Solutions

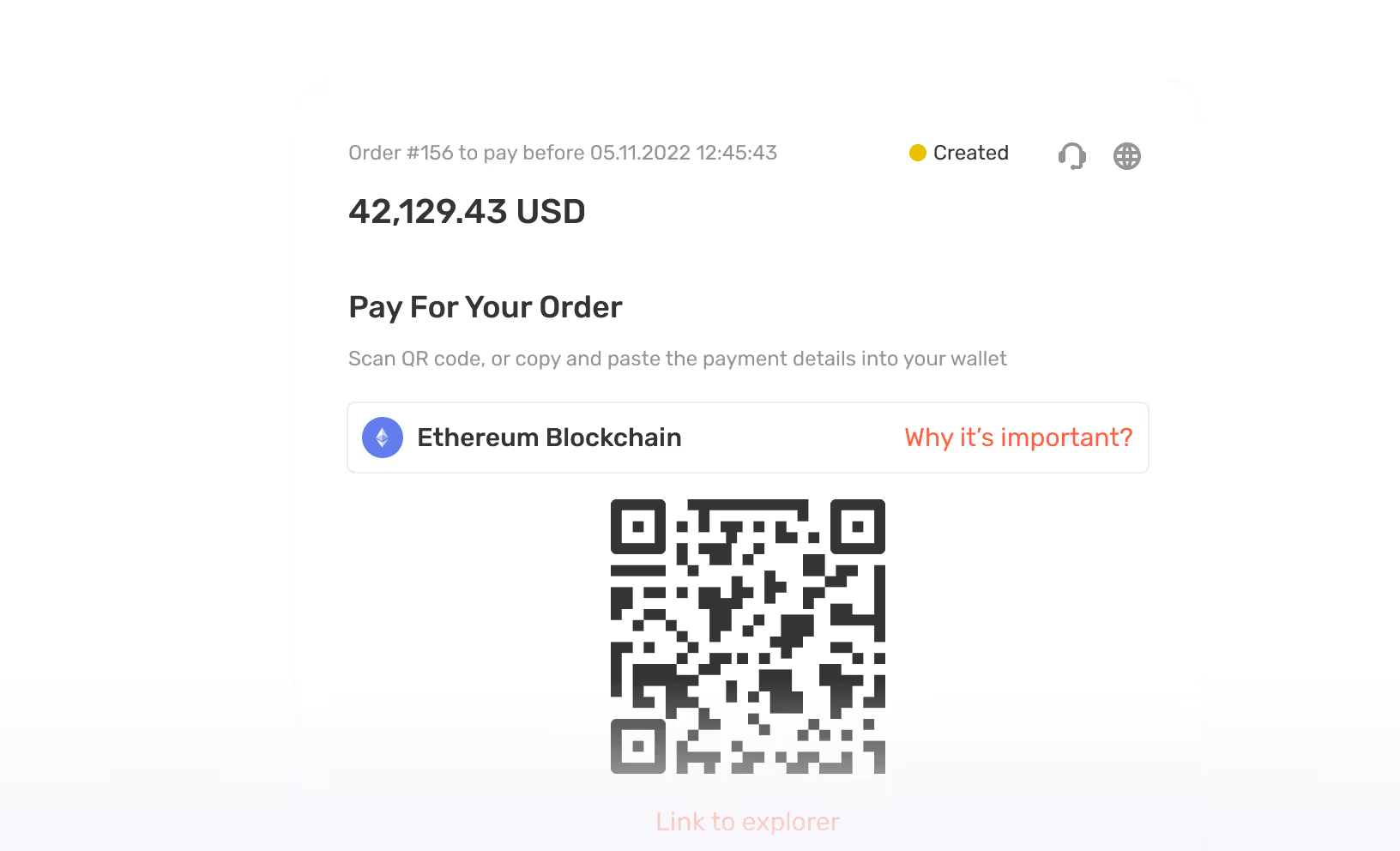

Accept payments effortlessly with our crypto payment gateway

Features

Core Functionality

Orchestrate your wallets, transactions, deposits, payouts, stakings and security

Features

Core Functionality

Accept crypto payments in all major coins and exchange it all into fiat, coins or stablecoins

Features

Crypto Payment Processing

Perfect solution for crypto swaps and high-volume businesses

Features

Wallet as a Service

Access deep liquidity with tight spreads, optimal prices, and extensive market depth

Features

Swaps

Features

Custody

Solutions

Customers

Merchants

Reap the benefits of online market by accepting crypto payments

Online Games

Offer users the chance to play using crypto

Gambling

Crypto payments for online gambling industry is worth billions

E-commerce

Offering crypto payments to customers is now the advantage

Adult

Best Crypto Payment Gateway & Processor for Adult Platforms with low fees and secure processing

Donation Tools

Receive crypto donations easily with B2BINPAY's processing

Payment Button

Integrate a crypto payment button to accept payments or donations

Customers

Developers

Supported Blockchains & Coins

List of blockchains and coins that are supported by B2BINPAY

Swap Pairs & Limits

Lineup with available currency pairs and info about its limits

Guides (How to)

Step-by-step tutorials how to use the B2BINPAY Web UI

Release notes

Changes, enhancements, bug fixes, and new features

Supported Stablecoins

List of stablecoins that are supported by B2BINPAY

Minimum Deposits & Withdrawals

Full information on currencies within each solution

API

Description and available methods of B2BINPAY API

Supported Tokens

List of tokens that are supported by B2BINPAY

Developers

Company

Media

Pricing

.svg)

.svg)

.svg)

.svg)

.svg)