The crypto landscape has experienced numerous transformations, growth and downturns in its young age. Despite the recent turmoil, the industry is finally entering a maturing phase with impressive yearly growth marks as of the third quarter of 2023. The general consumer base is re-developing its trust in cryptocurrency solutions, increasing the global demand considerably.

With the proper tools, emerging and current businesses can swiftly tap into the growing crypto user market, acquiring fresh revenue streams. There are numerous reasons why businesses should accept crypto payments, but the correct choice for the payment gateway demands careful consideration. Let’s explore.

Key Takeaways

- The recent resurgence of the crypto market has popularised cross-border crypto transactions again in 2023.

- Adopting crypto payment options has become a credible source for brand-new revenue streams and lucrative growth opportunities.

- Implementing crypto payment options is not challenging, but it still requires careful consideration and excellent execution.

Understanding Crypto Payment Processors

Before delving into the topic of accepting crypto payments, it is crucial to understand the concept of payment processors. Also known as payment gateways, these nifty API tools allow digital systems to integrate crypto payment options seamlessly. They are perfect for most small and mid-sized businesses that don’t have the time and resources to build in-house software solutions.

Previously, integrating crypto payment gateways was a highly complex procedure, even for large-scale corporations with substantial funds to spare. As of 2023, payment processors have been streamlined and simplified dramatically. In practice, they function similarly to other API tools that digital providers can purchase or rent. Thus, business leaders don’t have to become familiar with the underlying technology to adopt crypto payment solutions. Instead, they can swiftly find a reputable provider and execute the integration process without technical complexities.

A diverse selection of crypto processors on the market offers different pricing plans, bandwidth, cryptocurrency options and other advanced functionalities. The choice is practically limitless, and businesses can acquire a gateway solution that accommodates their local regulations, customer demand and scaling requirements.

Advantages of Implementing Crypto Payment Solutions

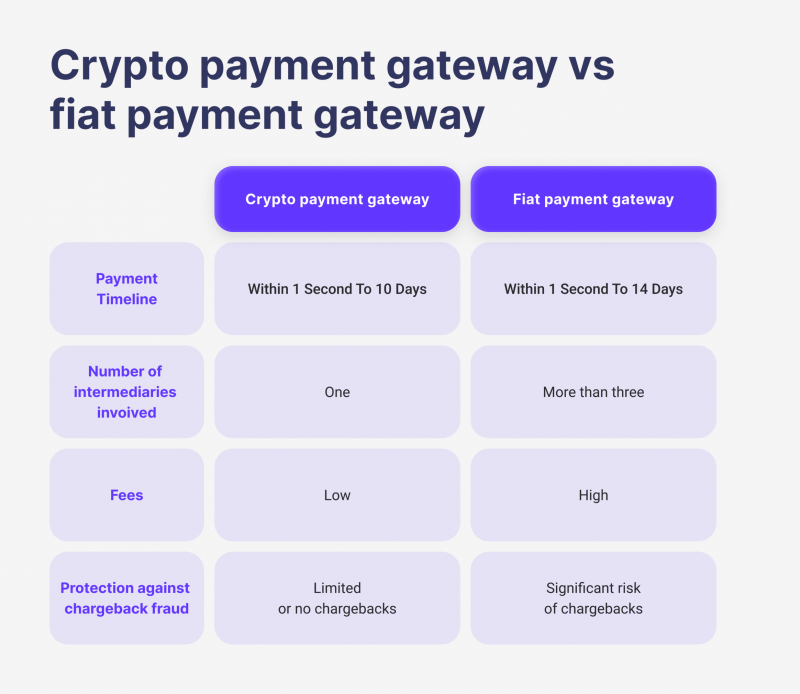

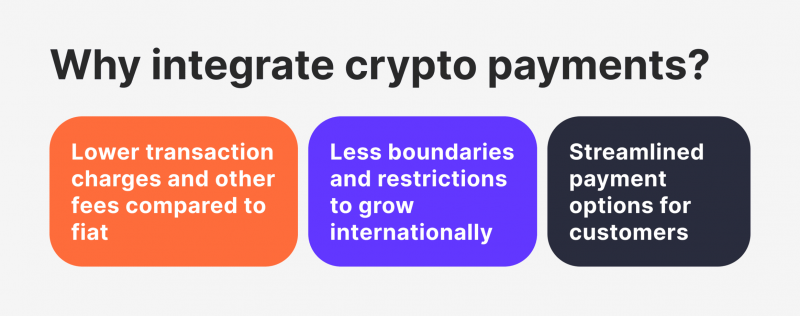

While crypto payment gateways have been simplified to accommodate small and mid-sized businesses, many companies still ask: Why is it a good idea to accept crypto payments? There are three major answers. First, merchants’ immediate transaction fees are considerably lower than traditional payment solutions like credit cards. In most cases, crypto gateways charge at least three times less than average credit card fees.

Secondly, businesses can grow faster beyond their local economic confines if they maximise their crypto customer base. It costs much less for customers to pay with crypto solutions than fiat transactions. Additionally, payments go through in a fraction of the time. Finally, businesses will not have to deal with numerous regulations, international laws and restrictions to set up cross-border payment systems.

Thus, implementing crypto payment processors simplifies things both on the customer side and for business operations. The biggest concern here is the overall industry’s success and future development. However, as of 2023, the crypto sector shows steadfast growth rates that will most likely continue in the following years.

How To Accept Crypto Payments On Your Website?

As discussed above, integrating crypto payment API into your online platforms is much easier than ever before. However, this task still has its complexities that must be considered carefully. So, let’s explore the essential steps to implementing crypto payment solutions properly and without any oversights.

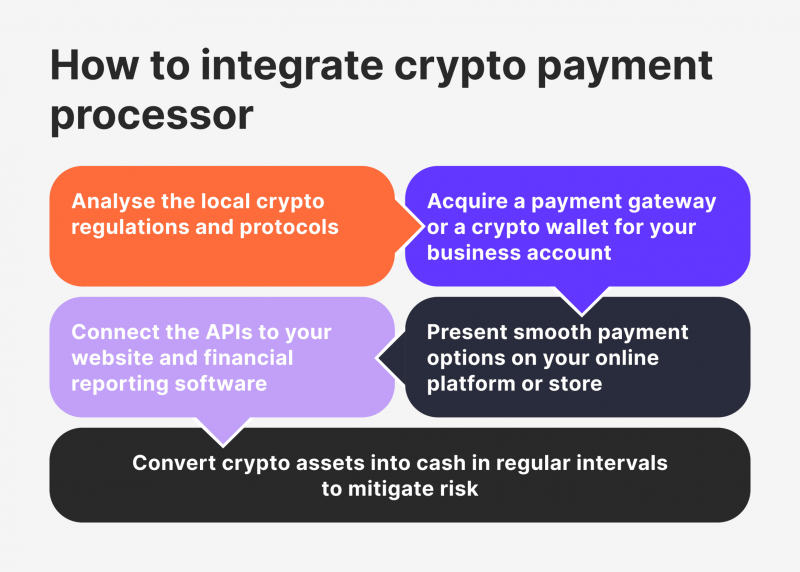

Step # 1 – Identify Crypto Payment Regulations And Needs

First and foremost, business owners must understand their local possibilities and, more importantly, limitations related to crypto transactions. As of 2023, every sovereign entity has developed some extent of laws and regulations that address cryptocurrencies. Some countries ban specific cryptocurrencies due to economic or political reasons. Some countries limit the transaction volumes or particular technologies.

Thus, getting a firm grasp on what you can and cannot do when implementing crypto payment solutions is critical. While there are plentiful resources documenting different sovereign legislations and guidelines for crypto transactions, it is advisable to consult with legal specialists. This way, business owners can be assured that their plans related to crypto payments are completely free of possible legal interventions.

Step # 2 – Purchase a Crypto Wallet Or A Gateway For Your Business

Once the legal aspect is cleared up, business owners should focus on finding the best crypto payment processor for their distinct needs. As outlined above, the market is ripe with numerous crypto gateway and wallet choices, offering different pricing plans, transaction mechanisms, digital features and accessibility options. However, there are no obvious choices here, as each company should consider their unique circumstances, budgetary restrictions and KPIs.

The best approach here is to look at your business plans for adopting crypto payments and ask several questions – What is your expected transaction volume? What cryptocurrencies do you prefer to implement? How effective is your cash flow liquidity? These and many other questions will help business owners identify the best choice on the market.

Step # 3 – Connect The Gateway To Your Financial Software

Since most gateways and wallet solutions have an accessible crypto payment API, connecting them to your private financial software shouldn’t be too much trouble. However, accessibility and efficiency are key aspects here. It is crucial to have a continuous and swift cash flow between your crypto gateways and the primary accounts.

Additionally, smooth software connection means businesses will seamlessly monitor their transaction volume and promptly make any important adjustments. Proper reporting and accounting are essential for any business, and well-connected crypto APIs will make your job much easier.

Step # 4 – Offer Crypto Payment Options Conveniently

After dealing with all the above-outlined technical aspects, it is time to create a seamless crypto payment offering to your customer base. The best online platforms and stores have smooth payment options, allowing clients to conduct transactions without dealing with numerous tables, questionnaires or data entries. Ideally, conducting a crypto payment should be a two-step process – users simply select their desired product or service and connect their wallets to execute the transaction.

Anything more complicated means that your system needs to be more streamlined. After all, crypto gateways were created to simplify transactions, and it is vital to support their effectiveness with an appropriately smooth user interface.

Step # 5 – Implement Crypto Converting Options

The final step is keeping the received crypto funds liquid and balanced for your business needs. It is important to remember that even the most stable cryptocurrencies are pretty volatile and include significant market risks. Thus, regularly converting crypto funds into cash reserves is practically a necessity. Businesses should actively cycle their crypto resources, maintaining a healthy crypto-fiat balance that mitigates risks for their overall asset portfolio.

Final Takeaways

Acquiring an optimal crypto gateway and accepting crypto payments is slowly becoming a dominant strategy for small and mid-sized companies. It is an opportunity to go beyond local markets swiftly without overwhelming bureaucracy. When you accept crypto payments, it is a win-win situation, as many customers have switched to utilising crypto for online shopping. Thus, investing in this venture and broadening your payment options is advisable.