Decentralized Exchanges (DEXs) have remarkably transformed the crypto market landscape by providing a secure, private, and permissionless way to trade digital assets. As we step into 2024, several DEX crypto coins stand out for their innovation, utility, and market performance.

In this article, we will discuss how DEXs work and what the best DEX crypto tokens are that crypto investors can choose to make informed investment decisions and boost their portfolios.

Key Takeaways

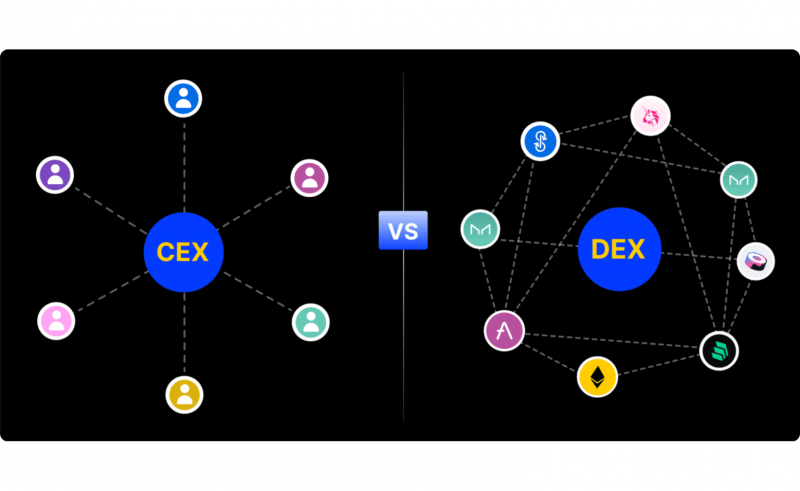

- Unlike CEXs, DEXs have no central authority.

- DEX crypto coins are governance coins used to incentivize various forms of participation within a DEX’s ecosystem.

- CAKE, GNO, and GMX are some of the most popular DEX coins.

- Some experts predict the future growth of DEX token utilization.

What is a DEX in Crypto, and How Does It Work?

Centralized exchanges (CEX) are traditional platforms that require a user identification and necessitate that crypto holders place their assets in in-house accounts for trading or exchange. These platforms are owned by companies or individuals who charge commissions for transactions, increasing the risk of hacking and theft.

In contrast, DEXs have emerged as a solution to the centralization in crypto trading, allowing users to hold their crypto assets in their own wallets and maintain full control over their property. These platforms enable users to buy and sell cryptocurrencies directly without a central intermediary.

A DEX operates on a blockchain network like ETH, allowing for a decentralized, peer-to-peer trading experience. Users create trade offers, which are broadcast to the network for other users to accept if the terms are favorable. The blockchain executes the transaction securely and transparently. DEXs use smart contracts, self-executing contracts, to match buyers and sellers, allowing traders to place orders and receive matching orders.

DEXs offer heightened security measures, such as robust cryptographic protocols, ensuring funds cannot be stolen from users’ accounts. They also guarantee liquidity and transaction transparency, and users can conduct operations with fiat money. Additionally, DEXs offer speedy transactions due to the absence of blockchain nodes on the exchange’s server side, eliminating the need for lengthy transaction validation.

The core features of DEXs include direct exchanges, secure payment verification, smooth KYC integration, security preferences, crypto address generation, and customizable balance and transaction management. Essentially, DEXs solve the problem of centralization in the crypto world while providing users with some benefits in exchange for a partial loss of freedom and privacy.

What are DEX Coins, and Why Do DEXs Need Them?

DEX tokens, typically native governance tokens, offer various use cases on their native protocol, including reward staking and voting. They provide holders with governance rights, liquidity, and staking rewards. These tokens are decentralized exchange-based and can be traded on both decentralized and centralized exchanges.

DEX coins play a crucial role in the DeFi ecosystem, which aims to replicate traditional financial systems with a decentralized architecture. They facilitate liquidity provision, ensuring swift trade execution and minimal slippage. DEX coins are used within liquidity pools, where users lock in tokens to provide market depth. In return, liquidity providers earn a portion of trading fees paid out in DEX coins, incentivizing liquidity provision and smooth exchange operation.

Beyond liquidity provision and governance, DEX coins incentivize various forms of participation within the ecosystem, such as rewards for staking, developers building on the platform, traders executing trades, or participation in special programs like liquidity mining.

Furthermore, DEX coins play a pivotal role in governance, granting holders voting rights to participate in decision-making processes that guide the development and operational procedures of the exchange.

DEX coins often carry additional utility within their native ecosystems, such as reduced trading fees, access to exclusive services, or the ability to use tokens for payment or collateral in lending and borrowing services. Understanding these roles is essential for grasping their value proposition within the DeFi space.

DEX Tokens vs Utility Tokens

Utility tokens are cryptos used to access a platform’s services or products within a blockchain ecosystem. They provide users with a way to pay for services or assets within a particular blockchain network. The value of utility crypto coins is often linked to the demand for the platform’s services and the adoption of blockchain technology.

DEX tokens, on the other hand, are specifically designed to support the operations of decentralized exchanges. These governance tokens, on the other hand, are designed to give holders a say in the decision-making processes of a decentralized network or organization. They are used for voting on proposals, making changes to network rules, and influencing the direction of the ecosystem.

Top 10 Most Popular DEX Coins in 2024 by Market Cap

Here is a list of the most popular DEX crypto tokens by market cap.

1. Uniswap (UNI)

Uniswap remains a leader in the DEX space due to its user-friendly interface and innovative Automated Market Maker (AMM) model. As the largest decentralized exchange for ETH, Uniswap boasts a total value locked (TVL) of over $4 billion.

Launched in 2018, Uniswap allows users to trade ERC-20 tokens directly from their wallets. The platform’s native token, UNI, is used for governance, allowing holders to vote on key protocol changes and upgrades. Uniswap’s continuous innovation and strong community support make it a top choice in 2024.

2. THORChain (RUNE)

THORChain is a decentralized liquidity protocol that enables cross-chain trading. THORChain’s core mission is to decentralize cryptocurrency liquidity and ecosystem products.

Its native token, RUNE, is used for staking, governance, and as a base asset for liquidity pools. It also can be used for paying for swaps and transaction fees. THORChain’s unique approach to liquidity and its ability to facilitate seamless asset swaps across different blockchains position it as a significant player in the DEX market.

3. dYdX (DYDX)

dYdX is a hybrid decentralized trading platform. Built on Ethereum, dYdX offers advanced financial tools like perpetual contracts, margin trading, and spot markets, enabling users to trade cryptocurrencies with leverage in a trustless environment

The platform’s native token, DYDX, is used for governance, staking, and fee discounts. The token can be bought and traded using smart contracts, with the potential to earn a yield through staked DYDX.

4. Gnosis (GNO)

Gnosis is a prediction market platform that has evolved into a DEX with a focus on liquidity provision and market-making. The platform is built on Ethereum and allows users to speculate on any outcome through decentralized prediction markets. It offers a unique set of products and tools for developers and enthusiasts, including the Gnosis Protocol, a permissionless decentralized exchange protocol.

The native cryptocurrency, GNO, governs the network and is used for decision-making and network activities. The GNO token is used for governance and staking.

5. Curve (CRV)

Curve is a DEX for trading stablecoins and pegged cryptos like wBTC. Originally built for ETH, it now supports 10 other blockchains. Investors can swap stablecoins and deliver liquidity to Curve to earn rewards from trading fees.

Curve also has a native token called CRV, which can be bought or earned by providing liquidity to specific pools.

6. Osmosis (OSMO)

Osmosis is an AMM protocol built on the Cosmos SDK, allowing for custom liquidity pools. Osmosis focuses on interoperability between blockchains, processing transactions between nearly 50 separate blockchains within the same DEX, competing with centralized exchanges.

OSMO is a token for Osmosis that facilitates liquidity mining reward allocation and the base network swap fee. It can be used for staking and liquidity, allowing liquidity suppliers to earn rewards. OSMO can vote on protocol upgrades, allocate rewards for specific pools, and set the base network swap fee. It was released with an initial supply of 100 million tokens.

OSMO has experienced two all-time highs and lows. The highest price was $11.25 on Mar 04, 2022, 96.89%, and the lowest price was $0.2245 on Oct 19, 2023.

7. PancakeSwap (CAKE)

PancakeSwap (CAKE) is a DEX that was developed by anonymous developers and launched in September 2020, utilizing smart contracts to trade cryptos and utility tokens without a centralized third-party facilitator. The platform uses an unlimited circulating supply of automated tokens, CAKE tokens, on the Binance Smart Chain. PancakeSwap offers automated market maker (AMM) functionality, allowing coin holders to exchange crypto with a liquidity pool or earn rewards by supplying liquidity with their coins.

PancakeSwap’s governance token, CAKE, can be paired with other digital currencies for staking and liquidity pools on PancakeSwap. It is also used for global digital payments. With a maximum supply of 750 million tokens, it benefits from regular token burns.

8. Raydium (RAY)

Raydium is a Solana-based AMM platform that enables users to trade, swap, and provide liquidity for digital asset returns. Raydium’s algorithm uses a CFAMM to maintain reserve assets constant, benefiting users and liquidity pools. The platform allows users to participate in DeFi activities like trading, yield farming, and pools.

The platform is powered by the RAY token, used for staking, liquidity mining, and governance.

9. Jupiter (JUP)

Jupiter provides a framework for dApp creation, execution, automation, scalability, and user privacy, facilitating secure asset trading across multiple blockchain networks.

JUP is an Ethereum token for the Jupiter Project, aiming to make blockchain accessible and safe for all users. It uses military-grade encryption to ensure user data privacy and security, enabling secure dApps on public and private networks.

10. GMX (GMX)

GMX is a decentralized spot and perpetual exchange that offers a user-friendly trading experience with low fees and deep liquidity. GMX is a decentralized exchange platform used for staking, earning rewards in ETH and AVAX, and facilitating fee payments for trading operations. It grants holders governance rights, allowing them to partake in decision-making processes.

The GMX token is used for governance, staking, and rewards, enhancing the platform’s functionality and user experience. GMX’s circulating supply is over 8.7M, with an expected maximum of 13.25 M. The total count of GMX tokens is set to reach 9,450,194 tokens, with the current circulating supply at 9,450,194 tokens.

Future Trends for DEX Coins

The future trends in DEX and decentralized coins are influenced by several factors. These include the integration of cross-chain technology, which aims to facilitate seamless transactions across different blockchains, improving user experience and the regulatory landscape. Cross-chain tech could lead to a more efficient blockchain ecosystem, fostering innovation and collaboration.

User experience is another key factor, with DEXs becoming more user-friendly, offering more intuitive interfaces, simplified transaction processes, and enhanced security measures. The regulatory terrain is evolving, with governments and regulatory bodies working to establish frameworks that ensure consumer protection and innovation. A balanced regulatory approach could legitimize and stabilize the market, encouraging more institutional and retail investment.

Security remains a paramount concern in the DeFi space, with the development and implementation of advanced security protocols, smart contract audits, and insurance mechanisms to protect users’ assets. The expansion of finance instruments and services could blur the lines between traditional finance and DeFi, attracting users looking for decentralized alternatives to conventional financial services.

Sustainability and environmental considerations are also important factors in the DEX space, with the adoption of energy-efficient consensus mechanisms and initiatives to offset carbon footprints. Community governance and decentralization are central to DEXs, with token holders having a say in the exchange’s direction and development. Comprehending these trends is paramount for investors, developers, and enthusiasts to navigate the rapidly evolving landscape of DEXs and DEX coins.

Bottom Line

DEXs offer the potential for financial freedom, innovative services, and a decentralized future, transforming the blockchain ecosystem and making it appealing to traders and retail users seeking asset rewards.

The crypto community’s innovative spirit is evident in the landscape of DEX and its associated coins. The top 10 DEX crypto coins by market capitalization in 2024 offer a glimpse into the future of finance, focusing on decentralization, security, and user empowerment. Investing in these coins provides exposure to cutting-edge finance technology and supports the evolution of a more accessible and equitable economic system. Despite the complexities of decentralized finance, the rewards can be substantial.

FAQ

What is a DEX?

A decentralized exchange (DEX) is a platform that allows cryptos to be traded peer-to-peer without the need for a central control or intermediary.

How do DEX coins work?

DEX coins are used within DEXs to facilitate transactions, ensure liquidity, and enable proper administration, ensuring the smooth functioning of the platform.

What are the benefits of using DEXs?

DEXs offer enhanced anonymity, control over funds, and security as they operate without mediators and rely on blockchain tech.

Are DeFi and DEX the same?

DEXs are crucial in DeFi as they enable the creation of advanced financial products through permissionless composability, often referred to as “money LEGO.”