At B2BINPAY, we offer two main types of crypto wallet solutions: Crypto Payment Processing (previously known as Merchant Digital Wallets) and Wallet-as-a-Service (WaaS) (formerly known as Enterprise Blockchain Wallets).

Each of these solutions comes with its own tailored commission structures to suit the specific requirements of our diverse client base, ranging from e-commerce businesses to large-scale enterprises like exchanges.

We regularly make changes to our commissions for both types of wallets, aiming to be in line with market standards and offering our clients the best deal possible. This guide will offer you a full overview of the current commission system.

Key Takeaways

- The Crypto Payment Processing solution offers a tiered commission model for incoming transactions, with zero fees on outgoing payments.

- Blockchain-specific minimum fees are applied to cover network costs, with regular reviews ensuring transparent and competitive pricing for Crypto Payment Processing.

- The WaaS solution charges fees only on outgoing transactions, aligning with clients’ exchange revenue models.

Crypto Payment Processing (Merchant Wallets) Fees

This solution is ideal for e-commerce businesses that need to accept payments in various coins, tokens and stablecoins quickly and securely.

You can check the current commission rates for merchants here.

Commissions on Incoming Transactions

For clients using Crypto Payment Processing, commissions are applied to incoming payments (deposits). We employ a tiered pricing structure, which means the fee percentage decreases as your processed volume increases:

- Higher Fees for Lower Volumes: The highest fee applies for processed volumes below $1 million – 0.4% for coins and 0.5% for tokens and stablecoins.

- Lower Fees for Higher Volumes: The lowest fee applies to clients’ processing volumes of over $5 million – 0.25% for coins and 0.35% for tokens and stablecoins.

The approach incentivizes merchants to scale up while keeping costs under control.

Zero Fees on Outgoing Transactions

Merchants do not need to pay any commission for outgoing payments (withdrawals) with cryptocurrencies. This makes it more economical for you to manage customer payouts or supplier payments without additional transaction costs.

Blockchain-Specific Minimum Commissions

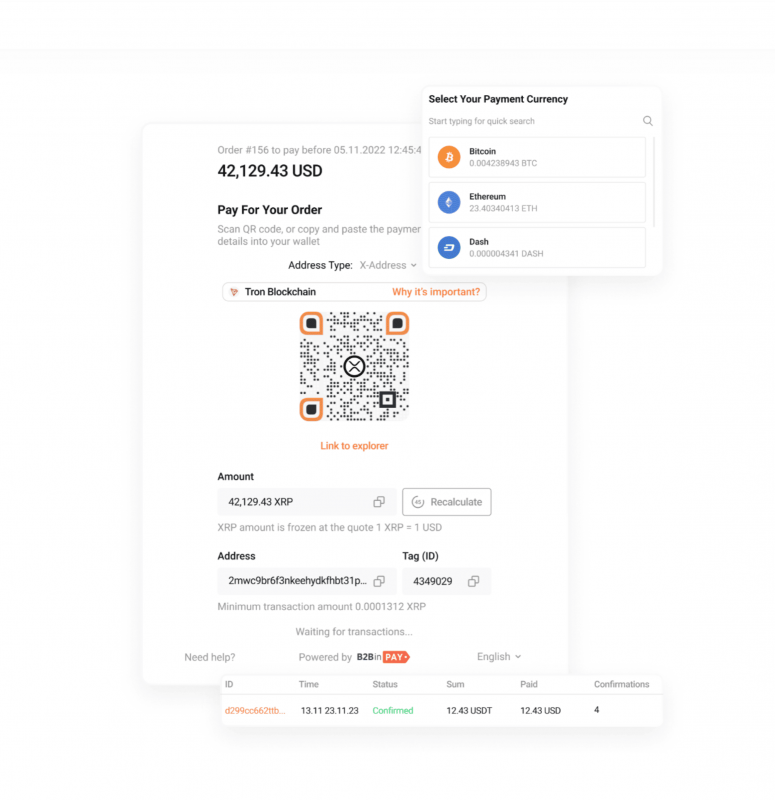

One of the unique aspects of the Crypto Payment Processing Solution is how the platform handles and manages multiple deposits. When your customers make payments, B2BINPAY generates a unique deposit address for each end-user. This helps to quickly differentiate, identify and track each incoming transaction.

However, in blockchain networks, funds sent to a deposit address remain at that specific address. For example, if 1,000 end-users each deposit $100, the funds would be spread across 1,000 unique addresses, each holding $100. Without additional steps, these funds do not automatically consolidate into a single total of $100,000.

Therefore, the deposited funds need to be brought together in one place. For WaaS, the responsibility for consolidating these funds falls on the client. In the case of Crypto Payment Processing, B2BINPAY manages the whole collection process. We handle these transactions by transferring funds from the individual deposit addresses to our main wallet.

Due to the costs associated with these consolidations, we charge a minimum commission on certain blockchains to cover the network fees required for gathering the funds.

For our clients, this is a hassle-free way of managing large volumes of payments without worrying about the complexities of blockchain consolidation.

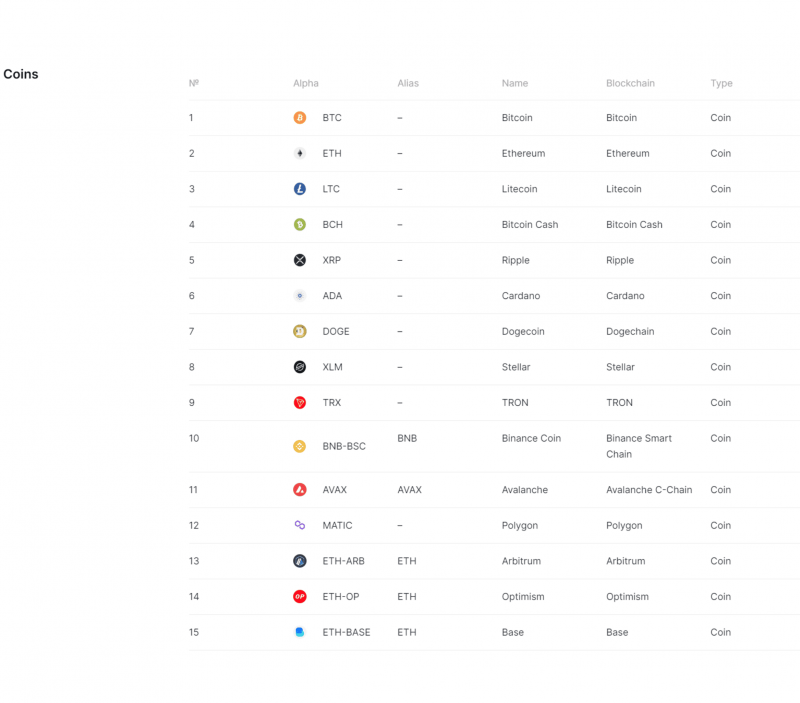

Blockchain-specific commissions are particularly relevant for Ethereum-like blockchains where gas fees can fluctuate significantly: Tron, Polygon, Avalanche, and BNB Smart Chain, as well as for Layer-2 networks like Arbitrum, Optimism, Base and others.

Changes to Blockchain-Specific Commissions

Previously, we absorbed blockchain processing fees as part of the overall percentage-based commission structure. However, due to rising blockchain gas costs, particularly on Ethereum-like networks, this approach became less sustainable. That’s why we’ve introduced these differentiated minimum fees based on each blockchain’s specific costs.

These fees are periodically reviewed and adjusted to keep up with market changes, ensuring that our pricing remains fair, transparent, and competitive.

Bank Withdrawals in Fiat Currencies

For clients who need to convert their crypto holdings into fiat, we offer bank withdrawal services via SEPA and SWIFT networks. The commission rates for these services are as follows:

- SWIFT EUR: Minimum withdrawal amount of €5,000 with a 0.5% commission (minimum €20).

- SEPA EUR: Minimum withdrawal amount of €5,000 with a 0.5% commission (minimum €10).

Due to European regulations, we can only process withdrawals in EUR.

Wallet-as-a-Service (Enterprise Wallets) Fees

The Wallet-as-a-Service (WaaS) wallets are a perfect solution for larger enterprises, such as exchanges, trading platforms, and high-volume crypto businesses.

You can check the current commission rates for WaaS here.

Zero Commissions on Incoming Payments

Unlike the Crypto Payment Processing wallets, where fees are charged on incoming transactions, WaaS applies commissions only on outgoing transactions (withdrawals). This better aligns with the business model of enterprises, such as cryptocurrency exchanges and trading platforms, who typically earn through trading fees and other activities after deposits are made.

Tiered Commission Rates on Outgoing Transactions

WaaS clients benefit from a tiered commission system, where higher processing volumes result in lower fees. As the processing volumes increase, clients automatically qualify for lower rates:

- Highest Fee: For volumes below $1 million, the highest fee is 0.05% for coins and 0.05% for tokens and stablecoins.

- Lowest Fee: For volumes above $20 million, the lowest fee is 0.025% for coins and 0.025% for tokens and stablecoins.

Support for Illiquid Tokens

For illiquid tokens, the WaaS Solution offers a straightforward and predictable fee structure with a fixed rate for outgoing transactions:

- Outgoing Transactions: A flat 0.15% commission is applied, regardless of the transaction volume.

- Incoming Transactions: Completely free of charge.

Businesses can manage a broad portfolio of assets with confidence without worrying about varying fees, ensuring that they can plan their costs accurately.

Big Changes to WaaS Wallets

Previously, we applied commissions on incoming transactions for our clients. Shifting to charging fees only on outgoing transactions is a strategic move that greatly benefits our clients.

For example, enterprises like crypto exchanges primarily earn revenue through trading fees. Charging commissions on incoming deposits reduced their profit margins, as they incurred costs before even earning revenue. With the new model, clients can first generate income from trading activities and then pay us only when they withdraw funds.

Moreover, our minimum fees for WaaS wallets were significantly reduced. The new highest rate of 0.05% is now equivalent to the previous minimum fee and ten times lower than the previous maximum, offering clients a much more competitive starting point.

Closing Thoughts

B2BINPAY is committed to helping businesses of all sizes process cryptocurrencies seamlessly. As the blockchain landscape evolves and transaction costs fluctuate, we continuously refine our fee structures to remain competitive and transparent. Our commitment is to deliver innovative, all-in-one crypto solutions that align with market trends and our clients’ business needs.

If you have any questions about our fees or need further clarification, feel free to visit the “Know Your Fees” page or contact our support team. We’re here to make your journey in crypto payment processing as smooth and efficient as possible.

FAQ

Why are there blockchain-specific minimum fees for some networks?

Due to the high gas fees of blockchains like Ethereum and Tron, we charge a minimum fee to cover the network costs associated with consolidating end-users’ funds from several addresses for Crypto Payment Processing wallets.

How often are blockchain-specific fees reviewed?

We periodically review and adjust blockchain-specific fees to stay aligned with market conditions. This ensures that our pricing remains fair and competitive as blockchain gas fees and other network costs fluctuate.

How do the fees work for bank withdrawals in fiat currencies?

For clients wishing to convert crypto to fiat, we offer bank withdrawals via SEPA and SWIFT. The minimum withdrawal amount is €5,000. SEPA transactions incur a 0.5% fee (minimum €10), while SWIFT transactions also incur a 0.5% fee (minimum €20).

Can I see a detailed breakdown of current fees for both wallet solutions?

You can find the complete list of current fees for both Crypto Payment Processing (Merchant Wallets) and WaaS (Enterprise Wallets) on our website.