Operating in the crypto landscape requires adapting to a wide range of virtual coins and blockchain-based tokens. Users are becoming increasingly aware of the numerous benefits cryptocurrencies provide, and the best way to accommodate these changing preferences is by adopting the most advanced technologies that suit their tastes.

Ripple emerged as a solid option for receiving payments if you offer products and services or brokerage services. XRP transactions are among the fastest among altcoins, with low fees and quick processing.

Integrating this solution into your website is straightforward, but it can get daunting for non-technical users. Let’s review why you need to accept Ripple payments and how to start.

Key Takeaways

- Ripple payments are faster than Bitcoin and Ethereum for online transactions.

- Ripple Labs established connections with traditional financial institutions and banks, which helped its global reach.

- XRP coins are pre-mined, and payments can be confirmed within six seconds.

Ripple Cryptocurrency Overview

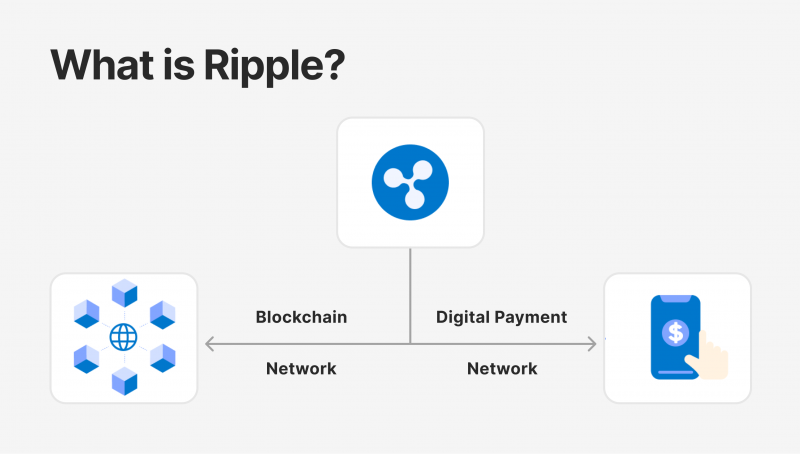

Ripple is one of the oldest cryptocurrencies on the market, having existed years before some of today’s top five coins. Ripple coin was released in 2012, before Ethereum (2015) and BNB (2017) saw light.

In fact, the founding team at the Ripple Lab started working on the project in 2004, years before the first Bitcoin came into existence. The intention was to create a decentralised payment system that combats the centralised control of government and financial regulators.

The project accelerated as the XRP developing team aimed to provide a faster processing capability and better interoperability than Bitcoin, overcoming the striking issues of the BTC blockchain.

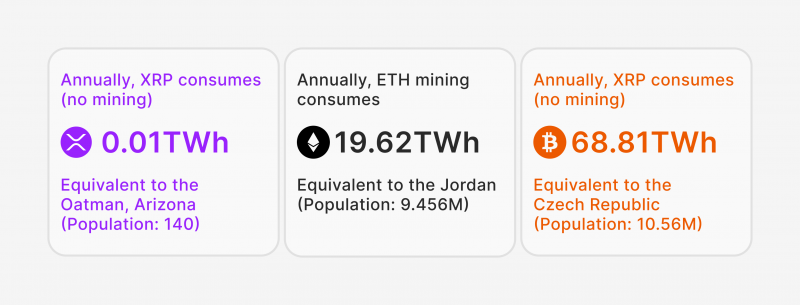

Since then, XRP digital currency has become famous as a flexible, hassle-free, and sophisticated way to build a decentralised ecosystem with a lower environmental footprint.

XRP transactions are faster because coins are pre-mined, eliminating the need to employ strong mining machines to solve equations and consume outstanding energy sources. The founding team, Ripple Lab, acts as an independent firm, allowing it to secure partnerships with major financial institutions and investment banks.

The Growth of XRP Into a Payment Method

The above-mentioned characteristics of quick transaction settlements, cooperation with global financial institutions, and low transaction fees made Ripple one of the leading crypto payment methods to ever exist.

Users and businesses use XRP to issue cross-border payments at a fraction of the cost. Bitcoin and Ethereum, the world’s leading crypto payment systems, require 5-10 minutes to confirm a transaction, which can go up to 30 minutes during network congestion.

However, XRP payment confirmation takes up to 6 seconds, which is phenomenal for merchants and clients who want quick settlements. This ultra-fast speed is attributed to the fact that no mining process is involved in the transaction.

This motivated many businesses to accept Ripple payments, contributing to quick service delivery, especially for those that require instant settlements, like gambling sites that accept cryptos and brokerage firms.

Nevertheless, the XRP Ledger, the Ripple blockchain, is equipped with an outstanding processing capability of up to 3,400 transactions per second, which puts it at the top of crypto payments for businesses and startups.

Why Should You Accept Ripple Payments?

Crypto wallets are becoming common, and businesses, including centralised financial institutions, are adapting to digital assets, whether for trading or simply processing transactions. Ripple payments have proven to be superior to other cryptocurrencies in the following ways.

Globality

Almost all blockchain-based currencies and tokens are accessible worldwide. However, XRP benefits from close ties with financial institutions and low computing requirements, which makes it preferable to users and businesses around the world.

Unlike major cryptocurrencies, XRP is less speculative and enjoys low price volatility. Therefore, more companies accept Ripple payments to receive payouts with major value changes during market fluctuations.

The coin has medium volatility, with a price of less than $1 since 2021, moving between $0.52 and $0.62 for the majority of 2024. This medium fluctuation helps overcome the highly changing exchange rates using fiat currency cross-country transfers.

Reliable Security Protocols

Receiving Ripple payments is one of the safest ways to transact with digital currencies. The fact that transactions are settled at ultra-high speed minimises the chance of being breached or redirected.

Hackers usually target operations in the mempool, where transactions wait to be picked up by validated nodes.

Additionally, Ripple uses an 80% consensus method, passing payments only after the vast majority approves them. When the rate of flawed nodes exceeds 20%, the blockchain stops functioning to address the malfunction in the blockchain.

The Byzantine fault-tolerant agreement protocol is an additional security layer deployed by the Ripple network. The validating nodes approve transactions despite being faulty. However, they declare the list of ill-functioning participants during the verification process.

Outstanding Transaction Speed

One of the main reasons users migrate from Bitcoin and Ethereum blockchains is the elevated transaction speed and irregularity of processing time. BTC payments can happen momentarily or take up to an hour if the network faces delays, which happen frequently.

Despite Ripple having less market cap than Bitcoin and Ethereum, it provides a faster processing capability, confirming payment in 6 seconds and processing around 3,400 operations per second.

In contrast, the BTC blockchain processes 7 transactions per second, and ETH only recently increased its TPS in the latest Ethereum network update.

Scalability & Interoperability

Ripple Labs emphasises utility and scalability. Businesses can seamlessly accept XRP payments whether they operate a low-volume e-commerce site or a brokerage platform with hundreds of thousands of users.

The XRP blockchain is home to over 1,500 DeFi projects and applications powered by multiple minting frameworks, building infrastructure, gaming models, and payment gateways.

Ripple announced its plan to launch a stablecoin later this year backed by US dollars, short-term US treasuries, and other cash assets.

How to Integrate Ripple Payments

Adding a Ripple solution to your website is done through a provider, which offers you API keys with its XRP payment solution, allowing you to accept Ripple as a payment method.

However, you must carefully consider the crypto payment provider to protect your and your users’ funds and data. Here’s how you can do it.

- Inspect the XRP payment provider license and ensure they have acquired a proper digital asset transaction at your location.

- Check out the wallet features and opt-in for those that offer additional asset and invoice management functionality.

- Choose a crypto payment provider that supports a wide range of virtual coins to accept crypto transactions in multiple currencies.

- Find if more features, such as on-ramp exchanges, are offered to accommodate paying in USD to send XRPs.

By signing up for a Ripple payment solution with B2BinPay, you can receive unique API credentials to your website to facilitate XRP payments.

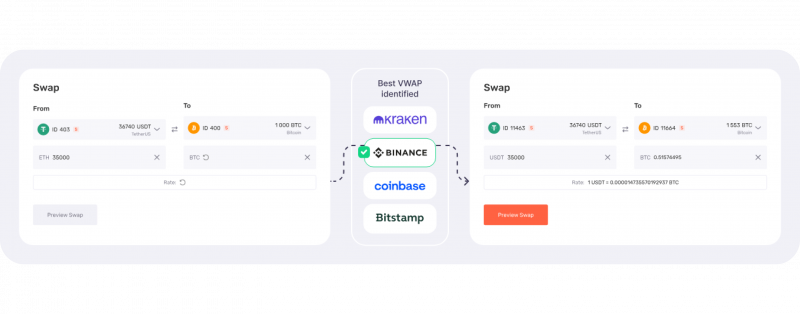

You can explore a wide range of features at B2BinPay crypto wallets, including coin swaps, multi-currency storage and enterprise blockchain management.

Conclusion

Transacting in cryptocurrencies is the new way of doing business. Users are switching to digital coins to send money quickly and at lower fees, while companies are adding blockchain-based currencies to receive payouts almost instantly.

Bitcoin and Ethereum are popular payment methods on e-commerce websites and cross-border transactions. However, companies now accept Ripple payments to cope with the increasing demand for blockchain currencies that offer modest volatility to preserve money value.