In contrast to standard databases that have a central authority, blockchains are peer-to-peer, decentralized networks in which anyone can participate. A classic blockchain system is built on cryptography and is a sequential chain of data blocks written one after the other. It has certain basic properties depending on how they are written into the blockchain chain.

For the system to work, and given that blockchain nodes are independent of each other, each node must have certain (and yet uniform) rules according to which it validates blockchain transactions and writes blocks into the chain. This set of rules is called the blockchain consensus algorithm.

In this article, we’ll look at the Proof of Stake (PoS) consensus algorithm, its advantages and disadvantages, and how it differs from another equally popular Proof-of-Work algorithm. In the end, you will learn about a few blockchain projects that are based on the PoS algorithm.

What is the Proof-of-Stake (PoS) Consensus Algorithm and How Does It Work?

Proof of Stake (PoS) is an algorithm for proving the share of ownership of digital currencies in the total pool. The PoS consensus algorithm is the second most popular in cryptocurrency implementation. As an idea, the Proof of Stake algorithm was proposed in 2011 at the Bitcointalk forum, and the crypto coin PeerCoin presented the first implementation of the protocol in 2012. The algorithm requires participants in the network – cryptocurrency owners. They join groups and delegate their coin mining rights to one participant, who forms a pool of participants for all their trustees. Such a network node is called a node.

The Proof-of-Stake system was created as an alternative to Proof-of-Work and sought to override its drawbacks, such as huge computing power consumption. This mechanism reduces the computational work required to verify transactions and the blocks that secure the distributed ledger. The PoS approach basically substitutes staking for processing power, with the network determining an individual’s mining capabilities. Owners offer their coins as collateral for the ability to verify new blocks and become “validators”. The validator realizes the process of validating transactions and verifying that the transactions in the block are correct. If done correctly, they add the block to the blockchain and are rewarded for their contribution. However, if the validator offers to add a knowingly wrong block, they lose some of their stacking assets as a penalty.

In PoS algorithms, it is possible to pre-generate the entire number of coins, and these coins can then be sent between network members. There are many implementations of the PoS blockchain consensus mechanism, which are presented in the following list of PoS systems:

Delegated Proof of Stake (DPoS)

The main difference between the algorithm and the classical distributed ledger consensus system PoS is an attempt to rid the algorithm of its main drawback, i.e., the risk of centralization. In DPoS, validators’ right to approve cryptocurrency transactions is delegated to them by coin holders, with the holders voting for a specific validator. Any network member with a certain amount of cryptocurrency can become a validator. Still, at any time, votes for that validator can be withdrawn in favor of another. DPoS, in turn, also has disadvantages. In particular, the risk is low activity of the network participants, then DPoS turns into PoS, and collusion of delegates is also not excluded.

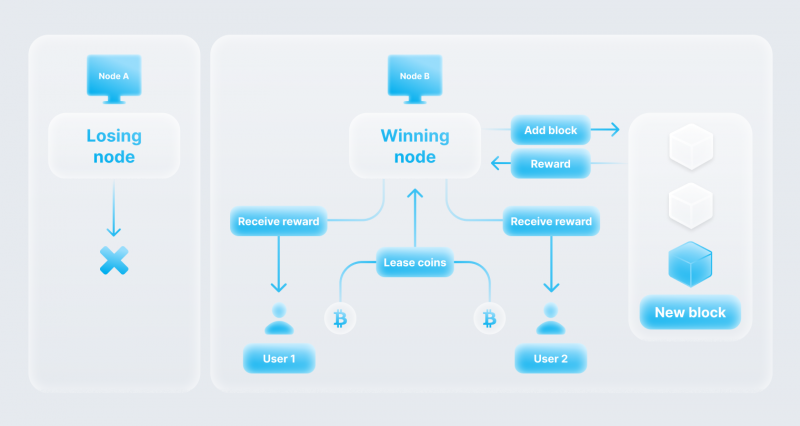

Leased Proof of Stake (LPoS)

This type of PoS involves a rented proof-of-ownership share. It is a pool of network participants with some crypto coins, which they rent out to participants with numerous crypto coins, forming a node. Thanks to the leased crypto coins, network participants have the opportunity to get their share of crypto coins from the mining node, otherwise, since the network participant’s share of the total market of a given cryptocurrency is minimal, the chance to get the reward is minimal.

The process of mining cryptocurrency based on the PoS consensus is called forging. It consists of creating a master node running on a dedicated computer, which is usually always connected to the Internet. The dedicated computer is always running a crypto coins wallet with a minimum number of cryptocurrencies. The work of the master node can bring significant profits only if the operations are carried out with low-popular crypto coins, the value of which is insignificant. If their value increases, you can become the owner of a large number and receive regular payments on your master node.

Key Takeaways

- Proof of Stake is a protocol used to add new blocks and validate transactions.

- PoS is greener and faster, but it tends to be centralized – whoever has the critical number of coins will manage the network.

- The PoS system was created as an alternative to Proof-of-Work and sought to override its drawbacks, such as huge power consumption.

Advantages and Disadvantages of Proof of Stake Algorithm

As crypto technology has evolved, more and more different consensus algorithms have emerged, where each new algorithm must be better than the previous one to enable the development of blockchain networks. Proof of Stake, as one of the most popular consensus mechanisms today, has its advantages and disadvantages.

Advantages of Proof of Stake Algorithm

This type of consensus algorithm boasts a number of impressive advantages.

1. Eco-Friendliness

Sustainability in crypto technology is an acute issue due to the high power consumption both for mining new coins and for other important processes to maintain blockchain systems, including various consensus algorithms, one of which is PoS. Unlike other types of algorithms, PoS is an energy efficient algorithm and does not require high consumption due to the optimization of mathematical models on the basis of which this consensus mechanism operates. This makes it possible to reduce energy consumption and many times reduce the level of harm to the environment in the process of mining.

2. High Security Level

A 51% attack is a blockchain network attack. It consists of one person, group, or organization gaining control of a large portion of the hash rate (hashing power). In this case, hackers will have the power to enable attackers to reorder or delete transactions. For example, deleting a transaction enables hackers to use the cryptocurrency several times (double transaction). Hackers can prevent the confirmation of transactions or mining of other miners, which can provoke a network failure.

In the case of PoS algorithm, to perform a “51% attack,” it would be necessary to take possession of more than half of the entire cryptocurrency network, which is a huge amount of money, and even if attackers gather such an amount, the attack will become financially unreasonable.

3. Low Commissions

As a rule, the amount of commissions becomes a stumbling block for miners. Mining with PoS systems is, to some extent, the optimal choice for many experts who mine new blocks in the distributed ledger network. High speed of verifying transactions, low commissions, and convenience of work with the system allows to achieve high results in mining new blocks in the blockchain network. Compared to the Proof of Work (PoW) consensus system, PoS offers a very low fee for mining new blocks, which is still dependent on the blockchain network.

Disadvantages of Proof of Stake Algorithm

Now let’s talk about the disadvantages of this consensus algorithm.

1. High Level of Centralization

The money is often held by a limited number of people. For example, at the start, it is difficult to pick a price for an ICO that will bring in the maximum number of buyers while keeping a large volume out of the hands of one person. When coins are accumulated, nodes gain a lot of processing power on the network. Large owners can vote for further decisions on the evolution of the network (in NEO, etc.) This has a negative impact on the credibility of this type of consensus mechanism on the part of many miners.

2. The “Nothing at Stake” Problem

Proof of Work bona fides of participants are guaranteed by the laws of physics. They cannot “unmake” the unit and get their electricity back if incriminated. This is a material penalty – they have wasted electricity and not made a profit. In Proof of Stake, the punishment exists only within the system: the unscrupulous player loses his blocked deposits. Once users withdraw their deposits, they are invulnerable. This is the Nothing at Stake – the threat of an attacker creating a fork of the coin by removing his funds.

3. Limitation

To participate in the network as a validator, you have to buy a cryptocurrency, and to do that, you have to spend fiat money – that is, you have to invest in this business one way or another. At times, the requirements of the network can be quite high, which not everyone can afford. On the other hand, the higher the validator’s rate, the higher the chance it will be chosen to validate a block of transactions. But there is a chance in any case: some blocks are not checked by a single person, but at once, for example, by a group. Top validators purposely buy coins and pool them together to make as much money as possible.

How Is Proof-of-Stake Different From Proof-of-Work?

Proof-of-Work is a consensus that requires solving complex mathematical problems. Therefore, miners are forced to use very powerful equipment with high power consumption. Proof-of-Stake works differently. Mining takes place by locking some of the coins in the wallet as collateral. The more of them, the more chances you have to become a transaction validator, join the block to the network, and get the reward. But there are other differences between the two consensus mechanisms.

Features of PoW consensus

The main task of the miner is to solve complex mathematical problems, as a result of which new hashes are generated for the blocks to be joined. They are formed based on the previous block’s hash, thus validating the entire chain. Whoever solves the problem faster gets a reward in the form of cryptocurrency.

Blockchains on this consensus have a serious vulnerability. If a miner with a hash rate greater than 50% of the network’s total power appears in the distributed ledger, it can take control of the blockchain. This is the 51% attack discussed above.

When the consensus “proof-of-work” is used, miners receive income from joining new blocks. They are also paid a portion of the commission that users are charged when making a transaction within the platform.

Features of PoS consensus

When using “proof of ownership,” network nodes act as validators. The money in their account is the pledge and guarantor of the validator’s presence in the network and the correctness of its node.

First, the node that holds more coins can attach a block and validate the transaction. Coins on the user’s wallet are blocked until a consensus is reached between blocks. The entire process is automatic. The validator is paid for this activity.

Second, with PoS consensus, the risk of a “51% attack” remains. But for that, the “rogue” node must have at least 51% of all coins in circulation. That is, there is no point in doing so. It will increase the rate if someone wants to buy up that many tokens. And if the amount is reset, it will collapse.

Third, intra-system rewards on PoS consensus are paid for validated trades in the network. Validation is faster, and the network works more efficiently than its consensus “proof-of-work” counterparts.

Ethereum’s proof of stake transition from the Proof of Work algorithm has become one of the most significant events in the crypto world in recent years.

Known Blockchains Using the Proof of Stake Consensus Mechanism

Most post-Ethereum blockchains use Proof of Stake consensus mechanisms. As a rule, each mechanism is modified according to the needs of the network. We will look at them in more detail below. Ethereum itself has now made the transition to Proof of Stake consensus mechanisms through the Ethereum 2.0 update.

1. Ethereum

Ethereum is a universal platform of smart contracts that can be used to run decentralized applications. Its main value is not its native Ether coin (ETH) but the opportunities provided by the EVM virtual machine.

The PoW algorithm, on which Ether used to run, required the constant solution of complex mathematical problems. To do that, miners created huge farms with powerful computer equipment that consumed gigawatts of electricity. After switching to PoS, it is enough to have money in an Ethereum wallet connected to the Internet to validate transactions. Mining farms do not need to be used, which has saved energy in the amount consumed by an entire country.

2. Polkadot

Polkadot is a network protocol based on the PoS consensus algorithm that allows the transfer of any data (not just tokens) between blockchains. This means that the network is a true poly-chain application environment, in which things like inter-chain registries and inter-chain computation are possible. Let’s make it a little simpler: in the Ethereum network, register distribution only occurs between users within a given network (chain). In contrast, in Polkadot, information is stored on devices running on all the networks integrated into this protocol.

3. Avalanche

Avalanche (AVAX) is an innovative Tier 1 smart contract platform created by Ava Labs. It is a universal blockchain that prioritizes decentralization, security, and scalability while reducing costs and providing high-speed transactions.

The Avalanche network consists of three separate blockchains: the X-Chain, C-Chain, and P-Chain. Each chain has a separate target, which is radically different from the approach used by Bitcoin (BTC) and Ethereum (ETH), where all nodes check all transactions. This separation of computational tasks provides higher throughput for Avalanche without sacrificing decentralization.

4. Solana

Solana is an innovative crypto system designed to support scalable decentralized applications (DApps). One of the key distinguishing features of Solana is its Proof of Stake (PoS) consensus system, which is backed by Tower Consensus. It is a variant of the Practical Byzantine Fault Tolerance (PBFT) system, and it allows distributed networks to achieve consensus despite attacks from malicious nodes.

Tower Consensus uses this synchronized clock to reduce the processing power needed to verify transactions because it no longer needs to compute the timestamps of previous transactions. This helps Solana achieve throughput that outperforms most competitors.

5. Cardano

Cardano is a decentralized and scalable open-source distributed ledger platform based on Proof-of-Stake. One of the most stable, reliable, and mathematically verified blockchains of our time – more than five years of operation without an outage. Cardano was created to perform similar tasks – such as launching smart contracts and creating DApps. In particular, the development and use of the Proof-of-Stake (PoS) protocol take Cardano smart contracts to the next level, providing high throughput and transaction speeds and making DApps available to all comers, as well as solving the interoperability problem with the rest of the block chain.

Conclusion

The evolution of distributed ledgers technologies has created a whole ecosystem of interconnected crypto trends, each of which is developing at an incredible rate. PoS and PoW consensus algorithms, being some of the most popular today, contribute to the systematic development of the mining process, and will certainly contribute significantly to the creation and development of new, more advanced consensus systems in the future, which will bring digital technology to a whole new level.