The intersection of cryptographic money and politics is shaping up to be a central theme in the upcoming 2024 U.S. election. With growing attention on crypto assets such as Bitcoin, Ethereum, and the broader digital currency market, many are asking whether the election’s outcome could trigger a new bull run for crypto. As political parties and candidates outline their stances on crypto regulation, the decisions made in Washington will have profound implications for the industry.

This article explores the current state of the cryptocurrency market, its crypto and politics relationship, and how the U.S. elections might influence a potential bull run. By delving into historical trends, market analysis, and policy stances, we can better understand how politics and crypto markets might interact in 2024 and beyond.

The Current State of the Cryptocurrency Market

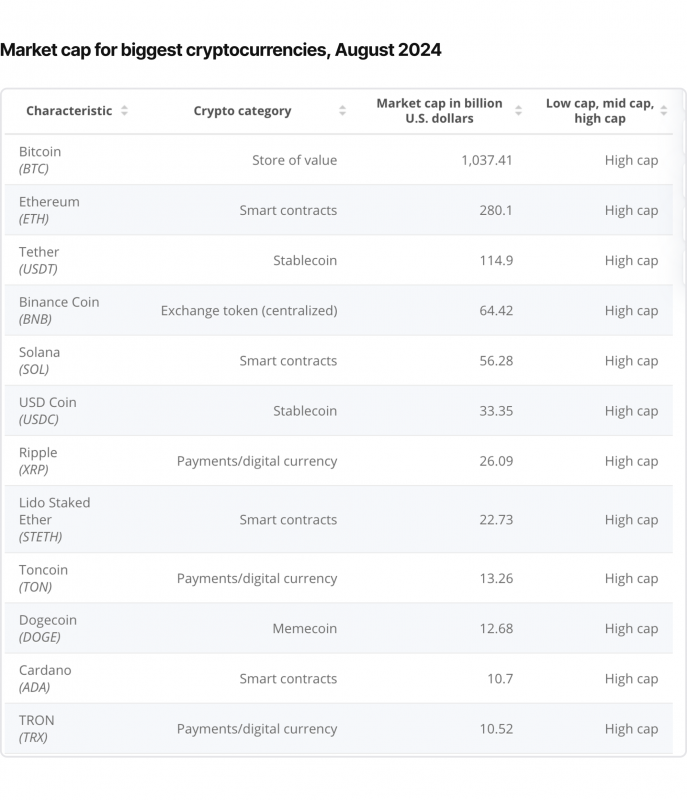

The cryptocurrency market in 2024 remains volatile yet promising, with BTC and ETH continuing to be dominant forces. Bitcoin, with a market capitalization of $1.34 billion, has experienced a significant surge, breaking previous all-time highs set in 2021. Ethereum, while stable, saw a slight decline after its Dencun upgrade, but it still holds strong at $2306 per ETH.

Bitcoin has long been seen as a hedge against inflation and market instability, attracting more long-term investors seeking to preserve value. As inflation and geopolitical risks rise, BTC’s scarcity becomes an attractive alternative to traditional currencies with its hard-capped supply of 21 million coins. ETH continues to serve as the backbone for dApps, maintaining its status as a favourite among developers and traders alike.

Meanwhile, stablecoins like Tether (USDT) offer relative price stability, important for traders looking to minimize volatility. Binance Coin (BNB) and Solana (SOL), though facing minor declines, remain strong contenders due to their respective ecosystems’ growth and innovations. As institutional investors continue to show interest in cryptos, many analysts predict that the next bull run could coincide with key political events, including the U.S. election.

Crypto and the 2024 Election

As the 2024 U.S. presidential election draws near, cryptocurrency is becoming a pivotal issue, with candidates offering differing perspectives on its future. Former president Donald Trump has historically been critical of digital assets, expressing concerns about their volatility and potential to disrupt traditional financial systems. During his presidency, Trump referred to cryptos as potentially fraudulent and advocated for stringent regulations to curb their use. His approach centres on maintaining control over financial systems and ensuring that U.S. currency remains dominant.

On the other hand, Vice President Kamala Harris has adopted a more nuanced stance. While Harris has not positioned herself as an outspoken cryptocurrency advocate, she acknowledges the importance of blockchain tech and financial innovation. Harris supports regulatory frameworks that protect consumers while allowing technological advancements to thrive, emphasizing the need for a balanced approach. She focuses on ensuring that innovation in the economic sector does not come at the cost of public safety or financial stability.

With cryptocurrency gaining widespread adoption and becoming an integral part of the global financial landscape, the 2024 US election could shape how digital assets are regulated in the United States. Voters will be paying attention to how each candidate navigates this rapidly evolving space, as their policies could have long-term implications for both the economy and the future of financial technology. As crypto becomes more mainstream, the regulatory direction set by the next administration will be crucial.

The Political Divide: Democrats vs. Republicans on Crypto

The crypto debate in the U.S. has highlighted a significant divide between Democrats and Republicans. Democrats, including Vice President Kamala Harris, are generally more open to the possibilities of blockchain tech, though they also advocate for regulation. Many Democrats view crypto as an opportunity for financial inclusion and technological advancement but stress the importance of preventing market manipulation and ensuring that regulation keeps pace with innovation.

On the other hand, Republicans have historically been sceptical of crypto. Many Republicans share a cautious approach, emphasizing the need for government oversight to prevent illicit activities tied to digital assets.

This political divide reflects larger economic ideologies, with Republicans focusing on safeguarding established financial structures and Democrats advocating for a balance between innovation and regulation. As crypto plays an increasingly significant role in the economy, the outcome of the 2024 election could significantly impact how digital currencies are integrated and regulated in the U.S.

Historical Links Between Elections and Financial Markets

Historically, U.S. elections have had a noticeable impact on financial markets, including equity and commodity markets. Since 1972, the U.S. stock market has seen an average annual return of 8.7% during election years, compared to 7.7% in non-election years. Though the connection between market performance and election outcomes isn’t always direct, there is often a correlation between the optimism or economic uncertainty around an election and market movements.

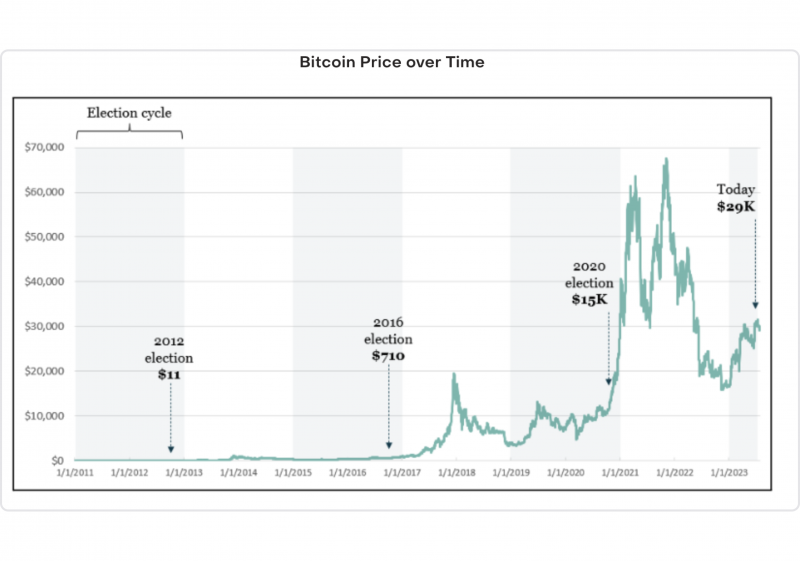

The cryptocurrency market, however, is much younger and more volatile than traditional equities; however, U.S elections and crypto also show regular dependence. Bitcoin’s price history during previous U.S. elections offers some insights. In 2016, following Trump’s victory, BTC saw a significant surge in price, and a similar pattern occurred after Biden’s election in 2020, as BTC prices rose rapidly the year after. With Bitcoin currently experiencing a bull run leading up to the 2024 election, many investors are speculating that political developments could further propel its value.

How 2024’s Election Could Influence Crypto Markets

The 2024 U.S. presidential election is poised to have a significant impact on the cryptocurrency markets, with both bullish and bearish scenarios depending on the political outcome. As candidates take divergent stances on crypto regulation, investors are keenly aware that the election results could shape the future of digital assets like BTC, ETH, and other altcoins.

In a bullish scenario, a win for Donald Trump or another pro-crypto candidate could spur a rally in the markets. If Trump wins, he is expected to bring more aligned policy and personnel to the White House, with GOP lawmakers and conservative groups drafting regulatory proposals in line with the industry’s wish list and potential regulators being floated by Republicans. If such policies are enacted, the cryptocurrency market could experience an unprecedented bull run, with some analysts predicting BTC could surpass $150,000. Lower taxes, less regulatory oversight, and increased institutional interest would likely boost investor confidence, potentially driving a surge in both market volume and prices.

On the other hand, a bearish scenario could unfold if the next administration continues with the more stringent regulatory approach seen under the Biden presidency. Kamala Harris, the current Democratic frontrunner, is expected to continue Biden’s regulatory stance, which includes greater oversight by the Securities and Exchange Commission (SEC) and potential new taxes on digital asset transactions. While this could stifle speculative investments in the short term, some argue that it may bring long-term stability and attract more institutional capital as clearer rules are established.

In either case, the 2024 US election will be a turning point for the U.S. crypto market. Whether a bull run emerges or the market faces new regulatory hurdles, the outcome will have a profound effect on market sentiment, market trends, and the global perception of cryptocurrencies.

Macro-Economic Factors and Crypto

The Republicans’ and Democrats’ attitudes towards certain financial issues are just a part of what influences the crypto market and the 2024 US election prediction. As the event approaches, macroeconomic factors are playing a significant role in shaping the digital coin market’s future. Inflation, interest rates, and global economic growth remain the most critical drivers of crypto asset prices, particularly for ETH, BTC, and other leading cryptocurrencies.

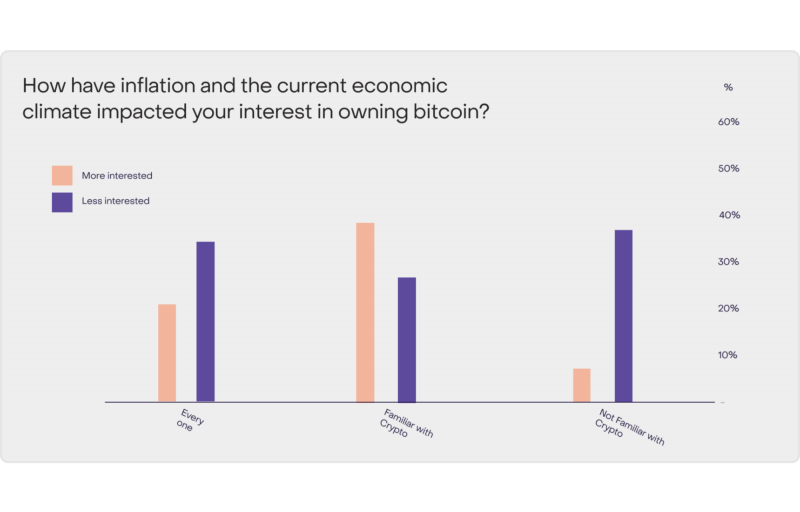

Inflation, a primary concern for voters and policymakers alike, has pushed many investors towards Bitcoin, often considered “digital gold.” This coin offers a hedge against rising inflation and a weakening U.S. dollar. As inflationary pressures persist, BTC’s appeal as a store of value increases, driving more institutional and retail investors to enter the market.

The Federal Reserve’s monetary policy is also a major factor influencing crypto performance. If interest rates remain high, risk assets, including cryptocurrencies, may see reduced investment as traditional safe-haven assets become more attractive. Conversely, a shift toward lower interest rates or a more dovish stance from the Fed could lead to a surge in liquidity, benefiting riskier investments like cryptos.

Global economic growth is another crucial variable. With ongoing geopolitical tensions, supply chain disruptions, and economic uncertainties, investors are seeking alternatives to traditional markets. Cryptocurrencies, with their decentralized nature and potential for high returns, are positioned as an appealing option in uncertain times.

The interplay between these macroeconomic factors and the crypto market is highly dynamic, and their influence will likely intensify as the 2024 election nears. Investors will closely monitor these economic indicators, weighing their impact on both short-term market movements and the long-term viability of cryptos as a financial asset class.

Investor Sentiment: What Are Crypto Enthusiasts Betting On?

Investor sentiment in the cryptocurrency market is buzzing with anticipation. Crypto users are closely watching how the political landscape will shape their investments, with many betting that a pro-crypto administration could trigger a market boom.

Donald Trump’s vocal support for cryptocurrencies has captured the attention of traders and investors alike. His promises of friendlier regulations, lower taxes, and the creation of a strategic Bitcoin stockpile have fueled optimism, particularly among younger investors and tech-savvy individuals. Many in the crypto community see a Trump victory as a catalyst for a new bull run, with Bitcoin and other altcoins potentially reaching all-time highs if regulatory restrictions are eased.

Online forums like Reddit and social media platforms such as Twitter (now X) are filled with discussions about how a Republican win could positively impact the market. Pro-crypto PACs are also investing heavily in supporting candidates who favour a more lenient regulatory approach, signalling the growing political clout of the crypto industry.

Despite Trump’s legal battles and fluctuating poll numbers, his pro-crypto stance could energize the market and draw in more institutional investors. Meanwhile, the possibility of a Kamala Harris presidency has raised concerns about stricter regulations, which could dampen short-term enthusiasm. However, some argue that clearer regulation could also bring long-term stability to the market.

Crypto enthusiasts are betting on a favourable political outcome, hoping the 2024 election will mark a turning point for the industry. With high stakes and the potential for market-defining policy changes, investor sentiment is a key factor driving speculation in the lead-up to election day.

Crypto Regulation and Policy: The 2024 Election

One of the most important issues in the 2024 election is how the next president will handle cryptocurrency regulation. The SEC, under Biden-appointed Chairman Gary Gensler, has ramped up enforcement actions against crypto exchanges and companies. Lawsuits against major firms like Binance and Ripple have highlighted the regulatory uncertainty in the industry.

Republicans, meanwhile, have pushed back against what they see as regulatory overreach. In Congress, several crypto-friendly bills have gained bipartisan support, including proposals to create clearer regulatory guidelines for digital asset custody and stablecoin issuance. The question remains: will the next president prioritize innovation and growth, or will regulation continue to dominate the conversation?

Final Takeaways

The 2024 U.S. presidential election is shaping up to be one of the most important in the history of cryptocurrency. As Bitcoin continues its bull run, political developments will play a key role in determining whether this momentum can be sustained. While Trump’s pro-crypto stance offers hope for a market-friendly environment, the possibility of stricter regulation under a Democratic administration looms large, though it might bring long-term stability and boost market confidence in the long run.

Ultimately, the future of the crypto market will depend on a combination of political, economic, and technological factors. As the election draws near, investors will be keeping a close eye on policy developments and market trends, hoping to answer the question asked by many crypto enthusiasts: “When is the next crypto bull run in 2024?”

1. How can the 2024 U.S. election impact the cryptocurrency market?

The 2024 election could significantly shape regulatory frameworks for crypto, potentially influencing investor confidence and market growth.

2. What happens if stricter regulations are proposed after the election?

Stricter regulations could cool market enthusiasm, possibly slowing investment and hindering the growth of the crypto sector.

3. Could pro-crypto policies from candidates fuel a bull run?

If pro-crypto candidates promote policies encouraging innovation and investment, it could trigger a bull run by boosting market confidence.

4. Is there a history of elections affecting the crypto market?

Yes, political events, including elections, often impact financial markets, and past elections have seen shifts in crypto prices based on regulatory expectations.