Decentralised currencies went through an exciting journey of acceptance and rejection by financial institutions and businesses, coming to where Bitcoin stands now.

After years of relying on banking processing systems, cryptocurrencies appeared at the forefront of transactions, providing entirely new payment methods and a whole ecosystem of decentralised assets and securities.

Today, cryptocurrency and digital payment systems rival most traditional transaction processors, such as banks and credit cards. Many factors play a role in this exceptional growth, especially fast processing capabilities and globality.

Therefore, if you are tapping into global markets, you should definitely consider having a cryptocurrency payment processing system. Let’s explain in detail what you need to know.

Key Takeaways

- Crypto payment processors allow businesses and individuals to send and receive Bitcoin, Ethereum and other virtual currencies.

- A typical decentralised payment system involves a crypto gateway, digital wallet, validating blockchain and a merchant as the transaction destination.

- Paying with Bitcoin is faster, safer and more global than traditional payment methods.

- Businesses can build a decentralised payment system from scratch or integrate white-label solutions with various personalisation features.

Understanding Crypto Payment Processing

Cryptocurrencies are commonly used as payment methods, allowing users to buy goods and services and pay with Bitcoin, Ethereum and thousands of other virtual coins through Web 3.0 wallets.

Let’s compare banking and cryptocurrency payment processing systems.

When a bank transfers money, they cooperatively process user information with other banking and system intermediaries to ensure data correctness and non-involvement of any party in any suspicious activity. This can be extended to currency converters, third-party financial institutions and payment processors if the transaction is global.

On the other hand, crypto payment systems utilise automatic blockchain capabilities like smart contracts to check users’ wallets and validate transactions according to blockchain protocols.

Once these two sides are cleared, the user confirmation is required to lock the amount and encrypt the operation with private keys before sending funds.

Cryptocurrency Payment Processing System: Key Elements

Creating an enterprise payment processing system can spur business growth, client conversion, and sales because this approach responds to recent market trends and user preferences. This is what every crypto payment looks like.

Crypto Payment Gateway

Payment gateways are interfaces that facilitate blockchain-based assets and virtual coins. When customers click on the crypto payment button, they are redirected to the gateway page that prompts them to enter their payment method details.

Traditional processors require entering credit/debit card details to perform the transaction, while crypto payment gateways link the user’s digital wallet to conduct a crypto transaction or utilise a QR code embedding the merchant wallet address to simplify the purchase.

Additionally, some businesses offer card-to-crypto payment processing capabilities, enabling their clients to use traditional bank cards to buy crypto and pay on the spot without switching pages.

Web 3.0 Wallets

Blockchain wallets are a major part of cryptocurrency payments. These are storage spaces where users store their virtual assets, coins, tokens, stablecoins and NFTs. Getting a crypto wallet is necessary to conduct Bitcoin payments and transact with decentralised platforms.

Users can connect their wallets to websites when buying online, allowing them to choose the digital currency and enter the amount they want to send.

Custodial wallets are mostly embedded accounts in crypto exchange platforms where funds are located, and third-party processors control the user’s private keys. Conversely, non-custodial wallets give users full control over their wallet’s private keys, seed phrases and security layers.

Blockchain

The blockchain is the most important element in the crypto payment system, as the decentralised ledger registers and holds all Web 3.0 transactions. All operations, whether paying with BTC, transferring an NFT ownership or staking activities, are recorded in the public ledger.

When a Bitcoin payment is initiated, the blockchain processes the transaction through smart contracts and validating nodes that ensure the operation matches the blockchain rules and regulations.

Bitcoin and Ethereum blockchains are the most popular ecosystems that facilitate crypto transfers. Other chains, such as Avalanche and Polygon, came into existence to boost transactions and offload congestion of the main public ledger.

Merchant Account

The crypto merchant account is connected to the e-commerce platform or website that receives the payment, where the funds reside before being transferred to the business account.

If the user pays through a scannable QR code, the merchant wallet’s address is embedded in the code. Similarly, if clients pay using P2P wallet transfers, the transaction destination is the website’s merchant account.

Businesses can adjust the way they receive funds. Some of the best crypto merchant service payment processing providers offer crypto-to-fiat settlements to store money in USD or EUR in their bank accounts or to set recurring charges.

Why Do You Need a Cryptocurrency Payment System?

Bitcoin payments not only meet customer preferences but also provide a fast and safe way to move funds locally and internationally. It can be technically challenging for new startups and companies that are used to traditional payment methods, but the advantages are worth it.

Elevated Security

Unlike banks that require account registration and the submission of multiple personal and financial information such as name, address, capital, source of income, and annual returns, blockchain wallets can be created without sharing the client’s name.

This can lead to some cybersecurity compromises, but it perfectly suits customers who do not want to expose their personal data to the internet. Additionally, it serves businesses that want to keep their financial transactions out of their competitors’ reach.

Besides that, crypto transactions are settled directly between users, while bank transfers go through multiple intermediaries, exposing customer personal data to cyber threats.

Fast Processing

Private local bank transfers are usually rapid. However, business settlements, cross-border transactions, cross-currency payments and foreign currency payouts can take a few business days to settle.

Moreover, they go through multiple currency converters and financial institutions, causing them to be delayed for a few days.

On the other hand, crypto payments’ processing times range from instant to a few minutes at maximum. Fewer intermediaries, their P2P nature, and price unification make cryptocurrency payment processing systems faster, safer and a better option for companies and individuals.

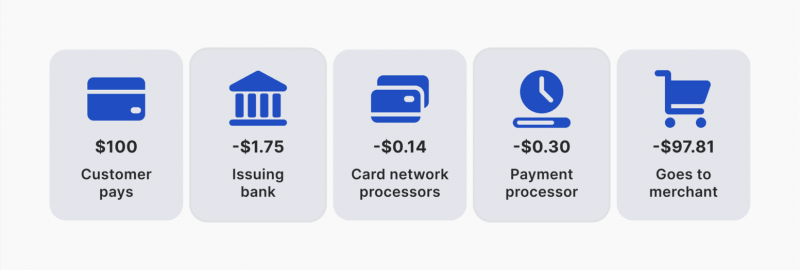

Cost Efficiency

Sending remittances and global transfers are usually associated with service fees, taxes and exchange rate deductions. In addition, banks are profitable organisations in nature, and their target is to grow wealth from transaction fees and commissions.

Conversely, blockchain is an open-source ledger technology that is held by a network of developers and nodes that maintain the system’s integrity and performance. The only type of blockchain cost is the gas fee, which is used to reward validating nodes and encourage them to process transactions.

Gas fees vary widely between chains and depend on network congestion. During peak times, these charges increase, while layer-2 scaling solutions are usually more cost-effective.

Business Expansion

Dealing with foreign currencies is regulated differently around the world. Some countries have local restrictions on receiving money from abroad, imposing limitations on amounts and taxes on foreign exchange.

Therefore, Bitcoin payment processing solutions are the best way out of this obstacle. Users can receive cryptocurrencies almost everywhere, benefiting from the price similarity and accessibility.

This makes it more viable for companies to expand to new markets and do business with global partners with minimum regard to currency exchange rates and economic restrictions.

Moreover, users are increasingly switching to decentralised assets, and adopting a cryptocurrency payment processing system accommodates the growing customer preference.

Despite the fact that most countries legalise owning and transferring cryptocurrencies, only El Salvador and the Central African Republic accept Bitcoin as a national legal tender.

Who Needs Crypto Payment Solutions

In essence, anyone can utilise Bitcoin transactions for personal or corporate use. However, cryptocurrency payment processing systems are becoming widely adopted among businesses that want to offer their customers more diverse ways to purchase goods and services.

Bitcoin payment processing providers are becoming increasingly available, and some developers offer ready-to-use platforms that encourage more organisations to accept payments. Users can pay with BTC wallets to buy a car or donate to charity. Decentralised transactions usually take place in the following sectors.

Brokerage Firms

Brokers who allow investors to trade with Bitcoin and Ethereum are more likely to accept crypto payments. They use cryptocurrency payment processing systems to receive deposits and issue withdrawals.

Additionally, they can offer their clients on-ramp and off-ramp exchanges to facilitate cross-currency conversion between fiat and crypto money.

Exchange Platforms

Centralised and decentralised exchanges are the top crypto payment gateway users. These businesses allow users to buy and sell virtual coins and tokens with other users in P2P pools and marketplaces.

Additionally, they enable users to create wallets or connect theirs to conduct various operations, such as swapping currencies or investing in staking campaigns.

E-Commerce Stores

Shopping online has evolved tremendously over the years, and customers can now use their digital storage devices or mobile phone wallets to pay with cryptocurrencies in various e-stores.

E-commerce platforms are becoming more crypto-friendly, allowing businesses to add various crypto-payment plugins to accept BTC, ETH, etc.

Individual Users

Besides the corporate use of cryptocurrencies, individuals can send private Bitcoin transactions as a faster and safer way to receive funds across borders.

This method is more efficient when sending large amounts of cash or avoiding currency conversion taxes and fees.

How to Develop The Fastest Payment System in Cryptocurrency

Facilitating Bitcoin payments requires integrating a pre-built decentralised payment ecosystem into your system, known as white-label solutions, or building a new one entirely from scratch.

There are multiple pros and cons to each approach. Let’s compare them.

White Label Payment Development

These turnkey solutions are previously developed software and tools that serve multiple purposes and can be added to platforms with some API integrations and coding.

Using a ready-to-use cryptocurrency payment processing system saves you the time required to create entirely new software, find qualified programmers, and go through multiple development and testing phases.

You can find some of the top crypto payment gateways developed by white labels, which saves you money needed for recruiting and training in-house developers.

WL providers utilise their vast knowledge and experience in building payment systems that suit your business needs and can be customised to match your user preferences.

Developing From Scratch

First-hand system development provides flexibility because you can create the whole software based on your needs and preferences.

However, it usually takes more time to find, hire, and train suitable developers to build your software from scratch, in addition to the variable costs of maintaining the system on your server.

Therefore, this option is more suitable for large corporations with considerable capital and highly qualified in-house talents.

Top 3 Crypto Payment Processing Companies

Finding and integrating a DeFi payment solution requires carefully reviewing available providers because several companies offer similar services. We analysed the best cryptocurrency payment processing system providers you can find.

B2BinPay

A leading provider of crypto payment technologies, ranging from blockchain-based gateways to decentralised wallets and API integration tools. B2BinPay is known for facilitating payments for companies of various industries, from multi-asset brokerage firms to product manufacturers.

With various wallet options (merchant and enterprise), brokerage firms, exchange platforms, and e-commerce businesses can receive payments in Bitcoin, Ethereum, Tether and hundreds of other supported cryptocurrencies.

B2BinPay offers a unique combination of coins, tokens and stablecoins through a mix of blockchains, side chains and layer-2 scaling networks to facilitate fast and robust transactions.

BitPay

BitPay is known for providing crypto payment solutions through its advanced web 3.0 wallet features. Individuals and businesses can utilise BitPay’s crypto plastic card to pay on various PoS or use the mobile app to purchase online goods and services.

BitPay supports a wide range of businesses to conduct crypto payouts for different purposes, such as invoice settlements, recurring charges, retail sales, offering loyalty programs.

Businesses can adjust their settlement options to receive money in crypto or fiat currencies at low fees while supporting hundreds of decentralised coins.

Coinbase

Coinbase is arguably the largest centralised crypto exchange platform, supporting hundreds of virtual coins, tokens, NFTs and digital assets. Coinbase Commerce tool offers one of the best crypto payment processing systems for e-commerce websites, equipping businesses with flexible invoicing and payroll options.

Coinbase supports institutional investors and exchange platforms to accept Bitcoin payments, whether to conduct deposits, issue withdrawals, or offer trading opportunities.

Additionally, Coinbase offers multiple trading options such as derivative exchange, DeFi investments and crypto staking.

Conclusion

Integrating a cryptocurrency payment processing system is a great way to tap into a world of thriving opportunities to grow your company. Customers are increasingly switching to decentralised wallets and assets, and businesses are settling for Bitcoin transactions and payrolls.

Therefore, accepting Bitcoin payments enables you to attract as many users as possible to your platform, offering flexible and diverse ways to transact.

E-commerce platforms and brokerage service providers are known for facilitating crypto payments to deposit and withdraw funds and purchase goods and services quickly and safely.

FAQ

How long does it take to process a Bitcoin payment?

The Bitcoin transaction process takes from an instant to a few minutes. Delays might happen during network congestion, which can prolong the operation by several minutes.

How do you accept cryptocurrency payments?

As a business, you must create a wallet and integrate a cryptocurrency payment gateway to allow your customers to pay with Bitcoin, Ethereum and other virtual currencies.

Can you build your own crypto payment system?

You can either build payment software from scratch or find a while-label solution provider offering a pre-built solution at affordable prices with advanced customisation and branding possibilities.

How much do Bitcoin payments cost?

On average, it costs less than $1 to transact with cryptocurrencies. However, this transaction fee can differ according to Bitcoin network congestion, which can rise considerably during ultra-high peak hours.