Similar to the industrial structures that first appeared on the map, the crypto mining business is only a few years old. However, it is among the vital industrial frameworks of the modern digital economy. Any technical advancement and change in the market’s direction affect the dynamics of running a farm profitably.

In this article, we will examine whether cryptocurrency mining farms will turn a profit by 2024. We will start by looking at the current situation, profitability considerations, and potential future growth of cryptocurrency mining.

Key Takeaways

- From straightforward PC installations to specialised, costly hardware, mining has developed into a fiercely competitive sector controlled by huge mining farms.

- The regulatory environment, hardware costs, energy costs, and cryptocurrency prices are essential elements that affect mining profitability.

- Events that halve Bitcoin’s mining rewards decrease profitability, but future price increases may assist; effective technology and techniques are crucial.

- Miners should investigate staking and DeFi systems to generate passive income and lessen their dependency on conventional mining activities.

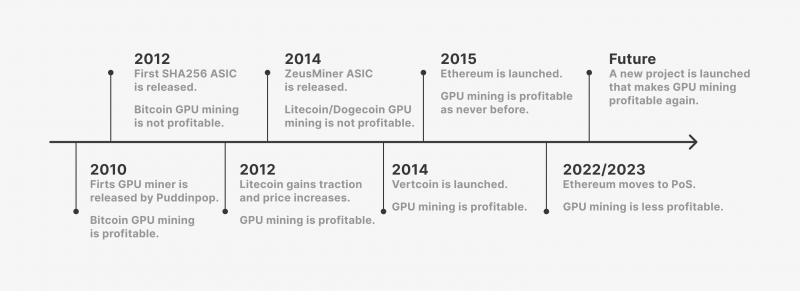

The Evolution of Crypto Mining

Significant developments have occurred in the cryptocurrency mining industry since its beginning. In the early days, anyone with access to simple computer hardware could engage in mining. However, the sector witnessed the rise of specialised gear like ASICs and FPGAs, making the process more resource-intensive and competitive as more miners joined the network and the difficulty of mining grew.

When cryptocurrencies first came along, crypto miners mined on regular computers. Anyone with a PC could start BTC mining using this method. Later, GPUs gained popularity as the mining difficulty rose because of their greater computational capacity, which allowed for more productive mining. This change signalled the arrival of more specialised mining equipment.

FPGAs (Field-Programmable Gate Arrays) and ASICs (Application-Specific Integrated Circuits) completely transformed the mining industry. Specifically engineered to mine specific coins, ASICs provide increased power and efficiency. Despite being less effective than ASICs, FPGAs offer flexibility because they can be adjusted for various mining applications. Mining became more competitive due to these developments, and only those with the means to buy such equipment could participate.

Huge mining farms currently control the majority of the cryptocurrency mining industry. Thousands of crypto mining rigs are housed at these industrial facilities, all operated in tandem to maximise earnings. These mining farms have moved to areas with more affordable electricity and friendly rules, increasing profitability while reducing operating expenses.

All things considered, the development of cryptocurrency mining has moved it from a hobby to a fiercely competitive business. Mining has become much more complex and expensive due to the creation of a large-scale crypto mining farm and the development of specialised hardware. Because of this, it has been harder for individual miners to compete, which has led to the domination of professional mining operations.

Factors Influencing Profitability in 2024

A crypto mining farm’s profitability is mainly determined by several important factors, including the cost of the hardware, energy usage, price of the cryptocurrency, and network difficulty. Understanding these components is crucial in evaluating the feasibility of a mining enterprise.

Mining rig acquisitions continue to be expensive. Setting up mining hardware, such as GPUs, FPGAs, and ASICs, comes at a significant upfront cost. However, as technology advances, efficiency and energy usage continue to rise, increasing the viability of initial investments over time.

Another important consideration is energy expenses. For mining farms, energy costs are a substantial operational expense. Areas with cheap energy expenses are more advantageous than others. New developments in renewable energy sources and energy-efficient mining equipment contribute to reduced operating costs, which boosts profitability even further.

The dynamics of the cryptocurrency market are also quite important. The profitability of mining Bitcoin is heavily influenced by its value. While price reductions can lower revenues, higher pricing can yield more significant returns. Furthermore, the difficulty rises with more miners joining the network, requiring more processing power to provide the same payouts.

The regulatory framework also influences mining profitability. It is crucial to abide by national and international laws, notably those about taxes and the environment. Regulations that prohibit, reward, or subsidise the use of renewable energy sources can impact the mining sector and the overall profitability of mining operations. Anyone attempting to determine if a Bitcoin mining farm will be profitable in 2024 needs to be aware of these issues.

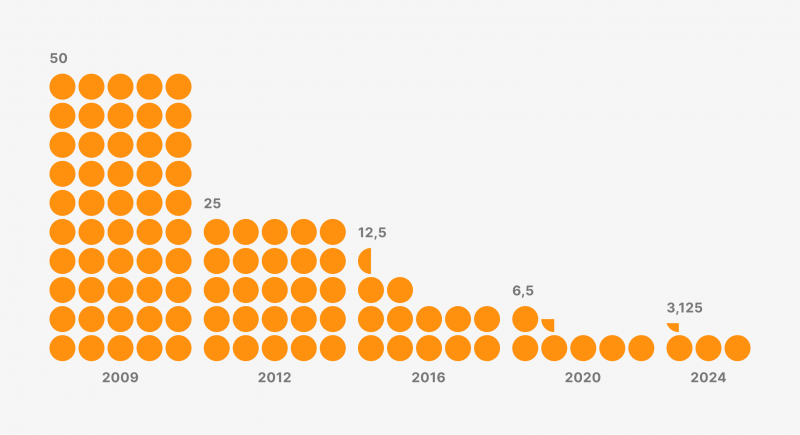

Bitcoin Halving Outcome on Mining Rewards

While Bitcoin is the most popular cryptocurrency mined, understanding its network dynamics can remain critical to mining profitability. The most important event that affects the Bitcoin network is the so-called Bitcoin halving. This is considered the most meta-event to take place, as it happens almost always every four years.

This method lowers the amount of newly created Bitcoin available for purchase by limiting the reward for mining a new block of Bitcoin. Halvings have historically significantly affected the network and the profitability of Bitcoin mining. The immediate result is a decrease in the Bitcoin network incentive, which impacts miners’ earnings.

The price of Bitcoin often rises due to this lowered supply, which can somewhat make up for the lower mining incentives. Professional Bitcoin miners need to use technology and mining tactics that are more efficient to stay profitable in this environment. Many turn to other blockchain applications or alternative cryptocurrencies to diversify the way they mine Bitcoin.

Furthermore, Bitcoin mining pools have become increasingly important since they enable individual miners to combine their resources to mine Bitcoin blocks successfully. Anyone hoping to mine Bitcoin profitably and manage the changing cryptocurrency mining industry must comprehend and adjust to the Bitcoin halving mechanism.

Academics at first disregarded and did not peer-review Nakamoto’s work, which raised doubts about its viability. However, when Nakamoto mined the first block at the beginning of 2009, the Bitcoin network was established.

Alternative Revenue Streams: Staking and Crypto Passive Income

For miners, exploring different revenue streams can open new avenues for earning money. Crypto staking is one such technique that makes it possible to generate passive income without investing in costly mining equipment. A consensus method called PoS enables users to approve Bitcoin transactions and produce new blocks, like Bitcoin block, in proportion to the amount of coins they possess and are prepared to “stake” as security. Staking rewards can be a source of passive income for individuals, and they vary based on the cryptocurrency and network conditions.

Participation in DeFi systems is another way to make money. A variety of blockchain-based financial services and apps are included in the DeFi portfolio. By lending assets, producing liquidity, or engaging in yield farming — which is producing liquidity in exchange for rewards in the form of more tokens — participants can generate profits. It’s crucial to remember that DeFi investments come with dangers, such as market volatility and vulnerabilities in smart contracts.

How to Create a Successful Crypto Mining Farm Business Plan

A business strategy for a successfully mining farm must carefully consider a number of important factors. First and foremost, a comprehensive market analysis is essential. This involves understanding the present and anticipated trends in the crypto mining sector in addition to examining the competitive environment to spot possible openings.

An additional crucial component of the company strategy is the operational plan. This involves deciding on the best site for the mining farm, considering variables like climate, electricity costs, and regulatory environments. In addition, careful preparation is necessary to purchase and install cooling systems, mining rigs, and other infrastructure.

Financial estimates are an essential component of the company plan. Calculating profitability involves examining setup costs, continuing operating expenditures, and prospective income streams. When estimating these figures, it’s critical to consider, for example, bitcoin price scenarios and mining difficulty levels.

Lastly, the company plan needs to cover risk management. This involves identifying possible risks, creating plans to reduce them, and ensuring the company complies with all legal requirements and protects against unanticipated circumstances.

Is Crypto Mining Still Profitable in 2024?

Many aspects need to be taken into account to assess whether cryptocurrency mining will still be lucrative in 2024. The state of the market indicates that the cost of energy and the value of cryptocurrencies significantly impact how profitable mining is. Rising energy prices can severely impact profits, particularly for major mining operations. On the other hand, technological developments in mining, like more productive ASIC miners, can assist in offsetting these expenses and increasing mining productivity.

Technological advancements are anticipated to be vital to the profitability of cryptocurrency mining in the future. Higher returns may result from more efficient mining operations overall, which can be achieved through better technology and mining strategy. Furthermore, market forecasts indicate that there can be notable swings in cryptocurrency prices, which would impact the profitability of mining.

Market turbulence and regulatory changes are examples of operational risks that might impact the consistency and predictability of mining revenue. Miners must weigh the possible rewards, which include block rewards and transaction fees, against these risks.

In 2024, the correct mining pool selection, energy consumption, and mining gear expenses will all significantly affect profitability. Participating in mining pools and Bitcoin cloud mining can offer substitute strategies to reduce costs and boost productivity. Successful mining will depend on striking a balance between these elements to maintain the viability and profitability of mining operations.

Final Thoughts

Many people still wonder if they can make money mining Bitcoin. A mining farm’s profitability will be influenced by several variables, such as energy prices, market dynamics, technology developments, and legal frameworks. Miners may overcome difficulties and take advantage of opportunities to preserve profitability by remaining informed and adjusting to changes in the sector. With proper planning and effective execution, a crypto mining farm can still be a successful business in 2024.

FAQ

Will crypto mining be profitable in 2030?

In 2022, the mining market was estimated to be worth $2 billion globally. From $2.24 billion in 2023 to $5.55 billion by 2031, it is expected to rise, exhibiting a 12% compound annual growth rate (CAGR) throughout this period.

When will mining end?

The Bitcoin system’s design reduces the number of new bitcoins created per block by half every four years. At this time, over 1.5 million bitcoins can still be mined. By 2140, experts predict that the last bitcoins will be extracted.

Will mining still be worth it?

It can still be rewarding in 2024, but success will rely on careful preparation and calculated methods to maximise profits. The future seems promising as well.