Within the constantly shifting crypto landscape, efficaciously addressing risk is paramount. Utilising delta hedging is a prominent strategy to reduce exposure to price oscillations in the base asset. Acquiring a thorough comprehension of this technique can offer a significant edge to individuals involved in trading crypto derivatives.

This article will explain what is delta hedging in crypto, how it works and what advantages and shortcomings it has.

Key Takeaways

- Delta hedging involves implementing a strategy in options trading to achieve directional neutrality.

- The primary goal of delta hedging is to mitigate directional risk, allowing options traders to focus on capturing changes in volatility.

Follow us on Telegram for more insights

What Is Delta Hedging?

Delta hedging is a risk management strategy used in the financial markets to reduce or decrease the chance of price declines in an asset. In the crypto context, delta hedging involves adjusting the portfolio of crypto instruments to offset the risk of price changes. This is done by taking offsetting positions in derivatives or other financial instruments with a delta value inversely correlated to the delta value of the base asset.

The process of delta hedging in crypto works by continuously adjusting the portfolio to maintain a delta-neutral position. This means that the overall delta of the portfolio is zero, effectively eliminating the risk of price swings. Traders and investors use delta hedging to protect their crypto holdings from adverse price fluctuations, especially in volatile market conditions. By employing this strategy, they can minimise potential losses and stabilise their overall portfolio value.

In summary, delta hedging in crypto is a risk management technique that involves adjusting the portfolio to offset the risk of price movements. By maintaining a delta-neutral position, traders and investors can protect their crypto holdings from adverse price fluctuations and minimise potential losses. This strategy is particularly useful in volatile market conditions, where price movements can be unpredictable and significant.

How Does Delta Hedging Work in Crypto?

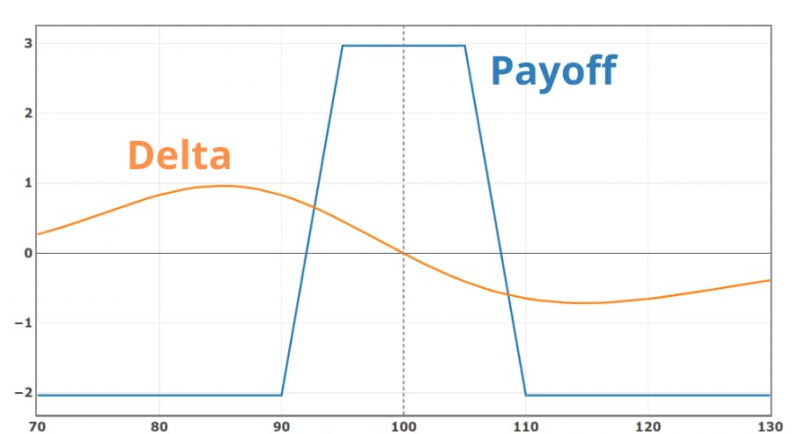

The delta (Δ) represents the speed of price movement in a derivative, like an option, compared to the movement of the underlying asset’s price. For instance, a delta of 0.5 indicates that if the underlying asset’s price goes up by $1, the option’s price will go up by $0.50. This is a simple example of a delta hedging formula.

The delta value falls between 0 and 1 for call options and between -1 and 0 for put options. This range signifies the potential price change in the option relative to the underlying asset’s price movement.

The objective of delta hedging is to achieve a delta-neutral portfolio, a strategy that is of utmost importance. This involves balancing the portfolio’s delta to zero, making necessary adjustments to the positions within the portfolio to ensure that the overall delta is neutral. By achieving a delta-neutral portfolio, it becomes resilient to minor fluctuations in the base asset’s price.

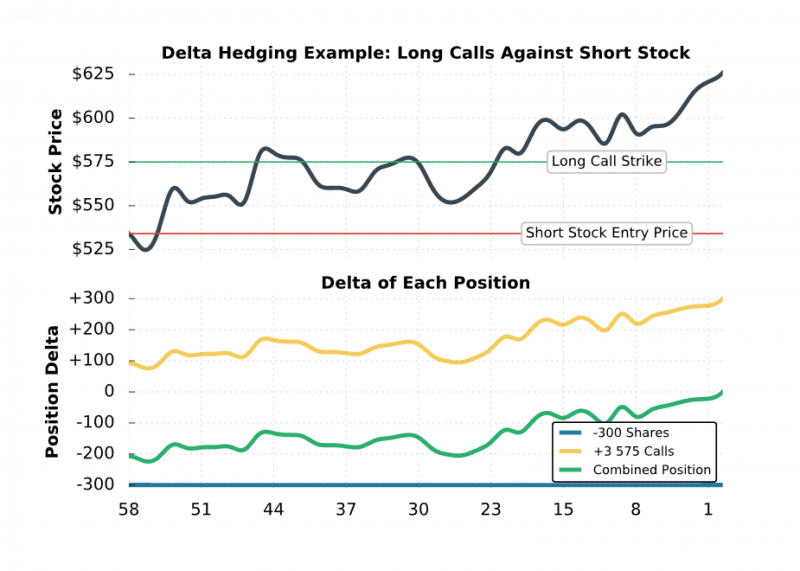

To illustrate, suppose you possess a call option with a delta value of 0.5, and the underlying asset is a cryptocurrency such as Bitcoin. You would short-sell 0.5 units of Bitcoin to reach a delta-neutral stance. This strategic move helps maintain a delta-neutral position within the portfolio, shielding it from the adverse impacts of small price variations.

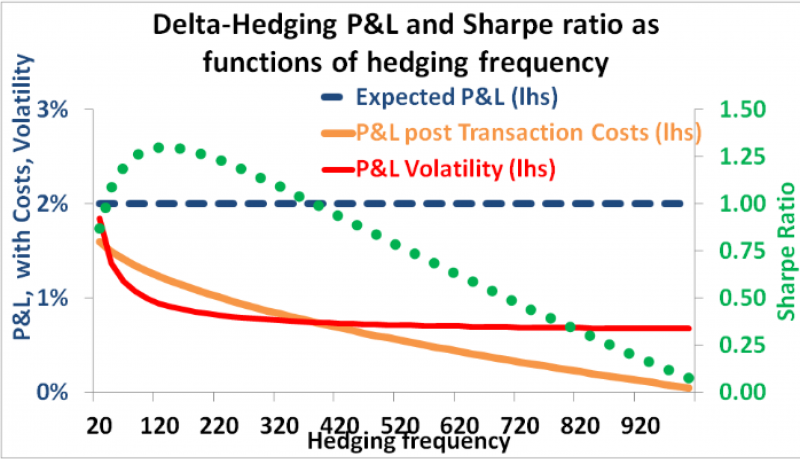

The hedge must be periodically adjusted due to delta drift, which occurs as the price of the basic asset changes. This adjustment process, known as dynamic hedging or rebalancing the hedge, is crucial to maintain its effectiveness.

The frequency of these adjustments is determined by the underlying asset’s volatility and the cost associated with rebalancing. In markets with high volatility, such as crypto, more frequent adjustments may be required to ensure the hedge remains optimal.

The delta measures the relationship between the price movement of an options contract and the corresponding change in the value of the underlying asset.

Advantages of Delta Hedging in Crypto

Delta hedging in the cryptocurrency market provides several key benefits, particularly given the market’s inherent volatility and unique risk factors. Here are the main advantages:

Risk Mitigation

Hedging allows crypto investors and traders to lessen their susceptibility to the high instability of the crypto market.

By taking an offsetting position, hedging can help protect the value of a portfolio or individual cryptocurrency holdings from adverse price movements.

Volatility Management

Cryptocurrencies are known for their significant price fluctuations, which can be challenging for investors to navigate. Hedging strategies, such as using futures or options, can help investors manage the volatility of their crypto holdings and mitigate the impact of sudden price swings.

Improved Portfolio Performance

Effective hedging can help stabilise the overall performance of a crypto portfolio, reducing the impact of market downturns and potentially enhancing risk-adjusted returns over the long term. This can be particularly beneficial for institutional investors or fund managers with fiduciary responsibilities.

Increased Trading Flexibility

Hedging allows traders to take more aggressive positions in the crypto market, as the hedging strategy helps to limit their downside risk. This can open up new trading opportunities and strategies, such as arbitrage, that may not be feasible without effective hedging in place.

Market Making and Liquidity Provision

Market makers and liquidity providers in the crypto derivatives market often use hedging techniques to manage their risk exposures. This helps to maintain tighter bid-ask spreads and more efficient pricing, ultimately contributing to the overall liquidity and stability of the crypto derivatives ecosystem.

Regulatory Compliance

In some jurisdictions, certain investment funds or financial institutions may be required to employ hedging strategies to comply with regulatory requirements or risk management guidelines. Effective hedging can help these entities meet their regulatory obligations.

Diversification and Correlation Reduction

Hedging with non-correlated or negatively correlated assets can help to reduce the overall risk of a crypto portfolio and improve diversification. This can be particularly valuable in times of market stress or when the broader crypto market experiences significant volatility.

Challenges in Crypto Delta Hedging

The delta hedging strategy in the crypto world has many advantages in practical application, but it also has a number of significant disadvantages that significantly complicate the work. Here are the main ones:

High Volatility

Cryptos are notorious for their wide price fluctuations, characterised by sharp and unpredictable changes. As a result, maintaining a delta-neutral position can be challenging and expensive due to the need for frequent portfolio rebalancing in response to these volatile market movements.

Liquidity

The liquidity of both the original cryptocurrency assets and the financial products derived from them can fluctuate, impacting the ease of carrying out transactions to hedge against potential risks.

Market Hours

The cryptocurrency markets differ from traditional markets in that they are open 24 hours a day, 7 days a week, unlike conventional markets with specific trading hours. This means that keeping track of market movements and being able to execute trades promptly is essential in the fast-paced world of cryptocurrencies.

Slippage

When conducting significant delta-hedging transactions in the spot market, it’s essential to be mindful of the potential for slippage, which can diminish the hedge’s ability to mitigate risk effectively.

Funding Costs

When holding a short position in the underlying asset, it’s important to be aware that maintaining this position may incur costs. These costs, known as funding costs, should be carefully considered and integrated into the broader trading strategy to assess the overall impact on potential returns accurately.

Operational Complexity

Regularly monitoring and adjusting the delta hedge is a complex task that demands advanced risk management systems and processes. This involves real-time market movement analysis and appropriate adjustments to the hedge position to manage and mitigate risk effectively.

Conclusion

Delta hedging is a valuable mechanism for managing the extreme risks correlated with the volatility of cryptocurrency markets. By offsetting the sensitivity of options and other derivatives to price swings in the main assets, delta hedging allows market players to protect their portfolios and achieve more stable returns. This technique calls for calculating the delta of a position, creating a delta-neutral portfolio, and regularly adjusting the hedge to maintain neutrality.