Over the last couple of years, the crypto market has been busy with the news about regulations and attempts from centralised authorities to seize control over digital asset trading and exchanging.

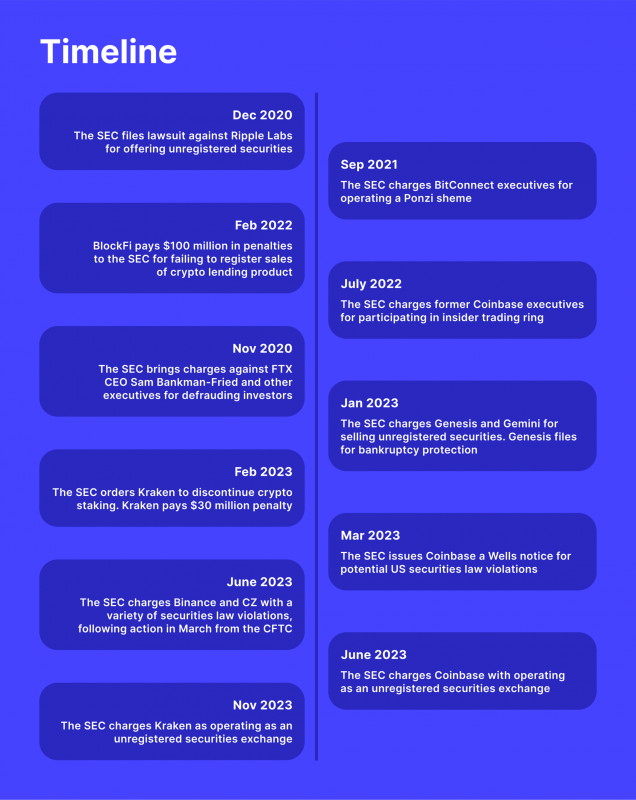

The SEC is doubling down on exchanges and businesses dealing with cryptocurrencies, especially after the infamous FTX fallout and the collapse of the LUNA coin. The US regulatory body has named a few tokens and coins as unregistered securities, suing organisations listing those assets.

The battle between crypto and SEC does not seem to settle down any time soon, with both sides going back and forth in US courts. Let’s review the timeline of the SEC’s activities and the future of crypto assets.

Key Takeaways

- The Securities and Exchange Commission (SEC) is the financial regulatory agency in the United States of America.

- The SEC identifies securities if they pass the Howey test, evaluating the money investments and involved parties.

- The SEC follows a strict framework when it comes to cryptocurrencies, suing multiple exchanges and platforms for dealing with unregistered securities.

- Registered securities require full disclosure to the federal agency. Otherwise, they become unregistered, which is a violation of the US Securities Exchange Act.

Understanding Unregistered Securities

National financial regulators control the transfer and ownership of selected asset types, requiring them to be registered with national or federal agencies and requiring full disclosure.

For example, stocks and bonds are considered national securities that hold a value associated with the ownership of a registered business. Therefore, organisations must provide full documentation about the market value, change of ownership, history records and more.

Thus, unregistered securities, by definition, are assets that are not registered at the relevant regulatory body, making buying and selling a violation. However, different authorities may have different requirements for registered securities, which we will talk about in later sections.

Are Cryptos Securities?

The first cryptocurrency was created in 2009 with the aim of creating a decentralised payment and storage system that does not rely on the central control of facilitators or governments.

Banks and centralised governments did not pay as much attention throughout the first few years of cryptocurrencies’ lifespan, believing that this fairytale would soon end.

However, more virtual assets and currencies emerged, and digital communities showed more interest in Web 3.0 and decentralised applications. Consequently, The crypto market grew in size, userbase, market capitalisation and trading volume.

These digital assets have become essentials in payment gateways, money transfers, and online businesses, shedding more influence on the global stage.

Therefore, regulatory bodies started scrutinising businesses that conduct crypto investments and transactions, overlooking the type of digital assets they offer and requiring them to be registered at a national level.

The recent events of the US regulatory body suing regulated crypto exchanges for listing virtual tokens and coins raised the question of what security is from a crypto perspective. And what are the criteria to be sanctioned?

The US regulator argues that virtual currencies represent ownership of an asset issued by a registered business – the founder of the coin or token – making it treated like a legal contract. However, this does not apply to Bitcoin. So, which cryptos are not securities?

The SEC’s Rule Over Cryptocurrencies

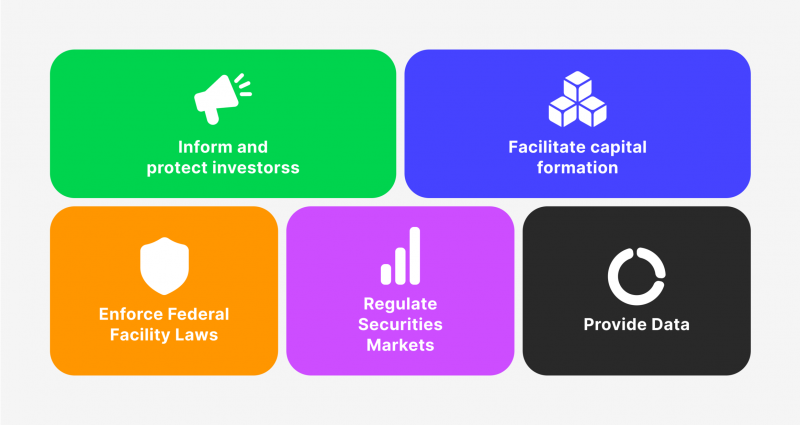

The Securities and Exchange Commission of the United States is the Federal authority in control of the securities market, tasked with regulating the transaction conduct, protecting the rights of investors and market participants and ensuring trading integrity and fairness.

The SEC was formed in 1934 as a centralised authority where businesses register their activities, exchanges disclose trades, and companies file their ownership status and shares. For most of the time, the SEC has been concerned with stocks and bonds trading, as the largest two industries with a considerable influence on the national economy.

For example, when a company goes public, it receives IPO approval from the SEC and records its transactions and valuation to ensure complete compliance with applicable rules.

However, the recent events in the crypto market drew the attention of the SEC, as the proclaimed regulator, to put an end to these incidents. These events include the meltdown of the stablecoin TerraUSD (UST), which led to the crash of LUNA, and the default of a famous crypto exchange after a financial mismanagement blowout.

Since then, Gary Gensler, the chairman of the SEC, cracked down with regulations and lawsuits on crypto exchanges for selling unregistered securities of a crypto nature.

The US Federal financial regulator took a sceptical look at virtual currencies and tokens, claiming that deregulating them leads to financial catastrophes and the only way to ensure benefiting from them is by offering them as registered assets.

Qualifications Requirements for Securities

The SEC identifies securities as financial instruments according to the Investment Company Act, which entails ownership in a publicly listed business, the right to claim ownership in the company’s assets, or an agreement to give/receive credit between a company and a government entity. These three cases are the definitions of stocks, options and bonds.

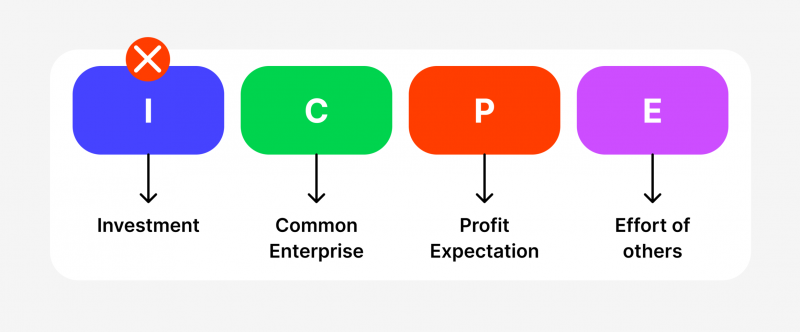

In order to determine which cryptos are not securities, the SEC conducts the Howey Test. This method is a measurement to find if the subject asset or transaction can be considered a legally binding investment contract, requiring it to be sanctioned under the SEC rule. Based on the Howey Test, an investment contract is considered if:

- Money investment is involved.

- The investment may generate profits.

- The money investment involved a publicly traded organisation.

- Third-party promoters and sellers can generate returns.

This test is applicable to financial assets and transactions and initial coin offerings initiated to find a newly introduced crypto coin or token.

Registered vs Unregistered Securities

The SEC’s crackdown on virtual currencies and exchanges raises multiple concerns about what security is in crypto coins and what is treated as unregistered securities.

The SEC uses the Howey test to evaluate tradable securities. Thus, if an entity or asset passes the test, it qualifies to be a national security that requires registration.

Registering security is a protection method for investors from scammers and illicit businesses, which requires financial disclosures to prevent fraudulent schemes.

The SEC states that, unless special exemptions are given, all public trades and transactions must be registered with the Federal agency. Otherwise, it would be difficult for the national regulator to trace illegal transactions or determine money laundering and suspicious activities.

Therefore, any traded security that was not disclosed or is managed by an exchange without a national security exchange or broker registration becomes unregistered, which violates the US securities and exchange laws.

SEC Stance on Cryptocurrencies

The SEC conducted the Howey test on crypto assets and coins and concluded that they are national securities, which must be registered with the Federal agency.

Thus, the US regulator scrutinised exchange companies and crypto platforms, requiring them to adhere to federal securities laws, including comprehensive documentation and disclosures for transactions, listed assets and parties involved in trades.

Crypto communities oppose this movement because it contradicts the fundamentals of decentralised currencies and blockchain that rely on the lack of a centralised authority and control.

However, the SEC proceeded to impose regulations on decentralised exchanges. Since the majority of crypto platforms are not registered as national security exchangers or brokers, a series of lawsuits started.

SEC vs Ripple

In 2020, the SEC sued Ripple, the developer of the XRP blockchain and token, for allegedly raising funds using XRP cryptocurrency as an unregistered security and gathering over $1 billion from this activity.

On the other side, Ripple argued that XRP does not qualify as a registered security because they are not offered to institutional investors. Instead, XRP tokens are sold through exchanges and online retailers, making them not securities and not subject to Federal registration.

The news of the Ripple lawsuit sent shockwaves in the market right before the 2020 crypto boom when BTC price reached record highs at $64,000 alongside other crypto coins and tokens. However, XRP was not having the best of times, especially when major platforms, like Coinbase, delisted the token from its offerings, raising more suspicions over the future of the blockchain and currency.

In 2023, the New York court decided not to charge the blockchain developer, as XRP was sold to the public using exchanges and trading platforms and not to investors.

SEC vs FTX

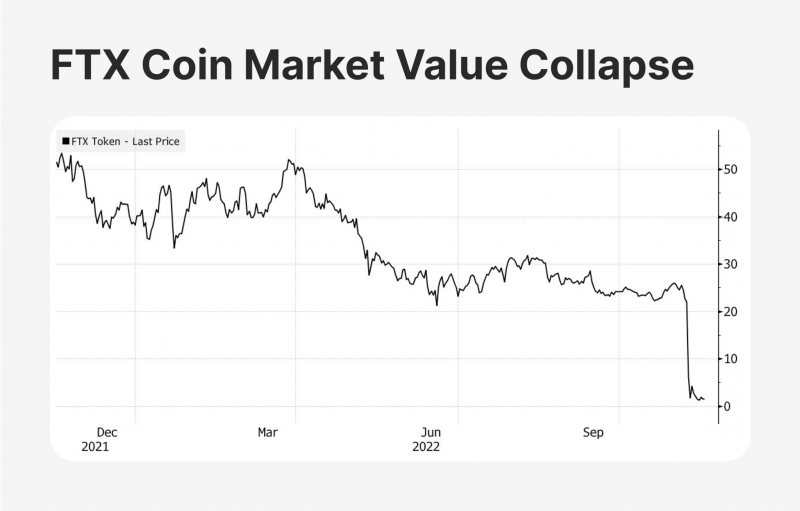

The collapse of the FTX crypto exchange was the most significant, topping a year of recession for most cryptos in 2022. The infamous collapse was all down to monetary mismanagement backed by vague strategies and mechanisms in holding owners’ funds exposed by a crypto news page.

The then third-largest crypto exchange platform was found to be holding investors’ funds in sister-company own and FTX’s native tokens, spreading fear among account holders.

Binance sold all its FTT holdings, deflating the exchange’s native crypto token and creating a panic in the market, with more participants withdrawing their money and drying out their accounts. Consequently, it took only ten days for the exchange to announce a liquidity crisis.

FTX sought to bail out from Binance and other joint ventures, but the complications behind the case deterred anyone from managing this chaotic system. Eventually, the crypto exchange collapsed, and the then CEO Sam Bankman-Fried was charged with seven counts, including securities fraud and money laundering.

SEC vs Coinbase

In 2023, the SEC concluded that Coinbase, the largest crypto exchange, violated the Securities Act by selling unregistered securities represented by seven tokens, like Polygon, Solana, Cardano and others.

The US regulator claims that these tokens resemble national securities that must be registered. However, Coinbase never registered itself as a security exchange or broker, making listing these tokens by an unregistered securities exchange illegal.

However, the exchange argues that these crypto tokens do not qualify as registered securities because they are not offered to institutional investors. Moreover, Coinbase states that they were never required to be a registered exchange when they made their official registration in 2021.

The Coinbase SEC lawsuit is still ongoing. However, Coinbase made an appeal in January 2024, asking the New York court to drop the case based on the arguments it represented in its defence.

SEC vs Binance

In 2023, the SEC found new prey as they sued Binance, one of the world’s largest and most famous exchanges, for several charges, including misrepresentation of trading tools and offering unregistered securities.

The US regulator put charges against Binance and founder Changpeng Zhao for accumulating over $11 billion from trading, selling and exchanging unregistered assets. Moreover, the SEC had questions regarding the legality of Binance’s staking programs and lending options offered with its native currency, BNB.

The case was concluded after the two parties reached a settlement of $2.7 billion paid by the exchange company, and the CEO stepped down after pleading guilty to anti-money laundering violations.

Fun Fact

Changpeng Zhao learned about Bitcoin while playing poker in 2013. Then, he continued his curiosity and search for cryptocurrencies by launching a payment provider and the crypto exchange platform Binance.

Bitcoin Spot ETF

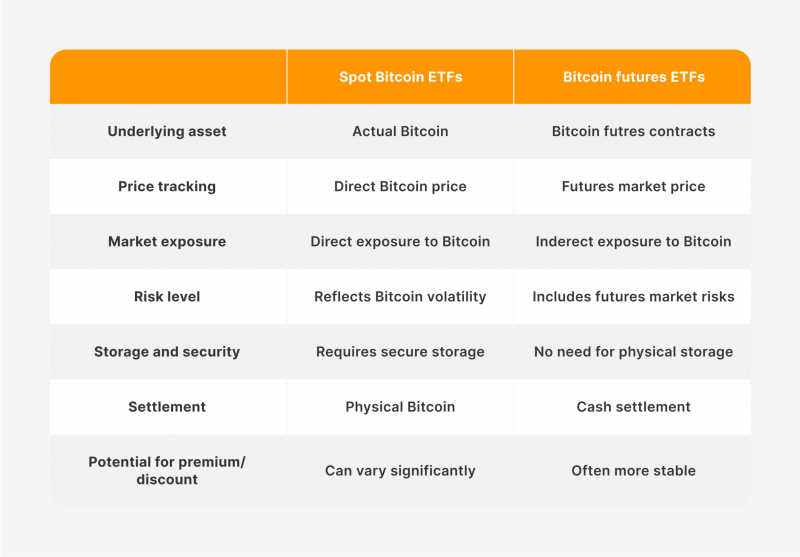

The Bitcoin ETF spot trading has been a major concern with traders and US regulators. After a long waiting time, the SEC has approved the Bitcoin spot ETF trading, a decision that is expected to contribute to the anticipated bullish market.

Top US investment firms, like BlackRock and Fidelity Investment, were the leading applicants to list BTC in ETF spot trading, a hope that finally came into reality.

Crypto communities, investors and platforms highly anticipate that the SEC’s decision will motivate traders to increase their transactions and holdings in BTC, sending the coin price to high levels and potentially crossing the previous record in 2021.

Is Bitcoin a Security?

Despite its double down with the narrative of “unregistered securities”, the SEC does not treat Bitcoin as such, which raises the question of what identities as a security and whether Bitcoin is a registered security.

The former chairman of the SEC commented on this topic that Bitcoin is a currency replacement for fiat money. Thus, it is a replacement for the US dollar, Japanese yen, British pounds, etc. Therefore, it is considered a security.

The claims are that, unlike other crypto coins and tokens, Bitcoin developers do not rely on public funding to grow its value or networks. Therefore, the Howey test does not fit the coin structure.

Conclusion

The US Securities and Exchange Commission is strictly scrutinising crypto exchanges and platforms dealing with unregistered assets, such as coins and tokens.

The SEC identifies crypto asset securities using the Howey test concerning the investment type, money generation model and involved parties to decide if the subject is considered a security or not. Registration means that transactions and holdings must be disclosed to Federal agencies in a timely and comprehensive manner.

However, this act faces opposition, as crypto investors see it as a violation of the nature of cryptocurrencies, relying on the decentralised basics of blockchain and peer-to-peer networks, as opposed to centralised authority’s control.

FAQ

What is an unregistered security?

Any tradable asset that is not registered according to the SEC’s regulations is considered unregistered security. Registration requires comprehensive financial documentation, including transactions and crypto investments.

Do SEC rules apply to crypto?

The SEC uses the Howey test to determine whether an asset qualifies to be sanctioned by the applicable rules of the SEC. Once the subject passes the test, it becomes required to register at the Federal agency.

Why SEC is attacking crypto?

The SEC is doubling down on crypto and exchanges to provide a layer of protection to retail investors, ensuring that illicit activities, especially after many exchanges and tokens, collapsed.

What happens if cryptos are considered securities?

If cryptocurrencies become securities, they will require full transparency in documentation and disclosure, whether it is a crypto trade, transfer or investment in a staking campaign. However, this seems highly challenging for cryptos with a decentralised and dynamic nature.