The advent of digital ledger technology has made it possible not only to buy digital art objects in the form of NFT, to interact with people in the virtual spaces of metaverse, and to earn money in the gameplay of blockchain projects GameFi but also the unique opportunity to make fast, convenient and secure transnational payments with cryptocurrency payment solutions that are changing the market beyond recognition today.

This article will detail what cryptocurrency payments are, what impact they have on the market, as well as what potential obstacles you may encounter when working with them.

Key Takeaways

- Cryptocurrency payment technology is designed to completely displace the current traditional payment systems.

- As part of the global financial system transformation, crypto payments will reduce the influence of banking institutions, create a crypto payments regulation system, digitalize the national currency system of states, and displace the existing traditional global payment systems.

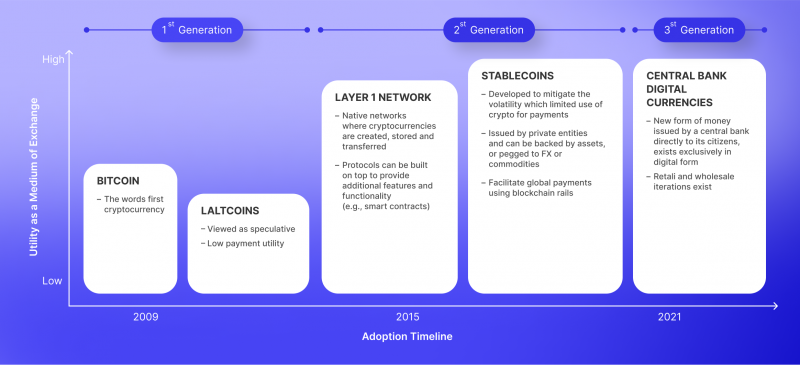

- One of the varieties of digital assets intended for cryptocurrency payments are CBDC, designed to ensure the stability of the national currency.

Overview of Cryptocurrency Payments

Despite their brief lifespan, cryptocurrencies have had a profound impact on history. The blockchain technology behind them is already enabling the usage of new kinds of assets to facilitate payments. With the establishment of the first cryptocurrency, Bitcoin, in 2009, the field of cryptocurrencies has advanced significantly. The emergence of third-generation digital currencies, also known as central bank digital currencies, is a prime example of this.

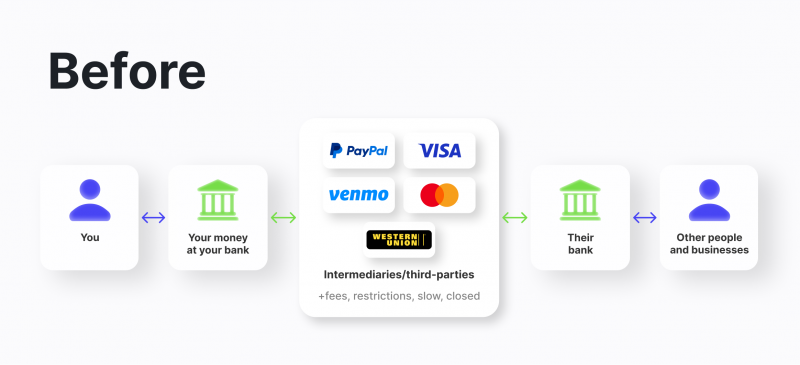

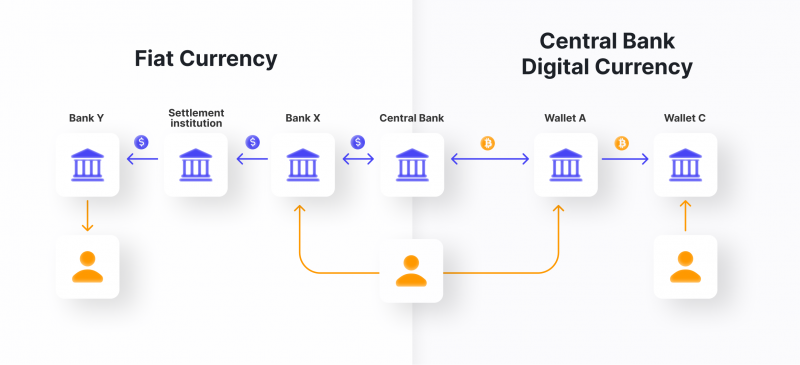

Because of the design of the protocol in which they are built, cryptocurrencies, which assert to fulfill the role of a payment system a priori, also serve as a payment system. The situation is different with traditional fiat currencies. For instance, the US dollar, which is a means of payment, can be accepted as payment for goods or services in cash (in which case the payment system as such does not exist) or in non-cash through the payment system Visa, Mastercard, and others. A distributed registry serves as a payment mechanism within which settlements are performed for cryptocurrencies, as they can only be purchased in non-cash form (due to their lack of physical representation).

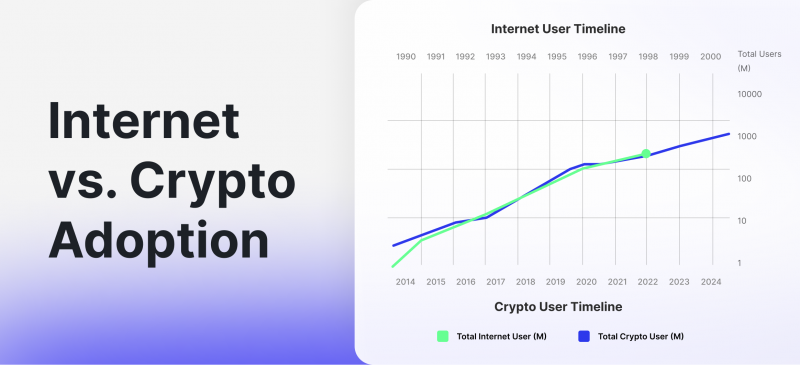

There has been an increase of over 173,000% in Bitcoin’s value between 2015 and 2023. During the period of 2019 to 2025, the cryptocurrency market is expected to grow with a compound annual growth rate of 56.4%, as Bitcoin reached an annual growth rate of 60% in 2021.

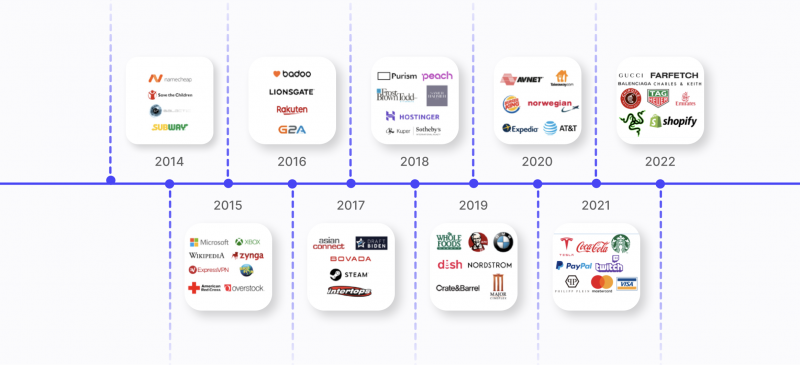

Since 2013, with the development of crypto payment systems and their active implementation in the financial system, many large and well-known international companies have begun integrating this technology into their business processes to simplify and accelerate transactions between their partners and customers. Due to its many indisputable positive aspects, crypto payments have become a priority payment method, eclipsing traditional payment methods.

According to many reputable sources, Bitcoin consistently ranks first among the most popular crypto assets for payments.

The Impact of Cryptocurrency Payments on the Market

The global payment industry is undergoing significant changes due to the widespread integration of crypto processors into companies’ infrastructure to use blockchain technology’s advantages in transactions between individuals and legal entities.

Representatives of the payment systems industry are positive about digital assets and are confident that they are the future. The Faster Payments Council (FPC) and the digital blockchain payment system Ripple created a report that details the possibilities of cryptocurrencies and their impact on the market.

Let’s consider crypto payments’ main spheres of influence in the modern financial system. To understand how crypto payments affect the market, it is necessary to understand that today, this technology is widely known and therefore has become an object for all sorts of experiments in the framework of payments using different crypto assets. On the other hand, it is imperfect and has flaws, which affect not only the business’s credibility, but also raise doubts among representatives of government agencies.

1. Reducing the Influence of Members of the Banking System

Today, banks play an essential role in the process of both local and international currency payments. As an integral part of both the banking and national financial systems, they are designed to provide stable and secure interaction with all payment structures involved in the verification and execution of payments.

The emergence of cryptocurrencies already makes it possible to exclude the participation of any banking sector organizations in the process of payment for goods and services between individuals and between legal entities. Because blockchain technology is decentralized, every crypto payment, regardless of the coin being sent and its volume, is sent directly from the addressee to the recipient within the established blockchain, which may charge a fee for making the payment, which is usually insignificant.

2. Creation of the System of Cryptocurrency Payments Regulation

Traditional payment systems worldwide have a set of normative documents regulating their work. All existing payment methods today, the most prominent of which are Visa, MasterCard, and American Express, have some limits in one or more countries. Since the bank is one of the links in the payment processing chain, it can impose certain limits related to using bank cards. At the same time, any state can do the same, imposing restrictions on banks.

The development of the crypto-payment system is already leading to the fact that every state, as well as many financial institutions, is developing a set of regulations and other regulatory documents that will help control this technology, which will have a variety of consequences.

3. Digitalization of the National Monetary System of States

Strengthening the role of digital assets based on distributed ledger technology could, in a sense, be a transition from an account-based payment system to one based on the value of the crypto asset. The main property of account-based systems is that the transfer of claims is recorded in an account with an intermediary, such as a bank. The functioning of a value-based or token-based system, by contrast, comes down to the transfer of an object of payment, such as a commodity or paper currency. The bottleneck here is verification of the value or authenticity of the payment object, regardless of the credibility of the intermediary or counterparty.

4. Displacement of Existing Traditional World Payment Systems

The incredible development of crypto-payment technology today makes it possible to significantly reduce the share of global giants in the field of payment services, which has a direct impact on the global economic structure. As a result, there is a massive adoption of the crypto-payment system, which, by the way, has a huge set of advantages and offers an inconceivable choice of coins that can be used to pay for any kind of goods, services, and services. The pace of adoption and implementation of the innovative payment system using digital coins today makes it clear that very soon we will see a complete transformation of this industry, as a result of which paper money may disappear forever.

5. Development of Competition on the Market of Crypto Payment Systems

Competition is a natural market reaction to an increase in the number of companies that provide the same service and sell the same product. Today’s market for crypto processing solutions has hundreds, and maybe even thousands, of companies that offer their solutions for using virtual assets as payment for both business and personal purposes. Since these companies always strive to be better than each other and offer only the highest quality tools for crypto payments, healthy competition helps to move the development process forward, while creating the ground for new ideas and developments.

6. Creating Available Terms of Use for Crypto as a Means of Payment

According to statistics, 1.7 billion people do not have access to bank accounts and are on the verge of accessing financial services. Thanks to cryptocurrency, individuals who do not meet the criteria of banking institutions can now freely and efficiently exchange and store currency and make payments with it. Since the advent of Bitcoin, international transactions have evolved significantly with faster, easier, and cheaper options for sending money overseas. Cryptocurrency and blockchain technology have created countless payment solutions, distributed large amounts of capital, and completely changed the idea of money. Because of these small but effective ways, cryptocurrency has transformed the entire financial system, eliminating lengthy transactions and allowing more people to keep their money safe.

Potential Challenges of Cryptocurrency Payments

Without a doubt, the introduction of such promising technology as crypto payment systems will help to eliminate a number of inconveniences associated with the use of traditional payment methods, whether it is a bank card, the use of digital payment applications, or cash. However, there are several obstacles that stand in the way of developing solutions that accept crypto as payment.

Public Skepticism

Distributed registry technology is very young and not fully understood. Despite the fact that it has gained widespread popularity, its application is limited by many factors that constrain both its development and its adoption. Today, a very large number of both private traders with investors and large corporations are very skeptical about crypto technologies and crypto payments in particular. This is because, as with any technology, there is always a chance that something will go wrong, and this fact keeps many people from choosing this option in order to avoid the unpleasant consequences of even the smallest mistake, which could lead to the loss of funds.

Technical Infrastructure

This problem arises from the novelty of crypto payments technology, which has not yet managed to create the necessary conditions for the full and convenient use of tools for working with crypto payments. This problem is not a serious obstacle in order to already use different digital coins for sending, receiving, or storing on a small scale, however, we are talking about the global implementation of such a technology, it will take more time to develop and implement the necessary systems for making crypto payments.

Security

Security has always been an important priority in the financial world. Ensuring the security of payment transactions, as well as the safekeeping of financial assets, has always received special attention in order to prevent fraudulent transactions. Crypto payments is a very vulnerable area of finance today due to its young age and weak infrastructure, which, however, is systematically developing. Practice shows that any field of crypto technology development that is widely known is subject to cyber-attacks or other kinds of fraud, which also generates skepticism about its use.

Volatility

Volatility is the biggest obstacle to the acceptance of cryptocurrency payments. Many investors and business owners believe that this factor can play a cruel joke at the most crucial moment. However, despite high volatility, the overall cryptocurrency market is growing. A number of states are reconsidering their attitude to cryptocurrencies, developing legal mechanisms to regulate them. Major media personalities are investing in cryptocurrency and publicly supporting cryptocurrency projects. Shares of Coinbase, one of the largest cryptocurrency exchanges, have been traded on the NASDAQ stock exchange for over a year. ETFs based on cryptocurrency assets are being created around the world.

Peculiarities of Legislation

In the modern world, there are many types of digital currencies, and states still need to develop uniform standards for their regulation. At the moment, it can be assumed that forming a single base that would establish the legal status and relations in the circulation of cryptocurrencies is a matter of time.

The big problem of most countries in implementing the legal support of cryptocurrencies is the lack of a large part of their state revenues, which indicates the shortcomings in the established system of regulation of digital coins that countries have yet to eliminate. However, there is no doubt that every state will tightly regulate every aspect of crypto payment technology.

Conclusion

There is no doubt that in the near future, crypto payments will become commonplace, completely replacing the usual methods of payment, both within the business and between individuals. The world economy will change forever, and with it will change the typical view of money. Thanks to digitalization, it will have a new value, help overcome the boundaries of the impossible, and determine the future development of crypto technologies.