Crypto and blockchain-based currencies evolved from being a novel virtual means of payment rivaled by traditional banks and entrepreneurs to a leading asset class and a security generating millions for investors.

Excelling in the crypto market requires an advanced understanding of how cryptocurrencies work, what affects them, and how to locate trends. You can start that with day trading, taking advantage of short-term volatility and chasing gains within minutes or hours.

So, how to day trade crypto assets, and which coins shall you choose? Follow this guide and find the best five strategies to start with.

Key Takeaways

- Day trading with cryptocurrencies offers lucrative opportunities due to high volatility and liquidity.

- Scalping is a popular crypto day trading strategy to earn from quick price action within a few minutes.

- Day trading is beneficial to crypto traders as it minimizes market exposure risks associated with the long-term approach.

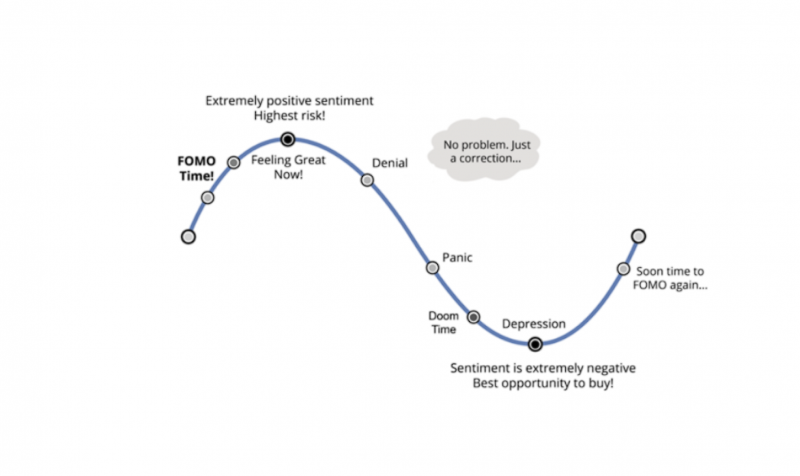

- The fear of missing out (FOMO) leads many to failure due to insufficient planning and analysis.

Introduction to Crypto Trading

Cryptocurrencies have become a pivotal part of the financial market, offering thousands of digital assets and coins that fluctuate widely and present multiple opportunities to grow wealth.

Many describe cryptocurrency trading as risky due to rising speculations and high volatility. However, its market size and adoption rate are increasing phenomenally. The crypto trading industry was estimated at around $36 billion in 2022, which is expected to grow at a CAGR of 14%, reaching over $135 billion in 2032.

This increasing trend is attributed to the improved crypto regulations, increasing Bitcoin ETFs trading activity at centralized institutions, and the skyrocketing number of trading desks, exchanges, and platforms.

How to Day Trade Crypto?

Day trading is a popular trading strategy that entails opening and closing a position within one day. You can say that this is similar to a 9-5 job, where you enter the market during its opening hours and conclude your activity around the session closing time.

Between the opening and closing, you execute multiple orders, adjust your positions, and change your approach according to market updates.

Day trading cryptocurrencies is a common approach for crypto investors looking to chase short-term gains boosted by the wide price swings and speculations.

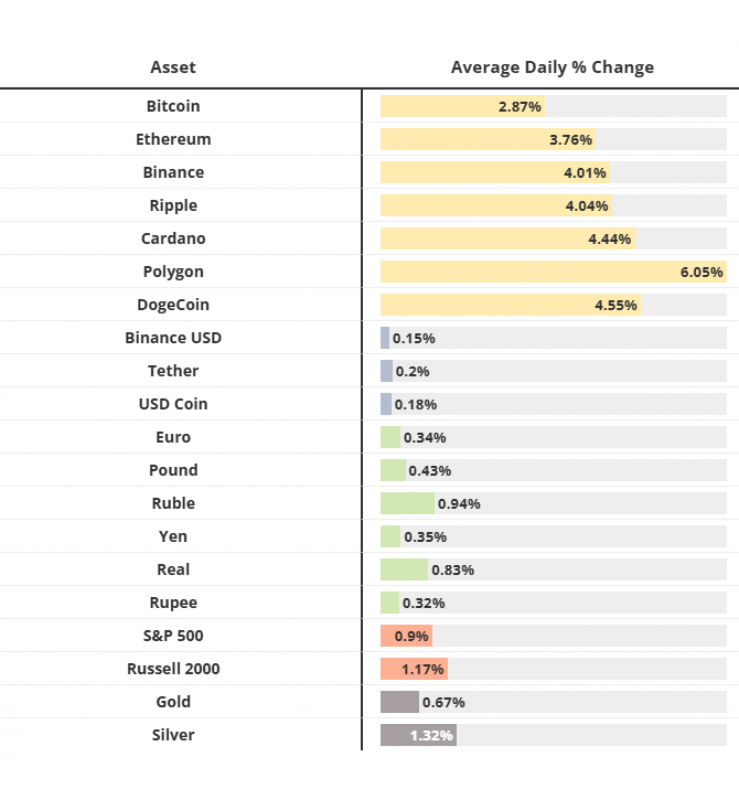

Most virtual coins have high daily volatility rates, making them ideal for realizing gains in one day. Between 2018 and 2022, Bitcoin recorded 2.87% daily volatility and Ethereum 3.76%. On the other hand, altcoins have had higher price swings on a daily basis, which are much higher than those of Forex currencies and stocks, ranging between 1% and 2%.

Many traders buy a cryptocurrency using fiat money and hold on to their position for a few hours to realize sufficient price fluctuations before liquidating their positions and reaping profits. This approach becomes highly lucrative during market booms or intensified bull runs.

For example, on 11 November, BTC jumped from $80,400 to $88,770, recording the highest rise in one day. This means that if you had 1 BTC, you would gain a whopping $8,370 as profit in a single day.

Choosing The Best Crypto to Day Trade

With over 10,000 digital currencies and tokens, knowing how to day trade crypto starts with picking the right currency. As such, you can choose the best cryptocurrency using the following criteria.

Liquidity

The availability of a cryptocurrency and counterparts impacts how quickly your order is executed and settled. The high supply of Bitcoin and Ethereum, as the leading cryptos, makes trading them very efficient.

High liquidity coins have low slippage and delay rates and offer more controlled price swings during high market traffic, making them the best choice for day trading in the crypto market.

On the other hand, low-liquidity coins are hard to locate, and matching engines require more time and effort to find a suitable order to settle your position. This delay can lead to opportunity loss.

Volatility

Analyze the range at which a coin’s price fluctuates. A digital asset with high volatility and broad swing limits means that its price can change quite widely, leading to potentially high returns.

However, a wide range also means that the crypto’s price can dip significantly, leading to considerable losses.

Choose the best crypto to day trade based on your preferred volatility range and risk tolerance.

Bitcoin’s daily price volatility averaged 3-4% in recent years, compared to less than 1% for traditional stocks or Forex.

News

Cryptocurrencies are highly prone to speculation. For example, Bitcoin rallied massively before and after the halving event, a crucial network update that matters to blockchain nodes and traders.

The Adoption of crypto-based instruments at classic banks and financial corporations affects the overall market. For example, the approval of Bitcoin and Ethereum ETFs was accompanied by increased transaction volume and price speculations.

Chart Analysis

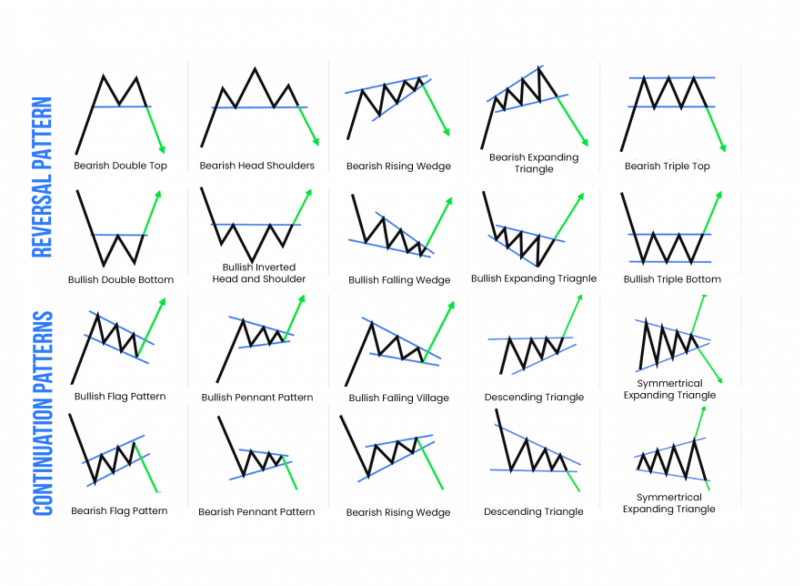

Choose your preferred digital assets after conducting rigorous research and fundamental and technical analysis. This includes applying and studying chart patterns, understanding indicators, and following signals.

The exponential moving average is a key indicator to find and follow price trends. Other useful crypto day trading chart options include the Bollinger bands and Fibonacci retracements to find price reversals or breakouts.

Top 5 Crypto Day Trading Strategies

One-day trading with cryptocurrencies can be done using short-term strategies. This way, you can earn gains from the crypto market volatility on major and alternative coins. Here’s how you can start.

Scalping

A popular approach to day trading in the crypto market is scalping, where you open and close positions within 5 to 15 minutes multiple times a day to accumulate ultra-short-term gains.

This strategy is used in various markets and assets. However, cryptocurrency scalping is a fast-paced approach to trading digital assets with high volatility rates, leading to high potential returns.

Scalpers choose from a 1-15-minute timeframe during price momentum and liquidate their positions once the trend ends, reaping the gained value. Traders can factor in multiple indicators and chart patterns to explore potential reversals and breakouts and enter at the right time.

Arbitrage

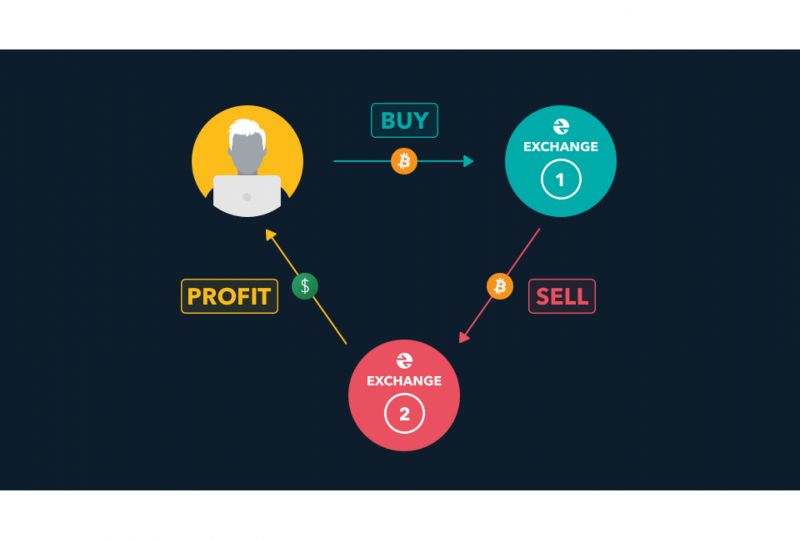

Arbitrage is a complex trading system that involves buying and selling the same assets in different markets, preferably in distinct geographical locations, to exploit price discrepancies. It is widely practiced in stocks and Forex markets.

However, cryptocurrencies offer various arbitrage opportunities across different exchange platforms, centralized and decentralized.

You can find crypto, like Bitcoin, traded on tens of platforms with slight price differences. Then, you buy from exchange A at a low price and sell it at exchange B at a higher price. However, you must carefully consider the trading costs and transaction fees and ensure they do not offset the arbitrage revenue.

Range Trading

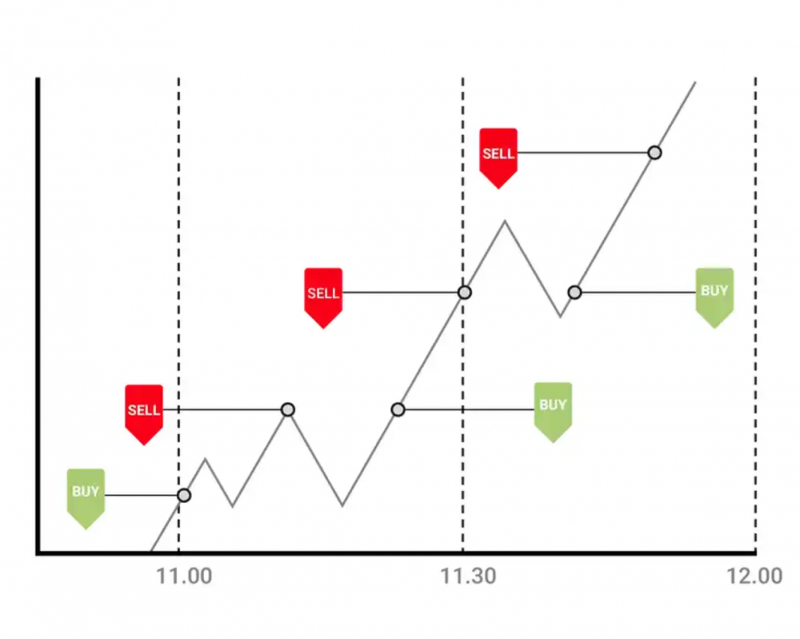

This strategy involves finding an upper and lower range at which the cryptocurrency is fluctuating. As such, you buy when the price starts to increase and sell when the line reaches its peak to reap the profits.

However, you must identify the support and resistance levels very accurately to ensure the right entry and exit times and avoid uncalculated losses.

Moreover, determining fixed resistance and support zones is challenging because virtual coins swing unexpectedly. Therefore, you must set order limits, use chart patterns to price range, and monitor the market for any news leading to new trends.

Breakout Trading

Breakout trading in crypto day trading entails entering a position when the price moves beyond a defined support or resistance level due to speculations or unpredictable market forces.

Traders capitalize on these trends as the price continues in the breakout direction, especially when more traders join and fuel the price rally. This strategy typically uses key levels such as trendlines, moving averages, or consolidation zones to optimize the market entry.

It is also vital to use risk management tools, like stop-loss orders, to minimize the impact of false breakouts and rapid reversals, which can lead to excessive losses.

Reversal Trading

Crypto day trading with the reversal strategy focuses on identifying the moment when a trend is about to change direction. Traders use crypto indicators to determine overbuying and overselling zones, followed by possible price bounces.

You can enter a position against the current direction to capture profits from the new trend during its early stages. Therefore, timing and discipline are critical, as premature entry can lead to losses, and moving against the rest can be intimidating.

Reversal trading is more suited for experienced traders who can recognize reliable reversal signals and patterns and manage associated risks with quick decision-making.

Avoid These in Crypto Day Trading

The crypto market moves quickly, and even after careful planning, you need to think on your feet and make rapid decisions. This includes losing or gaining momentum, which can lead to excessive losses. Therefore, consider the following recommendations.

- Overtrading: You might be tempted to execute too many trades, open multiple positions, or go all-in because of current trends. This might backfire due to market unpredictability and liquidity issues.

- Emotional decision-making: It is easy to get dragged to trading again after conceding significant losses or making greedy and irrational decisions.

- No-plan trading: The crypto market is risky, and you can only make it with thought strategies and discipline. Planning also allows you to reflect on your decisions and analyze what went wrong.

- Ignoring signals: Technical indicators, fundamental and technical analysis, and trading signals are vital to making fact-based decisions and achieving tangible results.

- Lack of risk planning: With the rising market dangers, you need suitable risk management, including order limits and stop-loss limits, and you must not exceed what you can afford to lose.

- Following others: Avoid following internet trade “gurus” and influencers because what worked with others might not work for you, considering different budgets, targets, and risk tolerance.

- FOMO trading: Avoid chasing trends and investing because everyone is doing so. The “Fear Of Missing Out” without a proper approach can lead to excessive losses.

Advantages and Disadvantages

With the abundance of opportunities in crypto trading during the day, there are several drawbacks that you need to consider. The high competition, volatility, pace, and changes can cast multiple challenges when you learn to day-trade crypto. Let’s review the pros and cons.

Pros

- Cryptocurrencies are highly volatile, and their prices fluctuate quite broadly in one session, giving traders multiple opportunities to invest and realize gains in a single day.

- The massive inflow of traders to crypto coins, especially major ones like BTC, ETH, and DOGE, makes them highly liquid and allows order execution at a low slippage rate.

- The market is available 24/7, enabling investors to find the best time of day to trade crypto with fewer limits and increasing access and liquidity.

- Many platforms facilitate trading without having to afford the entire coin’s value. Traders can invest with a fraction of Bitcoin and enjoy similar price action and return on investment.

- You can use different strategies and utilize numerous indicators to optimize your approach.

Cons

- The high volatility of these markets makes it highly risky to achieve consistent gains, even for the most experienced traders.

- The fast-paced dynamics of industry updates, news, price action, and developments can be emotionally overwhelming for some.

- Despite the positive regulatory changes in the crypto space, sudden changes or limitations can dramatically affect trading.

- The rising number of hacks and scam schemes requires additional caution when choosing a crypto asset or trading platform.

How to Start Crypto Day Trading?

Cryptocurrencies are suitable for short-term strategies and investments due to their quick price action and broad daily movements. However, succeeding in this space comes with adequate planning and the right use of technical tools. Here’s how you can trade with cryptos.

Choose The Right Cryptocurrency

Multiple factors and industry events affect cryptocurrencies. In fact, most of the time, crypto prices rally after macroeconomic events, geopolitical instability, presidential elections, and traditional market dynamics.

Therefore, choosing the right digital currency depends on ongoing events and predictions. Bitcoin is regarded as one of the best cryptos for day trading because it fluctuates widely during the day, as it is affected by a wide range of blockchain and non-blockchain economic changes.

If you prefer a more tame approach to day trading with cryptos, you can choose altcoins, like Solana and Litecoin, which can be affected by major network developments or DeFi events. This makes tracking your investment more straightforward.

Choose a Trading Platform

With the rising number of trading brokers and exchanges, finding the best platform to day-trade crypto requires careful research for credibility, reputation, and regulatory compliance.

Other factors determining your choice include digital wallet access, asset storage location, and processing capability. These traits set the main distinctions between centralized and decentralized platforms.

For example, Binance and Coinbase are centralized exchanges that allow you to trade using the platform’s wallet, relying on a centralized server while processing orders faster using off-chain networks.

On the other hand, decentralized exchanges like Pancakeswap and Uniswap allow users to integrate their crypto wallets for better security protocols while processing transactions directly on the blockchain.

Select Your Timeframe

Day trading involves opening a position for a few minutes or hours, depending on current market conditions and your objectives.

Moreover, determining your timeframe relies on your strategy. If you are scalping cryptocurrencies, your trading windows can be as little as 5 to 15 minutes. On the other hand, investing in breakouts or reversals can take up to several hours, depending on price momentum and how fast a new trend is established.

Set Your Order Limits

Using stop-losses and trailing order limits is vital to minimize the impact of market uncertainty and sudden changes. These risk management tools ensure you do not lose more than you can afford, primarily if you simultaneously operate multiple orders on different coins.

Use Chart Patterns

Chart options are robust in identifying and predicting price trends and trajectories. You can track market movements and identify bullish price patterns to enter at the right time.

Therefore, make sure your preferred day trading platform supports advanced chart patterns and options to observe price momentum and generate accurate trading signals.

Monitor Your Position

Track market movements and keep track of industry events and news that can affect your position. It is vital to set a plan when the market does not move in your direction, especially if you lack experience analyzing speculations and quick thinking regarding cryptocurrency trading.

Conclusion

Learning how to day-trade crypto assets is essential to capitalize on virtual currencies’ rising prices and opportunities. You can execute multiple short-term strategies to chase quick profits and locate trends to secure your share of the large money pool of cryptocurrencies.

Start scalping to reap frequent small gains or wait for price breakouts and reversals to gain on the trends before anyone else. However, you must follow a well-structured plan to weather the crypto market’s storms.

FAQ

How to day trade cryptocurrencies?

Choose the right digital asset that suits your budget, strategy, and risk tolerance. Find a reliable platform to execute your orders and use technical indicators and chart patterns to monitor your position.

Can you day trade crypto?

Yes. Cryptocurrencies are volatile and offer lucrative short-term returns. Major blockchain currencies swing around 2-4% daily, while altcoins experience higher daily volatility of around 4-5%.

What is the best day trading strategy for cryptocurrencies?

Scalping is a popular crypto trading strategy to capture and accumulate small price gains. This approach involves opening and closing market orders for 5-15 minutes multiple times in one day.

Which cryptocurrency is the best for day trading?

Bitcoin and Ethereum are the most popular assets for day trading due to their advanced ecosystem, regulated landscape, and moderate volatility.