The emergence of blockchain technology started only fifteen years ago, with the launch of Bitcoin in 2009. Despite such a short history, the blockchain market has progressed rapidly and introduced numerous iterations on the core formula of decentralised finance. Different blockchain networks have offered alternative payment systems, consensus algorithms, processing speeds and other variations on the classic Bitcoin formula.

As a result, the current crypto market features 1000+ unique blockchain platforms, all with their custom characteristics and methodologies. So, blockchain interoperability has become a prevalent issue in the crypto landscape.

This article will discuss the concept of wrapping coins, one of the most practical technologies that could solve cross-chain concerns and allow users to enjoy blockchain networks without limitations.

Key Takeaways

- Crypto wrapping is a new technology that allows individuals to use crypto coins across different blockchain platforms.

- Wrapped tokens are created through custodians, who mint the wrapped coins after receiving corresponding funds.

- Wrapped and original tokens are permanently pegged to each other, designed always to equal each other.

- Wrapped coins increase cross-chain activity, freedom of choice and market-wide liquidity.

- Reliance on custodians and third-party processes makes crypto wrapping inherently more susceptible.

The Blockchain Interoperability Problem

Before discussing the nature of wrapped crypto tokens, it is essential to understand the interoperability issue of blockchain. The early layer-1 networks like Bitcoin and Ethereum shared a similar approach to decentralisation and anonymity but were developed through entirely different systems, architectures and protocols. As a result, these networks have no effective means of “talking to each other” and exchanging information or assets in the process.

So, layer-1 and most of the layer-2 networks present in the market do not have any built-in solutions for sharing information. While this might not seem like a huge issue, the lack of cross-chain interoperability limits user funds and other assets under a single platform, considerably decreasing their freedom of choice.

While there are other methods of solving this issue, namely the bridge APIs and other third-party solutions, they often create problems of their own. Digital bridges connecting different blockchains have been proven risky in terms of cybersecurity.

So, the blockchain audience has looked for a reliable solution for a better part of the decade now. With wrapped coins, the industry might finally overcome this challenge for good. Let’s explore.

What is The Purpose of Wrapped Crypto Tokens?

The concept of a wrapped token was introduced in 2019 when three separate companies, Bitgo, Ren and Kyber Network, all came up with a similar idea. The idea was to create functionally identical equivalents of Bitcoin on other protocols like ERC-20 and TRC-20, effectively allowing individuals to use their BTC funds on other target blockchain platforms.

The entire process was possible thanks to the smart contract functionality, allowing developers to automate the wrapping process. As a result, in 2019, we received a wrapped version of Bitcoin called WBTC.

Smart contract functionality also ensures that WBTC always equals exactly one BTC coin, eliminating any chances of harmful arbitrage or user losses.

The above benefits combine to create a token that crosses chains without significant complications or security concerns. While the minting process of wrapped coins is not seamless, it is the most reliable way to enter new chains without purchasing native tokens.

A Quick Guide to Handling Wrapped Bitcoin Tokens

The process of wrapping BTC and other tokens is relatively straightforward. There are numerous platforms where users can initiate the wrapping process and receive wrapped crypto assets of the corresponding amount. Right now, Bitcoin is by far the most popular option on the market, so we’ll discuss the minting and wrapping process of the WBTC token. Notably, the wrapping techniques of other tokens are practically identical to WBTC, with mostly trivial differences.

How to Wrap BTC Coins

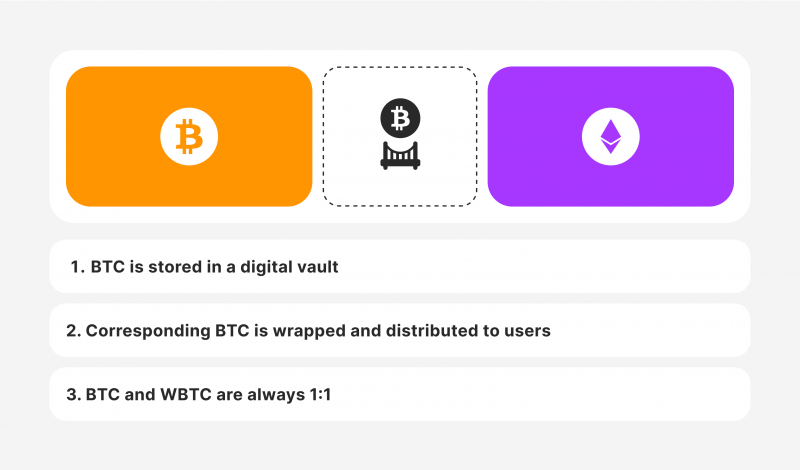

Wrapping the BTC tokens involves entering a centralised exchange or utilising a decentralised custodian approach. In both cases, users must send the BTC funds to respective custodians. After that, custodians effectively lock away the received funds, creating a functional reserve to mint the wrapped coins.

Next, the custodians initiate the minting process through smart contracts, which are designed only to allow an exact 1:1 minting process. Creating WBTC that equals the BTC coins stored in the digital vault is only possible. The automatic pegging protocol protects the blockchain network and its users from harmful arbitrage or sandwich attack practices.

Once the WBTCs are successfully minted, users receive the corresponding amount to their designated wallet and are free to use WBTCs without any limitations on the ERC-20 and TRC-20 networks.

How to Unwrap WBTC

While WBTC coins have much broader potential uses, users may wish to retrieve their original coins at some point. If so, the process described above is effectively mirrored, with users or merchants initiating a burning request with their respective custodians. As a result, custodians must permanently remove the corresponding BTC from circulation and release the remaining reserve coins in the digital vault.

While minting and burning operations are relatively straightforward, they depend on the trustworthiness of custodians. After all, most individuals value the decentralisation and anonymity of crypto tokes, which is inherently reduced when using the wrapping approach. To alleviate this issue, the blockchain communities have created Decentralised Autonomous Organisations (DAOs) that oversee the selection of custodians and third-party merchants.

The presence of DAOs ensures that only vetted and proven custodians can secure the underlying asset for wrapping and never tamper with the wrapped token’s value within the smart contracts. However, this process is far from perfect in its current iterations, as the wrapping technique still depends on the vigilance and professionalism of humans.

Different types of Wrapped Tokens

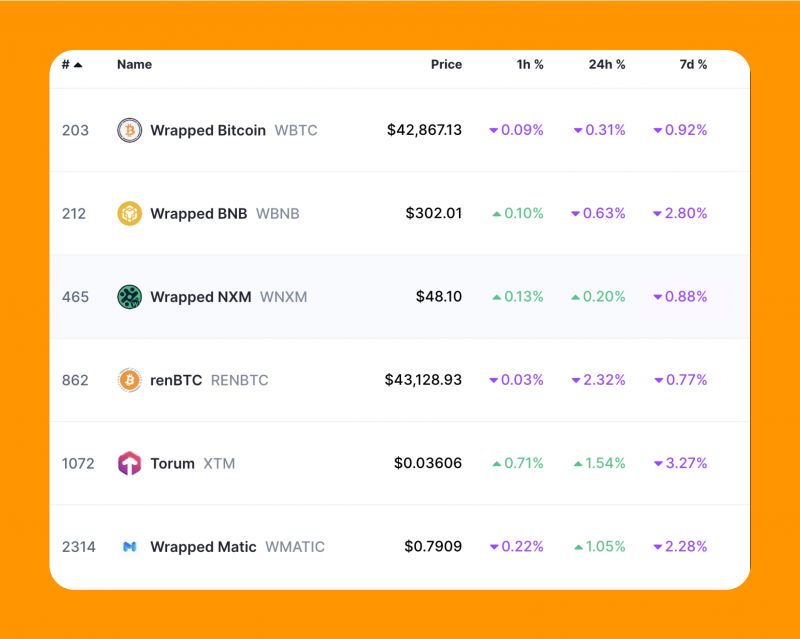

The wrapping technology is still fresh on the crypto market, and the possible options are pretty limited. However, most mainstream networks have tried to support the emerging wrapping technology. Notables include wrapped Ethereum (wETH), wrapped BNB (WBNB), wrapped DOGE (WDoge) and wrapped TRON (WTRX). As of this year, most of these WBTC alternatives share the same approach to wrapping and unwrapping virtual currencies.

Despite the rising popularity of alternative wrapped coins, WBTC remains firmly at the top, with nearly $7 billion in market capitalisation. This is mainly caused by the public perception that Bitcoin is still the most reliable and stable currency in the entire crypto landscape.

Naturally, the prospect of trading such a dependable currency on different networks is alluring, which has led to WBTC conquering the market just like its original version. The combination of BTC’s stability and benefits of using other, more technically advanced networks like Ethereum is unmatched in the crypto market. It will be interesting to see if other wrapped coins introduce competitive features to challenge the WBTC’s dominance.

Wrapped NFT Tokens

Wrapped NFT tokens are arguably the most distinct alternative to WBTC, serving an entirely different purpose for the NFT market. NFTs have experienced a bumpy road in recent years, losing most of the market capitalisation after the crypto boom of 2021. Today, NFTs are returning to their initial premise of digitising art pieces and allowing creators to receive full profits from their creations.

The wrapping process is perfect for NFTs, allowing owners to sell their content on virtually any network. Wrapping also enables owners to receive royalties from different blockchains and elevate their ownership security by storing the art pieces in digital vaults. As a result, wrapping is a dominant strategy for NFT owners, giving them the ability to increase their target audience naturally.

Unique Advantages of Wrapping Coins

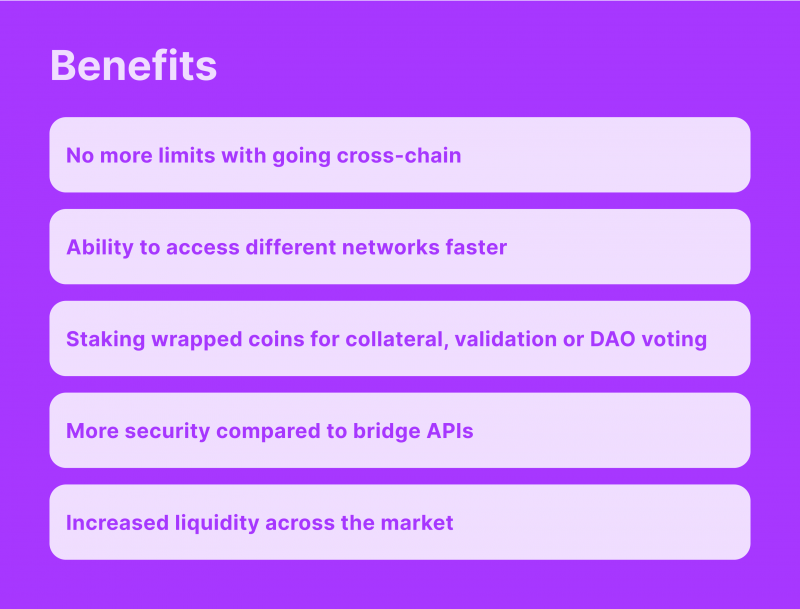

While the wrapping process doesn’t seem like a big deal initially, this technology considerably increases the scope and freedom of the entire crypto field. Previously, users had to limit themselves to a single network, set up different accounts, or utilise questionable bridge APIs to cross-chain. With the wrapping methodology, moving around different networks becomes seamless and profitable for all parties involved.

Solving the Interoperability Problem

As described above, interoperability remained at the top of the list of unsolvable issues for blockchain. Previously, it was difficult to diversify one’s portfolio without incurring transactional expenses or purchasing the desired crypto assets separately. The wrapping method allows users to move their funds across networks without much trouble or bloated costs.

Users no longer have to decide between different tokens, as they can simply purchase a specific coin and wrap it to utilise on various networks. This strategy is most useful with BTC, as it can be converted to be used on different ERC protocols. Moreover, the efficiency of wrapping crypto coins ensures that users can swiftly capitalise on time-sensitive opportunities in the crypto market.

Finally, the interoperability will allow individuals to stake the wrapped coins on various networks as collateral, either for receiving loans, engaging in the staking process or participating in various DAO communities.

Increasing Market-Wide Liquidity

Aside from personal benefits for crypto users, the wrapping process also increases the global liquidity for blockchain. With traders and businesses moving freely across the different chains, the market will feature more buyers and sellers on average, elevating the liquidity levels on all fronts.

As a result, it will be much easier to purchase or sell crypto tokens with minimal delays and tighter spread margins since technical limitations are no longer present in the mix.

Liquidity, or lack thereof, is still the biggest challenge in the crypto field, with many coins struggling to maintain healthy circulation volumes. Crypto swapping could be a definitive answer to this industry-wide challenge.

Limitations of Crypto Wrapping

The most significant drawbacks of crypto wrapping include regulatory considerations, the absence of universal standards and security concerns. The wrapping process is still in its infancy, and we have yet to see any regulations impacting this technology. It is impossible to foresee if crypto wraps will receive any limitations from regulatory bodies across the globe.

Moreover, the wrapping process is far from being standardised on various platforms. As a result, wrapping coins is not a trivial process across platforms, which offsets many of its benefits listed above. Many networks have not adopted this methodology, limiting the available wrapped versions of popular tokens.

Whether the wrapping methodology will acquire a dominating market position is still debatable, forcing the most popular networks to adopt this technology. Before that happens, it’s impossible to tell if the wrapping solution will ever be a viable alternative to utilising different networks simultaneously.

Finally, how wrapped tokens work is inherently flawed in terms of the decentralisation of blockchain. It is mandatory to connect with crypto custodians to receive wrapped tokens. This process naturally implies centralisation, as user funds have to go through a central third party. The wrapped token development solutions have yet to solve this crucial problem, with various companies working on decentralised variations of crypto wrapping.

Is it a Good Idea to Invest in Wrapped Tokens?

With the benefits and limitations described above, it is not clear whether the wrapping method will be a resounding success or a footnote in blockchain history. So, it’s hard to tell if wrapped coins are a reliable long-term investment for traders. Currently, the WBTC and WBNB coins are growing steadily and gaining more traction each month.

However, the wrapping method’s market-wide circumstances have been inconsistent, with numerous networks avoiding this technology. To solve the underlying technical complexities, wrapped coins must accumulate sufficient momentum. As a result, the market participants will have more motivation to work on decentralised alternatives and try to solve the decentralisation issues.

The legal aspect of wrapped coins is more unpredictable, but the core technology promises to reach maximum compliance as automated protocols eliminate many security concerns. In the short term, utilising wrapped coins has limited practical applications, with only a handful of networks supporting the tech.

Despite the limited scope, the available options with wrapped coins are beautiful for BTC users who wish to use smart contracts or other valuable features of different blockchain networks.

Final Takeaways

Wrapping coins is a fascinating new technology that has made the rounds across the crypto scene. Crypto enthusiasts are always open to increased functionality, freedom of choice, and network efficiency. The wrapping methodology provides all three improvements and adds the benefit of increased liquidity across the international market.

However, questions remain regarding the wrapping technology’s security, regulations, adoption and pegging reliability. Most of these problems can be fixed by polishing the core wrapping process and introducing improvements. However, in the current climate, it is unclear if the market is interested enough in the wrapping method to facilitate such improvements.

It will be interesting to see if the wrapping technology gains undeniable momentum and conquers the crypto market or remains an underrated alternative that fails to reach its maximum potential.

FAQ

What are wrapped coins?

Wrapped coins are alternative versions of popular blockchain tokens that can be used across networks running on ERC-20 and TRC-20 protocols.

What are the advantages and disadvantages of wrapped coins?

Wrapped coins can be used across different networks, increasing the freedom of choice for users and elevating market-wide liquidity. However, this technology still relies on third parties and isn’t supported by many networks in the current landscape.

What are the benefits of wrapped BTC vs BTC?

Wrapped BTC can be used on the Ethereum platform, which was previously closed off for BTC users. As a result, individuals can access Ethereum’s smart contract capabilities and other benefits without ever purchasing the ETH currency itself.