The world of crypto has been through a lot of turmoil in recent years, experiencing two crippling crypto winters in a short span of four years. However, the 2023 period has been kind to this surging market, rekindling the global popularity of crypto and allowing it to reach previous levels of exponential growth. Naturally, entering the cryptocurrency sector has become profitable and promising once again.

Creating your own crypto exchange business is among the most lucrative opportunities in the current setting, allowing businesses to benefit from increased trading volumes and overall industry growth. So, what is a cryptocurrency exchange? And how can you build your own one? Read on to find out.

Key Takeaways

- Crypto exchange platforms are digital hubs for exchanging cryptocurrencies and implementing various trading strategies.

- The crypto platforms have two primary variations – centralised and decentralised exchanges.

- Developing a crypto exchange platform requires several steps, including business plans, licenses, initial capital, liquidity provision and technical development process.

- Each stage is crucial to construct a proper exchange platform that functions well, delivers all relevant functionalities, and cares for its customer base.

What is a Cryptocurrency Exchange?

Before diving into constructing your cryptocurrency exchange, it is crucial to grasp the technology, operations and economy behind this lucrative business. Crypto exchanges function not unlike standard fiat exchanges. However, they employ several helpful tools and practices to account for the unique characteristics of the crypto market.

The primary purpose of crypto exchanges is to allow traders to find their desired crypto pairings and trade without any hitches or delays. However, the development of digital technologies has enabled the exchanges to have numerous secondary purposes that complement the core trading aspect.

The most advanced exchange platforms feature valuable tools for crypto exchange market overview. These tools include advanced charting, trend indicator analysis, live price updates, and other helpful information to facilitate data-informed trading.

Thus, crypto exchanges serve as intermediaries between the aggregate supply and demand in the crypto market, enabling traders to seek out and acquire or sell their desired assets.

The Underlying Technology Behind Crypto Exchanges

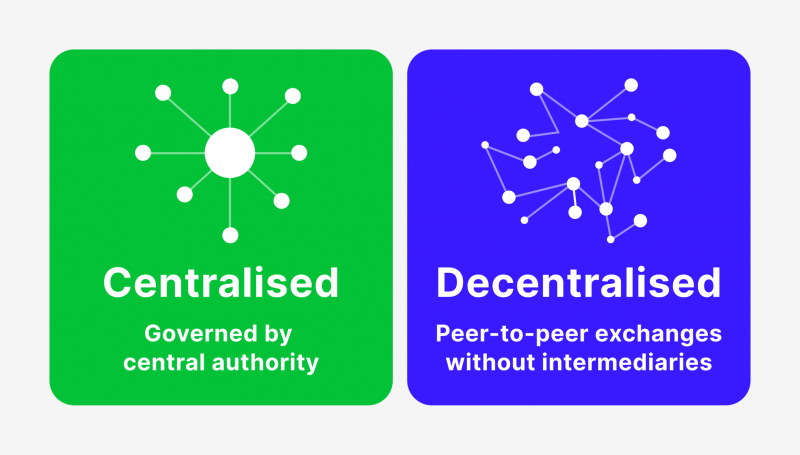

The most significant variations of crypto exchange platforms are centralised and decentralised exchanges. Centralised exchanges resemble their fiat counterparts, offering the same convenience, accessibility and features. The funds traded within the exchange are controlled, monitored and processed by a central entity, which slightly negates the decentralisation aspect of blockchain.

Conversely, decentralised exchanges preserve the core values of blockchain but fail to provide the same level of comfort to their respective customers. The technology behind decentralised subtypes is much more complex since the platform is required to function without human supervision or monitoring.

Thus, numerous safeguards and automated protocols should be employed to stabilise the trading scene whenever necessary. Naturally, the need for complex protocols goes against the benefits of convenience and accessibility found in the centralised exchange versions.

Liquidity pools also have a heightened importance in the crypto field to make up for the more prevalent price swings and market volatility. Many digital currencies suffer from low liquidity, and crypto exchanges employ automated market makers to fill demand-supply gaps without human intervention. However, the AMM systems are susceptible to market manipulation, another weakness for decentralised exchange variants.

White-Label Cryptocurrency Exchange Software

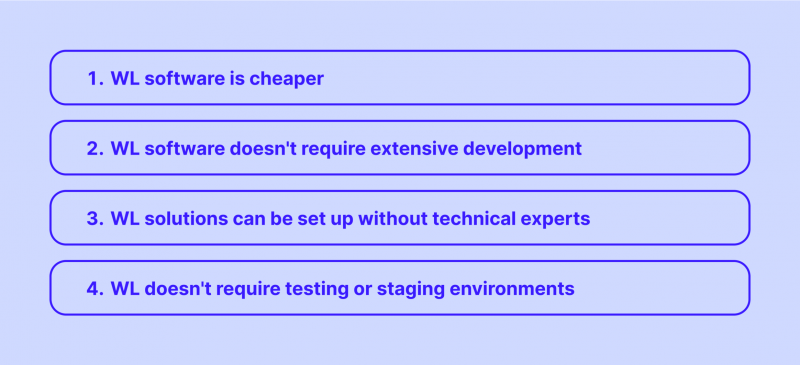

Another important tech consideration is the emerging trend of white-label crypto exchange platforms. Third-party developers create these digital software solutions, which can be purchased as a ready-made exchange platform. Naturally, businesses can customise and enrich the white-label template with numerous details to make it their own.

WL software is not as advanced and customisable as the in-house alternatives. However, many businesses lack the funds to build a crypto exchange from scratch. For such companies, WL solutions are a match made in heaven. Additionally, WL software is great for niche companies that aim to satisfy specific market needs.

For example, purchasing a WL solution is much cheaper and easier if you aim to construct a Bitcoin exchange that only revolves around the flagship cryptocurrency. In this case, the relatively limited features of WL solutions will not be a problem for potential customers.

How Do Crypto Exchanges Make Money

In most cases, crypto exchanges employ the spread methodology to earn profits, or they charge a certain fee per transaction. Some platforms even have a particular combination of the two methods, depending on the size and scope of their clients.

The spread income is a simple concept that enables exchanges to have an interval between their bid and ask prices. For example, crypto X will be sold at $1.5 but purchased at $1.3 on platform Y. The $0.2 difference is where platform Y makes its profits.

However, it is important to have tight spreads on the market, as wider spreads will encourage traders to switch off and explore other platforms in your region. Conversely, having thin margins will be bad for business, as crypto exchange platforms demand a lot of upkeep. In such cases, your company might simply go bankrupt in the long run. So, maintaining optimal spreads is beneficial for all parties involved.

Transaction fees are an even more straightforward concept that entails charging customers per each conducted transaction. Different platforms employ various percentages to accommodate customers reasonably.

Some companies have climbing rates that depend on the size or the quantity of transactions, whereas others focus on providing proportionally equal percentages across the board. Both approaches have their merits and are effective in different sectors.

Most exchange businesses fail due to insufficient liquidity and buggy exchange software that frequently shows technical issues.

A Definitive Guide on How to Start a Cryptocurrency Exchange

As stated above, constructing your own cryptocurrency exchange platform from the ground up is challenging since it requires cutting-edge technology and in-depth knowledge of the crypto field.

However, this task is feasible and potentially lucrative for those willing to commit their time and energy. To better understand what you are going against, let’s break down the creation process for cryptocurrency exchanges.

Create a Business Plan and Acquire a License

Before committing any significant resources to start a crypto exchange business, it is essential to identify your preferred business model and craft a thorough business plan.

This document usually includes the concept of operations, underlying technologies to be employed and integrated, potential funding sources, marketing plans and cash flow statements. While it might seem overwhelming initially, the business plan template follows a logical flow of constructing a business, and each aspect is equally important.

Business plans will simplify your efforts to acquire funding, loans or investments in the initial stages of development. It will also boost your chances of developing an exchange platform license required in most first-world crypto markets. An exchange license will let you legitimise your operations and effortlessly enter the global exchange market.

Purchase or Develop a Crypto Exchange Platform

Next, it is time to develop or search for an exchange platform software. As outlined above, two general choices are building software from scratch or purchasing a WL solution. Both options have their merits and benefit different types of exchange startups. In-house solutions are more suitable for prominent startups with maximum customisation and many unique features to accommodate a large client base.

Conversely, WL solutions are best suited for niche businesses that wish to have some options and choices on their platform but mainly serve a concentrated target audience. Single-currency exchange platforms are an excellent example of WL software utilisation, perfectly serving a smaller client base without shortcomings.

It is necessary to understand your financial capabilities to choose the best solution between the two. Generally, WL solutions are more lucrative and valuable for small and mid-sized businesses that wish to avoid the hassle of large-scale platform development.

While in-house solutions are great options for more prominent companies, they demand entire development departments and countless hours to complete. Additionally, companies will require automated or manual testing to ensure that the custom software functions correctly and has no technical problems.

Acquire Complementary Software Solutions

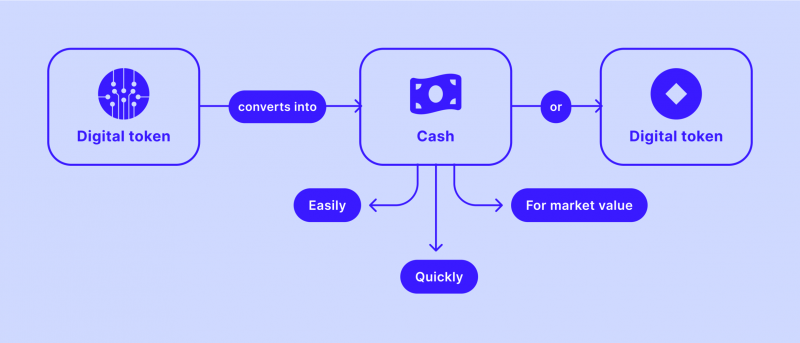

Developing an exchange platform is only half of the technical battle. You must adopt numerous other software solutions to build a cohesive exchange business. It is crucial to adopt crypto gateways to make crypto conversions simple and efficient for customers.

Crypto processors allow exchange platforms to transfer funds without utilising sketchy or dangerous middlemen, which makes them invaluable for any virtual currency exchange business. You must also implement reporting, finance and customer support systems that perfectly fit the existing exchange platform software.

Lastly, exchange platforms require an up-to-date compliance protocol system to ensure organisational regulatory consistency. There are no straightforward guidelines for adopting the best solutions in each aspect. It all depends on your specific situation and setup. Different jurisdictions require reporting, finance and regulatory compliance practices that should be closely followed.

Partner with Liquidity Providers

The most important aspect of building your cryptocurrency exchange platform is finding ample liquidity to support operations. There are numerous pathways in this case. Businesses can partner with a liquidity provider, acquire private funding or take out an institutional loan to receive initial capital.

Finding a crypto liquidity provider is the most diligent choice for smaller and mid-sized exchanges, as LPs provide generous financing options. LPs generally have lower financing costs since they charge only a small fee per transaction or fixed liquidity pool access.

In both cases, exchange platforms will receive sufficient liquidity without paying 10% or more compounded interest. Numerous LP options offer lucrative partnering options to smaller companies in many jurisdictions.

However, exchanges must have appropriate licenses and minimal initial capital to qualify for liquidity provision. Nevertheless, their requirements are mostly feasible even with limited budgets and capabilities.

Implement Air-Tight CRM Systems

Companies should not neglect the importance of providing excellent customer support regardless of their business model and target customer base. This is especially true with online exchanges, as there are increased risks of technical issues, bugs and errors.

After all, customers are entrusting your exchange platform with their private funds, and even the slightest technical complications can persuade them to switch to a different provider.

Thus, it is imperative to employ advanced CRM systems that handle customers from start to finish of their relationship cycle. Proper CRM systems must include customer acquisition programs, customer nurturing sequences and comprehensive support functionalities on the platform.

Customer acquisition mostly includes concentrated ads on social media channels and personalised email marketing campaigns.

Nurturing sequences can be conducted both through email and on-platform mechanisms. Companies can send various endorsements and proposals to clients, motivating them to purchase additional features or expand their trading horizons.

Customer Support

Finally, direct customer support is invaluable and should be considered carefully in the cryptocurrency exchange development process. Customer problems should be addressed promptly and conveniently.

Otherwise, the competitive exchange market will swiftly cause your customer base to shrink. Thus, it is crucial to construct a well-thought-out system that will allow customers to voice their concerns seamlessly and receive ample support within a reasonable timeframe.

There are numerous complementary tools to simplify the customer relationship process, including AI-powered support bots, ticket escalation systems and online chats. Regardless of your CRM system, it is crucial to be fast and address your customer complaints promptly.

Launch Strong and Adapt to Changing Environments

Properly launching an exchange platform is easier said than done. Businesses need to be extremely careful with selecting an appropriate deadline for launch, as any launch-day mistakes or shortcomings will be amplified due to high expectations.

Tech experts need to ensure that the platform functions optimally and there are no significant technical issues that will cause customer dissatisfaction or, even worse – loss of digital assets.

Companies must also ensure that their security measures are up-to-date and allow customers to manage their funds without any cyber threats. Various discounts and promotions can also encourage customers to try out a new platform and increase their chances of conversion.

After a successful launch, keeping up with the latest developments and new features in the exchange field is important. New trading instruments, tools, and metrics are introduced frequently, and competitive exchanges need to incorporate these additions to maintain the interest of the trading public.

Final Takeaways

Understanding what a cryptocurrency exchange is and how to develop one involves a complex process with various responsibilities, funding challenges, and technical hurdles. However, the potential profits and upside are worth the effort and investment.

If you aim to take on this challenge and start crypto exchange development, understand the overall scope of this process and carefully examine all the steps mentioned above. If carried out properly, an online exchange platform will reap massive benefits immediately and help your mid-sized business tap into the international market.

FAQ

Is starting a crypto exchange a good idea?

Considering all the initial challenges, building a crypto exchange is a difficult task that requires full-time commitment and massive resources. However, if achieved successfully, a digital exchange platform has high-profit margins and increased chances of success due to the recent crypto uprising.

How is a cryptocurrency exchange different from a cryptocurrency wallet?

While you can store your crypto funds on both platforms, crypto wallets are simply for transferring funds, whereas the exchange is impossible through digital wallets. Conversely, crypto exchange platforms support many trading features, including basic paring swaps, various contracts, liquidity options and leverage ratios.

Is it better to build an in-house platform or acquire a white-label solution?

Both options should be considered carefully, as they have unique benefits and advantages. In-house platforms are more feature-rich and accommodate a broader base of customers. On the other hand, WL labels are cheaper, more straightforward and take less time to implement. So, it depends on your budgets and business plans to select the perfect option for your distinct needs.