For some, trading is an opportunity for passive income. In contrast, for others, it’s a primary source of revenue. Despite high market volatility and quick price swings, the crypto market is still developing. Effective trading methods are essential to maximise profits and handle these situations. This article offers a methodical framework for comprehending and applying the top ten cryptocurrency trading tactics relevant to the current market state.

We start with a thorough introduction to some of the most advanced crypto trading strategies. Then, we delve deeply into each strategy’s potential applications, advantages, and things to remember in 2024. This article gives traders some information to help them improve their trading choices and adjust to the volatile character of the cryptocurrency market.

Key Takeaways

- Advanced tactics suited to the market’s state are necessary for successful crypto trading.

- Making wise trading selections requires keeping up with news, regulations, and market movements.

- Risk management is essential to reduce losses. This includes diversification and stop-loss orders.

- To preserve discipline and long-term performance, avoid emotional and excessive trading.

Overview of Crypto Trading

Trading cryptocurrencies involves purchasing, selling, and transferring digital assets while utilising various trading techniques to profit from market price swings. In contrast to traditional financial markets, cryptocurrencies are internationally accessible through multiple online platforms and exchanges and run around the clock.

Technological developments, regulatory changes, macroeconomic trends, and investor mood are significant elements that may impact the cryptocurrency market in 2024. These elements add to market turbulence, offering traders opportunities and risks.

Making informed selections requires traders to be current on news and market developments. The market players’ behaviour is reflected in market trends, which influence asset prices through variables including sentiment, high trading volume, and technical advancements. Short- and long-term price movements are shaped by market dynamics, which are also influenced by news events, regulatory changes, and economic indicators.

In 2024, traders will be better able to manage the unstable crypto market if they are thoroughly aware of these dynamics, keep up with news and identify trends. This information is the cornerstone for implementing profitable trading techniques to meet their financial objectives. So, below, we will discuss some of the best cryptocurrency trading strategies to keep you on track.

Top 15 Crypto Trading Strategies

Understanding these tactics is crucial for controlling risks and optimising returns. Every strategy specifically targets certain market conditions, trading goals, and risk tolerance limits, giving you the information you need to take advantage of market opportunities and make well-informed decisions.

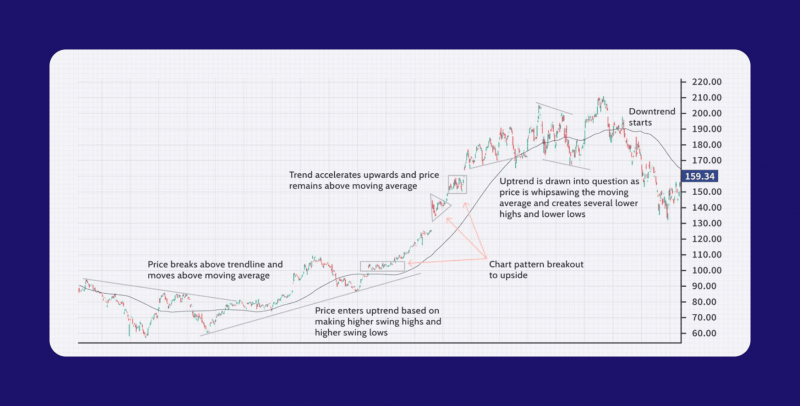

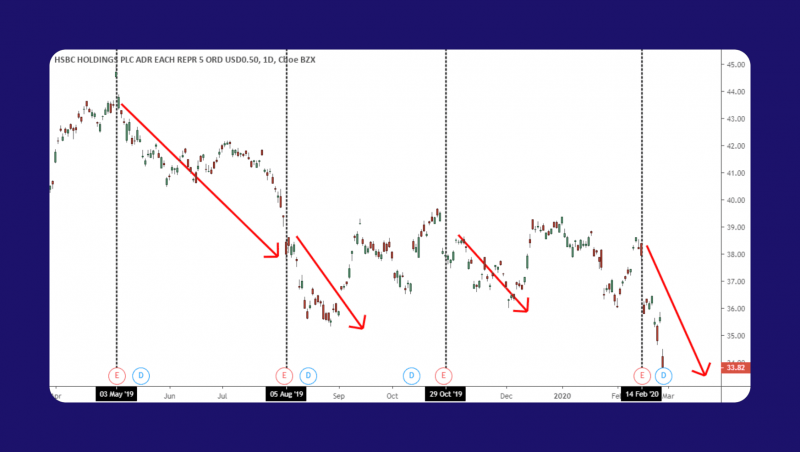

Strategy 1: Trend Following

For some, trend following is regarded as one of the best crypto trading strategies. Trend following means identifying and profiting from well-established market trends. Traders employ technical indicators such as trend lines and moving averages to validate them and initiate trades. They try to ride the market’s momentum by following trends until they see indications of a reversal. The Moving Average Convergence Divergence (MACD) and the Average Directional Index (ADX) are popular trend-following techniques used to verify trends’ strength and direction.

Strategy 2: Momentum Trading

Momentum trading takes advantage of brief price fluctuations caused by significant news or market trends. Technical indicators such as the Relative Strength Index (RSI) are used by traders to discover assets that exhibit strong market movement and to validate overbought or oversold circumstances. Effective execution necessitates quick decision-making to take advantage of swift price fluctuations. Limit orders are frequently used to control entry and exit positions.

Strategy 3: Swing Trading

Capturing short—to medium-term price swings within well-established or range trading is known as swing trading. Traders search for entry and exit locations based on technical analysis indicators such as support and resistance levels. Swing traders success depends on market timing and risk management techniques to profit from price changes without being exposed to the market for an extended period of time.

Strategy 4: Scalping

A high-frequency trading technique, scalping, seeks to make money off minute price changes during the crypto day trading. Traders use technical tools such as fast execution platforms and Level II market data to execute many trades with short holding periods. To profit from price differences between ask and bid prices, scalping necessitates rigorous discipline and sophisticated order types.

Strategy 5: Arbitrage

To make money, arbitrage refers to taking advantage of pricing discrepancies for the same asset across many exchanges or crypto markets. Traders use trading bots and low-latency connections to execute simultaneous buy and sell orders to take advantage of sudden price differentials. Arbitrage demands effective execution and continuous observation of market inefficiencies to profit from temporary opportunities.

Strategy 6: Hodling (Long-term Holding)

Hodling is the practice of retaining cryptocurrency for extended periods of time despite short term price fluctuations. Traders adopt a long-term strategy for investing because they firmly believe in the market’s potential and asset fundamentals. To optimise long-term financial gains, hodling methods concentrate on building holdings during market downturns and purchasing crypto assets during price declines.

Strategy 7: Diversification

Diversification distributes investments among cryptocurrency and asset types to reduce risk and improve portfolio stability. Traders divide their capital between stable, well-established cryptocurrencies and high-risk, high-reward assets. Diversification techniques aim to minimise market-specific risks and maximise portfolio performance by distributing assets across several industries and geographical areas.

Strategy 8: Mean Reversion Trading

The foundation of mean reversion trading is the idea that, following brief fluctuations, asset prices eventually return to their average historical prices. Traders in cryptocurrency markets use technical indicators such as stochastic oscillators and the RSI to determine when an asset is overbought or oversold. When the price of a cryptocurrency diverges much from its historical mean, traders expect a correction and adjust their holdings. To identify practical trading opportunities, mean reversion tactics must be used patiently and closely observing market conditions.

Strategy 9: Event-Driven Trading

Event-driven trading aims to profit from significant occurrences or news that impact cryptocurrency. Trades keep an eye out for news that could affect market mood and prices, such as those related to partnerships, regulatory decisions, technology breakthroughs, or macroeconomic events. Accurate news interpretation and fast responses are necessary for an event-driven strategy. In order to spot trading opportunities depending on how the market responds to events, traders can utilise sentiment research tools and keep up with real-time news feeds.

Strategy 10: Options Trading Strategies

Using derivatives contracts to speculate on price fluctuations or hedge against risks is common in cryptocurrency options trading methods. Depending on the state of the market and their trading goals, traders might utilise options to hedge against downside risks or to leverage their positions. Buying call or put options, writing covered calls, or using spreads are strategies to take advantage of volatility or lessen exposure to market swings. One must understand the implied volatile crypto market, its dynamics, and options pricing models to apply options trading tactics in cryptocurrency markets successfully.

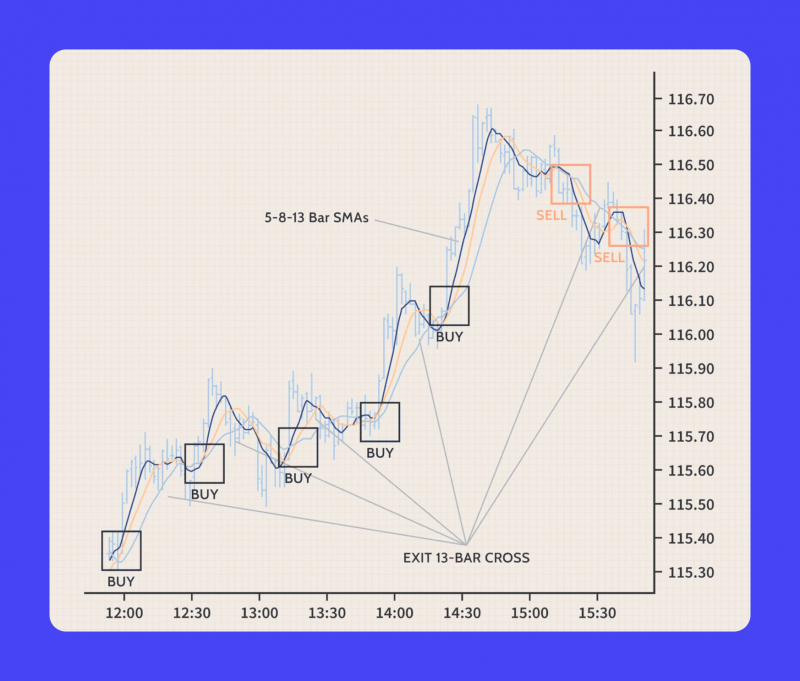

Strategy 11: 15-Minute Timeframe Trading

The 15-minute crypto trading strategy focuses on short-term price swings within a 15-minute timeframe. Traders employ technical analysis tools like volume indicators, stochastic oscillators, and moving averages to spot trends and possible entry or exit points. This method necessitates quick decision-making and vigilant price chart monitoring to profit from short-term price swings.

Strategy 12: Crypto Algo Trading Strategies

Trading bots and algorithms carry out trades automatically according to predetermined parameters in automated trading tools. Traders can create their own algorithms or utilise pre-existing ones that combine arbitrage opportunities, market sentiment analysis, and technical indicators. With automation, trades can be completed quickly, market circumstances can be continuously monitored, and emotional biases can be eliminated from trading decisions.

Strategy 13: Backtest Crypto Trading Strategy

Backtesting is assessing a trading strategy’s profitability and efficacy using past market data. Using historical price movements as a guide, traders simulate trading decisions to see how the approach would have performed in various market scenarios. Before implementing trading strategies in real-time trading environments, backtesting aids in strategy optimisation, risk identification, and strategy refinement.

Strategy 14: Breakout Trading

Finding critical price points, either above or below support or resistance levels, at which a cryptocurrency’s price breaks out of its recent trading range is known as breakout trading. Traders search for substantial price moves and strong trading volumes to verify a breakout. Potential breakthrough points can be found using technical indicators like moving averages and Bollinger Bands. Following the breakout, traders seek to take advantage of the momentum and enter positions to ride the price movement until it exhibits indications of a reversal or consolidation.

Strategy 15: Crypto Spot Trading Strategies

Spot trading is purchasing or disposing of cryptocurrencies to profit from underlying asset price changes. Spot trading techniques primarily analyse market trends, order book data, and liquidity circumstances to identify the best times to enter and exit the market. To make wise trading decisions in spot markets, traders can use indications of market mood, technical analysis tools, or fundamental analysis.

It’s impossible to say which is the most profitable crypto trading strategy. Still, these are some of the most popular and adapted methods that offer various ways to trade cryptocurrencies, each designed to the market’s unique characteristics and your preferences. Adding these tactics to your trading toolkit can improve your capacity to handle the market’s complexity and meet your financial objectives.

Richard Dennis’s 1983 Turtle Trading Experiment showed that teaching inexperienced traders to trade was possible by employing a certain trend-following method. The turtles made almost $175 million in total over five years, demonstrating the success of Dennis’s strategy in producing substantial gains from commodity trading.

Common Risks While Trading That You Should Avoid

After understanding the methods and techniques one can use while trading, it is almost as essential to comprehend that trading is not always as pleasing as it may look, but the road can also be challenging. So, let’s now break down some of the pitfalls you might encounter along the way.

Lack of Risk Management

Effective risk management is essential to preserve capital and reduce losses. To reduce possible losses, traders should use techniques like placing stop-loss orders, which automatically sell a position when it hits a specific price. Diversification across asset classes and appropriate position sizing based on risk tolerance can help reduce overall portfolio risk.

Emotional Trading

Emotional trading can result in irrational decisions and significant losses since it is motivated by fear, greed, or FOMO (fear of missing out). Instead of making rash decisions based on their emotions in response to transient market fluctuations, traders should practise self-control and adhere to their trading strategy. Retaining composure and sticking to a logical trading strategy can improve long-term success.

Overtrading

Trading is usually for people who have patience and the ability to control themselves. When traders make excessive deals in a brief amount of time, they are known as overtrading. This is frequently the result of a desire to take advantage of every trading opportunity. Reduced returns, increased risk exposure, and higher transaction costs can result from this. Traders can prevent overtrading and sustain disciplined trading habits by taking a selective approach to trading and concentrating on high-probability situations.

Ignoring Market Trends

Failing to keep up with news and market developments might result in mistakes and lousy trading judgments. Traders must keep up with changes in the market, technology, regulations, and macroeconomic factors that affect the price of cryptocurrencies. Analysing market mood and trends can facilitate making well-informed trading decisions that are in line with the market’s state.

Security Risks

Trading cryptocurrencies exposes investors to security threats like exchange breaches, phishing attempts, and hacking. The use of trustworthy crypto exchanges with solid security procedures, 2FA for account protection, and safe wallet storage are security precautions that traders should prioritise. Protecting assets requires constant vigilance against phishing efforts and updates on security best practices.

These pitfalls highlight how crucial it is to prioritise security precautions in crypto trading, retain emotional control, implement good risk management techniques, and keep up with market developments. Proactively solving these problems can improve your trading success and reduce potential dangers.

What You Should Consider

Examine credible websites and educational resources designed specifically for learning about cryptocurrency trading. These publications provide an in-depth understanding of trading tactics, market dynamics, and technical analysis tools—all crucial for building a solid foundation in crypto trading.

Developing a customised trading strategy is essential for negotiating the complicated rules of cryptocurrency markets. Start by deciding which tactics are appropriate, given the market’s state and your level of risk tolerance. Maintaining long-term profitability requires robust risk management measures and a disciplined approach to entry and exit points.

Effective trading strategy adaptation requires keeping up with changing market trends. Update your knowledge base regularly by continuing your education and implementing it. Modifying tactics in response to shifting market conditions improves adaptability and optimises trading results.

Final Thoughts

As cryptocurrency markets change, traders need to be knowledgeable and flexible. Although the tactics covered offer a firm basis, successful trading necessitates ongoing education, adaptability, and adherence to risk management guidelines. Knowing how to use these strategies will improve your ability regardless of your cryptocurrency experience.

Recall that every approach has its benefits and drawbacks. Therefore, the secret to long-term success in cryptocurrency trading is striking the correct balance based on your objectives and risk tolerance.

FAQ

Who is the richest crypto trader?

On the list of the wealthiest cryptocurrency investors is Changpeng Zhao, who has $15 billion net worth.

What cryptocurrency trade is the most profitable?

Cryptocurrency traders looking to make money still choose to trade using Bitcoin.

Which approach to cryptocurrency trading is the most successful?

The most popular one is buy-and-hold. Compared to other short-term methods, this strategy involves keeping investments for an extended period of time with the expectation of future profits.