The crypto market has been booming in 2023, producing impressive growth rates since the all-time downturn throughout 2022. The trading public is steadily warming up to the active crypto investment practice, increasing the demand for crypto exchanges, brokerages and swaps.

However, trading with crypto assets could lead to bloated gas fees and other charges, decreasing the overall profit margins. This is where crypto swaps come into play, allowing users to minimise investment costs and obtain digital currencies that are generally not available. So, what is crypto swap, and how can traders make money from this novel technology? The article will tell you all about it.

Key Takeaways

- Crypto swaps are fascinating alternatives to centralised exchanges, allowing users to exchange virtual assets directly.

- Swaps are much more cost-effective, often faster and support cross-chain crypto exchanges.

- Swaps are also great solutions for purchasing lesser-known crypto projects that could explode in valuation.

- Despite their plentiful benefits, swaps have downsides, including security, counterparty and slippage risks.

How Does Swapping Crypto Work?

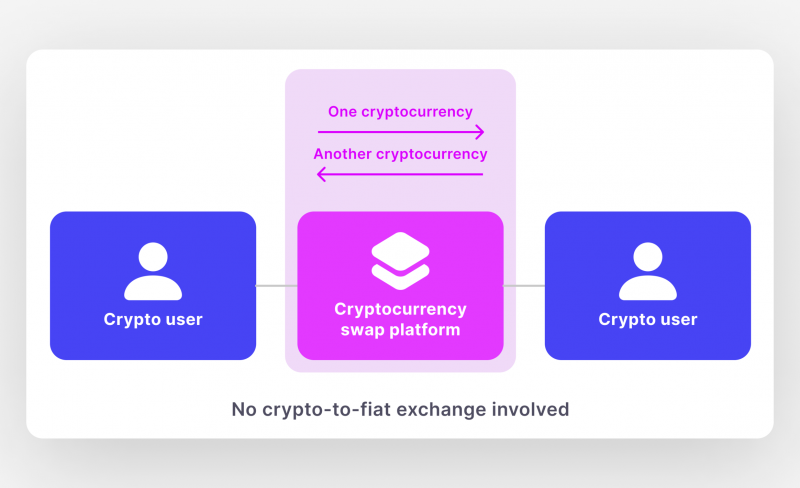

The practice of crypto swapping is identical to exchanging cryptocurrencies in its nature. Simply put, two individuals trade similar money equivalents but in different digital currencies. However, the big difference here is the underlying technical process of exchanging assets.

In the case of centralised crypto exchanges, the central entity itself regulates and processes every exchange. They monitor the validity of each party, verify transaction legitimacy and ensure that everything is within the regulatory guidelines.

Simply put, centralised exchanges serve as the arbiters of crypto transfers, ensuring everything is legal, secure and proper for all parties involved. However, this service has several trade-offs, namely the increased transaction costs and limited freedom of choosing the currency pairings.

This is why crypto-swapping services were invented, allowing individuals to swap assets without unneeded intermediaries and centralisation.

But how do crypto swaps work exactly? The crypto swap software allows users to sign up, connect their respective crypto wallets and buy, swap and sell digital currencies without ever dealing with centralised exchanges.

This method enables users to diversify their crypto portfolios without the hassle and dramatically reduce gas fees, generating crypto swap profits. Lastly, cross-chain swapping is also allowed with most crypto swap sites, whereas the centralised platforms often don’t support such activities.

The Unparalleled Freedom and Risks of Crypto Swapping

So, are the crypto swaps worth all the hype? The simple answer is a resounding yes. The long answers require a further examination of the unique benefits and some drawbacks prevalent in crypto swap technology.

Freedom, Liquidity and Efficiency

These digital solutions allow users to swap cryptocurrencies with practically no restrictions. Clients can seamlessly exchange virtual assets that have drastically different chain protocols and seek out currencies that are not listed on popular centralised exchanges. Plus, crypto swaps are much cheaper than their exchange alternatives.

For investors prioritising freedom and variety, calculated crypto swaps are a match made in heaven. This exchange methodology is also a great way to get ahead of the competition by discovering emerging currencies.

Most crypto-swapping opportunities involve a larger array of investment options, letting investors go beyond the borders of well-established currencies and enter the space of promising startups.

This is an excellent option for traders who wish to find successful projects during their very inception, maximising the potential profits. For example, many popular altcoins, like Dogecoin, weren’t available for purchase on centralised platforms in the early stages of their existence. So, acquiring them was nearly impossible without the crypto swaps.

Risks and Subpar Regulatory Presence

Despite the long list of excellent benefits discussed above, crypto swaps are inherently more risky and susceptible to cybercrime. Firstly, the counterparty risks are increased, as there are no intermediaries to check the legitimacy of the counterparty. Secondly, the crypto market volatility could result in price slippage, turning the deal into a monetary disaster.

Lastly, the protocol is entirely automated, making it susceptible to technical breakdowns. Since there is no active supervision of the process, these errors might persist for hours or even days. So, the increased degrees of freedom come with appropriately compounded downsides.

How Long Does it Take to Swap Crypto?

The length of crypto swapping depends on the direct currencies and their respective blockchain networks. For example, swapping Bitcoin units takes 10 minutes on average since that is roughly the time for producing new Bitcoin blocks.

The same is true for all other cryptocurrencies. Since the entire process is automated and doesn’t involve intermediaries, there are no effective ways to ensure minimal processing times with crypto swaps.

While some exchanges offer instant coin swap functionalities, these services come at much higher transaction fees. So, consider your options carefully.

Is a Crypto Swap Taxable?

Taxation is one of the most critical topics in crypto. New regulations are emerging yearly, trying to figure out how to tax the crypto owners and traders fairly.

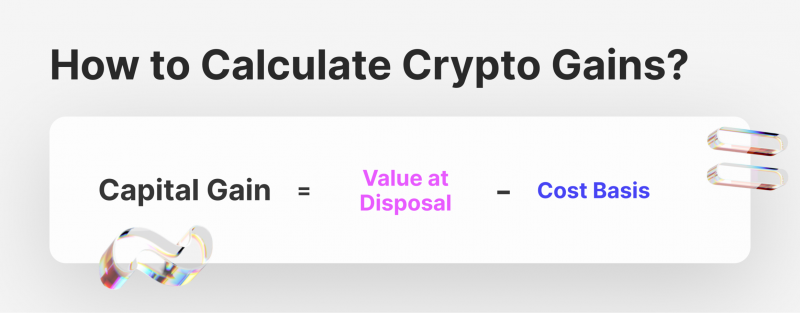

Currently, the default law on crypto taxation is the capital gains tax. This law states that crypto assets are taxable if sold, swapped or disposed of. So, swaps are considered as taxable actions as well. If you lose money by swapping crypto assets, you can write it off as a tax loss. In the case of profits, you will be subject to a capital gains tax.

Crypto swapping is highly lucrative during bull runs since many lesser-known coins are gaining traction during these periods. The upcoming 2024 bull run could further enhance the popularity of swaps.

How to Make Money Swapping Crypto

To make money by swapping crypto, you must invest your resources and effort in discovering new and promising crypto projects. While coins like Bitcoin and Ethereum are well-established and won’t generate 10X profits even in the long term, numerous emerging projects could achieve that milestone in weeks. Naturally, this practice is risky since most projects don’t exceed the $1 valuation per unit.

So, it takes a lot of commitment to research numerous projects and identify the ones with a legitimate promise. The trick is to study the underlying team, their background and proficiency in creating valuable crypto technologies. If their track record is impressive and they have legit professional backgrounds, the chances of success will increase dramatically.

In the end, finding fresh projects with 10X potential is still like shooting in the dark since there are no dominant signs to guarantee success. However, investing smaller portions into more promising coins could yield favourable results.

This action is only possible through swaps, as lesser-known currencies are seldom supported on mainstream exchange platforms. So, to make money crypto swapping, you must understand the underlying difficulties and risks involved.

Is it Better to Swap or Sell Crypto?

The dilemma between multiple coin swaps and a crypto-to-fiat exchange is ongoing and has no apparent answers. It is generally advised to keep things moderate and consider both options in different circumstances.

Crypto swaps are advisable during crypto bull runs and general market growth spurts. On the other hand, selling crypto is preferable when the market is experiencing a downturn and further price drops are imminent.

Of course, maintaining such a perfect balance is easier said than done in this uncertain crypto climate. However, it is great to have such options available.

A diligent investor should employ both methods to maximise their freedom of choice. This way, investors can maximise their profits using swaps and minimise their losses using crypto-to-fiat exchange options.

Final Takeaways

The crypto scene is finally entering its maturity, producing more promising projects that prioritise value over hype. So, swapping cryptocurrency is bound to increase in popularity in the coming years.

For that reason, B2BinPay is planning to enter the crypto swap market to deliver one of the most convenient, secure and cost-effective ways to swap virtual coins.

Our team aims to introduce a solution that emphasises all of the abovementioned strengths of crypto swaps and minimises their respective downsides. So, if you are actively using the crypto swap technology, B2BinPay has exciting news in store for you!