Cryptocurrencies are all about convenience, offering users better ways to send and receive money and pay for their purchases. The introduction of cryptocurrencies into the buy-now-pay-later world has significantly lifted this industry and boosted its potential.

This financial service bridges the gap between consumers and businesses, especially when selling high-value products. The buy now, pay later (BNPL) gives customers better purchasing power and boosts your sales.

It may look similar to credit card payments but more affordable. Let’s explain the concept of buy now, pay later from the crypto perspective.

Key Takeaways

- Buy now, pay later is a financial service that enables companies to offer payments in instalments.

- BNPL transactions are facilitated by third-party companies that pay on the customer’s behalf, while buyers pay on fixed instalments.

- Companies offering BNPL services are more likely to boost their revenue and attract more customers.

Understanding Buy Now, Pay Later (BNPL)

As the name suggests, buy now, pay later is a financial service that enables customers to purchase products or services and acquire them immediately while paying later, usually in interest-free instalments.

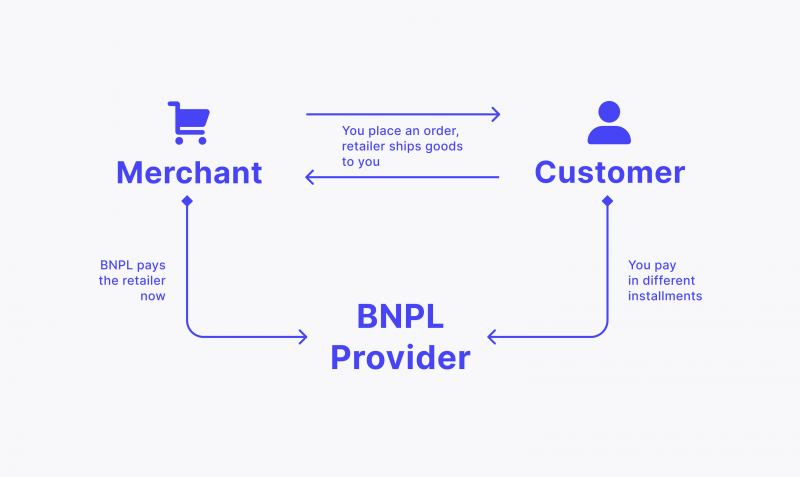

E-commerce and online retailers offer BNPL service through a third-party provider that organises and issues loans. This financing option is faster than traditional banks, which process loan requests through prolonged credit checks and documentation that can take days before finalising the purchase.

Businesses can expand their buy now, pay later BNPL service offerings by integrating crypto transactions, which offer much safer and faster payment options.

The BNPL business model is not entirely new, but the latest FinTech revolution has introduced various advancements and innovations that have contributed to the growth of this industry.

Should You Offer Buy Now Pay Later Solutions?

Adding buy now, pay later solutions can significantly improve your business regardless of the product or service you are selling. You can still offer full-payment solutions, but adding a financing option encourages your customers to increase their purchases.

There’s an increasing number of FinTech companies offering B2B BNPL integrations to streamline your clients’ loans and payments with instalments. These service providers take the financing and accounting burden from you to improve your buy now, pay later (BNPL) offerings.

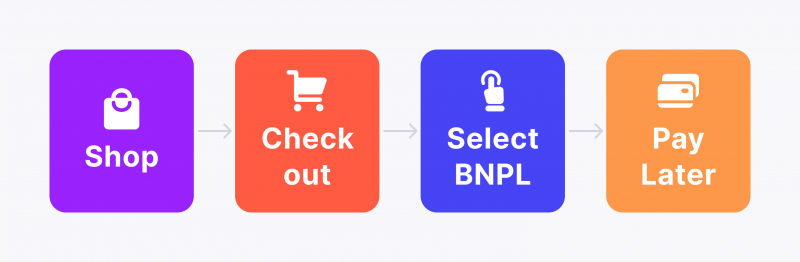

How Does The Buy Now, Pay Later Model Work?

Buy now, pay later works by integrating a third-party provider offering financing services. As such, when a customer buys a product or service using the BNPL system, you will receive the payment from the BNPL company, while the customer will pay the provider for fixed installments.

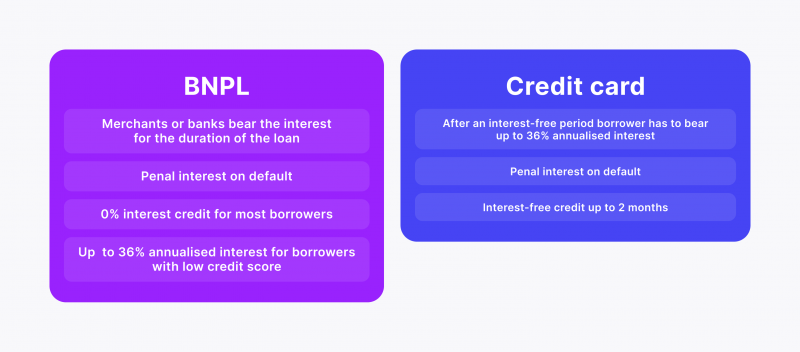

Credit Cards vs Crypto BNPL

Buy now, pay later offers higher flexibility compared to traditional credit cards. Depending on the provider’s policies, users could change their postponed payment system, payable amount, and period.

For businesses, buy now, pay later solutions are far more beneficial than traditional financing options. Bank loans entail a stringent credit score assessment, income analysis, and background checks before they are issued.

Moreover, buyers have to pay a certain percentage for the service, which adds to their total amount payable. There are also some penalties and conditions that users might not fully understand.

However, buy now, pay later payment solutions are more straightforward. They do not require financial commitments and do not have restrictions or hidden additional fees that make the process harder.

The profile checks and loan issuance process is automated and is faster than with traditional credit companies. BNPL companies usually charge a fixed fee rather than interest-bearing loans.

Many FinTech companies have made significant advances in this space. Apple has partnered with Goldman Sachs Bank to offer “Apple Pay Later”, where the bank acts as the financial intermediary between Apple products and customers.

PayPal is developing its own buy now, pay later (BNPL) product service, while Amazon offers this financial service through Barclays Bank.

Benefits of The BNPL Business Model

Buy now, pay later enhances your business performance because it improves your client’s capability to buy more products from your platform. Other benefits to buy now, pay later include:

Increased Revenues

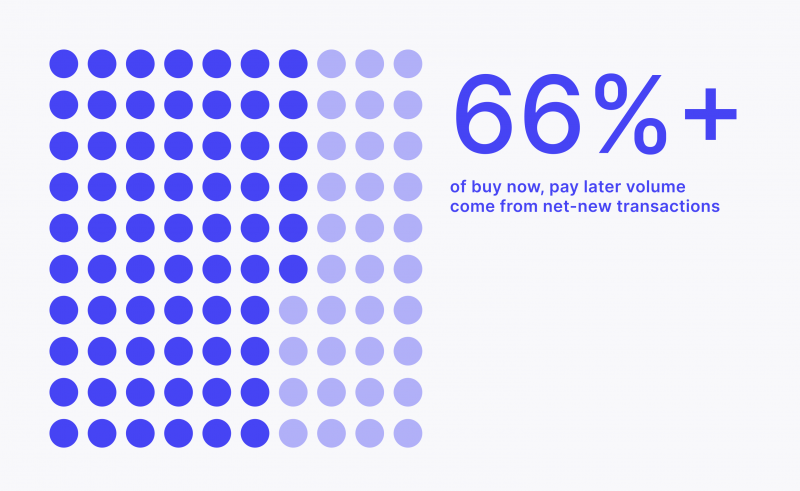

The BNPL market is growing steadily, meaning there are plenty of opportunities for your business to utilise. In 2020, BNPL payments accounted for $97 billion of the global e-commerce transactions.

This growth is expected to continue as more operators emerge, such as Affirm, Klarna, and Afterpay. These leading BNPL providers partner with renowned firms, such as Amazon, Target, PayPal, and Apple, to facilitate a better purchasing experience for their customers.

These figures are expected to grow exponentially in the coming years, with a CAGR of 45.7%, which could take the BNPL market size to over $450 billion by 2026. So, there is significant money for grabs.

More Convenience

Adding flexibility to your customers can only result in a better user experience. This service enables you to attract clients who are only looking to buy a specific product at websites offering BNPL services, which means converting more consumers into your database.

Since BNPL transactions do not require credit score analysis and profile checks, users can pay using their digital assets or crypto wallets, adding more flexibility and options to their checkout journey.

Offering BNPL crypto payments can significantly improve your customer experience, giving them more ways to transact, especially for those who are critical about their personal and financial privacy.

Improving User’s Purchasing Power

BNPL payments motivate users to buy products and services they usually cannot afford because they require significant investment, which improves their purchasing power.

It does not necessarily mean that every BNPL transaction must account for tens of thousands of dollars. However, consumers are more likely to split the payments over several months.

Minimising Exposure Risk

Delegating the financing functionality to a third-party BNPL provider, who pays the entire amount of the product/service on behalf of the customer, minimises your exposure risks and ensures that you can streamline your finances more efficiently.

This feature is handy for startups and businesses with limited budgets that cannot afford to issue high-value loans.

Klarna, an online FinTech firm, reported that 95% of BNPL loans are paid off earlier or on time, while 50% of consumer credit loans miss the monthly deadline.

White Label Buy Now Pay Later BNPL Solutions

White label BNPL companies are technology providers that design the entire buy now, pay later platform and system and brand it for another company.

For example, instead of integrating an established service provider, such as PayPal or Klarna, you can hire a white label technology company to develop the buy now, pay later system. You can then rebrand and customise the solution according to your requirements and corporate needs.

However, you need to integrate a banking solution or a financial institution to run the economic aspects of liquidity, loan issuing and account receivables.

Advantages and Disadvantages of Buy Now, Pay Later

Buy now, pay later solutions are an excellent way to launch your business and establish yourself among leading e-commerce companies. However, this feature has distinct ups and downs. Let’s review them.

Pros

- High flexibility: BNPL transactions enable customers to choose from numerous payment methods and manage their finances

- Cost-Efficient: Buy now, pay later loans are less expensive than traditional interest rates charged by credit cards or banks.

- Faster Processing: Traditional loan applications take a long time to process credit checks. However, BNPL loans are automated and faster.

- Global: Crypto buy now, pay later facilitates transactions worldwide, eliminating the barriers to fiat currency conversions.

Cons

- Market Volatility: Similar to typical loans, cryptocurrencies change their values quite frequently, and paying in instalments might lead to higher crypto-value payments.

- Regulations: The BNPL online shopping market is relatively new, and rules are still being updated.

Conclusion

Buy now, pay later is a financial service that enables customers to buy products and services and pay in instalments or later on a fixed date. This service is facilitated by a third-party provider that offers loans and financial management services.

Businesses offering BNPL payments can boost their sales by attracting new customers who want to buy products they cannot afford if they make a one-time payment.

Buy now, pay later (BNPL) with a digital currency adds flexibility and convenience to your customers. It allows them to choose their preferred payment method and secure their data and financial details.