With the increasing popularity of digital currencies, Bitcoin is revolutionizing the way we conduct online transactions. As a prominent payment method, an increasing number of online stores are deciding to accept Bitcoin, showcasing a significant shift in consumer behavior and business operations alike. The growth of online stores deciding to accept crypto payments is a testament to the expanding influence of cryptocurrencies in our daily lives.

Major Brands That Accept Bitcoin

The adoption of Bitcoin as a payment option by major brands is a significant milestone in the ongoing journey of digital currencies, paving the way for smaller businesses to also accept Bitcoin. It not only reinforces the growing acceptance of Bitcoin but also paves the way for smaller businesses to consider crypto payments as a viable option.

Tech Companies

Microsoft, a leading tech company, started accepting Bitcoin as payment for its online Xbox Store in 2014. The company briefly paused this service due to Bitcoin’s volatility but has since resumed, albeit exclusively for Xbox store credits through a Microsoft account. This move signifies a significant step towards mainstream acceptance of Bitcoin, as Microsoft is a dominant player in the tech industry. By accepting Bitcoin, Microsoft not only validates the currency but also exposes a large user base to the concept of digital currencies, which could potentially expedite its adoption.

AT&T is the first major U.S. mobile carrier to accept crypto, offering a cryptocurrency payment option to its customers through BitPay. This marks a significant milestone in the telecom industry, as AT&T’s adoption of BTC payments could pave the way for other telecom giants to follow suit. It also provides customers with more flexibility in how they pay their bills, especially those who prefer to use digital currencies. This move also signals a recognition of the growing role that cryptocurrencies are playing in the modern financial ecosystem.

Ecommerce Companies

NewEgg, a well-known company in the cryptocurrency community and an online store for selling computer hardware, has begun accepting Bitcoin for their products. This is significant for the hardware and the consumer electronics industry as it highlights the growing trend of digital currency as a viable payment option. By recognizing their popularity within the cryptocurrency community, NewEgg has positioned itself as a forward-thinking retailer ready to adapt to new payment methods, possibly setting a trend that other companies in the industry might follow.

Shopify, a leading ecommerce platform, has enabled numerous online merchants to accept Bitcoin as a form of payment. This is notable as it not only provides an avenue for Bitcoin holders to spend their currency but also encourages wider acceptance of Bitcoin among merchants using the Shopify platform. By offering Bitcoin as a payment option, Shopify is facilitating the adoption of digital currencies, which could potentially lead to a broader shift in how online transactions are conducted.

Etsy, a marketplace for unique and creative goods, allows sellers to accept Bitcoin and other cryptocurrencies. This move helps to diversify payment options and enhances the appeal of the marketplace to a broader customer base. As Etsy focuses primarily on handmade and vintage items, the acceptance of crypto could potentially influence other platforms in the niche to follow suit. Moreover, it could lead to a significant change in how transactions are conducted in this specific market, with a shift towards more digital and decentralized forms of payment.

Fintech Companies

PayPal, a globally recognized online payments system, has also embraced cryptocurrencies, thereby allowing its users to accept crypto for their transactions. As of October 2020, PayPal users in the U.S. can buy, sell, and hold select cryptocurrencies directly through PayPal. In 2021, they launched “Checkout with Crypto,” which allows U.S. customers to use their crypto holdings to pay at millions of online checkouts. PayPal’s move into the crypto space is a significant endorsement, given its massive user base and international reach. This could accelerate the use of cryptocurrencies in everyday commerce.

Intuit’s Quickbooks, a popular accounting software suite, has integrated Bitcoin payments into its services. This means businesses can now accept Bitcoin from customers and record the transactions directly within the software. The acceptance of Bitcoin by Intuit’s Quickbooks is a significant step in promoting Bitcoin’s usage in everyday business transactions. It simplifies the process of recording cryptocurrency transactions for businesses, which could lead to wider acceptance of Bitcoin and other cryptocurrencies in the business world.

Gaming and Entertainment Companies

Twitch, the leading game streaming platform owned by Amazon, accepts Bitcoin and Bitcoin Cash as payment for its services. After briefly removing this option in 2019, Twitch re-enabled it later that year. By accepting cryptocurrencies, Twitch is catering to its substantial user base involved in gaming and technology, sectors known to overlap significantly with the cryptocurrency community. It also signals a step towards wider adoption of cryptocurrency payments in the digital entertainment industry.

The Consumer Perspective

Bitcoin payments have been on the rise, and from the consumer’s perspective, this payment method can be both empowering and efficient. It opens up an entirely new avenue of financial transactions that are fast, cost-effective, and private. However, like any emerging technology, accepting Bitcoin payments also come with their own set of challenges. Let’s break it down and understand each aspect more thoroughly.

How Bitcoin Payments Work

Bitcoin transactions are facilitated through a decentralized network using blockchain technology. This digital ledger records every Bitcoin transaction across the network, providing transparency and security.

To make a payment with Bitcoin, consumers need a digital wallet and they must also choose online stores that accept Bitcoin. This wallet can be on a computer, a specialized hardware device, or a smartphone application. Each wallet has a public key, which is similar to a bank account number, and a private key, which functions like a PIN.

When a consumer wants to make a payment, they input the recipient’s public key (or scan their QR code), the amount of Bitcoin they want to send, and then use their private key to authorize the transaction. The transaction is then broadcast to the Bitcoin network where it is confirmed by miners, included in a new block on the blockchain, and the amount of Bitcoin is transferred from the sender’s to the receiver’s wallet. This process usually takes about 10 minutes but can be longer if the network is busy.

Advantages for Consumers Using Bitcoin for Online Purchases

There are several advantages to using Bitcoin for online purchases.

Privacy and Anonymity

Bitcoin transactions do not require personal information, which can help protect against identity theft. While the transaction itself is public, the identities of the parties involved are not, unless they choose to link their identity with their Bitcoin address.

International Use

Bitcoin can be used in any country without needing to worry about currency exchange rates or bank fees. This makes it convenient for consumers shopping on international websites.

No Middlemen

Because BTC operates on a peer-to-peer network, crypto transactions do not require a bank or payment processor. This can result in lower payment processing fees, especially for high-value transactions or international transfers.

Control Over Funds

Crypto users have complete control over their Bitcoin wallets and cannot be arbitrarily blocked or limited by banks or payment processors.

Challenges for Consumers Using Bitcoin for Online Purchases

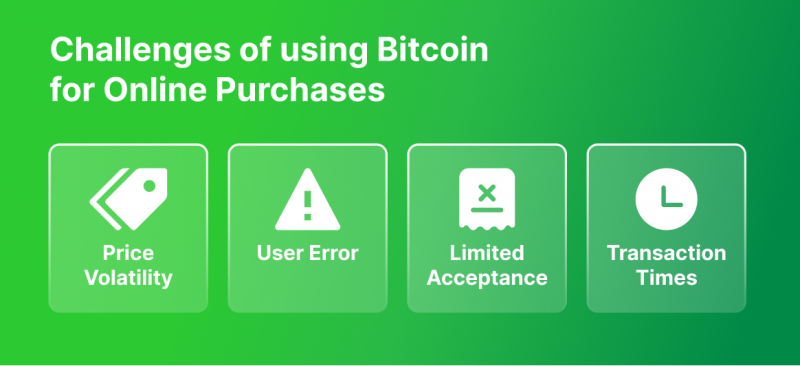

Despite the advantages, there are also challenges that consumers face when using Bitcoin for online purchases.

- Price Volatility: Bitcoin’s value can fluctuate significantly in a short period, which can impact the real value of a consumer’s holdings.

- User Error: If a consumer loses access to their Bitcoin wallet (for example, forgetting a password or losing a hardware wallet), the Bitcoin within can be permanently inaccessible. There is no ‘forgot password’ option or customer service to recover lost Bitcoin.

- Limited Acceptance: While more retailers are beginning to accept Bitcoin, it is still not as widely accepted as traditional currencies.

- Transaction Times: Bitcoin transactions can take longer to process than traditional electronic payments, especially during busy periods.

Consumer Reception to Bitcoin Payments

The reception of Bitcoin as a payment method by consumers has been varied, largely due to a combination of factors such as understanding of the technology, perceived security, and the volatility of BTC value.

A survey conducted by HSB in 2020 revealed that approximately 36% of small to medium businesses in the U.S. were open to accepting Bitcoin. This statistic shows a significant level of acceptance by businesses, indicating an understanding of the potential benefits that Bitcoin can provide, such as access to a global market, lower transaction fees, and quicker payment processing times.

However, the actual usage of Bitcoin as a payment method by consumers appears to be lower. According to a survey conducted by PYMNTS.com in 2021, only around 14% of American consumers had used Bitcoin or other cryptocurrencies to make a purchase in the past 12 months. This indicates a gap between merchant acceptance and consumer usage.

There are several possible explanations for this gap. One key factor is that many consumers are still unfamiliar with how Bitcoin and other cryptocurrencies work. This lack of understanding can make consumers hesitant to use Bitcoin, as they may be unsure of how to make transactions or how to secure their Bitcoin wallets.

Another concern is the security of Bitcoin transactions. While the blockchain technology underlying Bitcoin is secure, the ecosystem around it, including exchanges and wallets, can be vulnerable to hacking. This can create a perception that Bitcoin transactions are risky, further discouraging consumers from using it as a payment method. Advancements in blockchain technology and the growing cryptocurrency market have made Bitcoin transactions more secure and efficient than ever before.

Finally, the volatility of Bitcoin’s value can also deter consumers. The value of BTC can fluctuate widely in a short period of time, which can make it difficult for consumers to predict how much their Bitcoin will be worth when they use it to make purchases. This volatility can be particularly problematic for larger purchases, where a small change in the value of Bitcoin can translate into a large difference in cost.

Despite these challenges, the ongoing development in the cryptocurrency space, including efforts to increase consumer understanding of cryptocurrencies, improve security, and stabilize the value of cryptocurrencies, suggests that the use of Bitcoin as a payment method by consumers could increase in the future.

It’s worth noting that there are also significant regional differences in the acceptance and use of Bitcoin. For example, in countries with unstable local currencies, Bitcoin can serve as a more stable store of value, leading to higher usage. Meanwhile, in countries with strong financial systems, consumers may be less motivated to switch to Bitcoin from traditional payment methods.

Key Takeaways

- The growing acceptance of cryptocurrencies, particularly Bitcoin, by major companies indicates a shift towards embracing innovative payment methods and recognizing the potential benefits offered by digital currencies.

- The integration of Bitcoin payments by online stores demonstrates a willingness to adapt to evolving consumer preferences and taps into the expanding market of crypto-savvy shoppers.

- Accepting Bitcoin and other cryptocurrencies as payment options offers businesses access to a global market, lower transaction fees, and increased flexibility, while providing consumers with privacy, international usability, and greater control over their funds

- With ongoing efforts to improve user experience, enhance security, and stabilize cryptocurrency values, the future of Bitcoin payments in online retail looks promising, as more merchants and consumers embrace this innovative form of digital transaction.

The Future of Bitcoin Payments in Online Retail

The future of Bitcoin payments in online retail looks promising based on the recent trends and predictions. It is already evident that several major brands across different sectors accept cryptocurrency as payment, which indicates a growing trend towards wider acceptance of crypto payments in the retail industry. However, despite the increasing number of stores that accept Bitcoin, it is still not as widely accepted as traditional currencies.

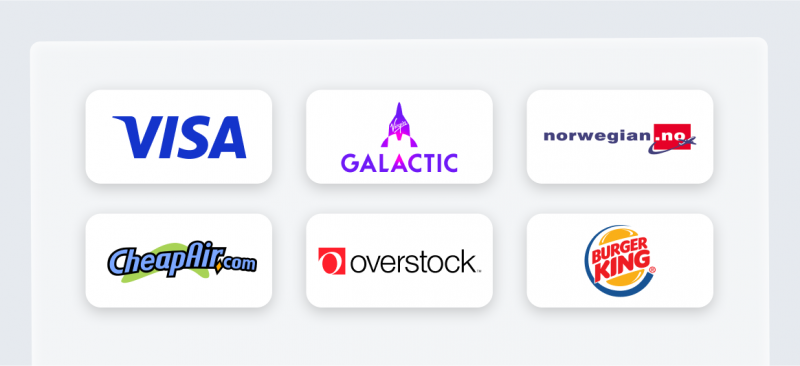

The outlook of BTC in online retail appears to be bright, with an increasing number of companies starting to accept crypto for their goods and services. In recent years, several large companies have begun accepting Bitcoin as payment for their goods and services, including Virgin Galactic, Norwegian Air, CheapAir (online travel agency), Overstock, and Burger King, in addition to various gift card services. This shows that businesses are increasingly recognizing the potential advantages of using cryptocurrencies like Bitcoin as a preferred payment method.

In recent years, Visa, one of the world’s largest payment processors, has shown a progressive attitude towards cryptocurrencies. Recognizing the potential of digital currencies to disrupt traditional financial systems, Visa has taken steps to integrate and support various aspects of the crypto ecosystem.

In addition to wider merchant adoption of Bitcoin payments, there are also numerous initiatives aimed at improving the user experience when using cryptocurrencies for online purchases. For example, developers are working on ways to make transactions faster and more secure with technologies such as the Lightning Network and atomic swaps. There are also initiatives to reduce user error by making crypto wallet recovery easier, and to increase consumer understanding of cryptocurrencies through educational resources.

Lastly, the increasing number of crypto-specific payment processors is another positive sign for crypto payments in online retail. These companies provide a bridge between traditional currencies and digital assets, enabling consumers to use their cryptocurrency holdings to make purchases on websites that only accept fiat currencies. Additionally, many of these processors strive to provide a better user experience by offering lower fees and faster processing times than traditional payment gateways.

Overall, it appears that the future of BTC and other digital currencies in online retail is bright. With wider merchant adoption, improving technologies, and increased consumer understanding of cryptocurrencies, it is likely that Bitcoin payments will continue to grow as a viable payment method in the years to come.

Conclusion

The acceptance of Bitcoin as a payment method by major brands across various industries marks a significant shift in consumer behavior and business operations. The growing trend of online stores and companies embracing Bitcoin payments reflects the expanding influence of cryptocurrencies in our daily lives. As more brands recognize the potential benefits and decide to accept Bitcoin, it not only reinforces the wider acceptance of digital currencies but also encourages smaller businesses to consider crypto payments as a viable option.

Despite challenges such as price volatility and limited acceptance, ongoing developments in the cryptocurrency space, including increased consumer understanding, enhanced security measures, and improved stability, suggest a promising future for Bitcoin payments in online retail. With the combined efforts of merchants, technology developers, and crypto payment processors, it is likely that Bitcoin as payment will continue to grow as a viable and widely accepted method in the years to come.