The crypto mining landscape has been on the rise ever since 2009, serving as a core pillar of verifying transactions in the entire network. Bitcoin miners are the most common type since Bitcoin has historically offered the highest mining rewards.

However, the cryptocurrency mining community has become concerned in recent periods, believing that this industry could be heading toward a downfall. So, is crypto mining dead, or are we entering the new golden age to get into the market? Let’s explore.

Key Takeaways

- Crypto mining solves complex mathematical equations to generate new crypto units and validate transactions.

- Miners get monetary rewards per each validated block.

- Mining is the most popular niche, but the upcoming BTC halving threatens its profitability.

Exploring the Crypto Mining Landscape

The crypto mining operations started in 2009 when Bitcoin unveiled its transaction verification and creation method. In simple terms, the Bitcoin protocol needs miners to produce new blocks of information into new BTC units. The network also needs miners to validate new transfers and maintain a clean ledger without any questionable transfers entering the system.

Both duties are arguably the most important functions within the Bitcoin network, allowing users to transfer funds safely and securely. Naturally, miners receive ample rewards for their efforts, accumulating financial rewards on each transaction they verify and each block they add to the network. More than a decade after Bitcoin’s initial launch, many other crypto projects are using the mining techniques for their purposes.

How Does Bitcoin Mining Work?

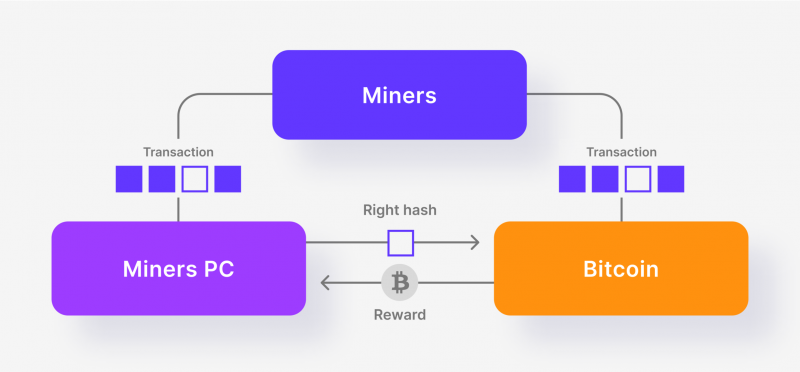

In practice, Bitcoin mining is similar to digital data mining. Individuals require mining rigs to conduct this procedure. Mining rigs are PCs modified to solve complex mathematical equations, creating cryptography keys that, in turn, construct Bitcoin data blocks. Cryptography keys are also helpful in the transfer validation process.

While new BTC unit creation is straightforward and doesn’t involve decisions, miners get to choose which transactions they can verify. Each transaction is initiated by users and stored in the mempools.

Their respective gas fees and volume determine how valuable these transactions are for miners. Simply put, more significant transactions have higher rewards, incentivising miners to prioritise them.

Mining Equipment Considerations

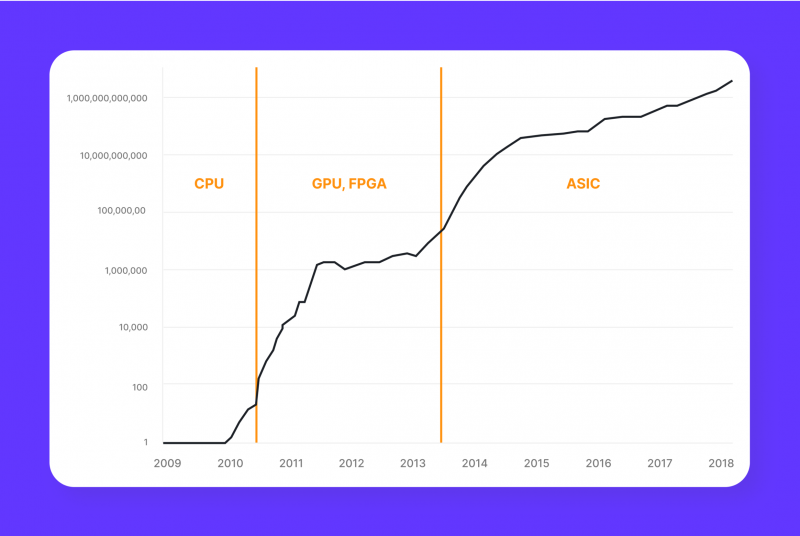

Another important aspect is the mining hardware efficiency. In simple terms, this process is becoming more and more complex with every new transaction or data block. This is because the increasing network size requires more complex computations to retrieve hash keys for the data blocks.

Naturally, the increased computational difficulty requires more powerful PC setups, which has made Bitcoin mining a relatively expensive undertaking. The technology considerations have also changed during the last decade.

Previously, traditional GPU mining could easily handle all complex equations needed to retrieve hash keys. While GPU mining remains relevant for individuals, high-volume block production requires the new ASIC set-up to stay competitive in the modern landscape.

Several years ago, ASIC and GPU mining were comparable in profits and losses; however, ASIC mining has dominated the market in recent years thanks to the optimised computational setup and increased efficiency.

Mining Profitability and Easy Mining Options

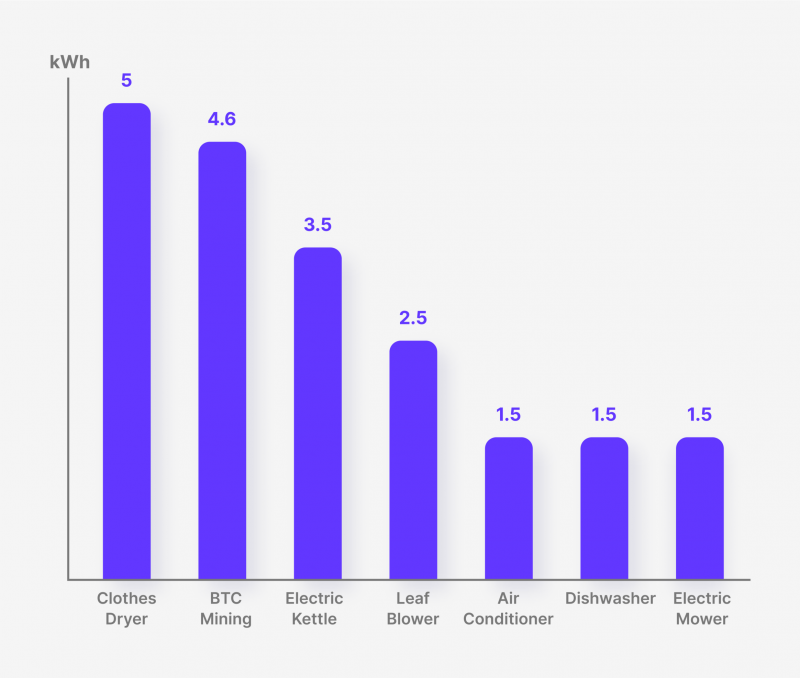

In 2023, mining difficulty has increased considerably due to the increasing network size and fierce competition. Still, BTC mining is rewarding for determined individuals and companies.

However, it is essential to understand that the rewards differ depending on the equipment. Some rigs can produce up to $2,000 in profits daily, while others might be limited to $10. It all depends on the quality of mining rigs and the extent of equipment.

Also, profits must be compared to relevant electricity costs, upkeep or even staff in some cases. With all that said, it is evident that mining is not a job for novice individuals in the crypto field, as it has many hidden costs and variables that should be carefully considered.

What the Bitcoin Halving Date Means for this Industry

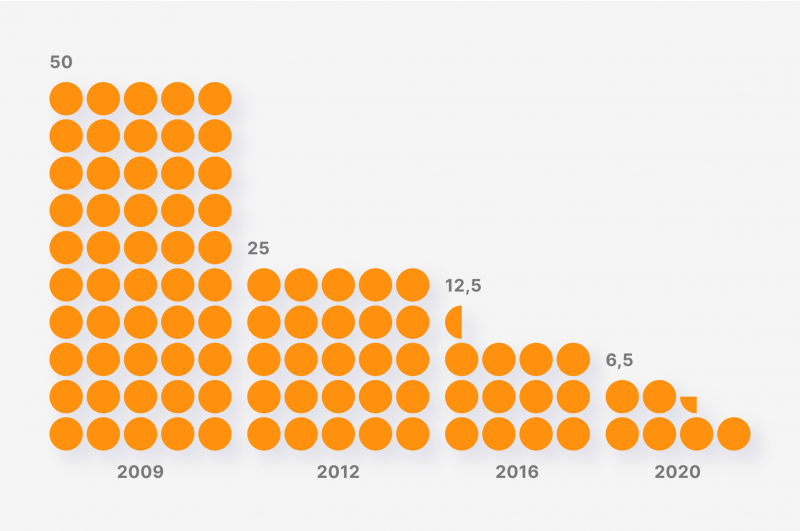

The biggest Bitcoin mining news is the soon-to-happen BTC halving countdown. The last event occurred in 2020, and the fourth is projected to arrive in April 2024.

The profit of generating a transfer block is about 6.25 BTC. This number will shrink to half of its value, becoming only 3.125 BTC. While this number still seems relatively high, the relative costs are massive, including all the direct and overhead expenses.

Naturally, the discussed costs will remain the same, but the profits will only be half their previous amount. While this still leaves miners with a certain amount of net profits, the margin will become much thinner and, in some instances, not worth it for numerous miners.

The halving date is designed to achieve precisely that – decrease the supply to slow down BTC production. However, the supply change might not affect the entire market similarly.

Addressing the “Crypto Mining is Dead” Sentiment in 2024

As discussed above, the Bitcoin halving will shrink the mining supply considerably. However, many experts believe that the latest halving will negatively impact the smaller and mid-sized miners the most, while large-scale miners remain profitable. In simple terms, mining demands a lot of overhead costs, including maintenance, staff and similar expenses.

These costs are much easier to manage in large production, while smaller miners might go below the break-even point. So, the statement saying that crypto mining is dead is only half right.

Bigger miners might even flourish in this case, as they will have more control over the market in the long run.

While the Bitcoin halving 2024 will achieve its goal, it might nudge the market to become more monopolistic and controlled by a few entities instead of a fully-fledged democracy.

It is difficult to foresee the severity of this development, but Bitcoin creators should re-examine their methods related to making Bitcoin scarce.

Considerations for the Crypto Mining Industry in Late 2024

As analysed, the mining industry in 2024 might be much more concentrated and monopolised. Smaller miners will be encouraged to either invest more in their business, team up with other miners or simply go out of business to cut losses.

However, a second scenario might also emerge, where smaller miners thrive in the market. Simply put, large mining companies are expected to achieve wide profit margins. All things being equal, the halving event will shrink their margins in half.

As a result, many companies might move out of the market due to not meeting investor expectations and move into more profitable projects like Litecoin mining. So, smaller miners still have the chance to remain successful in the Bitcoin niche.

Final Thoughts

There are no obvious answers when it comes to considering crypto mining in general. This business is quite competitive and has many complexities and hidden costs that could quickly move you below the break-even point. However, if you manage to set up the initial equipment well, calculate costs accurately and reach an optimal production level, Bitcoin mining could be incredibly profitable.

So, is crypto mining dead? With the upcoming halving and the ever-present price variation, crypto mining in 2024 could easily become unprofitable in the worst-case scenario. But the current market conditions hint at a much brighter future for fellow miners!