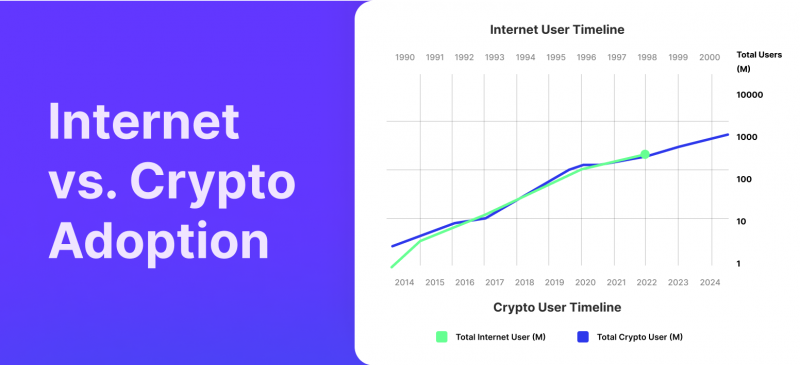

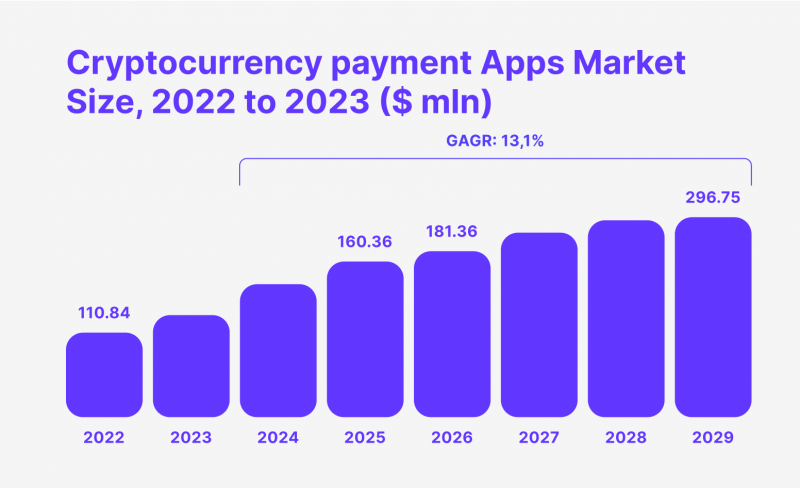

It’s no secret that the crypto market has experienced many trials and tribulations in the past several years. However, in 2023, cryptocurrency payments have regained their sturdy footing across the digital landscape. As of 2023, the number of active crypto users has reached 420 million, making this segment a lucrative target for top companies across the globe.

Crypto payments can open up a nearly untapped revenue stream for growing businesses. Additionally, accepting cryptocurrency payments can prove valuable to existing customers, offering them speed and minimal transaction fees as an alternative on a given platform. Today, we will delve into cryptocurrency payments, their prominence in the emerging economy, and possible risks that follow in their tracks.

Why Crypto Payments are Here to Stay

With its unparalleled security, anonymity, and fractional transaction fees, cryptocurrency payments are a no-brainer improvement over traditional payment options. Instead of a bank account, debit card, credit card, and numerous other financial instruments, a given customer can have a neat digital wallet that does everything faster and cheaper.

However, if the crypto payment method is such a Paretto improvement, how come it’s not the default way to conduct business? The answer is quite simple — this exciting industry is still in its relative infancy, experiencing volatility every other month. With volatility come price variation and general trust issues. Additionally, several countries have classified cryptocurrencies as digital assets and introduced various taxes on their ownership and income.

Some digital currency owners might spend all their transaction fee savings on tax, effectively making the whole operation fruitless. So, becoming a cryptocurrency user is a complex topic that requires careful examination of individual options. However, the user numbers are rising every month and, according to different market researchers, will continue to do so in the current decade.

Fo29GAr an aspiring company that targets swift growth, adopting a payment method that accommodates crypto payments is a dominant strategy in 2023. After all, an additional payment method with little-to-no investment is always worth considering. Numerous industry leaders have refused to miss out on this rapidly expanding niche, from luxury brands like Gucci and international airlines like Emirates to an eCommerce juggernaut Amazon. Now, let us answer the question of the day:

How to Accept Crypto Payments?

Despite the cutting-edge possibilities of cryptocurrency payments, the actual implementation process is not all that complicated. It will also rarely stress your monthly operating budgets since most cryptocurrency providers have convenient plugins ready to be integrated within your existing online stores. However, as with all things crypto, there are some important topics to consider here. Let us discuss this.

Be mindful of local regulations.

While cryptocurrency will save you considerable amounts of cash on transaction fees, the authorities across the globe are catching on and introducing hefty crypto taxes. Since the industry is still almost brand-new, there is a lot of uncertainty and change in tax laws related to cryptocurrency every month.

While there are some tax-free countries remaining, the majority of the sovereign entities have decided to tax the cryptocurrencies one way or another. Most countries view cryptocurrency not just as digital money but as a digital asset, equivalent to a property, and enforce appropriate property taxation laws. So, if you decide to accept payments in crypto, a deep dive into your local tax laws is necessary to avoid heavy taxes on your expenses sheet.

Acquire a reliable crypto payment gateway.

Now, this is where it should get technical. After all, a payment gateway is the most intricate part of implementing crypto transactions within your business. However, with industry-leading crypto providers like Coinbase and Bitpay providing easy-to-integrate gateways, you will have no trouble arming your online platform with a neat new payment option.

While setting up the gateway APIs is nothing to write home about, there are still significant matters to consider. Different providers offer different benefits and advantages in your crypto-related growth efforts. So, before you choose a definitive gateway provider, assessing your requirements as a business is a must.

Set up a risk-averse strategy for your crypto funds.

When you start accepting cryptocurrency payments as a business, significant fluctuations in your crypto value will follow soon after. Despite the industry’s best efforts, crypto remains highly volatile throughout the fiscal year. In this economic landscape, having a diligent strategy to avoid volatility risks is another necessity your business cannot avoid.

There are two main options here — steadily converting your crypto funds to cold-hard cash or carefully analyzing the price trends of the near future. If your company is short on liquidity and would use cash injections into monthly operations, steady crypto-cash conversions are a go-to tactic. However, if you can afford to play the waiting game, it could prove more lucrative to speculate and watch your crypto value spike in the long run.

Below is a snippet of just how volatile Bitcoin can be. Keep in mind that Bitcoin is considered to be one of the more stable options in the crypto landscape.

Remember a refund policy.

Any online business that sells goods and services needs to have sensible and fair refund procedures in place. Otherwise, your customers will be simply too terrified to interact with your online shop. By default, cryptocurrency payment systems do not have a built-in refund policy, which is great for online businesses at first. But your reputation can suffer in the long run if dissatisfied customers do not receive ample compensation.

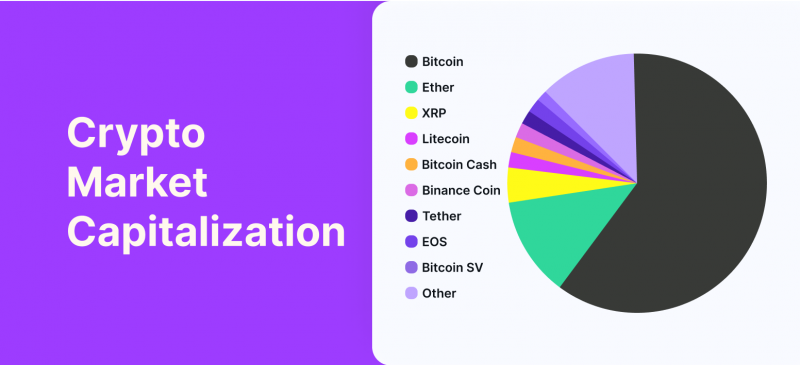

What’s the Best Cryptocurrency to Accept?

While there are plentiful options available on the market, it is always wise to go with established names in this case. Bitcoin, Ethereum, and Tether are choices here due to their widely accepted popularity, stability, and long-standing track record. Of course, there can be exceptions to this rule, and a promising new cryptocurrency could sweep the competition, but if you are aiming for stability, faster transactions, minimal fees, and rock-solid security, Ethereum is the way to go here.

A Steady Improvement in Quality

Ethereum has been steadily increasing its potency through timely upgrades that bode well in the public eye. Ethereum is continuously progressing, reducing its carbon footprint significantly and processing transactions with unprecedented speeds. However, Ethereum is still not Bitcoin and has struggled to escape its shadow for quite some time now.

But for a thriving business that aims to uncover new growth venues, this might be a good thing. Bitcoin is a go-to option when it comes to implementing a new payment method. Thus, most leading companies accept crypto payments in Bitcoin, which in turn leads to market saturation. In short, if your digital currency of choice happens to be Bitcoin, you’re not offering anything new to your customers.

On the other hand, Ethereum is the next best thing, offering a fresh opportunity to unlock a new revenue stream without the significant risks of volatility and instability. In 2023, few options can stack up to accepting ETH payments on your online platform. However, this particular window of opportunity can be short, as numerous companies are getting in on the action.

So, with the Ethereum network presenting lucrative possibilities to extend your growth horizons, let’s get a bit more specific and discuss the specific implications of why you should accept Eth payments.

Benefits of Ethereum as Your Currency

As we have already discussed, Ethereum boasts plenty of impressive benefits despite often being perceived as a second option after Bitcoin. In short, Ethereum will arm you with transaction speed, global outreach, security, and lower fees without skyrocketing your monthly budgets. Ethereum has steadily polished and perfected its blockchain technology, and as a result, this digital currency has firmly remained the fastest on the market.

Unmatched Speed

Out of the three biggest players in the crypto landscape, Ethereum is an undisputed leader of speed and swiftness. If you implement an Ethereum payment gateway, your customers will enjoy unparalleled transaction times, completing transactions well before any reliable alternative on the market. With slightly bigger fees than its competitors, Ethereum’s speed might come at a certain price and it comes down to what’s more important for your customer needs at a given moment. However, the minimal spike in fees rarely proves to be a significant burden and most of the online stores that accept ETH are enjoying a steady stream of income from this niche.

International Fluidity

Additionally, Ethereum gives you the means to conquer the global market without getting lost in the web of cross-border laws, regulations, and hundreds of different judicial laws. Most companies that try to expand beyond local horizons get stuck figuring out the international legal waters, being forced to stop in their tracks and miss out on narrow growth opportunities due to bureaucracy.

By integrating Ethereum payments, numerous online stores and e-commerce websites have gotten over the hump of international complexity. Many thriving businesses like Crypto Emporium have already implemented Ethereum as their digital currency, opening doors to millions of existing and potential customers.

Air-tight security

A traditional payment system offered by online banks requires a set of information you have to type every time you make a purchasing account. Your deeply personal and sensitive financial information has to travel through numerous APIs and inevitably rub shoulders with questionable security firewalls at some point. With Ethereum, your personal information stays with you.

Ethereum blockchain has one of the sturdiest and well-constructed security algorithms on the crypto market, making it an easy choice if you value security first and foremost. Best online stores on the market are known for their solid security measures, giving their customers peace of mind when browsing in the digital landscape. Ethereum can uplift your reputation as an online business with its widely accepted reputation for safety.

Conclusion

With rising numbers, improving security, lightning-fast transaction speeds, and low fees, accepting crypto payments is becoming a no-brainer for aspiring online businesses. This method provides freedom to operate worldwide and ensures the maximum security of your customers. However, increasing tax implications, everpresent price volatility, and general industry uncertainty discourage many online businesses from dipping their toes in this endeavor.

Since the risks are material and highly probable on some occasions, we believe that integrating crypto payments should not be the lion’s share in your revenue-generating strategies. As of 2023, a functional crypto payment system is a great bonus for your core business that invites a new audience to purchase your offerings.

If you decide to accept Ethereum payments, this can serve as a neat addition to your strong business foundation, but you should always control the volatility levels and track your liquidity to avoid the potential losses down the road. If you are mindful of the risks and hedge them properly, implementing Ethereum into your online setup could reap significant rewards that might exceed your expectations.