As the crypto landscape has transformed from a niche industry to a global juggernaut, managing the crypto portfolios has become a complex process that requires dedicated specialists. As the crypto market continues to grow, investors worldwide have become interested in adding digital currencies to their portfolios or even creating crypto-only asset pools. As a result, investors are actively seeking crypto management services. Thus, crypto asset management is now a fully-fledged speciality that demands attention, expertise and in-depth market knowledge.

This article will explore the significance of portfolio management and one of its most important aspects – asset segregation.

Key Takeaways

- Asset management is a vital practice ensuring investors’ profitability and risk mitigation.

- There are several well-established strategies in asset management, including diversification, the DCA method and asset segregation approach.

- Asset segregation enables managers to divide the portfolio into manageable groups of crypto assets.

- Crypto management strategies and methods will not be effective without appropriate research and analytics.

Asset Management Defined

When the world was introduced to the first iteration of crypto in 2009, there was little to no interest from traders and investors worldwide. However, as time went by and the blockchain proved itself to be a strong alternative to fiat currencies, investor interest skyrocketed dramatically.

Ever since 2013, the world of crypto has become one of the most fascinating investment opportunities, attracting businesses and individuals across the globe. After a decade, the crypto landscape is no longer a fledgling industry that only attracts a niche audience.

In 2023, the market achieved a $1.07 trillion capitalisation, with numerous new cryptocurrencies entering the market and establishing their unique offerings in the digital asset market. With such a vast market and diverse offerings, simple speculative investment tactics are no longer sufficient to grow your portfolio and keep it properly managed.

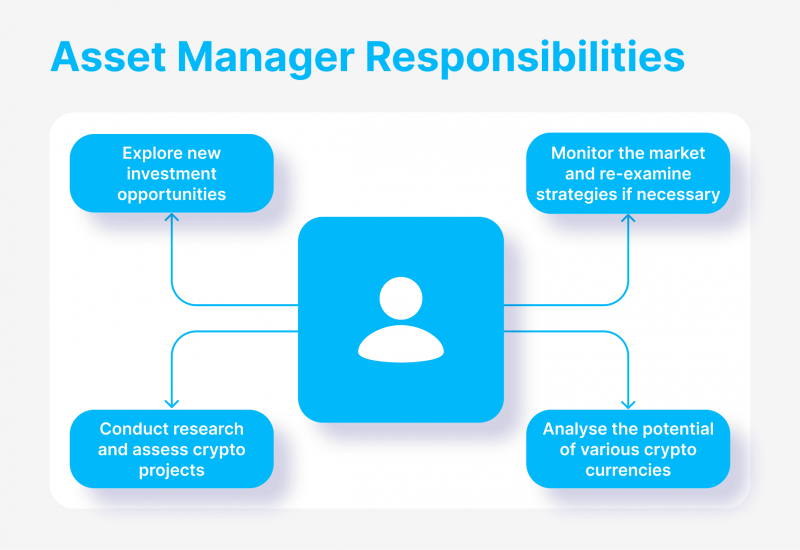

Thus, asset management is now a separate field of investment finance. Crypto management pertains to analysing, controlling and optimising the combination of assets in a specific crypto portfolio to ensure maximum profitability in the short and long term. Crypto management requires investors to conduct market analysis and make correct decisions on purchasing, holding and selling various digital assets. However, this process is much more complex in practice, filled with various management tactics, evaluation models and variables to consider.

Most Popular Crypto Management Practices

Portfolio managers must employ various strategies to carry out the asset management duties flawlessly, including asset diversification, daily trading and risk mitigation tactics. As the name suggests, diversification aims to avoid depending on a single investment. This is one of the most important aspects of crypto management, as failing to diversify assets might lead to crippling consequences.

Asset Diversification

To further illustrate this point, let’s imagine investor X, who aims to invest in crypto and reap profits. Investor X has put their sights on crypto A, a brand-new currency with promising upside. He puts considerable resources into purchasing crypto A and nothing else since he believes crypto A will grow significantly in the coming months. While the upside of crypto A has a lot of potential to generate impressive returns, it is essential to remember that the market is highly volatile.

The mentioned volatility causes the market to make unpredictable price shifts without any predetermined signs of trouble. Empirically, the market has witnessed numerous promising projects fall under pressure due to numerous causes, including tainted reputation or inability to deliver on promised utilities. Thus, investor X’s projection, regardless of research and analysis, could simply turn out wrong, as crypto A’s growth could turn into a downward spiral at any moment.

If that happens, investor X will lose their entire portfolio, as the fall of crypto A will not be offset by any other assets in the portfolio. This is where asset diversification comes into play, letting investors reduce risks and maximise potential profits. With diversification, investor X will reconsider putting all their funds in a single investment.

Instead, they will assess the market and analyse good diversification opportunities against crypto A. For example, investor X could choose a digital coin with a different consensus mechanism or a blockchain network. As a result, if crypto A falters for any reason, the portfolio will remain strong overall. Thus, diversification is an indispensable strategy in crypto asset management, letting investors minimise potential losses and avoid dependence on the success of a single project.

Active Trading

Trading actively, or dollar cost averaging (DCA), is another great strategy to consider when managing the crypto portfolio. As discussed above, the market remains highly volatile despite the best efforts to stabilise the industry prices. Therefore, purchasing large amounts of crypto assets at once could be a dangerous gamble, as the market could shift uncontrollably. With DCA, portfolio managers simply purchase desired digital assets on a regular basis instead of all at once.

For example, investor X has decided to purchase 50,000 crypto A units. Even if investor X has sufficient capital, purchasing large amounts of crypto A in a single or few transactions could result in significant losses. With the DCA approach, investor X will split the purchasing process into several weeks or months, buying fractions of the final amount regularly. This way, if crypto A enters a downward trend, investor X will have a better position to adjust their game plan and pivot into purchasing a different asset.

Asset segregation enables managers to divide assets into various classes, simplifying the monitoring and analysis of the entire portfolio.

Asset Segregation: How Does It Work?

Asset segregation entails dividing portfolio assets into different segments. This process allows managing parties to get a clear picture of their portfolios and quickly identify risks or opportunities. Asset segregation also goes hand in hand with diversification, as managers can identify new growth venues swiftly. With this approach, portfolio managers will have a better chance to mitigate risks and achieve varying goals in the same portfolio.

Before diving into asset segregation, it is crucial to understand the different types of crypto assets available on the market. As the crypto landscape progressed from a single offering of Bitcoin in 2009, today, the market features numerous different types of crypto. To segregate assets properly, portfolio managers must have a sound understanding of the following crypto asset classes:

Bitcoin and Altcoins

These trading instruments are the most popular crypto assets in the crypto market. Bitcoin itself is a flagship cryptocurrency that established the entire crypto landscape. Moreover, Bitcoin is mostly speculative, with no significant utilities tied to its coins.

However, Bitcoin is the primary coin used in conducting large-scale purchases, as it is the most reliable crypto asset on the market. Altcoins are similar to Bitcoin but have various distinctions. For example, Ethereum supports a robust ecosystem of decentralised applications and NFT marketplaces, increasing the token’s inherent value.

Stablecoins

This class of trading instruments are crypto backed by a relatively stable asset of various types, including fiat currencies, bonds, gold and other commodities. The goal of stablecoins is to provide price stability in the volatile crypto market, fixing its valuation to a stable asset and letting crypto users transact without the fear of losing their asset values. Stablecoins have become widely popular, as they can maintain predictable prices in the long run. However, it is still possible to experience price variations in this niche, as stablecoins could lose their fixation on underlying stable assets.

Security Tokens

This class of tokens enable users to acquire digital assets with the same utility as conventional securities. With security tokens, investors acquire ownership over various securities while enjoying blockchain’s decentralisation and security.

Utility Tokens

Such a tokens class are crypto coins that allow investors to access various products and services the crypto issuer offers. Fan tokens are a great example of utility tokens, letting holders enjoy special benefits of specific sports clubs worldwide.

Non-fungible Tokens

This tokens class is tied to digital assets of various types, including art, media content, entertainment, etc. By purchasing NFTs, customers have complete ownership over the underlying assets.

While there are other types of assets on the crypto market, the classes mentioned above are by far the most popular and take up most of the crypto market capitalisation. Now that we have outlined the asset classes, let’s examine how to conduct a crypto segregation practice flawlessly.

How to Properly Segregate Crypto Assets

While every portfolio has a specific goal, asset segregation is another general practice that applies to most asset management cases. There are several ways to divide crypto assets, depending on the specific goals and needs of a portfolio:

Segregation by Market Capitalisation

Dividing crypto assets by their total market valuation is a well-established practice, as it easily separates more popular and stable assets from up-and-coming crypto projects. Crypto market caps are readily available online, but they can also be calculated by multiplying a crypto unit price by its total quantity on the market.

Segregation by Sectors

As mentioned above, the crypto landscape has become a large market with numerous sectors focusing on different blockchain features. Some sectors prioritise security and decentralisation, while others focus on the stability or utility of cryptocurrencies. This segregation method is also quite popular, as it allows investors to retrieve assets from diverse sectors and identify new investment opportunities.

Segregation by Risk Levels

Another great strategy to segregate crypto assets is the respective risk profiles. In simple terms, portfolio managers always create a risk profile for each crypto asset in their asset pool. There are numerous ways to classify asset risks, and different investors employ different methodologies. Regardless of the approach, each portfolio has crypto assets with different risk levels, which is a great segregation point. With this approach, managers will easily identify the portfolio’s overall risk and analyse the necessity of adding higher or lower-risk assets to the pool.

Practices and Tools Required for Crypto Currency Management

The crypto management strategies, as outlined above, depend on the specific needs of the investor parties. Each portfolio has different goals and aspirations in the long term, including short-term profits, asset growth or reliable portfolio returns. However, even the best strategies available in the asset management market won’t be enough to ensure success without proper execution and appropriate preparation. Therefore, it is essential to conduct strong research, analysis and strategy pivots. Let’s discuss further:

Employ the Best Research and Analysis Practices

It is no secret that entering the crypto market is riskier than more conventional investment markets like fiat foreign exchange, bonds and stocks. However, the crypto volatility also presents lucrative opportunities to make substantial investment gains over time. Thus, the ever-present volatility factor does not detract investors from adopting crypto portfolios, but the market risks should be offset by diligent research and analysis.

Thus, blockchain asset management depends on conducting due diligence, thorough research and analysis to identify strong crypto projects and make correct investment decisions. Crypto asset managers must have a firm grasp on the fundamentals of crypto projects, including the blockchain operating principle, consensus mechanisms, tokenomics, utilities and other crucial aspects. Each investment opportunity must be examined through this lens, as asset managers must identify the long-term potential of a crypto asset.

In this case, many asset managers employ third-party researchers or purchase priced reports on upcoming crypto projects, effectively outsourcing the arduous research process. Even with readily available research findings, crypto asset managers must still have enough practical experience to make correct decisions based on the detailed account provided by research specialists.

Additionally, asset managers must have a firm grasp of various analytical models, including quantitative modelling, project assessment and technical analysis. Thankfully, there are numerous digital tools that assist crypto managers in the analysis process, severely decreasing the time and resources required to conduct proper analysis.

Stay in the Loop of the Crypto Landscape

In addition to comprehensive research and project assessment, portfolio managers must stay vigilant and monitor any material shifts in the crypto landscape. The combination of rapid development, growth and volatility in the crypto market causes numerous assets to vary in price dramatically. These price variations can occur very abruptly if the portfolio managers do not have their finger on the crypto market pulse.

Thus, it is of utmost importance to stay in the loop of recent crypto developments and assess their potential impacts on specific portfolios. While it is not necessary and feasible to read up on every single news in the crypto market, it would be best to monitor a mix of global news and the developments related to specific assets in the portfolio pool.

Final Takeaways

Crypto asset management has become a challenging endeavour due to the sheer size and complexity of the market. Portfolio managers must employ the best practices available on the market, including foolproof strategies, advanced analytics tools and rigorous research. With strategies like diversification, DCA and asset segregation, managers stand a higher chance to offset the market volatility and reap sizable profits from managing a crypto portfolio.