Custodians have played a critical role in traditional banking since the 1960s. The rising popularity of cryptocurrency has created a greater need for custodians to ensure the safekeeping of virtual assets.

Filtering through the numerous custody providers can be overwhelming, but understanding the key considerations can help make the best choice for your business.

In this article, we will explore the idea of crypto custody, discuss the role of crypto custodians in today’s crypto landscape, and share some tips on how to pick the optimal custody provider to safeguard your digital assets.

Key Takeaways

- Custodians of crypto safeguard the confidential codes required to access funds stored in a digital wallet.

- With self-custody, you can store your digital assets without intermediaries, holding your own private keys for your wallet yourself.

- Third-party custodians are organisations that hold clients’ private keys and ensure the protection of their funds.

- To choose the optimal custody provider, you should pay attention to such factors as security measures, fees and prices, licensing and access to Web 3.0.

What is Crypto Custody?

Asset custodianship, traditionally associated with capital market financial institutions, is responsible for safeguarding investors’ assets and providing services like trade settlement, exchange, clearing, and corporate action execution.

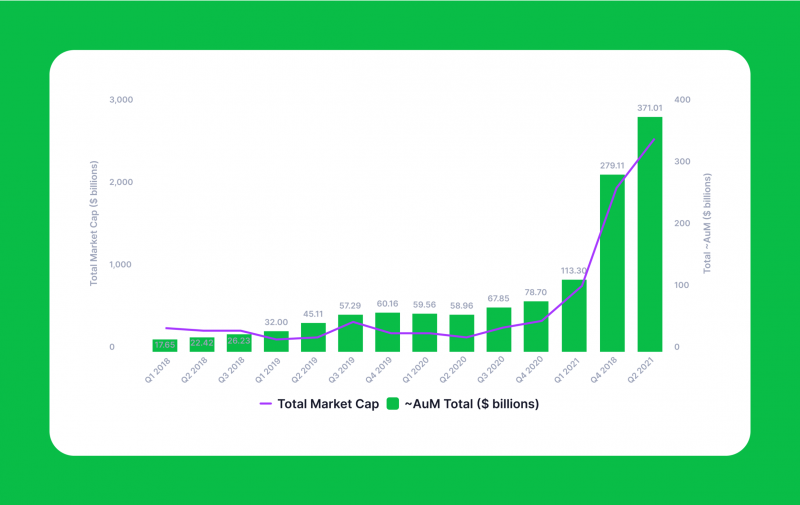

However, the demand for digital asset custodianship has grown due to accelerating investment in the crypto space. Digital asset custodians, like traditional capital market custodians, are responsible for the custody of the keys to clients’ crypto assets, ensuring they are cryptographically secured.

They do not hold the asset itself but manage the keys through safe key management, ensuring the asset cannot be accessed by any other party.

The custodians in crypto custody are responsible for protecting users’ access codes for their funds stored in a crypto wallet. They play a crucial role in popularising and extensive adoption of digital assets since they are often shunned by major investors who deem them unsafe.

Financial institutions such as hedge funds, pension funds, investment banks, and family offices are required by law to have a custodial partner to ensure the safety of their clients’ funds.

With the growing interest from major investors and companies in digital currency, there is a heightened demand for services that can ensure the security of these funds.

Types of Custody

There are two main types of crypto custody: self-custody, partial custody, and third-party custody.

Self-Custody

Self-custody is a method of storing and managing digital assets without intermediaries, similar to storing cash in a wallet or safe, meaning that you hold the private key for your wallet yourself. This allows you to prove ownership and access your holdings. However, this power comes with great responsibility.

You have complete control over your wallet but also bear all risks, such as losing access to your cold wallet or forgetting the private key, which could result in your crypto being permanently lost.

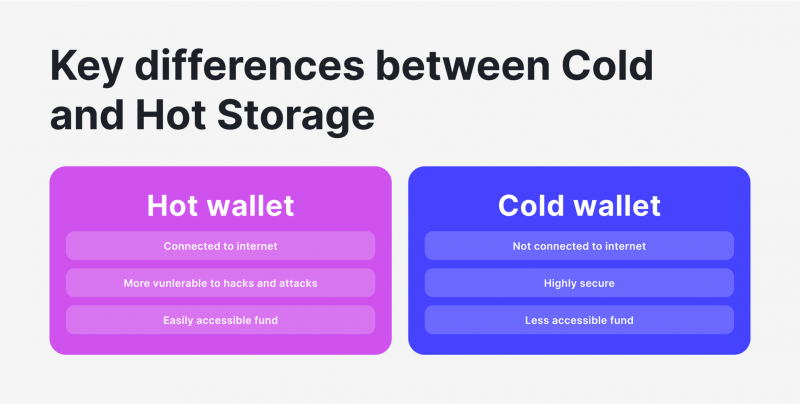

There are two main types of self-custody solutions: hot and cold storage.

Hot storage is a crypto self-custody solution that stores and manages your crypto using an internet-connected application — a so-called hot wallet — allowing you to access your private keys. These wallets are popular among crypto traders due to their ease of access, allowing quick transactions and interaction with dApps.

However, internet connectivity also increases the risk of hacks or scams, and it’s crucial to trust that the application provider hasn’t left vulnerabilities that could expose your private keys. The most widespread hot wallets are, for example, MetaMask, Exodus, or TrustWallet.

Cold storage is a secure alternative to hot storage for digital assets, where private keys are not immediately accessible to the internet. This method is similar to storing money in a personal safe, providing security by being disconnected from the internet.

However, it requires bringing digital assets back online before use, which can be time-consuming. To transfer or withdraw digital money from a cold storage wallet, users must connect their keys to the internet and send a transaction, similar to spending fiat in a store. This step increases security but reduces accessibility.

In 2011, Electrum developed the first mobile Bitcoin wallet application for Android, claiming to be one of the most popular and user-friendly wallets.

Third-Party Custody

Third-party custodians are registered finance institutions with state-level or national licenses to act as custodians. They securely hold clients’ private keys to their wallets and ensure the protection of their holdings.

Users can compare this to having a checking account with a bank. To open an account and to store crypto with a third-party custodian, users must undergo know-your-customer and anti-money laundering checks to ensure the funds were not acquired illegally.

Third-party crypto custody providers typically have extensive security measures, such as multi-factor authentication, encryption, and cold storage, to protect clients’ assets. They are often highly experienced in managing and safeguarding digital assets, providing security, risk management, and compliance expertise.

Additionally, they are typically insured against losses due to theft or other malicious activities, providing additional protection. Regulatory oversight ensures compliance, especially for institutional investors with strict asset safekeeping requirements.

Furthermore, third-party custody providers offer user-friendly interfaces, account management tools, and reporting capabilities, making tracking holdings and managing portfolios easy.

Key Aspects of Crypto Custody

Custody services cater to both institutional and private clients, ensuring the availability, confidentiality, and integrity of private keys and the necessary information for their restoration, enabling customers to access their crypto assets. Here are the key factors that characterise crypto custody.

Security

Crypto funds protectors employ various security measures to safeguard digital assets, including multi-signature wallets, encryption, physical security, and secure offline storage of private keys to prevent theft, hacking, and unauthorised access.

Adherence to Regulations

Custodians must comply with legal restrictions in their business regions, including KYC checks, AML protocols, and reporting and auditing requirements, among other obligations.

Private Key Management

Virtual money custody services are responsible for generating, securing, and managing private keys that govern access to a user’s digital holdings, which are crucial for signing blockchain transactions and establishing asset ownership.

Insurance

Cryptocurrency custody firms offer insurance coverage to protect users from financial damages caused by theft or security breaches, providing additional peace of mind for those who trust their money with them.

Accessibility

Custodians must prioritise security while making assets accessible for user management, allowing users to start withdrawals or transfers as long as certain security constraints are met.

Services Provided By Crypto Custodians

Financial institutions offering custody services for traditional assets are well-positioned to offer crypto asset-specific services, thereby creating exponential customer value. This competitive edge is achieved by offering a wide range of financial services for cryptocurrency-based assets, thereby enhancing their overall offerings.

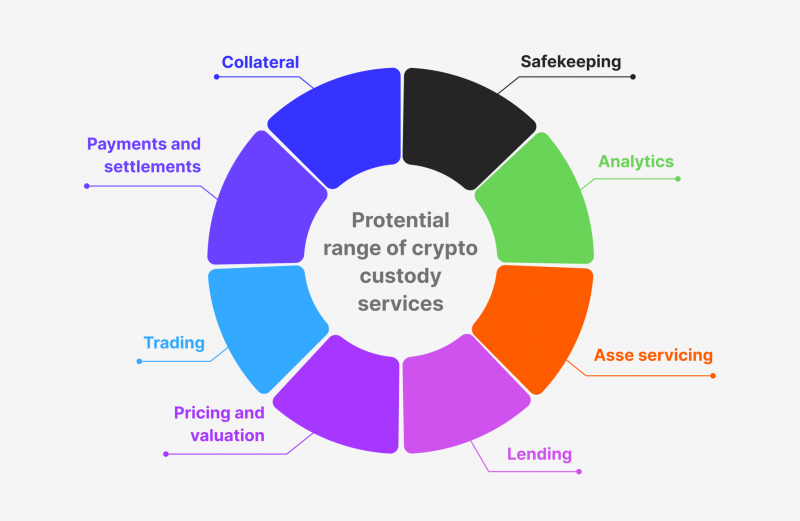

Crypto custody services involve safekeeping, analytics, trading, pricing, valuation, payments, and settlements. They provide digital locking facilities for private keys of investors’ crypto assets, allowing them to be held in public ledgers with proper investor permission.

Custodians offer insights on demand and transaction volumes, enabling portfolio advisory and real-time pricing information for simultaneous portfolio value updates.

Cryptocurrency trading services can be provided through internalising or routing to selected exchanges, and payments and settlement services can be provided using cryptocurrency balances for transactions like futures contract settlement.

Additional value-added services include asset servicing, lending, and collateral management.

Custodians must enable asset servicing to ensure crypto asset balances reflect correct ledgers. They can facilitate lending and borrowing of cryptocurrency assets through an omnibus account structure backed by appropriate risk management policies.

Cryptocurrency assets can also act as collateral, and custodians can provide collateral management services to customers pledging these assets.

Crypto Custodians Fees

Providers charge fees for safekeeping money, similar to regular banks. Crypto custody providers’ fees typically fall into three categories: custody, setup, and withdrawal fees.

Third-party custodians charge a yearly custody fee for managing crypto assets. The fee is typically less than 1% of the total value; however, it depends on the platform used and the amount of your assets.

Account setup fees may vary between platforms, but most charge a flat rate for opening a custodial account with a provider.

Withdrawals can incur a percentage-based cost. For example, Coinbase charges up to 1% of the withdrawal amount. The fee for withdrawing crypto depends on the provider and the amount of crypto withdrawn, with some providers charging a flat fee.

Self-custody offers savings on custody, setup, and withdrawal fees, but it’s not free since users must maintain their wallets and purchase storage products to secure their private keys.

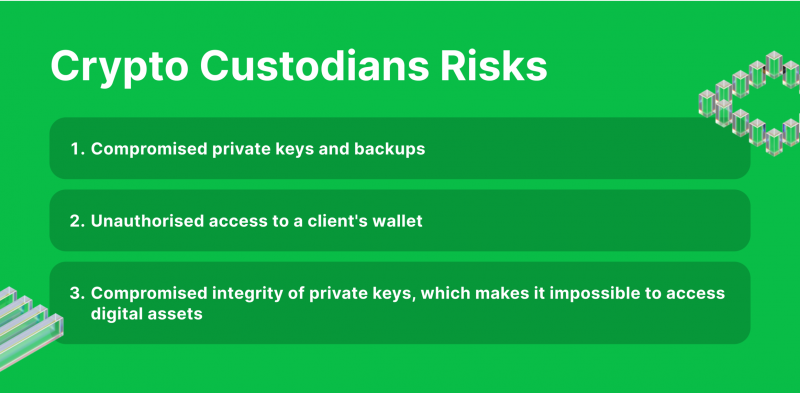

Crypto Custody Risks

Reliable digital asset custodians might be an excellent option for storing and managing your capital. However, they are also susceptible to many risks, mainly due to holding clients’ private keys, which allow users to access their digital assets and protect against illegal access or transactions.

Third parties can control the digital assets if a private key is compromised, for example, through fraud or theft. It is, therefore, very important to create and store private keys and their backups in a secure manner.

When users’ private keys and backups are compromised, they might lose confidentiality, availability, or integrity.

With the loss of confidentiality, unauthorised individuals can access private keys and backups and execute transactions with digital assets on a client’s behalf.

The limited availability of private keys and backups makes accessing digital assets difficult or even impossible.

Compromising the integrity of private keys or backups may render them unreadable and make it impossible to access digital assets.

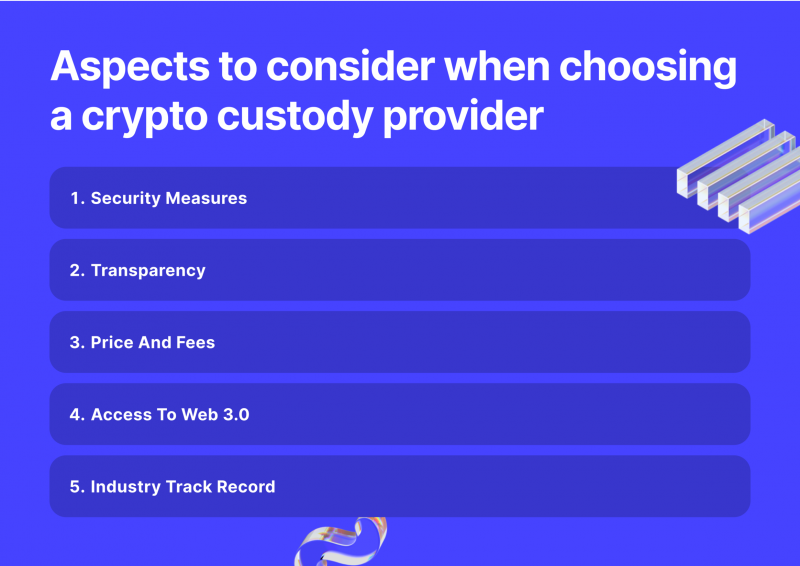

How to Choose a Custodian

Cryptocurrencies have surged, necessitating the need for secure custody solutions, making digital asset custodians a crucial element of the crypto industry. However, choosing the optimal one might be tricky. Here is a list of aspects you should consider when selecting among crypto custody providers.

Security

When selecting a custodian, consider their security infrastructure, including advanced encryption technologies and technical expertise. A custodian should have advanced cybersecurity measures like cold storage, multi-signature wallets, and hardware security modules. Regular audits of robust protocols, insurance coverage, and advanced standards like penetration testing, data encryption, and 24/7 DDoS monitoring are essential for preventing breaches and data loss.

Licenses and Regulations

A licensed digital asset custodian offers added security and peace of mind, while their familiarity with local laws and regulations indicates stability and reliability. Custodians also must adhere to regulations like KYC and AML, with proper licensing and oversight for accountability and potential fraud detection.

Transparency

Custodians should be transparent about their security and management of holdings, requiring frequent audits and reporting. Real-time account overviews and transaction tracking should also be transparent. Legitimate and expert custodians will not falsify information, ensuring transparency and accountability.

Price

Understanding the pricing structures of a crypto custody provider is crucial for budget alignment. Evaluate features and asset value when evaluating solutions. Institutional-grade custody doesn’t have to be expensive; look for affordable pay-as-you-use options to ensure a cost-effective solution.

Web 3.0 Access

Crypto custodians should not only provide storage but also empower users to navigate Web 3.0 with confidence. They should connect users to various dApps and protocols, such as DeFi, NFTs, and DAOs, and offer value-added tools and services like instant zero-fee transfers, trustless settlement, on-chain monitoring, DeFi bots, staking, and audit support.

Industry Track Record

A custody provider’s industry track record demonstrates reliability, resilience, and understanding of client needs. Look for custodians with a long-standing presence who can navigate market cycles, secure large cryptocurrency transfers, and adhere to rigorous security protocols.

Top Crypto Custodians

Crypto custodians are vital in the crypto funds industry, and picking the reliable one is crucial for safeguarding your assets. But if you struggle to select storage for your assets, here are the top 3 crypto custody providers.

Coinbase Custody

Coinbase, a leading crypto exchange in the U.S., launched its custody service in 2012. Coinbase is ranked high and considered the best crypto storage due to low service fees and high insurance coverage. It is a leading provider of cryptocurrency services supporting hundreds of tokens.

Coinbase Custody offers a secure and user-friendly platform for storing digital assets. Its custodial service is built on a multi-signature model, ensuring full control over funds without a single point of failure.

Coinbase’s proprietary cold storage technology and geographically distributed data centres make it a reliable solution for storing digital assets. The service also provides dedicated trading services and 24/7 customer support worldwide. Advanced security protocols and risk management systems further ensure the safety of clients’ funds.

The platform undergoes regular audits and allows users to stake funds directly from their offline wallets for yield.

BitGo

BitGo is a top crypto custodian offering comprehensive security solutions for digital asset holders. It provides storage, management, and access control services for cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

BitGo uses advanced technologies like multi-signature wallets, secure key storage systems, and quality assurance protocols to ensure the highest level of security. The platform also offers real-time portfolio performance tracking and insurance coverage to protect funds from theft or unauthorised access.

Anchorage

Anchorage is a top crypto custodial service providing secure digital asset storage using proprietary technology and institutional-grade security. Their platform includes multi-factor authentication, cold storage, insured custody services, and 24/7 monitoring to protect clients’ digital assets from theft or loss.

Anchorage offers easy access to funds via an integrated exchange interface, open-source analytics tools, and automated compliance reporting. Available to both individual and corporate customers, Anchorage prioritises financial privacy, transparency, and trustworthiness, making it the preferred choice for safekeeping cryptocurrencies.

Final Takeaways

Crypto custody solutions are crucial for storing and protecting digital assets, ensuring their safekeeping against theft, unauthorised access, and inherent risks in the crypto space. As financial services adapt, the role of digital asset custody becomes increasingly crucial, reshaping the future of financial responsibility in the virtual realm.

Crypto custody goes beyond technical necessity; it’s a strategic imperative for building a secure and trustworthy foundation for the digital financial future. Crypto custodians must stay ahead of the curve by implementing advanced security measures, prioritising user experience, and continuously innovating to address evolving traders’ needs.

FAQ

What is the difference between wallet and custody in crypto?

Non-custodial wallets provide users total control over their crypto funds, while custodial wallets entrust them to a third party.

Who is the biggest crypto custodian?

Coinbase Custody is one of the most significant and reliable custodial services.

How much does custody crypto cost?

Custodians usually ask for three types of fees: custody fee, which is typically around 1% of the total value; setup fee, which is usually a flat rate; and withdrawal fee, which depends on the provider and the amount of crypto.

Why should I Opt for a crypto custodian?

Qualified crypto custodians benefit large investors by protecting private keys in crypto asset holdings for a certain fee. However, trade-offs must be considered when deciding between self-custody and third-party storage.