In the rapidly evolving fintech landscape, EMIs face increasing pressure to adapt and give their users more advanced and easily accessible payment options. One strategic move that EMIs should seriously consider is the adoption of white-label crypto payment processors. This integration can bring many perks that can help EMIs ameliorate their client satisfaction, optimise their operations, and stay competitive in the market.

The integration of a white-label crypto payment processor offers EMIs a compelling value proposition that can profoundly impact their business. By embracing this technology, EMIs can expand their payment options, reduce operational complexity, improve their global reach, and ultimately position themselves for long-term success in the emerging financial services sector.

This article will explain EMIs, their key characteristics and distinguishing features. You will also learn where EMIs are used and how white-label crypto payment processors can help businesses expand their business opportunities.

Key Takeaways

- EMI is an organisation that offers individual clients and businesses the ability to conduct various activities with crypto and fiat assets.

- WL crypto payment processor is a ready-to-use embedded infrastructure for conducting transactions with crypto and fiat assets within a brokerage system or web interface.

- EMIs offer an alternative approach for enterprises to interact with payment applications, eliminating the disadvantages of the banking system, but bringing the advantages of blockchain innovation.

What Are EMIs and What Are Their Distinctive Features?

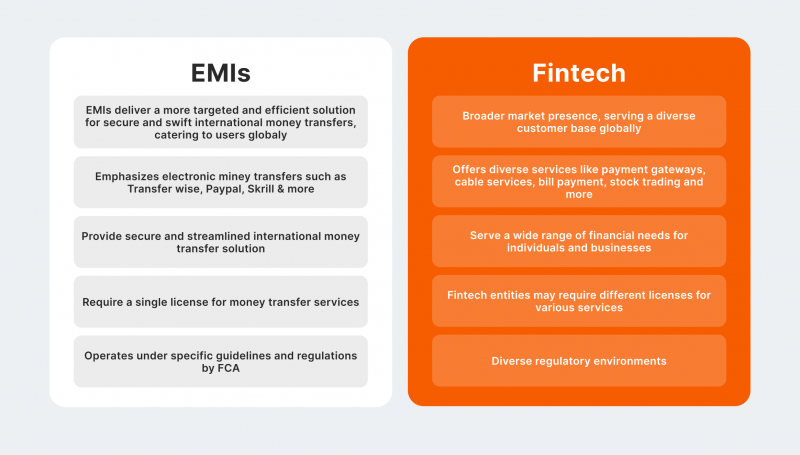

Electronic Money Institutions (EMIs) are financial organisations with the authority to create electronic money, often called e-money. E-money is a virtual substitute for physical currency, enabling seamless electronic transactions. EMIs are essential components of today’s financial landscape, offering services that streamline the handling and movement of digital funds.

EMIs are responsible for issuing e-money, which can be utilised for various online transactions, including purchases, transfers, and payments. By providing secure and efficient electronic payment solutions, EMIs contribute to the affordability and effectiveness of digital financial solutions. Their role in enabling the storage and transfer of electronic funds is instrumental in supporting the growth of cashless transactions.

In the digital age, EMIs are instrumental in shifting towards cashless economies by offering innovative solutions for managing electronic money. As technology advances, EMIs are at the forefront of developing secure and user-friendly platforms for handling e-money. Their contributions to the financial sector are pivotal in shaping digital payments’ future and enhancing electronic transactions’ efficiency.

Key Characteristics of EMIs

Due to their nature and technical features of operation, EMIs have the following key characteristics.

Non-Bank Status

EMIs do not operate as full-service banks; instead, they function as specialised financial institutions that concentrate on electronic money and payment services.

Electronic Money Issuance

EMIs have the authorisation to issue electronic money, which represents a claim on the institution and is stored in electronic form.

Payments Focus

EMIs specialise in facilitating payment operations, encompassing both domestic and international money transfers, mobile deposits, and a multitude of digital payment services.

Regulation and Supervision

EMIs are generally governed by specific regulatory frameworks and are typically subject to oversight by central banks or financial regulatory authorities.

Distinctive Features of EMIs

At the same time, the work of these companies is associated with the ever-changing electronic payment space, not least of which is rapidly developing due to the penetration of crypto technologies. In this regard, EMIs have the following distinctive characteristics.

Faster Time-to-Market

EMIs are often able to introduce new payment products and services more rapidly than traditional banks. This is attributed to their specialised focus and agile nature, allowing for quicker adaptation to market demands and opportunities.

Innovative Technology

EMIs utilise advanced financial technologies, such as digital wallets, mobile applications, and APIs, to provide streamlined payment experiences.

Accessibility and Inclusion

EMIs are designed to extend financial services to individuals and communities who have limited access to traditional banking services or are entirely without access, thereby furthering the goal of financial inclusion.

Flexible Business Models

EMIs can customise their products and service approaches to cater to specific market segments or individual customer prerequisites, promoting innovation within the payments industry.

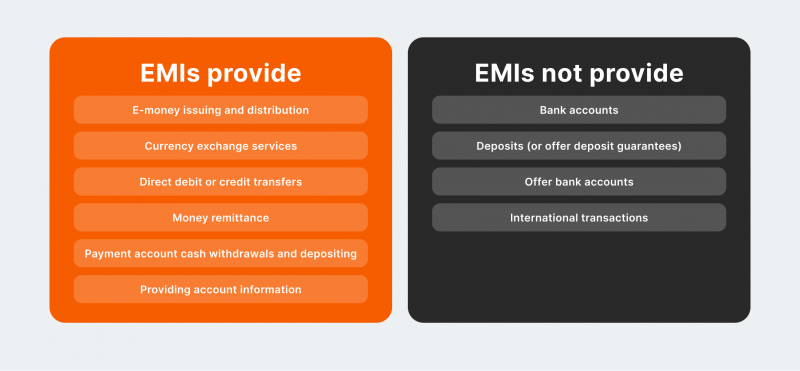

Despite the extensive list of advantages and functionalities EMIs offer, they cannot receive deposits and other redeemable funds that generate returns.

Use Cases for EMIs in Crypto Payments and Financial Services

EMIs contribute to financial inclusion by providing access to financial services for individuals who are underserved or excluded from traditional banking systems.

By offering easy-to-use and affordable solutions for storing and transferring funds, EMIs empower individuals to participate in the global economy and manage their finances more effectively. Thus, increased access to financial services can help bridge the gap between the unbanked population and the mainstream financial system, promoting economic growth and stability in underserved communities.

Here are some key use cases for EMIs in the realm of crypto payments and financial services:

1. Crypto Wallets and Custody Services

EMIs can provide secure and reliable cryptocurrency wallets to store and manage various peer-to-peer currencies. These wallets come with robust security features to ensure the safety of the stored assets.

In addition, EMIs can also provide custody services to store and manage digital assets on behalf of users securely. These services include advanced security procedures and protocols to prevent the assets from unauthorised access or theft.

2. Crypto Payment Gateways

EMIs can create and manage payment gateways, allowing merchants to deal with various cryptos as a form of payment securely.

Additionally, they can enable the immediate conversion of received cryptocurrencies into traditional fiat currency, thereby reducing the impact of market volatility on merchants.

3. Intercontinental Payments

Leveraging the decentralised nature of cryptocurrencies, EMIs can harness the power of blockchain technology to provide cost-effective and efficient cross-border payment solutions. Using cryptocurrencies, EMIs can streamline remittance processes, significantly reducing the time and fees associated with traditional cross-border transactions. This approach offers a faster and more economical way for individuals and businesses to transfer funds across borders, ultimately enhancing financial inclusion and accessibility.

4. DeFi Integration

EMIs can seamlessly connect with decentralised finance (DeFi) platforms, allowing users to use various financial services such as lending, borrowing, and yield farming. By serving as a regulated gateway to DeFi, EMIs play a crucial role in enhancing the safety and accessibility of these services for the general public.

5. Crypto-Linked Cards

EMIs can offer prepaid or debit cards directly linked to cryptocurrency wallets. These cards enable users to seamlessly utilise their cryptocurrencies for transactions at any merchant that accepts conventional card payments. Notably, at the point of sale, these cards can instantly convert the cryptocurrency to fiat currency, providing users with a convenient and flexible payment option.

What is a White-label Crypto Payment Processor, And How Does It Work?

A third-party company offers a white-label crypto payment processor service, empowering businesses to deal with and handle cryptocurrency payments using their branding. By utilising this solution, companies can provide their customers with the convenience of crypto payment options without investing in the development and upkeep of the underlying technology.

Under the umbrella of a white-label crypto payment processor, businesses can seamlessly integrate cryptocurrency payment capabilities into their operations. This service, provided by a trusted third-party company, allows enterprises to maintain their unique brand identity while benefiting from the advantages of accepting digital currencies. By outsourcing the technical aspects of crypto payments, businesses can focus on their core operations and client satisfaction.

The concept of a white-label crypto payment processor revolves around outsourcing the complexities of cryptocurrency transactions. Businesses can effortlessly incorporate crypto payment options into their systems by partnering with a reputable third-party provider. This saves businesses the time and effort required to develop and maintain their own payment infrastructure and ensures a seamless and secure payment process for their end-users.

Here are the main characteristics and features of white-label crypto payment processors:

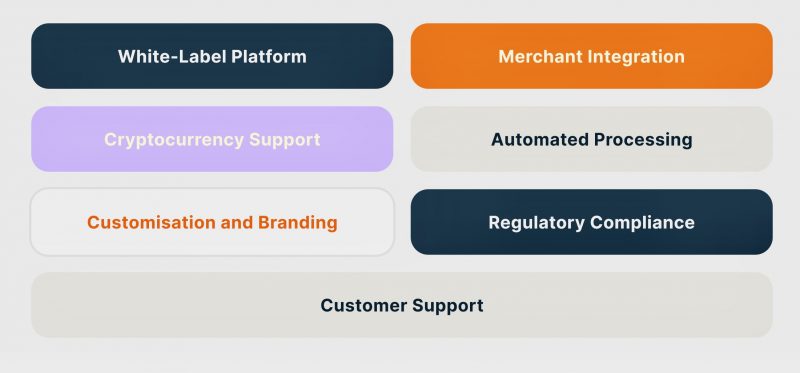

White-Label Platform

The pre-made crypto payment processor with white-label capabilities offers a customisable solution that can be tailored to fit the branding and requirements of the merchant’s online platform. Merchants can easily start accepting and managing cryptocurrency payments by seamlessly integrating this platform into their website or application.

Equipped with essential features and functionalities, this platform streamlines the process of accepting and processing cryptocurrency payments. With a focus on convenience and efficiency, merchants can leverage this white-label solution to enhance their online payment capabilities and provide a seamless experience for their customers.

Merchant Integration

Merchants can conveniently expand their payment options by integrating a white-label crypto payment processor into their existing payment infrastructure. This integration is often achieved through the utilisation of APIs and software development kits (SDKs), enabling merchants to incorporate cryptocurrency payments alongside their conventional fiat payment methods seamlessly.

Cryptocurrency Support

The versatile white-label platform is equipped to handle numerous well-known cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and stablecoins. This ensures that users have a wide array of digital currencies to choose from when conducting transactions on the platform.

By utilising the white-label platform, merchants gain the flexibility to select the specific cryptocurrencies they wish to accept. This empowers them to offer their customers diverse payment options, catering to individual particular interests and ameliorating the all-around user experience.

Automated Processing

With the white-label solution, merchants can effortlessly delegate the intricate backend tasks associated with cryptocurrency transactions, including conversion to fiat currency, settlement, and reporting. This relieves them of technology and regulatory compliance complexities, empowering them to prioritise their core business operations.

Customisation and Branding

The white-label platform can incorporate the merchant’s branding, colour schemes, and other visual elements, resulting in a smooth and cohesive customer experience. By doing so, the merchant can uphold their brand identity while using the crypto payment capabilities offered.

Regulatory Compliance

By partnering with a white-label provider, the merchant can rest assured that all the required regulations, such as KYC and AML, are being met. This not only helps minimise any potential legal risks but also ensures that the payment solution fully complies with the applicable laws and industry standards, providing a secure and trustworthy experience for the merchant and their clients.

Customer Support

White-label crypto payment processors go the extra mile by offering comprehensive customer support services. These services encompass troubleshooting assistance, resolution of transaction issues, and addressing any general inquiries that may arise. This commitment to providing support ensures a smooth and intuitive process for merchants and their clients, fostering trust and trustworthiness.

Why Should EMIs Consider White Label Crypto Payment Processor Integration?

Assessing and analysing the potential of WL solutions is vital for various reasons. WL platforms have the capacity to assist EMIs in reducing costs, improving efficiency, and increasing market penetration. Thus, there are several reasons EMIs should consider adopting white-label crypto payment processors:

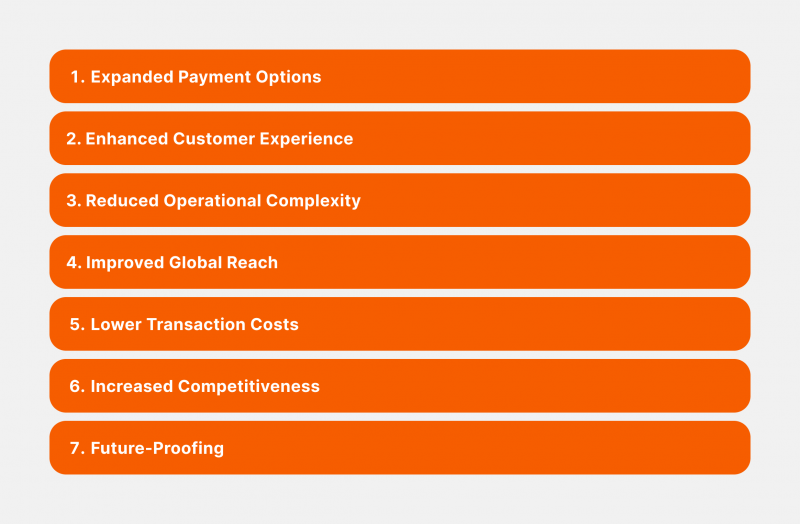

Expanded Payment Options

By incorporating a white-labelled cryptocurrency payment processor, EMIs can now allow their clientele to settle payments through digital currencies alongside conventional fiat payment channels. This enhancement grants customers increased flexibility and aligns with the trend towards diverse payment alternatives, ultimately enhancing user experience and satisfaction.

Enhanced Customer Experience

By utilising white-label integration, EMI can provide its customers with a seamless and branded experience. The payment gateway can be tailored to reflect EMI’s visual identity and branding. This customisation helps uphold a reliable and consistent user experience, which is vital in fostering customer loyalty.

Reduced Operational Complexity

Utilising a white-label solution enables EMIs to sidestep the intricate technical and regulatory challenges associated with constructing and up keeping their personal cryptocurrency payment framework. The white-label provider takes charge of the backend processing, compliance, and customer service, granting the EMI the freedom to concentrate on its fundamental business operations.

Improved Global Reach

Cryptocurrencies provide a worldwide and unrestricted payment system, allowing EMIs to effortlessly receive payments from clients across the globe. This has the potential to significantly broaden EMI’s customer reach and unveil fresh avenues for market growth.

Lower Transaction Costs

Cryptocurrency transactions frequently come with reduced processing costs as contrasted to traditional payment systems, particularly when it comes to cross-border transactions. This can assist EMIs in cutting down their total payment processing expenses and providing more attractive rates to their clientele.

Increased Competitiveness

Integrating a white-label crypto payment processor allows EMIs to set themselves apart from the competition and maintain a leading position in the ever-changing fintech industry. Providing cryptocurrency payment solutions can be a valuable tactic in appealing to and keeping knowledgeable customers.

Future-Proofing

By incorporating a white-label crypto payment processor, the EMI strategically embraces and takes advantage of the increasing acceptance of digital currencies and the overall developments in the fintech sector. This move enables the EMI to safeguard its payment infrastructure for the future and ensure its continued relevance in the dynamic field of financial technology.

Conclusion

Adopting white-label crypto payment processors allows EMIs to quickly and cost-effectively enter the crypto market, providing enhanced security, conformity, and customer loyalty. This strategic move can enable EMIs to focus on their core competencies while offering innovative and scalable payment methods, assuring they remain competitive in the lightning-fast expanding financial services space.

FAQ

What are white-label crypto payment processors?

White-label crypto payment processors are services provided by third-party companies that encourage businesses to engage in crypto payments under their own branding. These solutions offer the necessary infrastructure and technology for dealing with crypto funding without requiring the business to develop these systems independently.

How does a white-label solution help EMIs reduce operational complexity?

The white-label provider handles all the technical and regulatory aspects of cryptocurrency payment processing, reckoning backend processing, compliance, and end-user support. This allows EMIs to focus on their core business activities rather than building and maintaining their own crypto payment infrastructure.

How can white-label crypto payment integration future-proof an EMI's payment infrastructure?

By adopting a white-label solution, EMIs position themselves to adapt and capitalise on the growing adoption of digital currencies and the broader trends in the fintech industry. This helps the EMI remain relevant and competitive as the payment landscape evolves, rather than being left behind by technological advancements

What are the key considerations for EMIs when selecting a white-label crypto payment processor?

When choosing WL crypto payment processor for EMI it’s recommended to consider the following aspects: breadth of cryptocurrency support, customisation and branding capabilities, regulatory conformance and precautionary measures, reliableness and robustness of the payment platform, client support and integration assistance.