment Fund

Increase your revenue with crypto payments

Customers

Developers

Supported Blockchains & Coins

List of blockchains and coins that are supported by B2BINPAY

Swap Pairs & Limits

Lineup with available currency pairs and info about its limits

Guides (How to)

Step-by-step tutorials how to use the B2BINPAY Web UI

Release notes

Changes, enhancements, bug fixes, and new features

Supported Stablecoins

List of stablecoins that are supported by B2BINPAY

Minimum Deposits & Withdrawals

Full information on currencies within each solution

API

Description and available methods of B2BINPAY API

Supported Tokens

List of tokens that are supported by B2BINPAY

Developers

Company

Pricing

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

-2.avif)

.avif)