As businesses more and more explore the use of cryptos, stablecoins like USDC and EUROC (Euro Coin) present unique opportunities, especially for companies operating in Europe. EUROC, a stablecoin pegged to the Euro, offers a compelling alternative to traditional finance systems, combining the stability of fiat currency with the advantages of digital currency.

In this article, we delve into the benefits of accepting EUROC crypto as a business in Europe, examining how this stablecoin can streamline operations, reduce costs, and open up new markets.

Key Takeaways

- EUROC offers a stable, Euro-pegged digital currency for more efficient transactions.

- Adopting EUROC can reduce currency conversion costs and improve transparency.

- Businesses must be aware of evolving regulations and potential market risks when using EUROC.

What is EUROC?

Euro Coin (EUROC) is a euro-backed stablecoin issued by Circle, a payment technology company known for its popular USD Coin (USDC). Launched as a fiat-backed digital currency, EUROC is pegged 1:1 to the Euro and built on the Ethereum blockchain. This design ensures that every EUROC in circulation is backed by an equivalent amount of Euros held in reserve by Circle in U.S.-regulated finance institutions. By August 2024, EUROC had gained significant traction, achieving a market cap of over $58 million.

Circle’s foray into the stablecoin market began in 2018 with the launch of USDC, which quickly became one of the most widely used stablecoins globally. EUROC follows the same stablecoin operational model, offering businesses and individuals a reliable digital asset tied to the Euro, thus combining the benefits of blockchain tech with the stability of a traditional currency. This innovation enables businesses to engage in fast, secure, and low-cost transactions across borders, making it an attractive option for companies in the European market.

How EUROC is Regulated

Regulation is a critical aspect of any monetary means and stablecoin issuers, and EUROC is no exception. As a Euro-pegged stablecoin, EUROC operates within a robust regulatory framework to ensure transparency, security, and compliance with European economic standards. European authorities oversee its regulation, aiming to maintain the integrity of the digital currency market while protecting consumers and businesses.

Circle, the issuer of EUROC, adheres to stringent regulatory requirements, including AML and KYC procedures. These measures are crucial in preventing fraudulent activities and ensuring that EUROC operates within the legal boundaries set by the European Union. Circle also commits to maintaining total reserves of Euros to back every EUROC in circulation, a practice that third-party firms regularly audit. This ensures that each EUROC remains stable and redeemable on a 1:1 basis with the Euro, providing businesses with confidence in its value.

Moreover, EUROC is subject to the broader regulatory environment of the European Union, which is increasingly focusing on the regulation of digital assets through initiatives like the MiCA regulation. MiCA aims to create a comprehensive regulatory framework for cryptos and stablecoins, ensuring that products like EUROC are integrated into the financial system with robust oversight. As these regulatory frameworks evolve, businesses using EUROC can expect enhanced transparency and security, making it a reliable and compliant option for conducting digital transactions within the Eurozone.

How EUROC Works

EUROC is an ERC-20 token built on the Ethereum blockchain, making it compatible with any Ethereum-based wallet or protocol. This compatibility extends to various decentralized finance (DeFi) applications, enabling businesses to participate in the growing digital financial services ecosystem.

Circle EUROC functionality is straightforward yet powerful. As a stablecoin, its value is maintained by holding equivalent real-world assets, in this case, Euros. The stablecoin is backed 1:1 by Euro reserves, which are regularly audited to ensure the stability and reliability of the coin. This reserve-backed model is crucial for maintaining trust and stability, making EUROC a viable option for businesses looking to avoid the volatility commonly associated with other crypto assets.

For businesses, EUROC offers a seamless way to engage in digital transactions and crypto trading using a currency they are already familiar with—the Euro. This eliminates the need for currency conversion, simplifies cross-border transactions, and aligns with local financial practices. Whether used for payments, trading, or accessing DeFi services, EUROC provides businesses with a flexible and secure tool for managing their finances in the digital age.

Use Cases of EUROC for Businesses

EUROC offers a wide range of use cases for businesses, particularly those operating within the Eurozone. One of the most significant advantages is the ability to accept cryptocurrency payments in Euros from customers worldwide. This expands the customer base and enables businesses to tap into the growing market of crypto-savvy consumers.

Another important use case is in international trade. EUROC facilitates seamless cross-border transactions, allowing businesses to settle payments in Euros without needing currency conversion. This particularly benefits companies with suppliers, contractors, or customers in multiple countries, as it simplifies transactions and reduces costs. Moreover, businesses can use EUROC to pay employees, vendors, and contractors, streamlining payroll and reducing the complexities of managing payments in different currencies.

EUROC also plays a role in decentralized finance: businesses can use it for various financial activities, such as lending, borrowing, and trading. The integration of EUROC into DeFi platforms allows businesses to access new investment and liquidity management opportunities. For example, companies can use EUROC to participate in lending liquidity pools, earn interest on their holdings, or collateralize loans, accessing capital without selling their assets.

In addition to these use cases, EUROC enables businesses to offer rebates or rewards to loyal customers, enhancing customer engagement and retention. By issuing rewards in EUROC, businesses can create a unique value proposition that differentiates them from competitors. Furthermore, using EUROC in rewards programs can encourage customers to return, driving repeat business and increasing overall profitability.

Euro Stablecoin vs Dollar Stablecoin

Businesses use Dollar and Euro stablecoins to manage their transactions. Both stablecoins offer the core benefit of stability, as they are pegged to their fiat currencies, the Euro and the U.S. Dollar. EUROC pegged to the Euro, simplifies transactions by eliminating the need for currency conversion and reducing costs associated with exchange rate fluctuations. This benefits businesses operating primarily within the Eurozone, as it aligns with local financial practices and regulatory standards.

On the other hand, Dollar stablecoins, like USDC, are globally dominant and suitable for international businesses or those dealing heavily in cross-border trade. The choice between Euro and Dollar stablecoin payments depends on the business’s operational needs and market focus. EUROC offers stability and seamless integration with the local economy, while USDC offers global liquidity and widespread acceptance.

Benefits of Using EUROC for Businesses

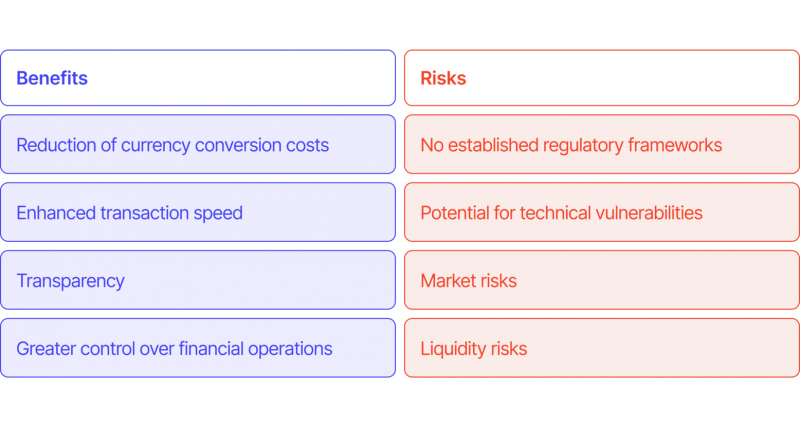

The adoption of EUROC by businesses in Europe presents numerous advantages, particularly in terms of cost efficiency, transaction speed, and financial transparency. One of the most significant benefits is the reduction of currency conversion costs. Businesses operating within the Eurozone can use EUROC to eliminate the fees and potential losses associated with converting Euros into other currencies.

In addition to cost savings, EUROC enhances transaction speed and efficiency. Traditional banking systems often involve delays, particularly for international payments. EUROC, however, enables near-instantaneous transfers, allowing businesses to settle payments quickly and efficiently.

Transparency is another key benefit of using EUROC. Blockchain technology ensures that all transactions are recorded on a public ledger, providing a high level of transparency and traceability. This can be particularly advantageous for businesses that require detailed records of financial transactions for regulatory compliance or auditing purposes.

Furthermore, EUROC offers businesses greater control over their financial operations. Unlike traditional banking systems, which can be subject to restrictions and delays, EUROC allows businesses to manage their funds directly on the blockchain. This gives companies the flexibility to move funds as needed, without relying on mediators or facing unnecessary delays.

Risks of Using EUROC for Businesses

While EUROC offers many benefits, businesses must also consider the potential risks associated with its use. One of the primary risks is the relatively nascent stage of regulatory frameworks surrounding cryptocurrencies. Although EUROC operates within a regulatory framework designed to ensure compliance with EU regulations, the broader regulatory environment for digital assets is still evolving. This can lead to uncertainty, and businesses must stay informed about changes in regulations to ensure they remain compliant.

Another risk is the potential for technical vulnerabilities. As a digital asset, EUROC is subject to the same risks as other cryptos, including hacking, technical failures, and other security threats. Businesses must implement robust security measures to protect their EUROC holdings and ensure their digital assets are not compromised.

Market risks are also a consideration. Although EUROC is designed to maintain a stable value by being pegged to the Euro, it is still influenced by the broader cryptocurrency market. Changes in market sentiment or external factors could impact EUROC’s stability, potentially leading to fluctuations in its value.

Lastly, businesses should consider the potential liquidity risks associated with EUROC. While EUROC is designed to be a stable and liquid asset, its liquidity may be influenced by market conditions, particularly during periods of high volatility.

Final Thoughts

Incorporating EUROC stablecoin into business operations offers a range of compelling benefits, from reducing costs and enhancing transaction speeds to increasing transparency and financial control. For businesses using crypto in Europe, EUROC presents a unique opportunity to leverage the stability of the Euro while accessing the advantages of blockchain technology. However, it is essential for businesses to consider the potential risks carefully and to stay informed about the evolving regulatory landscape.