Today, numerous companies are adopting digital money payments to enhance their services, expand their global customer base, and simplify transactions. Binance Coin (BNB) is the leading digital currency on the Binance platform. This is an excellent choice for organizations seeking a secure and adaptable payment method.

This article will guide you through the essential aspects of choosing a BNB payment provider, addressing key benefits, potential drawbacks, and the factors to consider when selecting the right provider for your business.

Key Takeaways

- BNB is a versatile coin offering lower transaction fees, fast processing, and global business reach.

- Accepting BNB payments can position companies as early adopters of emerging technologies, attracting tech-savvy customers.

- BNB’s value can fluctuate due to market volatility, which presents opportunities and risks for businesses.

- Selecting the right BNB payment provider involves evaluating fees, security, integration capabilities, and global support.

What is Binance Coin (BNB)?

Binance Coin (BNB) is Binance’s native cryptocurrency, one of the world’s largest and most influential cryptocurrency exchanges. Launched in 2017 as an ERC-20 token on the Ethereum blockchain, BNB has since migrated to its own Binance Chain, becoming an integral part of the Binance ecosystem. Initially created to offer users discounted trading fees on the Binance platform, BNB has evolved into a versatile utility token with many uses.

BNB is central in powering the Binance Smart Chain (BSC), a high-performance blockchain that supports decentralized applications (dApps), smart contracts, and fast transactions at low costs. This makes BNB attractive for developers and businesses seeking cost-effective blockchain solutions.

Beyond Binance’s ecosystem, various merchants, platforms, and companies accept Binance Coin payments, allowing users to pay for goods and services worldwide. Additionally, BNB holders can participate in exclusive token offerings through Binance Launchpad and benefit from Binance’s quarterly “burns,” a process that reduces the total supply of BNB and potentially increases its value over time.

With its growing adoption and expanding use cases, Binance Coin has cemented itself as a key player in the blockchain market, offering both utility and investment potential.

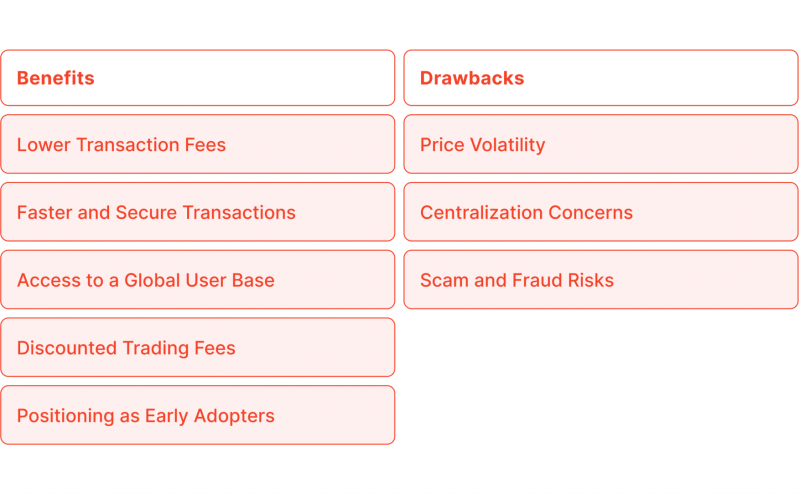

Why Businesses Should Accept BNB Crypto Payments

Accepting BNB payments presents a range of benefits for businesses, making it an increasingly attractive option in today’s digital economy. Let’s focus on some of them in more detail.

Lower Transaction Fees

The lower transaction fees are one of the most compelling reasons to accept Binance Coin payments. Blockchain transactions typically involve minimal processing costs compared to traditional financial systems, and BNB’s fees are even lower than many other cryptocurrencies, making it cost-effective for both businesses and customers.

Faster and Secure Transactions

Payments made with BNB are processed on the Binance Smart Chain, which is known for its speed and security. Transactions are typically confirmed within seconds, which is significantly faster than traditional banking systems or even many other cryptocurrencies. This speed reduces delays in order processing and enhances the overall customer experience.

Access to a Global User Base

Binance is one of the largest crypto exchanges, boasting millions of users globally. By accepting BNB payments, businesses can tap into this expansive user base, potentially attracting new customers who prefer transacting in cryptocurrencies.

Discounted Trading Fees

For merchants who are active on Binance or who use its services, accepting BNB as a payment method also allows them to benefit from discounted trading fees on the platform. This can be a valuable bonus for businesses engaged in virtual coin trading.

Positioning as Early Adopters

Integrating BNB payments sets businesses apart as early adopters of emerging technologies. This can attract tech-savvy customers and enhance the business’s brand image as a forward-thinking company poised to embrace the future of digital finance.

Potential Drawbacks of Accepting BNB Payments

While BNB payments offer numerous benefits, there are also some risks and challenges that businesses should be aware of.

Price Volatility

Cryptocurrencies are inherently volatile, and BNB is no exception. The value of BNB can fluctuate dramatically, which means that a payment made in BNB could lose value before it is converted to your local fiat currency. This volatility poses a risk for businesses that may prefer stable revenue streams.

Centralization Concerns

Binance, as a for-profit company, has considerable control over BNB and its ecosystem. Although Binance Smart Chain operates on decentralized technology, the company itself holds a significant portion of the tokens, raising concerns about centralization. For businesses that prioritize fully decentralized payment options, this could be a drawback.

Scam and Fraud Risks

The growing popularity of the Binance Smart Chain has attracted bad actors who attempt to exploit the Binance Coin network for scams and fraudulent activities. Merchants need to work with reputable payment providers that have robust security and fraud prevention measures in place.

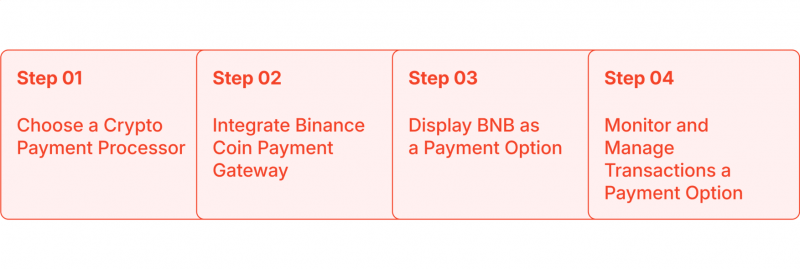

How to Start Accepting BNB Payments

To start accepting Binance Coin payments, businesses must first select a cryptocurrency payment processor that supports BNB transactions. Here are the steps involved in setting up BNB payments:

1. Choose a Crypto Payment Processor

Selecting the right BNB payment processor is critical to ensure smooth transactions. Look for providers that offer seamless integration with your existing payment infrastructure, support BNB transactions, and provide currency conversion services if needed.

2. Integrate Binance Coin Payment Gateway

After choosing a provider, the next step is to integrate their crypto payment gateway into your website or e-commerce platform. Most providers offer plugins or APIs that simplify this process.

3. Display BNB as a Payment Option

Once the integration is complete, businesses should make BNB visible as a payment option during checkout. This will allow customers to choose BNB when making purchases.

4. Monitor and Manage Transactions

After enabling BNB payments, it’s crucial to monitor transactions and ensure that payments are received correctly. Most payment processors provide dashboards for real-time tracking and management of cryptocurrency transactions.

How to Choose the Right BNB Payment Provider

Selecting the right payment provider for BNB transactions requires careful consideration of several key factors:

Transaction Fees

Different payment processors charge varying fees, and comprehending how these fees are structured is crucial. Some offer tiered or volume-based pricing, while others may provide flat-rate fees. Assess your transaction volume and choose a provider that offers competitive rates for your business model.

Security

Security is paramount when dealing with cryptocurrency payments. Ensure that your chosen provider complies with the Payment Card Industry Data Security Standard (PCI DSS) and employs advanced encryption and fraud detection technologies to safeguard both your business and customers.

Integration with Existing Platforms

The payment processor should seamlessly integrate with your existing e-commerce platform, accounting software, or other business systems. Some providers offer plugins or APIs that can simplify this process.

Global Reach

If your business operates globally, choose a payment processor that supports multiple currencies and international payment methods. This is especially important for businesses looking to expand into new markets or cater to an international customer base.

Customer Support

Reliable and timely customer support is essential when dealing with any payment issues. Select a provider known for offering 24/7 customer service and technical assistance to ensure any potential problems are resolved quickly.

Fraud Detection

Your payment processor should offer robust fraud detection tools to minimize the risk of chargebacks and fraudulent transactions. This is especially important for cryptocurrency payments, where transactions are irreversible.

User Experience

A smooth and efficient user experience can lead to higher conversion rates. Ensure that the cryptocurrency payment gateways provide a streamlined checkout process with minimal steps or redirects, enhancing the overall customer journey.

Top 10 BNB Payment Gateway Providers

Here are some of the most reliable BNB payment providers that businesses can consider:

1. B2BINPAY

B2BINPAY stands out as a top BNB payment provider, offering businesses a seamless, secure, and cost-effective solution for accepting cryptocurrency payments. With support for BNB and a wide range of other digital currencies, B2BINPAY ensures low transaction fees, fast processing times, and robust security measures.

Its user-friendly interface allows businesses to integrate cryptocurrency payments with ease, while features like real-time transaction monitoring and detailed reporting provide added value. Trusted by companies worldwide, B2BINPAY is an ideal choice for businesses looking to tap into the growing demand for BNB payments.

2. BitPay

BitPay is a trusted leader in the crypto payment solution industry, offering comprehensive support for BNB payments. Known for its user-friendly platform and robust security, BitPay allows businesses to accept BNB with minimal transaction fees and fast processing times. With features like seamless integration, real-time payment tracking, and automatic currency conversion, BitPay simplifies cryptocurrency transactions, making it a top choice for merchants globally.

3. NOWPayments

NOWPayments is a leading cryptocurrency payment gateway supporting BNB and other digital assets. Offering simple integration, NOWPayments allows businesses to accept BNB payments with low transaction fees and fast processing. The platform also provides automatic conversion to fiat currencies, ensuring merchants’ flexibility. With strong security protocols and 24/7 customer support, NOWPayments is a reliable solution for businesses looking to integrate BNB payments seamlessly into their operations.

4. Plisio

Plisio is a trusted cryptocurrency payment gateway offering seamless support for BNB payments. Known for its easy integration and user-friendly interface, Plisio allows businesses to accept BNB with low transaction fees and fast processing times.

The platform also supports automatic conversion to fiat currencies, offering flexibility for merchants worldwide. With top-tier security features and reliable customer support, Plisio stands out as an efficient and secure solution for businesses looking to accept BNB and other cryptocurrencies.

5. CoinPayments

CoinPayments is a versatile cryptocurrency payment gateway that supports Binance Coin along with numerous other digital currencies. Known for its ease of use and global reach, CoinPayments offers merchants seamless integration, low transaction fees, and automatic conversion to fiat currencies.

Its robust security features, coupled with support for recurring billing and real-time payment tracking, make CoinPayments an excellent choice for businesses seeking to accept BNB payments efficiently.

6. CoinGate

CoinGate is a trustworthy platform that enables businesses to process digital payments, particularly in BNB. It’s an excellent choice for businesses looking to provide additional payment methods.

CoinGate offers a straightforward experience and functions efficiently alongside different platforms. It enables companies to accept BNB easily and provides useful features such as automatic currency conversion and real-time payment tracking.

With competitive transaction fees, strong security measures, and a wide variety of supported coins, CoinGate is an excellent option for businesses aiming to venture into the growing cryptocurrency market. The reliable platform ensures that BNB transactions are secure, fast, and convenient for companies globally.

7. OxaPay

OxaPay offers a comprehensive solution for businesses looking to accept payments in BNB. Known for its seamless integration and user-friendly platform, OxaPay provides fast, secure transactions with low fees. Its features include real-time payment tracking, automated bulk payouts, and multi-currency support, making OxaPay a reliable choice for businesses embracing BNB and cryptocurrency payments.

8. CoinsBank

CoinsBank is a reliable payment gateway offering robust support for BNB payments. Its platform provides businesses with seamless integration, allowing them to accept BNB with ease.

CoinsBank is known for its strong security features, fast transaction processing, and competitive fees, making it a favored choice for businesses seeking efficient cryptocurrency solutions. Additionally, its multi-currency support and real-time payment tracking offer flexibility for merchants looking to embrace the growing demand for BNB and digital payments.

9. Cryptopay

Cryptopay is a trustworthy payment platform that enables companies to process payments using Binance Coin. It makes digital payments easy and safe. With Cryptopay, businesses can effortlessly handle BNB payments thanks to its intuitive design. It includes functionalities such as automatic currency conversion and minimal transaction fees.

Cryptopay is recognized for its strong security measures and reliability, which facilitates businesses in accepting BNB payments and entering the expanding cryptocurrency market.

10. Binance Pay

Binance Pay, a premier solution from the Binance ecosystem, offers businesses a seamless way to accept BNB payments. Built on Binance’s trusted infrastructure, Binance Pay ensures fast, secure, and zero-fee transactions, making it an attractive option for global merchants.

The platform allows easy integration with e-commerce stores and supports a wide range of cryptos, giving businesses flexibility and broad payment options. With advanced security features, real-time transaction tracking, and global reach, Binance Pay positions itself as an ideal solution for businesses looking to leverage the growing demand for BNB and cryptocurrency payments.

Final Takeaways

Choosing the right BNB payment provider is essential for any business looking to capitalize on the benefits of cryptocurrency transactions. By evaluating factors such as transaction fees, security, integration, and customer experience, you can ensure that your business is well-equipped to handle BNB payments efficiently. Additionally, leveraging the growing popularity of BNB can attract new customers and position your business as an innovator in the digital economy.

Whether you are a small business or a large enterprise, the right BNB payment provider can streamline your payment processes, reduce costs, and offer a competitive edge in today’s increasingly digital marketplace.

FAQ

Can I accept Binance Coin donations?

Some providers like BitPay allow nonprofit and charitable organizations to accept crypto donations without market volatility risk, with easy no-code integrations and no crypto knowledge required.

How reliable is BNB?

BNB is generally reliable due to its integration with the trusted Binance ecosystem, strong security features, and widespread adoption. However, like all cryptos, it faces price volatility and some centralization concerns.

What payment details are required when using BNB payments?

Typically, payment details include the recipient’s BNB wallet address, the amount to be paid, and a unique transaction ID for tracking. Some providers may also offer invoice generation or automatic conversion to fiat.

Is BNB legit?

BNB, a legitimate cryptocurrency, is managed by Binance, a prominent digital exchange and trading venue.