A bull market is the favourite buzzword for crypto investors, marking tremendous market opportunities to grow someone’s wealth by investing in Bitcoin and other major virtual currencies.

After the crypto boom in 2021, virtual currencies have been on a declining trend, where most digital assets’ prices dropped dramatically and are significantly away from their all-time high.

However, recent activities in blockchain currencies and digital assets show strong signs of recovery, as the BTC price caught a consistent rally, reaching new peaks in 2023.

Bitcoin traders interpret the recent price increase for the overall market as preparation for a new Bitcoin bull run, which seems to be closing in on the horizon. Let’s review the recent updates in Bitcoin and what a bull market means for you.

Key Takeaways

- A bull run is an event where market prices increase for longer periods, backed by increased investors’ confidence and trade volume.

- Bitcoin achieved massive growth in 2023, growing from $16,000 to $45,000, or over 180% in one year.

- The recent news about the Bitcoin ETF trading application and upcoming halving in 2024 are the main drivers for the next Bitcoin boom.

- Bitcoin bull run is expected anytime between 2024 and 2025, especially after the halving event in April and considering the developments in the global economy.

Bitcoin Bull Run History

The crypto market goes through multiple phases where prices move up and down. These events happen due to the speculative nature of virtual coins and tokens, which rely on demand and investors’ trading patterns.

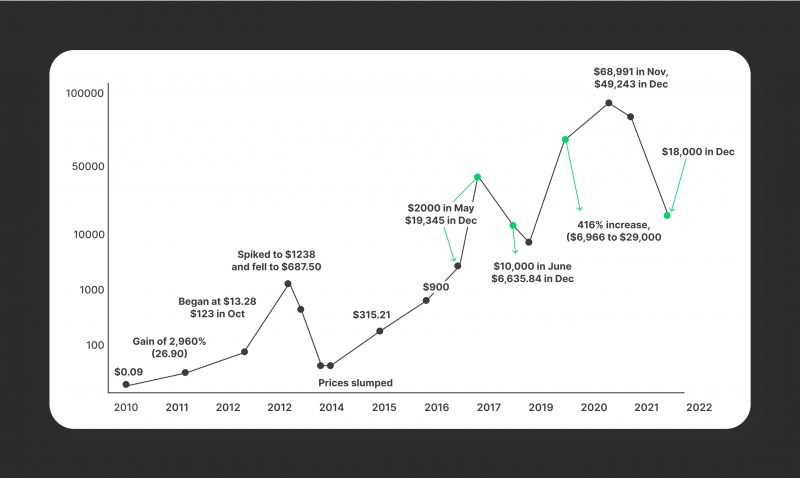

Bitcoin is the major blockchain currency, as the first and the fastest growing virtual coin, rising from less than $1,000 in 2016 to over $65,000 in 2021, marking a tremendous 6,400% price markup.

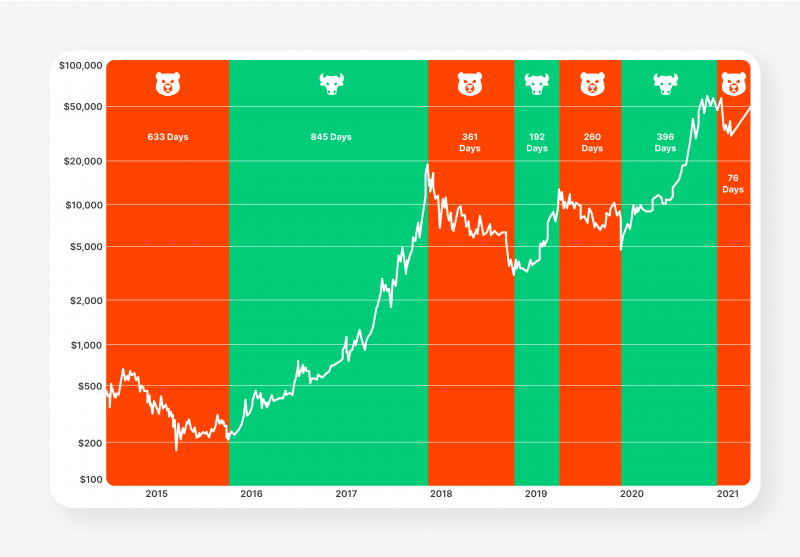

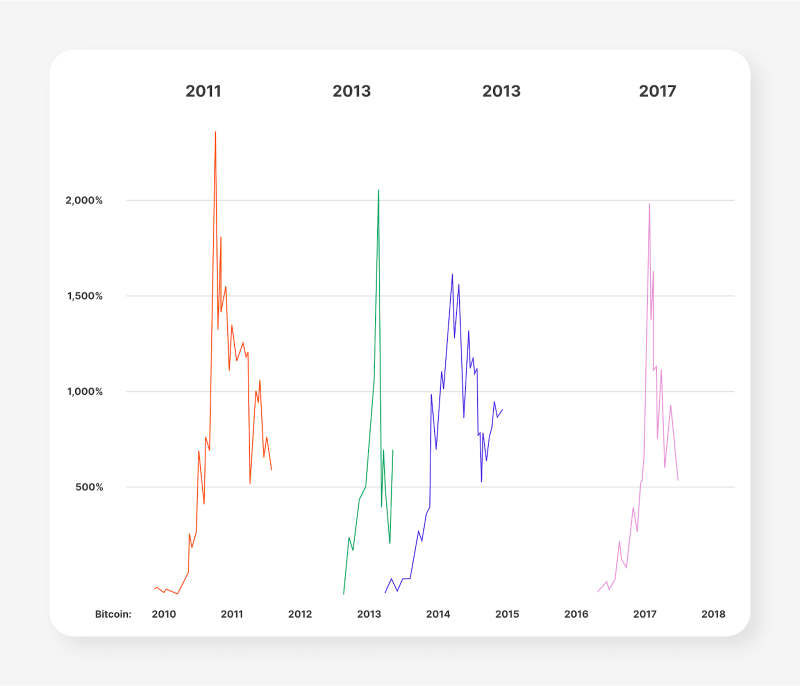

Looking back at the history of Bitcoin’s bear and bull markets, it seems like there is a pattern of bullish sentiment every four years. Will history repeat itself, and will the BTC bull run happen soon? Let’s review the historical Bitcoin bull markets.

2013: First Price Growth

The first noticeable Bitcoin growth happened in 2013, amidst growing media attention and public interest, pushing BTC price from $10 to $200, which later peaked at $1,100 in December 2013.

This momentum was supported by the growing popularity of Bitcoin in China and the futuristic solutions the blockchain and cryptocurrencies introduced. However, Bitcoin could not maintain this growth as it was preliminary to judge its usability amidst fears of losing control.

2017: Crypto Market Boom

After trading around $200 for a couple of years, the 2017 Bitcoin boom happened in response to growing interest in crypto investment, fueling Bitcoin prices to just south of $20,000, creating a tremendous speculative market that became everyone’s talk.

This growth was attributed to the increasing number of newly founded cryptos, the development of the Bitcoin blockchain, and the attention paid to mining machines.

2020-21: Bitcoin Record Surge

The biggest bull run for Bitcoin happened in 2021, influenced by multiple financial and economic factors. When the COVID-19 pandemic hit the world, central banks printed more money and increased interest rates to stimulate economic recovery.

Thus, traders feared possible inflation and shifted their attention to Bitcoin, besides the increasing interest in Web 3.0 applications, crypto exchange and the metaverse, sending the Bitcoin price over $65,000.

Bitcoin in 2023

Crypto investors describe 2023 as the recovery year for Bitcoin and other virtual currencies, as they slightly recovered from the crypto winter in 2022. BTC started the year at around $16,000 and steadily grew throughout the year.

Much of this growth was attributed to major events, starting from March 2023, when a series of US commercial bank failures happened, starting from the collapse of Silicon Valley Bank, and consumers’ confidence in regulated financial markets was lost.

This news alone helped the Bitcoin price reach just below $30,000, breathing a new life into cryptocurrencies that many believed were dead.

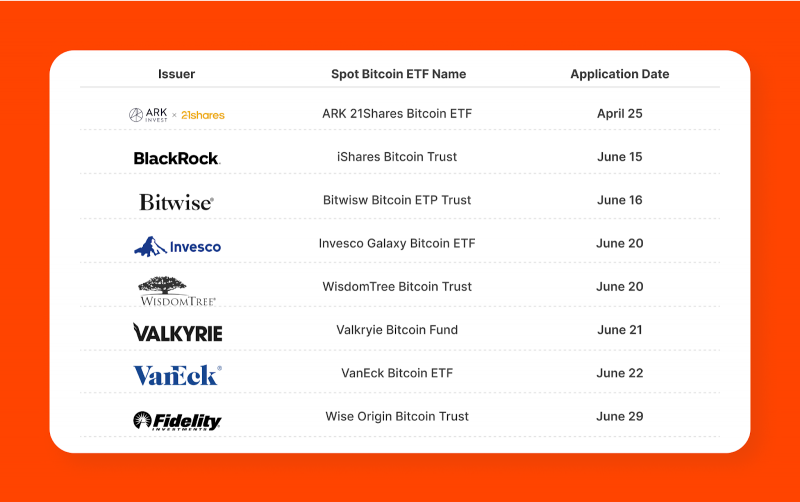

In June, major investment firms, such as Black Rock and Fidelity Investments, filed an application with the US Securities and Exchange Commission to enlist spot Bitcoin ETF in their trading desks. Unlike other applications, the SEC did not jump into rejecting these requests, which gave the investors some hope that the application would go through.

This news, coupled with insider news about a possible ETF approval on the horizon and the SEC’s prolonged decision due date, sent the Bitcoin price on a new ascent, reaching $45,000 during the first week of December.

The Bitcoin bull run history chart, coupled with these events and the significant price rally, hints at a promising bull movement coming soon.

The trading volume during the last bull run reached $131.21 trillion in 2021, compared to $41.21 billion in 2023.

What Affects the Bitcoin Bull Run?

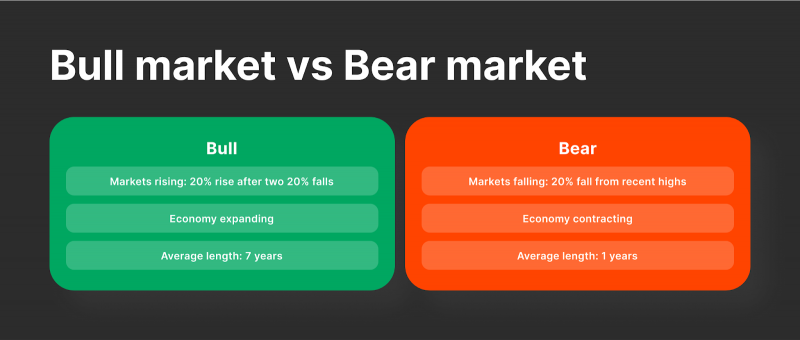

A Bitcoin bull run is a phenomenon where the BTC market price increases for a longer time, coupled with an increase in investors’ confidence and market sentiment.

During bull runs, the market experiences a significant increase in investing and buying Bitcoin due to positive speculations about potential price action. The Bitcoin price increases massively when the demand surges for cryptocurrencies.

It is not just a short-term price increase as a natural market dynamic. Instead, it is usually attributed to various factors, such as global adoption, developing technologies in decentralised economies and governmental regulations regarding trading and using cryptos.

Why is the Crypto Bull Run Important?

Bitcoin is the leading virtual currency, with the highest market cap and the most sophisticated blockchain structure. Therefore, a Bitcoin bull run will cast its impact on the rest of the market, causing other cryptocurrencies to rise in market value and create other price surges.

This crypto bull run is essential to restore the investors’ faith in digital currency, especially after an adverse crypto winter in 2022, where crypto prices dropped, a major crypto exchange was bankrupt, and many DeFi platforms suffered from investors pulling their funds.

Therefore, a crypto market bull run increases the overall market price, increasing the investments in Web 3.0 platforms and currencies and encouraging developments in the decentralised world.

What Contributes to the Next Crypto Bull Run Prediction?

Unlike historical Bitcoin bull runs, this time, the bullish market is fueled by several updates and events that are expected to send the Bitcoin price to unprecedented levels. These events are as follows.

Bitcoin Halving Event in 2024

The Bitcoin blockchain conducts supply halvings every four years or 210,000 registered blocks, meaning that the supply of Bitcoin in the market is slashed to half, reducing the miners’ rewards to half.

This event is crucial to prevent virtual coins from inflation, especially when demand sharply increases or mining activities are growing rapidly.

Thus, when the Bitcoin supply is reduced to half amidst increasing demand, the coin maintains and increases its value to attain viability and development.

The halving event is critical in the Bitcoin life cycle, as every previous halving was followed by significant bull runs in 2013 and 2017 and the most recent supply reduction in 2020.

BTC Spot ETF Approval

Over the past few months, leading investment firms in the US, such as Black Rock and Fidelity Investments, filed an application with the SEC to approve Bitcoin as a spot ETF security. However, the commission has yet to produce any decision in this regard, considering the unregulated nature of cryptocurrencies and the volatility of major virtual coins.

This movement is motivated by the increasing tendency to adopt BTC payments and use cases in the regulated market and the failure of classic banking systems.

This application, if approved, may result in tight regulations regarding trading and storing cryptocurrencies, which contradicts the essence of decentralised economies.

However, centralised finance institutions are realising the growing value of BTC and other major cryptos as tradable instruments and their rising popularity in public.

The expectations are for the decision to be made early in 2024, as institutional investors are confident of receiving a positive answer since the SEC took more time than usual to decide on the application. This prolonged process may mean that the commission is waiting for the right time to announce its approval.

ETH Spot ETF Approval

Leading investment and asset management companies in the US have also applied for the Ethereum spot ETF trading listing.

Approving this application is more likely than BTC ETF, given the tremendous developments and work the ETH network has been putting in over the years to develop blockchain technology and security.

Moreover, the SEC approved future ETH ETF trading in October 2023, and nine leading firms, such as Bitwise and ProShare, offer ETH futures ETF trading.

However, this decision is anticipated to take place after the Bitcoin ETF spot trading application to avoid overhyping Bitcoin prices before the decision has been made.

When is the Next Crypto Bull Run?

There is no definitive date for the next bull run in Bitcoin and the overall crypto market since the news is based on speculations and market sentiment.

However, analysts who stick to the 4-year theory support the fact that the halving event that occurs every four years has been a catalyst for significant investor sentiment.

This time, the BTC bullish market is not only fueled by the halving event, but more crypto news and announcements are happening at the same or close times, encouraging an increase in investors’ confidence and BTC value prediction as bulls hold an upward trend.

Despite the massive growth in crypto prices this year, offsetting the losses incurred during the 2022 crypto crash, Bitcoin and most leading coins are still way behind the all-time high price.

Bitcoin reached record highs in 2021, north of $65,000, and Ethereum crossed $4,800 in the same year, far from the current prices of $42,500 and $2,200 for the BTC and ETH, respectively, on the day of writing. However, these currencies achieved massive year-to-year growth.

Bitcoin investors argue that the next bullish market will take place in 2024, soon after the halving event, especially if the SEC approves the spot ETF application before the halving date.

Other crypto communities back the theory that the bull market will likely happen in 2025 as the market prepares and rearranges itself after the major announcements during the first half of 2024.

Possible Effects of the Bitcoin Bull Run Prediction

Not only is the Bitcoin price expected to rise greatly during the anticipated bull run, but other decentralised applications and platforms are projected to grow in popularity and development.

The Metaverse

AR/VR platforms underwent massive developments during the last bull run as more Metaverse projects were created. However, many of them foreclosed during the crypto winter. Therefore, this bull run is expected to increase the funding and interest in these platforms.

DeFi Platforms

Crypto exchanges and DeFi services suffered from a lack of liquidity and interest the past year, and many faced SEC sanctions and lost confidence after the FTX crash. Thus, the Bitcoin bull run can pump more liquidity into these platforms.

GameFi

Gameficiation and play-to-earn concepts have grown massively over the past few years. However, they lost users’ interest as soon as most cryptocurrencies stagnated.

NFTs

This promising creation of blockchain technology has lost its hype with limited use cases. However, a significant bull run may aid NFT’s utility and popularity development.

What Could Go Wrong with the Bull Market?

Cryptocurrencies, in general, and BTC, in particular, are volatile and unregulated, which makes all of the expectations about bull runs and price increases based on speculations and historical events.

At the beginning of 2023, economy experts predicted a global financial crisis anytime in 2023 or early 2024, or at least in the US, given the economic events and key indicators.

The Federal Reserve increased its interest rates ten times, from less than 0.25% to 5.50%, reaching new highs since 2001. This activity, coupled with geo-political unrest and instability in gold and oil prices, has shaken the investors’ confidence in regulated financial markets.

Crypto investors expect an increase in Bitcoin investments as a safe haven compared to instability in most asset classes, prominently gold and oil. However, this sharp uptick may accelerate financial turmoil that brings the cryptocurrency price down to a bear market before reaching its full potential.

Conclusion

The recent developments in Bitcoin and other cryptos, coupled with technical analysis, indicate that a possible bull market is coming on the horizon. The speculations are not “if” bull will happen, but “when” the bullish movement will happen.

The upcoming Bitcoin halving and the pending BTC ETF spot trading application are two events that crypto investors are anticipating and describing as the main catalysts for the upcoming market boom.

FAQ

When will the crypto bull run start?

The exact date for the bullish sentiment is unknown yet. However, the recent market updates and massive growth in major cryptos indicate that a significant price uptick is coming anytime next year, especially around the Bitcoin halving event in April 2024.

Has the crypto bull market started?

Bitcoin and other major cryptos achieved massive growth in 2023. However, they are still way behind their all-time highs. Therefore, the next bull run is more likely to happen in 2024, especially after halving the Bitcoin supplies and the spot ETF trading application.

Which crypto will boom in 2024?

Bitcoin, Ethereum, Binance coin and other major cryptocurrencies usually catch momentum during bullish markets, which makes them projected to hit record prices compared to altcoin and other crypto tokens.

Which crypto should you buy for the next bull run?

BTC, ETH and BNB are expected to catch the biggest trends, given their developments and importance. However, traders conduct their own research to track growing coins and invest in the right crypto at the right time.