The influence of distributed ledger technology on industries is revolutionary, transforming global processes with its limitless potential. With continuous advancements, both consumers and businesses are exploring creative ways to leverage its capabilities for various purposes.

A prime example of blockchain’s transformative potential is its role in securing and simplifying cross-border transactions. This advancement not only boosts operational efficiency but also enhances customer satisfaction, making it a valuable asset for businesses looking to stay ahead in today’s competitive landscape.

This article will explain what blockchain cross-border payments are, how they work, what benefits they offer and what types of blockchain cross-border payments exist today.

Key Takeaways

- Blockchain technology can offset all the disadvantages of traditional payment systems when dealing with international transactions, opening up greater business opportunities.

- International crypto transactions have lower costs, faster processing speeds, greater geographic reach and enhanced security.

Blockchain Cross-Border Payments: What Are They?

The emergence of blockchain technology and decentralised finance (DeFi) has sparked a growing need for cross-border payments within the Web3 ecosystem, as more individuals and organisations aim to engage in transactions involving digital assets.

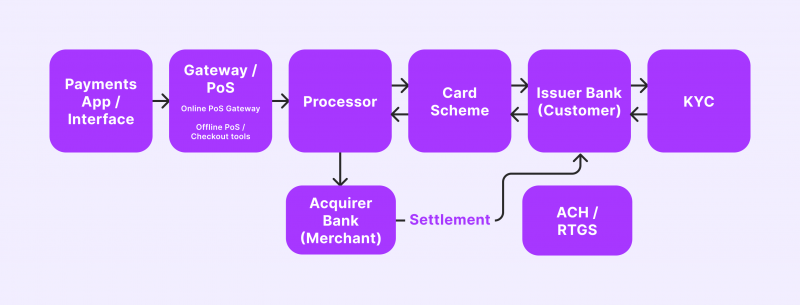

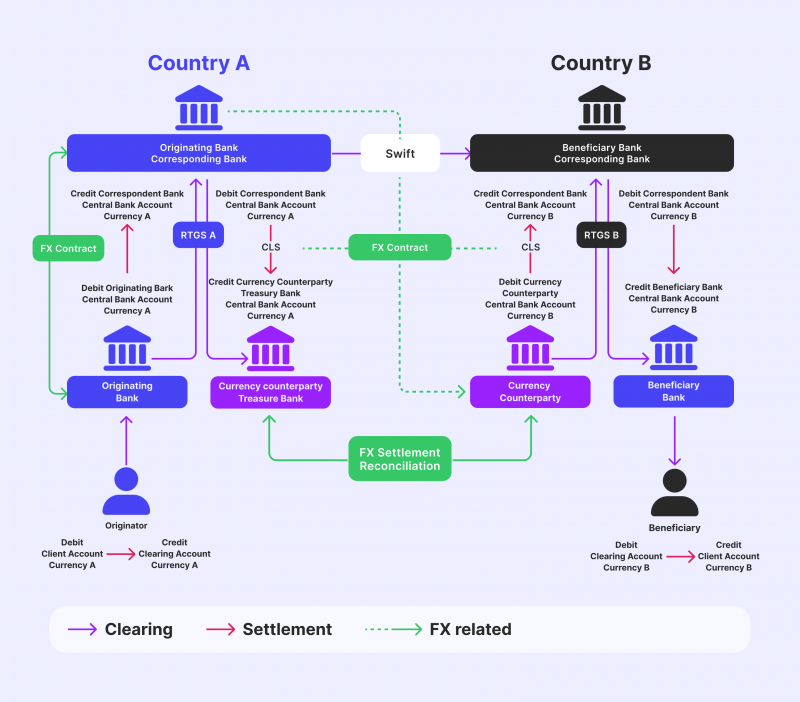

Traditionally, crypto cross-border payments were facilitated by banks and financial authorities, often involving a complex network of intermediaries like correspondent banks and clearing houses. Unfavourably, this convoluted process resulted in exorbitant transaction fees, lengthy processing periods, and a lack of transparency in the payment system.

In contrast, blockchain cross-border payments aim to revolutionise the payment landscape by eliminating intermediaries, reducing transaction costs, and enhancing transaction speed and security.

Today, these innovative payment solutions are facilitating faster payments for both business-to-business and person-to-person blockchain payments and settlements. As a result, they are reshaping the realm of international money transfers and settlements, presenting a compelling use case for blockchain technology.

With its potential to streamline and enhance cross-border payments, blockchain technology is poised to transform how we conduct international transactions.

According to the research, 92% of global cross-border payments are B2B payments, and 90% of them are made through banks, which shows that banks are the main channel for cross-border payments.

How Do Cross-Border Payments Function Utilising Blockchain?

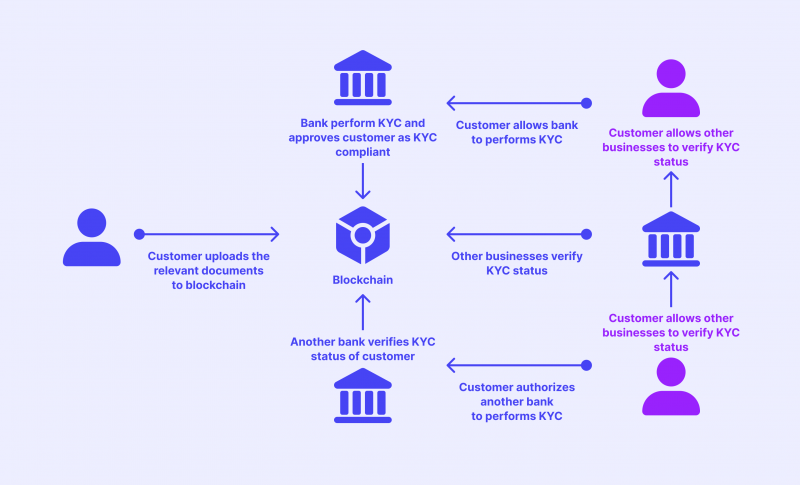

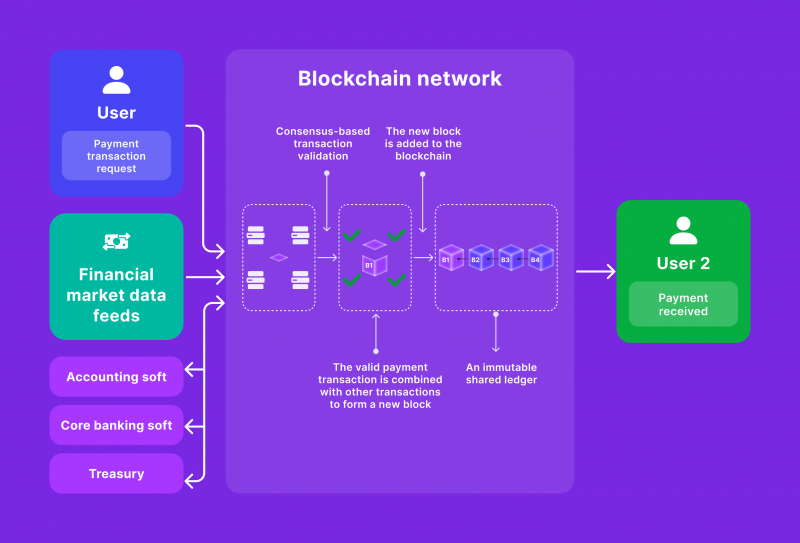

The blockchain network members or smart contracts automatically execute cross-border payment transactions based on predefined events. These transactions are then sent to a peer-to-peer network of nodes, which validate them using a chosen consensus protocol.

Permissioned blockchains are commonly used by traditional banking, financial institutions, and large businesses for high-value transfers, and only trusted users with special rights can access and validate payment events.

On the other hand, permissionless blockchains are preferred by fintech companies and SMEs for smaller-value B2B and C2B transactions, as they promote financial inclusion and ensure maximum payment transparency.

Once validated, payment-related data is encrypted using a hash function and stored in timestamped blocks linked in chronological order. These blocks create an immutable ledger, serving as a single source of truth for tracking payment activities.

Individuals, businesses, and financial service providers interact with the blockchain through role-specific web and mobile applications to initiate, receive, and monitor payments. Each participant maintains updated copies of the distributed ledger, ensuring transparency and accountability in the payment process.

What Selling Points Can Blockchain-Based Cross-Border Payments Offer?

The emergence of technological progress and the increasing prominence of blockchain and cryptocurrency systems have prompted a drive to discover more streamlined and economical approaches to cross-border payments. These innovative technologies present a range of selling points:

1. Rapid Settlements

By harnessing the power of blockchain network payment systems, cross-border payments can now be executed with remarkable speed, rendering intermediaries such as banks or payment processors obsolete.

This groundbreaking advancement ensures that payments are swiftly processed, taking mere minutes instead of the traditional lengthy waiting period of days. Furthermore, this technology empowers the direct transfer of funds between the sender and the recipient, eliminating unnecessary middlemen and streamlining the payment process.

2. Reduced Fees

Making these payments can incur substantial costs, as traditional payment methods frequently impose exorbitant fees. Nevertheless, utilising blockchain technology can significantly diminish the expenses associated with such payments. This is primarily due to the absence of intermediaries in blockchain transactions, thereby mitigating the costs of processing payments.

3. Better Transparency

Blockchain technology offers a transparent and immutable ledger of every transaction, ensuring that both the sender and receiver can monitor the payment’s journey and confirm its legitimacy. This level of transparency plays a crucial role in minimising the chances of fraud and enhancing confidence in the payment system.

4. Global Dimension

The decentralised nature of blockchain technology allows it to operate independently of any particular country or jurisdiction. This unique characteristic makes it an optimal choice for facilitating blockchain-based global payments, eliminating the necessity for intricate foreign exchange transactions.

5. Improved Security

With their complex processes and high transaction costs, traditional payment systems often present significant challenges for companies looking to expand into new and untapped markets. These markets may be geographically distant, have different regulatory frameworks, or need access to traditional banking services.

Nonetheless, the emergence of blockchain technology has opened up new possibilities for companies to overcome these barriers and effectively tap into previously inaccessible customer segments.

What Are The Types of Blockchain Cross-Border Payments?

When working with international payments based on blockchain technology, you may encounter several types, each of which has its own characteristics and provides businesses with certain advantages over traditional methods. Here are the main ones:

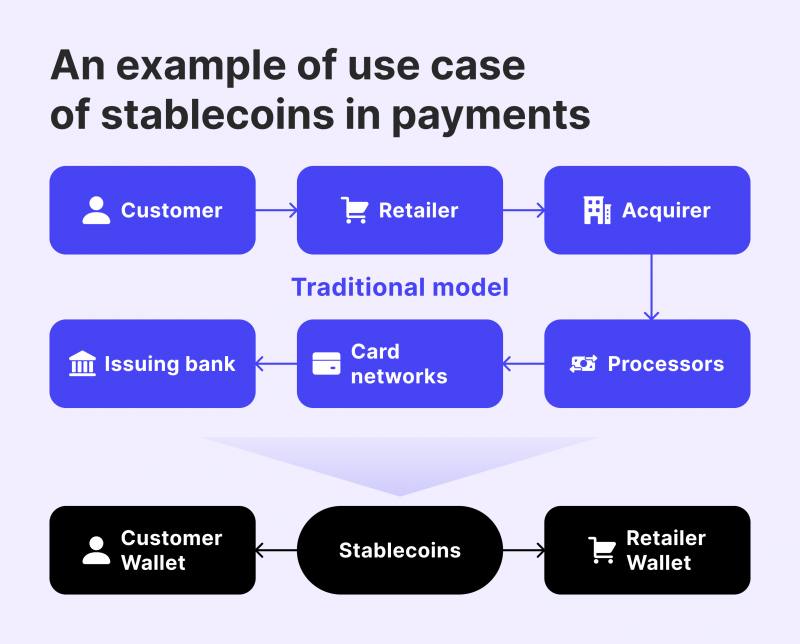

1. Stablecoin-Based Payments

Cross-border payments can be facilitated by utilising stablecoins, digital currencies that maintain a fixed value relative to a specific fiat currency. These stablecoins provide a reliable and efficient method for conducting transactions across countries and currencies.

By pegging their value to a fiat currency, stablecoins offer stability and reduce the volatility often associated with traditional cryptocurrencies. This innovative approach enables seamless and secure cross-border transactions, benefiting individuals and businesses.

2. Crypto-to-Crypto Payments

Crypto-to-crypto payments offer a revolutionary solution for individuals and businesses looking to engage in international operations without the need for traditional fiat currency. By utilising digital currencies such as Bitcoin, Ethereum, or Litecoin, users can seamlessly make purchases or conduct transactions in a foreign country, eliminating the hassle of converting their funds into local currency.

3. Blockchain-Based Remittances

Remittance services utilising blockchain technology leverage its capabilities to streamline cross-border money transfers. By eliminating the reliance on conventional intermediaries such as banks and money transfer operators, these services utilise distributed ledger technology to facilitate direct transactions between individuals and organisations.

4. Interbank Blockchain Payments

The potential of blockchain technology is showcased through interbank blockchains, which provide unparalleled audit trails and consensus mechanisms that traditional databases cannot replicate. By adopting this technology, financial entities can streamline and accelerate cross-border payments, increasing cost-effectiveness and transparency for all stakeholders involved.

5. Central Bank Digital Currencies (CBDCs)

CBDC is a crucial policy objective by central banks, particularly in emerging and low-income countries, to promote cross-border payments. By addressing the obstacles that hinder financial inclusion, well-designed CBDCs have the potential to be embraced by those who are currently excluded from the formal financial system, enabling them to engage in digital payments.

CBDCs can act as a gateway to broader financial services, serving as an entry point for individuals. The unique characteristics of CBDC, such as its risk-free nature, widespread acceptance as a digital currency, availability for offline international transactions, and potential for reduced costs and increased accessibility, contribute to its potential benefits for businesses.

Are Cross-Border Payments Safe?

The utilisation of distributed ledgers in recording transactions ensures that every participant within the network possesses a copy of the ledger. Before any transaction is added to the ledger, it undergoes verification through a consensus mechanism.

This robust process makes it exceedingly challenging for any individual party to manipulate the data or modify the transaction records, thereby ensuring the system’s integrity.

Apart from these fundamental technological principles, most payment systems based on blockchain also employ encryption techniques to safeguard user data and private keys.

These keys are essential for accessing and transferring funds. By incorporating encryption, an additional layer of security is established, significantly raising the difficulty level for hackers or other malicious entities attempting to breach the system and gain unauthorised access to sensitive information.

Nevertheless, it is essential to acknowledge that, like any payment system, blockchain-based payment systems are not impervious to all risks. Users must adopt appropriate measures to safeguard their assets. This includes implementing solid and secure passwords, utilising two-factor and multi-sig authentication methods, and storing private keys safely.

By taking these precautions, users can enhance the protection of their assets and minimise the potential vulnerabilities associated with blockchain-based payment systems.

Verdict

The blockchain cross-border payments sector has experienced significant expansion within the blockchain payments industry. Through its ability to provide quicker settlements, lower expenses, and improved security, blockchain technology has the potential to completely transform the payment processing and international fund transfer methods employed by businesses.

The future of blockchain in cross-border payments appears promising, thanks to the growing acceptance from financial entities and customers, the development of regulations and standards, and the introduction of innovative solutions that enhance speed and scalability. As blockchain continues to advance, it is poised to revolutionise how businesses handle payments and facilitate efficient international operations.