The swift expansion of cryptocurrencies as a mainstream investment option has strengthened the need for safe practices in managing and storing digital assets.

To securely utilize the blockchain and conduct transactions, having a digital coin wallet is crucial. For anyone dealing with virtual currency, crypto wallets are indispensable because they protect keys and streamline the transaction process.

This article will dive into the top 10 crypto wallet providers, offering an overview of their key features and functionalities and helping you pick the best option for your needs.

Key Takeaways

- Crypto wallets hold both public and private keys, letting users manage their digital assets securely.

- Hot wallets are connected to the internet for easy access, while cold ones store private keys offline for enhanced security.

- Choosing the right wallet depends on security features, supported tokens, ease of use, and integration with dApps.

- MetaMask, Ledger, and Guarda are some of the best crypto wallet providers.

Breaking Out the Concept of a Crypto Wallet

A digital money wallet is a tool that allows users to securely store, send, and receive digital assets like BTC, Ethereum, and other crypto coins.

While often referred to as “storage,” these wallets don’t actually hold the money itself. Instead, they store public and private keys—the cryptographic codes that give users admission to their funds on the blockchain. Wallets act as a digital ledger, tracking transactions and balances for a given blockchain address.

There are two crucial components in a crypto wallet: the public key, which is similar to an account number that can be shared, and the private key, a confidential piece of code that grants access to the funds.

The phrase “Not your keys, not your coins” highlights the importance of owning your private keys—The associated assets become inaccessible if a private key is lost or compromised.

How Does It Work?

A wallet’s public key is akin to a bank account number. It’s a long string of characters generated by the wallet provider and is shared with others to receive cryptographic money. On the other hand, a private key acts like a password, granting the owner the authority to sign transactions and manage their crypto assets.

The secret key must always be kept confidential—if lost or compromised, it can permanently lose the associated funds.

When someone sends money to your wallet, they are signing off the ownership of those funds to your wallet’s public key. This transaction is then broadcast to the blockchain network, where it gets verified and recorded.

However, to access those funds, the private key linked to the public key must be used to confirm ownership. Crypto wallets also generate wallet addresses, which serve as unique identifiers for receiving cryptocurrency.

In essence, a crypto wallet functions as a secure gateway to the blockchain, allowing users to interact with their digital assets. Whether you’re sending funds, checking balances, or engaging with dApps, the wallet ensures that only authorized users can access their crypto holdings.

Crypto Wallet Types

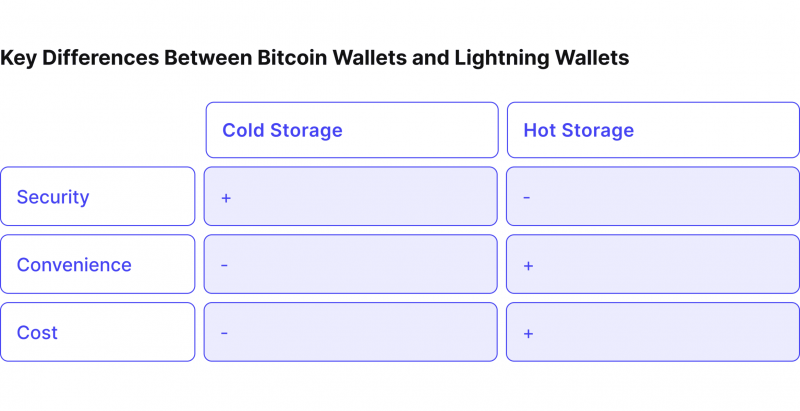

When managing cryptos, choosing the right type of wallet is essential for balancing security, convenience, and control. Crypto wallets are typically divided into two main categories: hot and cold wallets, each offering distinct advantages depending on your needs.

Additionally, wallets can be further classified as custodial and non-custodial, influencing who controls the private keys.

Hot Options

A hot wallet (or a software wallet) is a digital wallet connected to the internet, making it ideal for users who frequently trade or engage with dApps. Accessible via mobile apps, desktop applications, or browser extensions, hot wallets provide quick, convenient access to your funds.

They are suited for everyday transactions and interaction with DeFi protocols or NFT platforms. However, their constant online connection makes them more vulnerable to hacking attempts, phishing scams, and malware.

Cold options

A hardware wallet, another term for a cold wallet, ensures that your private keys remain offline. This greatly enhances the safeness of keeping your money over an extended period. Many investors prefer to utilize cold wallets to store their assets.

By storing private keys offline, these wallets significantly reduce the risk of cyber attacks. Paper wallets, printed papers containing your public and private keys, can serve as cold wallets.

While crypto hardware wallets provide high security, they can be somewhat tricky for everyday transactions due to the additional steps required to access your funds.

Custodial vs. Non-Custodial Wallets

Another key distinction between crypto wallets is whether they are custodial or non-custodial. Custodian wallets are managed by third parties, such as exchanges, which control your private keys, offering convenience but requiring trust. On the other hand, non-custodian wallets give you full control over your private keys, enhancing security and ensuring that only you have access to your funds.

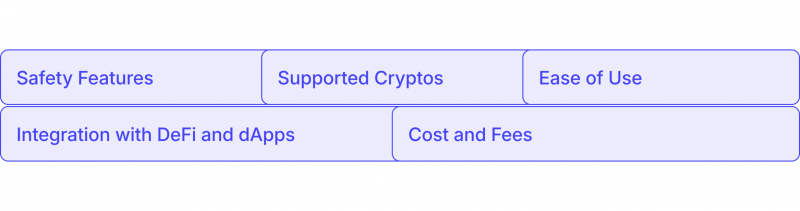

What to Consider When Choosing a Wallet Provider

Choosing the right crypto wallet service provider is crucial for guaranteeing the security, functionality, and accessibility of your digital assets. With a wide range of wallets available, making an informed decision requires careful consideration of several key factors. Here’s what to keep in mind when selecting a wallet provider:

1. Safety Features

Security should be your top priority when managing cryptocurrencies. Look for wallets that offer advanced protection measures, such as 2FA, multi-signature support, and encryption.

Cold wallets, which store keys offline, provide an added layer of protection for long-term storage, while hot ones often include extra security layers for online usage.

2. Supported Cryptos

Before choosing a wallet, ensure it supports the specific cryptocurrencies you plan to hold or trade. Some wallets focus solely on major assets like BTC and ETH, while others support a diverse range of altcoins and tokens, providing flexibility for investors with varied portfolios.

3. Ease of Use

A user-friendly interface is essential, especially for those new to digital coins. The wallet should be intuitive and easy to navigate, offering smooth access to features like sending, receiving, and managing digital assets. Mobile and desktop compatibility is another important factor for users who want seamless access across devices.

4. Integration with DeFi and dApps

For users interested in DeFi and dApps, wallet integration with these platforms is critical. Hot wallets like MetaMask or Trust Wallet offer native support for DeFi protocols, enabling users to participate in staking, lending, and NFT trading directly from their wallets.

5. Cost and Fees

Consider any upfront costs, especially if opting for a hardware wallet, and transaction fees for sending or exchanging crypto. Some wallets offer customizable fees, allowing you to prioritize speed or cost-efficiency depending on your needs.

Top 10 Best Crypto Wallet Providers

Selecting the right crypto wallet is essential for securely managing and accessing digital assets. In this section, we highlight the top 10 best crypto wallets, breaking down their key features to help you choose the best option based on your needs, whether you’re a long-term investor, an active trader, or a crypto enthusiast.

1. Ledger

Ledger is one of the market’s most popular hardware wallet providers, known for its robust security features. Ledger’s flagship products, the Ledger Nano S Plus and Ledger Nano X, support over 5,500 coins, including ETH and BTC, and a wide variety of ERC-20 tokens. The Nano X also offers Bluetooth connectivity, making it accessible via mobile devices.

Ledger offers deep integration with popular software wallets like MetaMask, allowing users to interact with DeFi protocols securely.

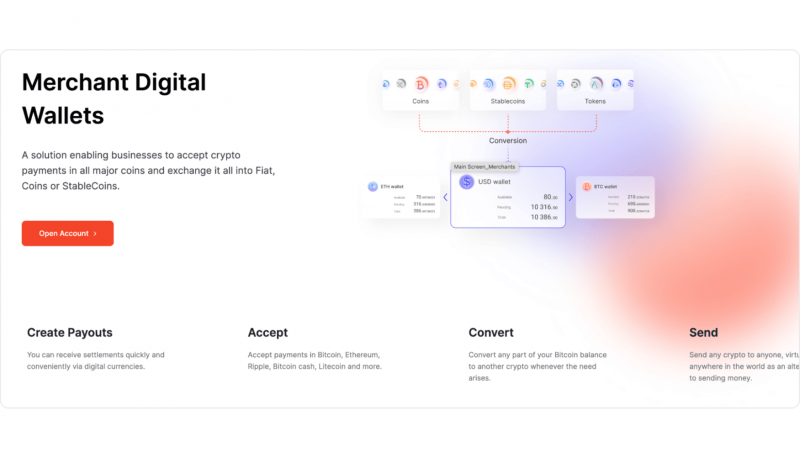

2. B2BINPAY Wallet Solution

B2BINPAY plays an important role in the digital wallet space by providing Wallet as a Service (WaaS) solution. This enables businesses to integrate secure and scalable crypto wallet functionalities easily.

B2BINPAY’s WaaS solution allows companies to manage digital assets through both custodial and non-custodial options, giving businesses a choice between maintaining private key control or relying on a trusted third party.

With features like multi-signature technology, multi-party computation (MPC), and strong encryption, B2BINPAY emphasizes security and reliability in every transaction. Its API-driven setup also simplifies integration into existing platforms, making it a practical option for companies offering crypto services without heavy development.

3. Trezor

Trezor is another well-known hardware wallet, often compared to Ledger, for its similar functionality and security features. Trezor offers two models, the Trezor One and the Trezor Model T, which support over 1,000 cryptos. While the Trezor One is more affordable, the Model T offers additional features like a touchscreen interface.

As a white-label crypto wallet provider, Trezor is ideal for companies seeking to provide secure cold-storage solutions under their own brand with the highest levels of security.

Trezor’s software is open source, which enhances transparency and security. The wallet also integrates with software wallets such as Exodus, providing users with a flexible way to manage their digital assets. However, it lacks native support for staking and DeFi, limiting its use for more advanced users.

4. Exodus

Exodus is a popular online wallet known for its user-friendly interface and compatibility with desktop and mobile devices. The wallet supports over 300 cryptos and includes an in-built exchange, allowing users to swap coins without leaving the wallet.

Exodus wallet also integrates with Trezor, enabling users to store assets in cold storage while enjoying Exodus’s slick interface. However, Exodus is a closed source, which may raise concerns among security-conscious users. It also lacks 2FA, a drawback for those seeking additional security measures.

5. MetaMask

MetaMask is one of the most widely used hot wallets, particularly for ETH-based assets and dApps. As a browser extension and mobile app, MetaMask allows users to store, send, and swap ERC-20 tokens and interact with dApps like Uniswap, OpenSea, and Compound.

With over 30 million monthly active users, MetaMask is the go-to wallet for Ethereum enthusiasts and DeFi traders. It supports Layer 2 solutions like Polygon and Arbitrum, making it a versatile tool for accessing various blockchains. However, MetaMask currently doesn’t support BTC or other non-ETH-compatible tokens, which may be a limitation for diversified portfolios.

6. Trust Wallet

Trust Wallet, the official Binance wallet, is a versatile hot wallet supporting over 10 million tokens and 100 blockchains, including ETH, BTC, SOL, and Binance Smart Chain. It is highly rated for mobile users due to its clean interface and built-in dApp browser.

Trust Wallet is non-custodial, meaning users are responsible for safeguarding their private keys. It also supports staking for coins like BNB, Tezos, and Cosmos, allowing users to earn passive income directly from the wallet. The downside is that it lacks 2FA and more advanced customer support options.

7. Coinbase Wallet

Coinbase Wallet is a hot wallet developed by the popular exchange Coinbase. It supports a wide range of coins, including BTC, ETH, and SOL, and provides integration with dApps and NFT marketplaces.

While Coinbase Wallet is ideal for beginners due to its simple interface and integration with the Coinbase exchange, it’s a non-custodial wallet, meaning users have full control over their private keys. However, its limited support for non-Ethereum-based assets may deter some investors looking for broader coverage.

8. Zengo

Zengo is a relatively new wallet offering a unique feature: keyless security. Instead of a private key, Zengo uses a multi-party computation (MPC) protocol, allowing users to restore access using biometric authentication. This setup eliminates the risk of losing private keys while maintaining a high level of security.

Zengo is non-custodial and supports a variety of popular cryptos. However, it is mainly designed for mobile use, and its desktop version is still under development. This makes it a less versatile option for those who prefer using wallets on multiple platforms.

9. Guarda

Guarda is a multi-platform wallet that is available as a mobile app, desktop software, and web extension. It supports over 50 blockchains and thousands of tokens, including Bitcoin, Ethereum, and Polkadot. This crypto wallet provider also offers staking services and integration with Ledger hardware wallets for cold storage.

One of the key features of Guarda is its non-custodial nature, meaning users possess full authority over their private keys. However, it doesn’t provide native support for dApps, which may be a drawback for users looking to interact with DeFi platforms.

10. BitGo

BitGo is a wallet provider known for its enterprise-level services, primarily catering to institutions and high-net-worth individuals. BitGo supports over 100 crypto coins and offers custody solutions, multisig wallets, and staking services.

While BitGo is more suitable for large-scale investors, its multisig security features make it an excellent choice for those requiring additional protection layers. The wallet is also insured, providing extra peace of mind. However, it may not be the best fit for retail investors due to its complexity and fee structure.

BitGo is also a crypto wallet API provider. BitGo’s API allows developers to develop hot wallets and cold storage solutions, supporting over 100 cryptocurrencies. With institutional-grade security, it’s ideal for virtual coin exchanges and large financial institutions looking for high-level crypto management solutions.

Final Takeaways

Selecting a suitable digital wallet is essential for protecting your digital funds and improving your overall experience with digital currencies. Cold Bitcoin wallets offer a high level of security for holding BTC, whereas hot ones provide greater ease of use and convenience.

Regardless of your level of experience in investing, understanding your needs—such as security, user-friendliness, or compatibility with specific blockchains—will assist you in selecting the top crypto wallet providers for your digital assets.

FAQ

Are crypto wallets safe?

Digital wallets are safe if used properly and with a reliable company. Moving cryptos off exchanges adds extra protection against cyberattacks. Hot wallets connected to the internet can be exposed to hackers, so use a robust security company. Cold wallets are safe but must be protected to avoid losing cryptos.

How to get a crypto wallet?

To obtain a software wallet, download it to your device and register on the wallet’s website or app. For a hardware wallet, purchase the physical product from a brand’s online store and set it up before using it.

What are the main types of crypto wallets?

Digital coin wallets can be classified into cold and hot wallets, with the first being accessible online and the latter being offline storage devices. The wallets can also be custodial and non-custodial.

Does my crypto still grow in a cold wallet?

Cryptocurrencies can either appreciate or depreciate in value, depending on their storage method in a wallet or on an exchange.