The crypto market has been buzzing recently, especially with the increasing adoption rate among centralised institutions and national regulators.

Traditional bankers and investment firms recently submitted multiple applications to list spot crypto ETFs, including Ethereum and Bitcoin, and both were approved. It is worth noting that the ETH spot ETF approval came faster than the BTC ETFs, marking increased trust among investors and policymakers about the importance of digital assets in classic financial markets.

The ETH ETF approval caused another surge in the market, sending Ethereum’s price higher and closer to its all-time high. However, how long will this effect last? How will it affect the overall crypto market? Let’s find out.

Key Takeaways

- ETH ETFs are financial securities that track the Ethereum market price in regulated tradeable baskets.

- US regulators approved spot ETH ETFs on May 24, 2024, spiking the coin’s market price and liquidity.

- Investing in spot Ethereum ETFs is a better way for traditional traders to make income from the growth in crypto markets.

Understanding Ethereum ETFs

Exchange-traded funds (ETFs) are investment baskets that derive their value from the underlying assets. An ETF may include a collection of stocks or cryptocurrencies, and its price reflects each asset’s market value and price changes.

Ethereum ETFs are instruments that investment firms and funds use to trade Ethereum. An ETH ETF derives its value from the Ethereum market price.

Investors are gradually adapting to digital assets, starting with Bitcoin and Ethereum, the two most sophisticated decentralised ecosystems that guarantee higher stability than other cryptos.

Investing in Ethereum ETFs is similar to trading cryptocurrencies, which decentralised exchanges and traders undertake. However, ETFs are registered securities that centralised institutions and funds use to offer trading opportunities without the hassle of crypto wallets and risky P2P transfers.

ETH ETF Timeline

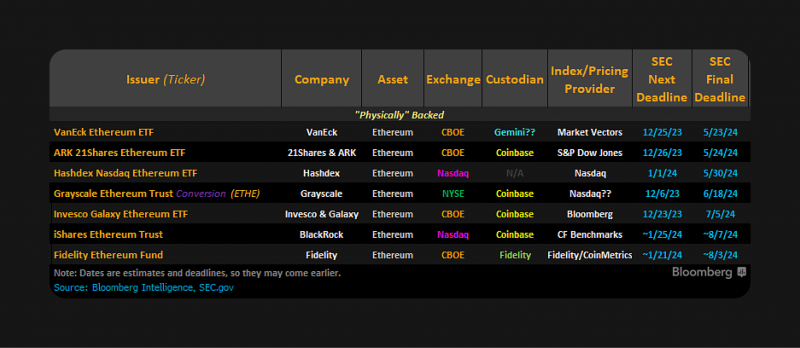

It started in May 2023, when BitWise and Grayscale ETH ETF futures applications were submitted to the Securities and Exchange Commission (SEC), which was filing a lawsuit against Grayscale over the Bitcoin ETF listing. In July 2023, more firms followed suit and requested the listing of Ethereum futures ETFs at their trading desks.

A couple of months later, VanEck, Ark Invest and 21Shares submitted their applications in September 2023, joining a herd of US investment firms, including BlackRock, Fidelity, Grayscale, Franklin Templeton, Invesco, Bitwise and Hashdex, who filed for ETH spot ETF trading.

The first ETH futures ETFs were approved and listed in October 2023. However, investors were waiting for the spot approval.

In March 2024, BitWise joined the applicants for spot ETH ETF listings, increasing the pressure on the SEC, which had already approved spot BTC ETFs two months earlier.

At the beginning of May 2024, the SEC took serious steps towards the Blackrock ETH ETF approval by discussing listing plans and projections with leading ETF providers. This boosted investors’ confidence in a favourable decision.

The SEC communicated the ETH spot ETF approval on May 24, 2024, when the regulator started discussing trading details with applicants, and listings were pending approval.

Why is The ETH Spot ETF Approval Important

The Ethereum ETF approval date was vital to keeping the industry on its feet without causing an overwhelming effect. After the massive crypto market bull run in January 2024, raising speculation and demand for Ethereum could have steered the market out of control, which regulators and funds do not want.

The decision raised confidence among investors, especially after listing crypto ETFs at some of the most trusted investment corporations, encouraging traditional traders to add cryptocurrencies to their portfolios.

The Ethereum price experienced a significant spike a few days before the ETH spot ETF approval. In fact, on May 21, it went from $3,150 to $3,700 in one day.

Then, on May 23rd evening, the coin price surged to $3,910, recording a 23% increase one week before the ETH ETF approval date.

BTC Spot ETFs

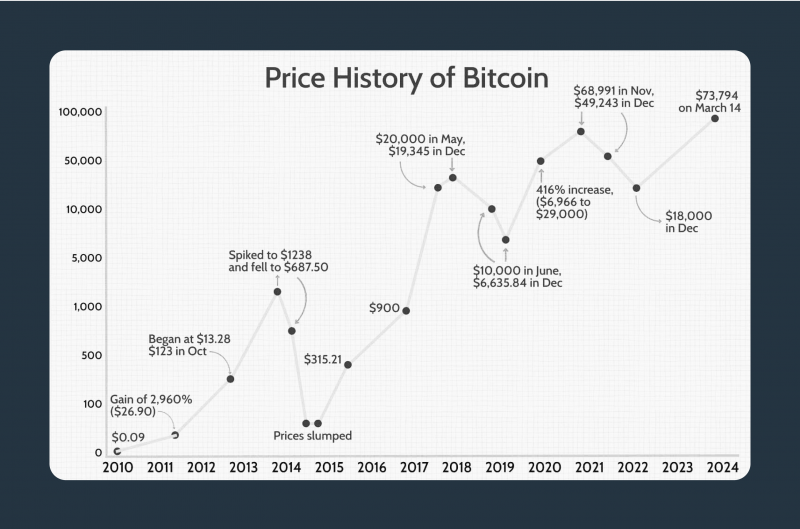

A major event that contributed to the rippling market effect was Bitcoin spot ETF approval after a prolonged procedure that lasted from May 2023 to January 2024. After nine months, the SEC approved listing 11 spot Bitcoin ETFs at major US investment firms.

This long-awaited decision was the first spark that ignited the market, causing Bitcoin to reach its all-time high of $73,000 on March 13.

Approving Bitcoin spot ETFs was probably a significant factor in the fast approval of spot ETH securities that many investors did not anticipate due to the lengthy process of approving BTC ETFs.

Next Crypto Spot ETFs

Approving spot ETFs of Bitcoin and Ethereum has opened the door for speculations about the next cryptocurrency to be approved as an ETF.

Many argue that Ripple (XRP) might be the next crypto asset on investment firms’ trading boards. However, the history between the SEC and Ripple, including a court case, might deter the US regulator from approving XRP assets.

However, SOL could be a better candidate for the next crypto ETF. The Solana Foundation has developed its blockchain and ecosystem significantly similarly to Ethereum, making it harder for the SEC to deny listing SOL ETFs if such applications are submitted.

The SEC sued Ripple Labs in 2020 for illegally raising billions in an unregistered securities offering by selling XRP. In 2024, the court ruled in favour of the SEC, imposing a $2 billion fine on Ripple Labs.

How to Buy Ethereum ETF

The ETH price predictions after ETF approval are over the roof, motivating investors to add ETH ETFs to their portfolios. However, investment firms and banks have yet to list these securities on their trading desks since they are pending the SEC’s final sign-off.

It is unknown how long it will take regulators to discuss the listing individually with each fund. It might take weeks or months before we see these assets, but speculators are somewhat positive about this.

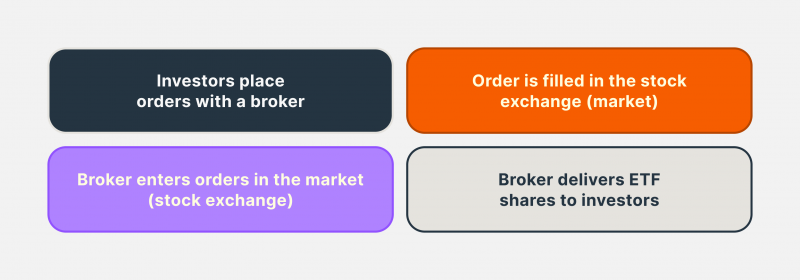

In order to trade Ethereum ETFs, you need to find a brokerage firm that connects you with these corporations that got their applications approved by the SEC and start trading directly with these markets.

- Register your account at the brokerage platform.

- Deposit funds according to the minimum amount requirements.

- Search for ETH ETFs in the listed securities and place your order.

Another way is to find a decentralised exchange where you can buy Ethereum coins and swap them with Ethereum ETFs. These swaps can come at higher fees because they entail interconnections with third-party providers and layer-2 chains.

Binance and Coinbase offer Ethereum ETFs through their wallets, which you can acquire as the following:

- Create your Binance/Coinbase wallet.

- Purchase or transfer ETH coins to your wallet.

- Swap the purchased/transferred ETH coins with ETH ETFs.

Advantages and Disadvantages of ETH ETF Approval

The ETH spot ETF approval caused a buzz in the market that fluctuated prices. Most of these implications are expected to increase trust in the crypto industry and create a sense of discipline.

However, does this decision bring only positive outcomes? Let’s review.

Pros

- Approving ETH ETFs bridges the gap between centralised and decentralised financial markets.

- Ethereum spot ETFs allow traditional traders to invest safely in crypto assets.

- The increased demand for trading ETH assets caused the coin price to rise sharply alongside other cryptocurrencies.

- Listing Ethereum on traditional financial institutions increases liquidity and price stability.

Cons

- Investing in centralised crypto ETFs exposes investors to issuer’s risks if the investment firm or issuer defaults or faces credit issues.

- Traders have no access to their coins when investing in crypto ETFs.

- Increased managerial regulations and policies result in higher investing and service fees.

Conclusion

After listing BTC ETFs and the Bitcoin halving event, the ETH spot ETF approval prolonged the surge in the crypto market, where most cryptocurrencies and tokens continued their upward trend.

The SEC’s decision increased trust among institutional investors and who want to capitalise on the growing opportunities in decentralised markets and created a sense of control in DeFi assets.

The increased demand for Ethereum ETFs caused a spike in the market price, liquidity levels and trading volume. Speculations are now for the next crypto ecosystem to become regulated, such as Solana and Ripple.