A well-written white paper is one of the most powerful tools a blockchain startup can have. It is a comprehensive document outlining your project’s purpose, technology, and potential development, providing crucial details that inform and persuade conceivable investors, users, and partners. This document is often the first point of contact with your audience.

For crypto startups, a white paper does more than just explain a concept; it positions your project as credible and transparent, helping to build confidence within the blockchain community.

In this article, we’ll find out what is white paper in crypto and learn how to write a white paper to create a compelling document that connects with your target audience and sets your crypto project on a path to success.

Key Takeaways

- A white book is essential for digital startups, serving as a detailed report on a project’s objectives.

- It builds credibility, attracts investors, and helps define the project’s roadmap.

- Key components of a white book include a problem declaration, solution, technical details, tokenomics, and market analysis.

- Influential examples like BTC, Ethereum, and Polkadot’s white papers have shaped the blockchain industry.

What is a White Paper?

A white paper (or white book) serves as a comprehensive document that outlines the main details of a crypto or blockchain project. It covers the project’s aims, tech, product or service offerings, token economics, and plans.

Unlike promotional materials designed to sell, a white book gives an unbiased explanation of how the project tackles a particular issue. In the crypto domain, the white book is crucial in building trust with potential investors, partners, and users by providing an in-depth look at why the project matters, how it functions, and what it hopes to achieve.

Originating nearly a hundred years ago, white books were initially utilized by government agencies to inform the public about key policies or decisions. In 2008, Satoshi Nakamoto introduced the Bitcoin white paper, which led to the rise in the popularity of BTC. Since that time, they have emerged as a popular option for blockchain startups initiating an Initial Coin Offering (ICO) or pursuing various fundraising endeavours.

Why Is a White Book Essential for Crypto Startups?

The crypto industry is competitive, and a white paper is often the first piece of formal communication a project offers to the world. It helps your startup by:

- Building Trust: Investors look for transparent information before investing in a project. A well-written white paper fosters trust by offering clear, detailed insights into the project’s goals and technology.

- Attracting Investors: A white book explains the technical and economic model of the project, giving potential investors the information they need to evaluate the project’s potential.

- Setting a Roadmap: A clear, actionable roadmap shows what the project aims to achieve and instils confidence that the team knows what they are doing.

- Showcasing Credibility: Highlighting the qualifications and expertise of the team behind the project helps build credibility and demonstrates the team’s ability to execute the project.

What to Consider Before Writing a Crypto Coin White Paper

Writing white papers can be overwhelming, especially for startups. Here are a few factors you should focus on when writing the document:

Identify Your Audience

Before you search for a crypto white paper template for reference, it’s essential to define your own target audience. Is your document aimed at retail investors, institutional investors, developers, or the broader blockchain community? Different audiences require different approaches. For instance, a white book for developers may dive deeply into the technical aspects of the project, while a document for general investors should focus on the economic model and potential returns.

Clarify Your Main Objective

Your white paper should have a clear goal. Are you looking to raise capital, explain a new technological innovation, or attract partnerships? Once you define your objective, it becomes easier to structure the document and deliver a clear message. If you’re raising funds, make it obvious how potential investors can contribute and benefit. If you’re promoting a dApp, focus on how your project solves an existing problem better than current solutions.

Decide Who Will Write the White Paper

While project owners and project managers often draft the first version of the document, it’s a good idea to hire a professional writer or an industry expert to polish the content. Legal professionals should also review the document to ensure compliance with local and global regulations.

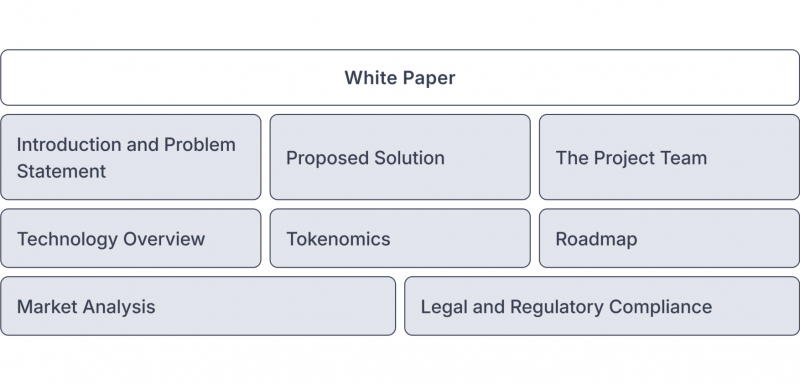

Key Components of a Crypto White Paper

A white book for a crypto or an ICO project generally follows a specific structure. Below are the critical sections you should include:

Introduction and Problem Statement

Start with an engaging introduction that explains the problem your project aims to solve. This section should be concise but powerful enough to grab the reader’s attention. Explain why the issue is important, how it affects the market, and why current solutions fall short.

Proposed Solution

After laying out the problem, add a detailed description of how your project will solve it. This is where you showcase your unique value proposition. Be specific about the product, service, or technology you’re developing and how it works. Use diagrams, charts, and visuals to simplify complex ideas.

Technology Overview

This section should explain the technology behind your project in detail. For blockchain projects, you need to cover the architecture, consensus mechanisms, smart contracts, and any innovations your project brings to the space. Include technical specifications like system requirements, security protocols, and scalability solutions.

Tokenomics

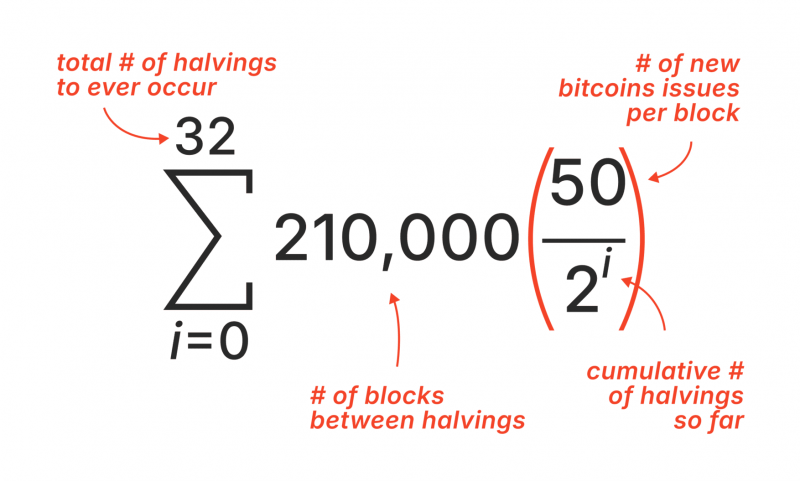

The tokenomics is a vital section of your white book, particularly if you are writing an ICO white paper. Explain how your token functions within your ecosystem, what its utility is, and how it will be distributed.

Key elements to cover:

- Token Supply: How many tokens will be created?

- Utility: What function does the token serve in your platform?

- Distribution: How will tokens be allocated between founders, investors, and other stakeholders?

- Inflation or Deflation: Will more tokens be minted over time, or is there a hard cap?

Use graphs and tables to provide a clear visual representation of the token distribution model.

Roadmap

A solid plan details the sequential actions needed to advance the project. Important objectives such as launching the token, developing the platform, forming partnerships, and penetrating the market should all have specific deadlines. The roadmap is crucial for demonstrating the strategy and projected advancements to investors and users.

The Project Team

Investors will be more inclined to support your project if they believe the team can execute it. Include detailed bios of the key members of your team, highlighting their expertise and experience. Where possible, link to LinkedIn profiles or provide other ways for readers to verify credentials.

Market Analysis

In this section, outline the potential market for your project. What is the size of the market? Who are your competitors, and how does your solution compare? Include data and statistics to back up your claims and show investors that there is a demand for your product or service.

Legal and Regulatory Compliance

The crypto token industry is under increasing scrutiny from regulators. Be clear about your legal framework and how you comply with local and international regulations. Mention any licenses or certifications you have or plan to obtain. This section can also include disclaimers, particularly about the risks of investing.

Best Practices for Writing a White Paper

To succeed in a competitive market, it’s crucial to tailor your crypto or ICO white paper template to meet the industry standards. Here are some of the best practices to write an outstanding white book.

Keep It Professional and Concise

A white book is not a sales pitch, so avoid hype and overly promotional language. Keep the tone professional, focus on facts, and provide evidence to support your claims. Be concise—while white papers can be long, every word should add value to the document.

Use Clear Language and Visuals

While it’s important to include technical details, avoid jargon or convoluted explanations that might alienate your audience. Diagrams, flowcharts, and infographics can help make complex concepts easier to understand.

Provide Evidence and Data

Back up your claims with real data, market research, or case studies. If you’re proposing a novel solution, show how it’s an improvement over existing technology with quantifiable metrics and why it is such a good solution.

Stay Transparent

Transparency is key to building trust. If there are risks or challenges, address them openly. Be clear about your project’s limitations and the risks involved in investing in it.

Ensure Legal Compliance

Cryptocurrency regulations vary by jurisdiction, and your white book should be legally sound. Work with legal professionals to ensure that you comply with relevant laws, particularly if you are planning to raise funds.

Crypto White Paper Example

The top crypto coin documents have played a significant role in shaping the development of innovative blockchain techs and setting strategic visions for successful projects in the crypto space. They have laid down the technical foundations for decentralization, tokenization, and blockchain applications that continue to evolve today. Here, we explore some of the most influential white papers in the crypto world: Bitcoin, Ethereum, and Polkadot.

Bitcoin White Paper

Satoshi Nakamoto’s 2008 BTC white book, titled “Bitcoin: A Peer-to-Peer Electronic Cash System“, is widely regarded as the document that sparked the digital money revolution. The paper addressed the issue of double-spending—a flaw in digital currency models where the same token could be spent more than once—and proposed a solution through a peer-to-peer network.

This groundbreaking white paper described BTC as a decentralized, trustless system that eliminates the need for intermediaries like banks. By utilizing blockchain, a distributed ledger, and the PoW consensus mechanism, BTC offered a secure, transparent, and censorship-resistant form of money that could be exchanged globally.

Key takeaways from the BTC white paper:

Double-Spending Problem: Bitcoin’s main document solved the double-spending issue by using cryptographic proof rather than relying on a centralized authority.

Peer-to-Peer Network: It proposed a decentralized ledger where transactions are verified by network participants, or miners, using computational power.

Security and Censorship Resistance: The paper outlined how BTC ensures the security of transactions and protects against fraud or government intervention by making the network tamper-proof.

The BTC white paper is concise, comprising only nine pages, but it laid the foundation for all future crypto projects. It has become an essential reference for understanding how blockchain tech can power DeFi systems.

Ethereum White Paper

In 2013, Vitalik Buterin introduced the ETH white paper, which expanded BTC’s blockchain capabilities by introducing a fully-fledged, Turing-complete programming language. ETH was designed as a digital currency and a platform for dApps, offering far more flexibility than BTC. Developers could build and deploy smart contracts, enabling a new world of DeFi and applications beyond currency.

ETH’s white paper highlights the platform’s innovative use of blockchain to support various applications. While BTC focuses solely on peer-to-peer currency, ETH allows developers to create programs that operate autonomously on the blockchain, such as dApps and DAOs.

Key aspects of the Ethereum white paper:

Smart Contracts: ETH enables the creation of smart contracts that automatically execute when predefined conditions are met, removing the need for transaction intermediaries.

Ethereum Virtual Machine (EVM): A Turing-complete virtual machine capable of running dApps, making Ethereum much more flexible than BTC.

Tokenization: Ethereum’s ERC-20 standard made it easy for other projects to issue their tokens on the ETH blockchain, helping to fuel the ICO boom.

Since its publication, Ethereum has become the foundation of most blockchain projects, from DeFi platforms to NFTs. The white paper is a continually updated and improved living document, which deviates from the more static nature of Bitcoin’s original document.

Polkadot White Paper

In 2016, Dr. Gavin Wood, a co-founder of ETH, introduced Polkadot, a blockchain protocol that focuses on solving interoperability and scalability issues that other blockchains, including BTC and ETH, face. Polkadot’s white book proposed a sharded blockchain network, where multiple blockchains, or parachains, can operate independently while still being able to interact with each other through the Relay Chain.

Polkadot was designed to enable different blockchains to swap information and assets, enhancing scalability by processing multiple transactions in parallel. Its key innovation lies in its ability to allow a variety of blockchains to interoperate in a secure and scalable environment.

Highlights of the Polkadot white paper:

Interoperability: Polkadot enables multiple blockchains to communicate with each other, which can be crucial for projects seeking to expand beyond a single blockchain’s limitations.

Sharding: Polkadot’s use of parachains allows for parallel processing of transactions, greatly enhancing scalability compared to traditional blockchains.

Security and Scalability: The platform provides shared security to all blockchains connected to its network, enhancing security while increasing the system’s capacity to handle transactions.

Polkadot represents a major step forward in blockchain tech by addressing the critical issues of scalability and cross-chain interoperability, allowing for a more connected ecosystem of blockchains.

Bottom Line

A sound white book is more than a marketing tool for any digital startup; it’s a thorough document that demonstrates how serious and credible your project is. Learning how to write a white paper can help you gain trust, draw in investors, and set up your startup as a significant contender in the blockchain world.

FAQ

What should you look for in a blockchain white paper?

The document should demonstrate the project’s mission, technology stack, consensus mechanism, tokenomics, team credentials, use cases, and a clear problem declaration and resolution.

How often do white papers get updated?

Whitepapers may be updated to reflect project changes, but frequent updates without clear reasons can indicate instability or lack of vision.

Who can write a blockchain white book?

Anyone can write a white paper, but understanding blockchain, cryptography, and the problem is crucial. Good whitepapers are well-researched and technically sound.