Bitcoin payments are gaining popularity as a simpler and cheaper alternative to credit cards, benefiting businesses. Despite the instability of cryptocurrencies’ values, experts predict the growth of cryptocurrency use in the coming years. However, fiat money still remains a prevailing option for online and offline payments.

In this article, we will explore the difference between crypto and fiat payment processors and find out how payment processors work.

Key Takeaways

- Payment processors are responsible for managing payment logistics and finalising payments.

- Fiat payment processors accept and process payments in national currencies.

- Crypto payment processors allow retailers to accept digital currency as payment.

- The difference between crypto and fiat payment processors is in the type of currencies they process, third-party involvement, fees, etc.

Explaining the Concept of Payment Processor

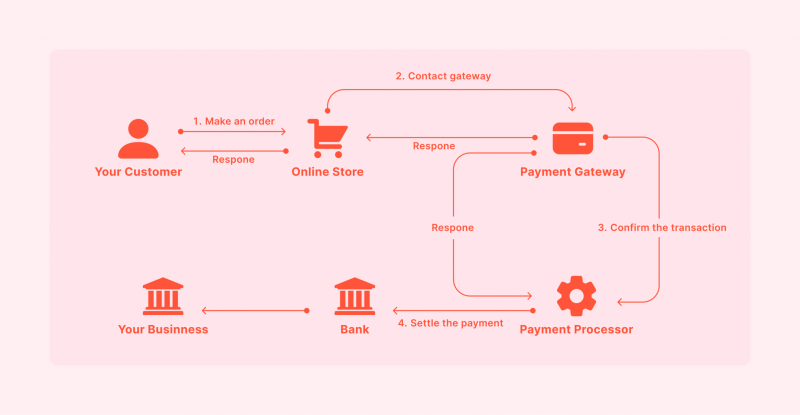

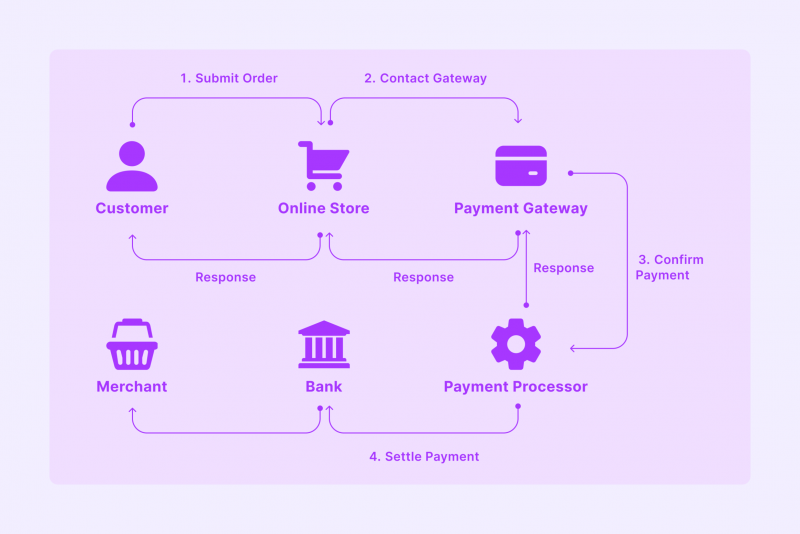

A payment processor (or gateway) is a vendor responsible for managing the card payment logistics. It transfers card data from customers to payment networks and banks involved in the transaction.

A payment processor is responsible for finalising card payments: it transfers money from the customer’s card account to the merchant’s account.

Here’s what the process looks like:

- Customers provide card information to merchants through various methods, such as store terminals, online payment pages, or other methods. This information is submitted through a payment processor.

- The payment processor initiates the transaction by sending it to a card network like Mastercard or Visa for approval.

- After the transaction is approved and completed with a merchant, the payment processor informs the customer’s card issuers to send funds to the merchant’s bank.

- The merchant receives the funds. Depending on the payment provider, this can happen instantly or within a few business days.

Payment-processing systems facilitate trade, support e-commerce, and promote economic growth. Businesses rely on these systems to manage cash flow and other financial operations. A well-functioning system reduces fraud risk, ensures data security, and maintains compliance with regulations and industry standards.

According to some reports, only 39% of consumers believe cryptocurrencies should be used for regular payments for items and services.

How Crypto Payment Processing Works

A crypto payment processor, or gateway, is a service that allows retailers to accept digital currency as payment on various platforms, websites, mobile apps, and offline. It functions similarly to standard payment processors, but digital assets are accepted instead of fiat cash.

A cryptocurrency payment gateway is a secure, dynamic processing infrastructure that enables merchants and providers to accept crypto payments, allowing users to transfer money between wallets.

Payment gateways are crucial for securely delivering sensitive wallet-related data to merchant software, making them increasingly popular among businesses seeking profitable, secure, and quick payment methods despite their core functions.

The blockchain ecosystem, which supports crypto payment gateways, offers immutability and transaction transparency. Its decentralised structure eliminates intermediaries like banks, speeding up transactions and reducing processing procedures. This promotes digital currency usage and the popularity of decentralised gateways.

Serving as a bridge between cryptocurrencies and traditional banking, crypto payment gateways ensure a simple and secure way to make purchases with cryptocurrency.

Here is a sequence of actions that explains how crypto payment processing works:

- The customer begins by selecting a cryptocurrency token as their payment method.

- The crypto payment gateway generates a special code for the transaction — a unique string of alphanumeric characters that is connected to the transaction.

- The customer sends the required tokens to this address.

- The blockchain network verifies the transaction, and the crypto payment gateway instantly converts tokens’ value into a widely accepted currency like the US Dollar or Euro, preventing sellers from dealing with cryptocurrency conversions.

- After the conversion, the amount is transferred to the seller’s account, where they receive the payment as they would with any conventional transaction.

Crypto payment gateways provide businesses with more than just payment options, boosting sales and promoting transaction transparency and safety due to their decentralised blockchain structure. These processors are adopted by small, medium, and large enterprises, offering the potential to remove record-keeping systems and reduce data storage costs. The market targets individual and online businesses, and as enterprises adopt crypto payment gateways, they are expected to see significant growth.

Pros of Crypto Payment Processors

More and more banks, businesses, and consumers are starting to adopt digital payment systems with blockchain’s distributed ledger-based financial solutions. This revolutionary solution offers merchants secure, instant, and cost-effective ways to process payments using cryptocurrencies. Let’s explore the core benefits crypto payment processors offer.

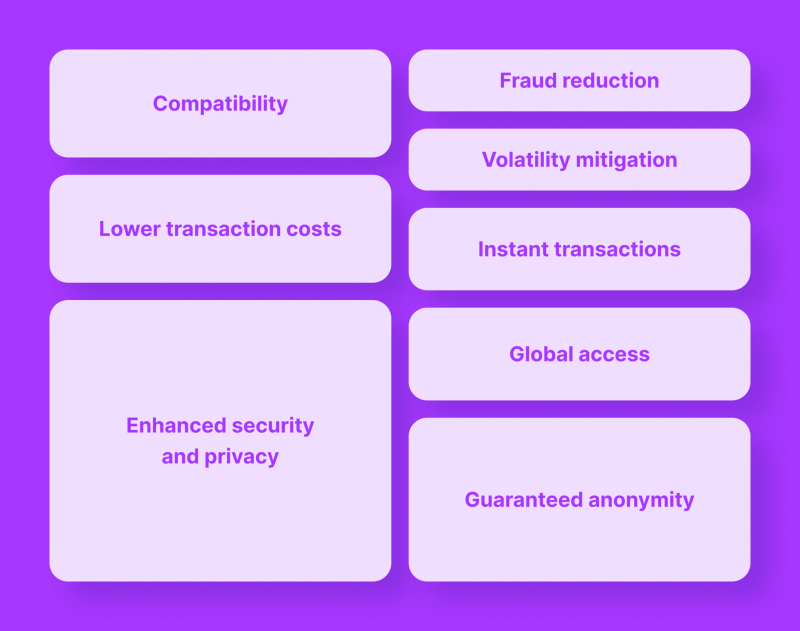

- Lower transaction costs – Traditional financial systems and payment networks often involve fees and intermediaries, while crypto payments eliminate middlemen, reducing costs for merchants and consumers. Crypto payment processors typically offer lower transaction fees.

- Enhanced security and privacy – Crypto payment gateways use blockchain technology’s security features like encryption and decentralisation to reduce fraud and hacking risks. They also maintain user anonymity, unlike traditional payment methods that require sensitive information sharing.

- Fraud reduction – Blockchain technology, which records cryptocurrency transactions and makes them visible to all participants, significantly reduces the risk of fraudulent activities, providing a significant advantage for businesses.

- Volatility mitigation – Cryptocurrencies can be volatile, but many payment processors offer instant conversions, enabling merchants to accept and convert crypto payments to stable fiat currency, thereby reducing the risk of price fluctuations.

- Instant transactions – Cryptocurrencies offer instantaneous transaction validation and settlement, a crucial advantage in the fast-paced e-commerce world, as they don’t rely on standard banking hours.

- Compatibility – Cryptocurrency payment gateways are compatible with all operating systems, making it easy for merchants to set up crypto payments on their devices. This integration doesn’t require any additional code knowledge, and there is no need for device modifications or upgrades.

- Global access – Crypto payment gateways provide global accessibility, enabling crypto transactions for individuals and businesses from any location, thereby attracting a vast customer base without the limitations of traditional banking networks or the high costs of cross-border transactions.

- Guaranteed anonymity – Crypto enthusiasts seek anonymity in payments due to distrust of banks. Decentralised mechanisms like crypto payment gateways eliminate KYC procedures, preserving sensitive data. Offering a crypto payment option demonstrates customer privacy and allows businesses to benefit from their anonymity, demonstrating the value of privacy in the digital world.

Cons of Crypto Payment Processors

Cryptocurrencies offer numerous advantages, but knowing potential obstacles when accepting crypto payments on websites is crucial.

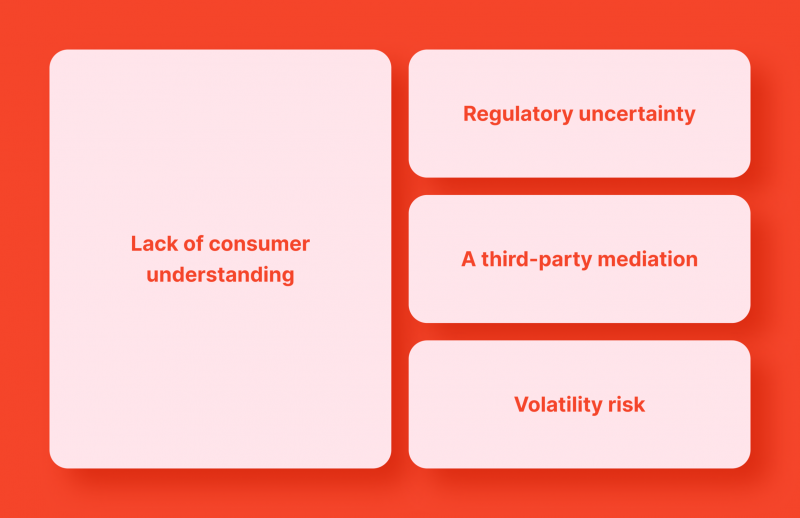

- Regulatory uncertainty – Cryptocurrencies operate in a rapidly evolving legal environment, with regulations varying by country. This lack of consistent regulation can pose a challenge for businesses accepting crypto payments, as some jurisdictions embrace them while others ban them.

- Lack of consumer understanding – Cryptocurrencies are gaining popularity, but their widespread adoption may deter customers from making payments in crypto, potentially limiting businesses’ market. User-friendly platforms can help simplify the crypto payment process, bridging this gap.

- A third-party mediation – Cryptocurrencies were initially designed to bypass intermediaries, but payment gateways compromise decentralisation as merchants must trust and depend on payment service providers.

- Volatility risk – Most providers offer instant fiat conversion to mitigate risk, but drastic price fluctuations before conversion cannot be entirely ruled out.

How Fiat Payment Processing Works

A fiat payment gateway accepts national currencies as payment, sending transaction information digitally or physically through web-based services and APIs. They are popular among e-commerce and retail customers.

A Fiat payment gateway is a third-party service provider that acts as an intermediary between the customer and the merchant, processing payment information like credit card details and transferring funds to the merchant’s account.

Fiat payment gateways, such as PayPal, Stripe, and Square, are widely used for online and in-person purchases. They are crucial back-end technologies in electronic payment processing systems, responsible for designing and building web page interfaces and sending customer information to the transaction processing bank.

Fiat-Crypto And Crypto-Fiat Transactions

Fiat processors are also engaged in converting fiat to crypto and vice versa. They serve as a bridge between traditional finance and decentralised finance. A fiat gateway allows users to purchase digital currencies with traditional fiat currencies.

This process is also called crypto on-ramp. The reverse process, called off-ramp, requires a crypto-to-fiat gateway. On-ramp services are widely available online and offer various payment options like bank transfers, credit and debit card payments, and PayPal.

The main goal of a fiat-to-crypto payment gateway solution is to enable users to buy crypto for fiat money. The process involves converting fiat money into crypto, which involves exchanging money from the user’s fiat wallet to their crypto wallet. The operational process consists of three simple steps.

- The user enters the service/dApp using a fiat onramp and needs to fill out a purchasing order to initiate the crypto buying process, specifying the currency pair, the amount of crypto to purchase, and the actual crypto wallet address.

- The user selects the most suitable payment method to complete the transaction, such as Visa, Mastercard, Google Pay, Apple Pay, or other local payment options.

- The purchase occurs instantly. However, blockchain transactions may take longer, ranging from a few minutes to one hour.

Fiat onramp services are crucial for businesses dealing with cryptocurrency, bridging the gap between traditional finance and the Web3 world. They simplify purchasing, delivering a positive user experience to users.

Crypto on-ramps also offer a secure and transparent platform for financial operations, with advanced security measures protecting users from hackers and fraud. They provide detailed records for compliance and auditing purposes. Crypto on-ramps are vital for the cryptocurrency ecosystem, providing businesses with the tools and resources to offer users the easiest and most convenient way of buying crypto.

Pros and Cons of Fiat Payment Processors

Fiat payment processors are a vital part of the financial system, and just as crypto payment processors have many advantages.

Pros

Let’s look at some major advantages of using fiat payment processors.

- Easy fiat-to-crypto conversion – A fiat gateway eliminates the risks of peer-to-peer transactions. On-ramps offer a quick and easy purchase of digital currency with a wider range of payment options, including credit or debit cards, bank transfers, and wire transfers, allowing users to find a method that fits their needs.

- Potential for increased adoption of cryptocurrency – Crypto on-ramps offer accessibility and convenience for converting local currencies into cryptocurrency, potentially increasing adoption. This is particularly beneficial for beginners or those without access to traditional exchanges. On-ramps also facilitate local currency conversion into cryptocurrency, thereby increasing the number of crypto users and promoting the mainstream acceptance of cryptocurrency as a legitimate payment and value store.

Cons

Despite the advantages, fiat payment gateways have some significant drawbacks that should be considered when choosing this type of payment processing.

- Fees – Crypto on-ramps often charge hidden fees for their services, such as deposit, withdrawal, and conversion, in the form of flat or percentage fees.

- Security risks – Fiat on-ramp services are susceptible to security breaches, including cyber and physical attacks. Hackers can use phishing, malware, and ransomware techniques to access gateway systems and steal sensitive data or funds.

Difference Between Crypto and Fiat Payment Processor

A fiat payment gateway is a type of payment gateway that accepts only fiat (national currencies) for payment, unlike a crypto payment gateway that accepts both. It transmits transaction information via web-based services or a payment terminal.

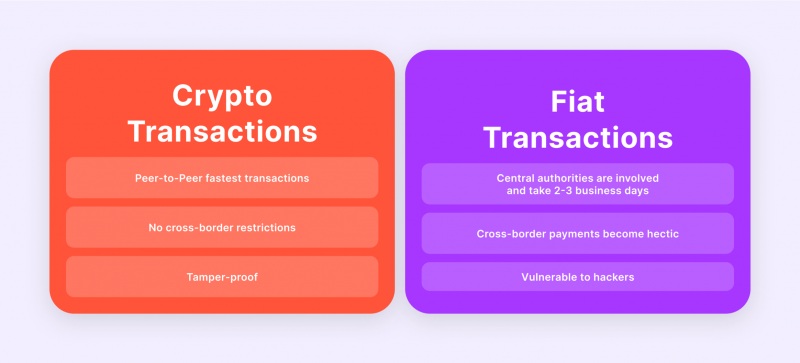

Both gateways aim to allow merchants to accept payment for goods or services, but their services differ. Here are some of the differences between fiat currency and cryptocurrency payment gateways:

- Fees – Crypto offers efficiency and international payments with relatively low network fees due to the absence of many intermediates. Fiat payment processors often charge higher fees and can have hidden fees for such operations as funds withdrawal, deposits, etc.

- Speed – Crypto payments are well-known for their near-instantaneous transfers. All of this is possible because the blockchain enables rapid transactions independent of the client’s or merchant’s location. Depending on the cryptocurrency, its design, protocol, and so on, the payment might arrive at the store in a matter of seconds or ten minutes. Fiat transactions usually take longer, up to several days, due to a third-party mediation and can depend on banks’ working hours.

- Safety – Blockchain technology offers anonymity and transparency, allowing anyone with wallet addresses to see transaction details and money transfers. Fiat processing services are susceptible to cyber and physical attacks that may compromise sensitive information and lead to the loss of funds. Also, blockchain transactions are irreversible and protect retailers from chargeback fraud, unlike fiat payment gateways, where payments are often lost.

- Third-party involvement – Unlike fiat payments, crypto payments are decentralised, eliminating the need for third-party involvement. However, the anonymous nature of blockchain technology and the absence of transaction verification by a third party may become the reason for payment acceptance from criminal business owners.

- Global acceptance – Unlike fiat payments, which are widespread and accepted throughout the world, digital currencies and crypto payments are banned and considered illegal in some countries, like Egypt or China.

Conclusion

Payment gateways are crucial for processing order information and transferring payments to sellers. Crypto payment processors are crucial since more people and enterprises embrace cryptocurrency payments. At the same time, fiat payments remain the most widespread and common way of settlement. Therefore, it is essential to have knowledge of both payment options and understand the difference between crypto and fiat payment processors when selecting a gateway.

FAQ

What is a fiat wallet, and how it differs from a crypto wallet?

Crypto wallets handle decentralised digital currencies, while fiat wallets manage traditional, government-regulated currencies.

How to transfer from crypto wallet to fiat wallet

Choose a reputable exchange for selling cryptocurrency for fiat currency, create an account, verify your identity, transfer cryptocurrency to the platform, sell it for fiat currency, and withdraw it to a bank account or debit card.

What are the advantages of fiat money over cryptocurrency?

Fiat money is generally more stable than cryptocurrency, with major currencies experiencing less price variability compared to the volatile crypto market.