Small business owners are increasingly seeking ways to raise capital for their ventures or startups. Traditional business loans are no longer the only option, as crowdfunding platforms offer a venue to invest in your project. These financing platforms are a new funding method where companies raise funds from a community of people rather than seeking loans from banks or financial institutions.

Understanding the basics of crowdfunding, how to leverage it for business, and which websites to explore are crucial for successful fundraising.

This article will delve into the basics of crypto crowdfunding and explore the best crypto crowdfunding platforms for your campaigns.

Key Takeaways

- Crypto crowdfunding is a method where a project creator can issue their own crypto token representing ownership or utility in their ventures.

- Crypto crowdfunding is secure and provides extensive community support.

- Indiegogo, Tecra Space, etc., are top crypto crowdfunding platforms for your crowdfunding crypto projects.

Why Do We Need Crypto Crowdfunding Platforms

Crowdfunding is a method of raising capital for various purposes through the collective efforts of friends, family, customers, and investors. It’s primarily done online via social media and crowdfunding platforms, allowing for greater reach and exposure. Unlike traditional fundraising methods, crowdfunding broadens fundraising efforts to include anyone interested in the project or business, ranging from small to large amounts.

Crypto crowdfunding is a strategy for small and medium-sized enterprises seeking project funding using cryptocurrencies instead of fiat money. Startups showcase their product ideas and white papers during a crypto fundraising campaign, creating bespoke tokens within existing blockchains.

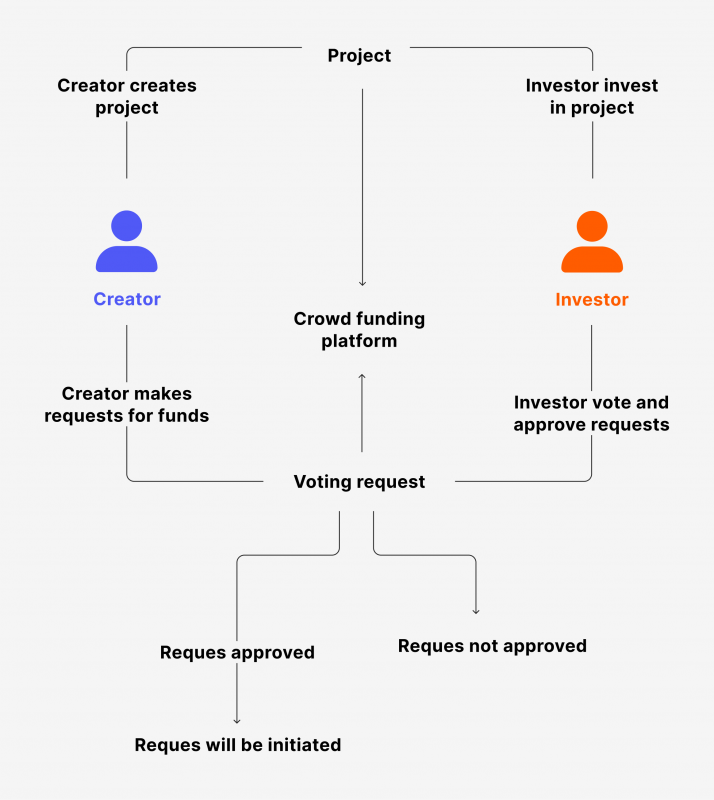

Crypto crowdfunding involves project creators minting tokens representing ownership or utility in their ventures, granting backers access to exclusive services, voting rights, or future dividends. Automated on blockchain platforms, these tokens represent a stake in the project’s success. Decentralised crowdfunding allows investors to participate in a global marketplace, allowing them to become integral players with just a cryptocurrency wallet.

Crypto Crowdfunding Methods

There are various revenue-generating methods supporting these campaigns, including IPOs, ICOs, STOs, IFOs, IDOs, and IEOs.

ICO, or Initial Coin Offering, is a popular method for startups to introduce new coins, apps, or services without centralised authority or government intervention. It can significantly enhance a business by pooling investments.

Security Token Offering (STO) is a reliable method for selling real-world assets like stocks, bonds, or commodities, enhancing investor security and mitigating issuer risks. STO platforms ensure safe, transparent trading, adhering to financial standards and regulations. Entrepreneurs can enlist reputable companies to create a robust platform and foster trust among global investors.

Initial Exchange Offerings (IEOs) are gaining popularity in the crypto sector as a fundraising method for startup ventures. They involve purchasing digital assets through established exchanges, streamlined like ICOs. Participation requires creating a personalised crypto token, simplified by collaboration with crypto token development companies. This approach yields substantial funds in shorter periods.

Perks And Risks of Crypto Crowdfunding

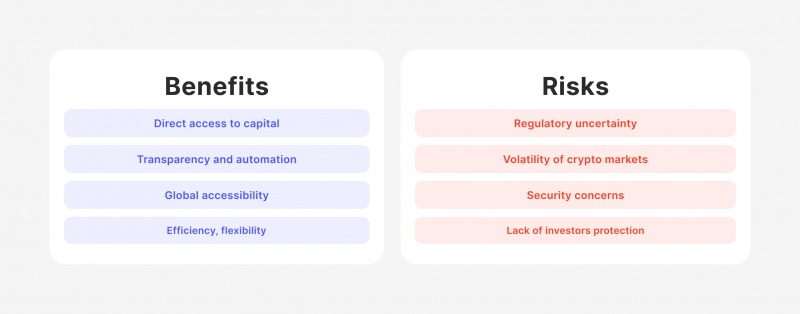

Crowdfunding with digital currencies offers entrepreneurs global accessibility, inclusivity, and transparency. Smart contracts ensure pre-established terms without third-party intermediaries, streamlining the financing process.

Crowdfunding in crypto provides startups with access to capital that they might not have been able to secure from traditional funding sources. It also allows for market validation, audience building, feedback, less risk, and significant publicity through social media shares and traditional media coverage.

Additionally, crowdfunding campaigns can attract industry leaders, potential partners, and other funding sources, leading to strategic partnerships and further investment opportunities.

The decentralised approach of crypto crowdfunding ensures transactions are securely recorded in a distributed ledger or blockchain. Crypto crowdfunding also provides community support, connecting startups with investors and increasing fundraising potential. Plus, the tokens used, particularly security tokens, are easily tradable across global exchanges.

However, crypto crowdfunding also poses risks, including market volatility, regulatory uncertainty, and security vulnerabilities. Platforms and projects are vulnerable to hacking, fraud, and other cybersecurity risks. Investors must exercise caution and conduct thorough due diligence before participating in campaigns.

The absence of investor protection measures, such as regulatory oversight or insurance guarantees, exposes investors to higher risks of fraud or project failure. Therefore, investors must remain vigilant and proactive in safeguarding their investments.

How to Choose the Best Platform

The choice of crowdfunding method for a startup depends on its nature, goals, and ability to meet the demands of each method. Factors to consider include the business’s nature, financial needs, market validation, ownership and control, ability to fulfil obligations, and legal and regulatory considerations.

The choice of crowdfunding method also depends on its unique benefits. Thus, ICO allows for proper whitepaper creation and no need for well-financed start-ups. STO development is a secure and trusted crowdfunding method for long-term investment, while IEO, managed by a reputable crypto exchange, is risk-free for investors.

The main differences between these methods depend on the business requirements. For quick funding, ICO is the best option, while STO offers high security, and IEO provides support from an exchange platform. The choice of method depends on the startup’s needs and the funds required.

Choosing a reliable crypto crowdfunding platform development company is crucial for aspiring entrepreneurs to launch successful crypto crowdfunding campaigns.

Top 5 Best Crypto Crowdfunding Platforms

Understanding business crowdfunding is crucial for managing campaigns, launching projects, and raising funds for small businesses. Let’s take a look at some of the best crypto crowdfunding sites.

RealBlocks

RealBlocks, founded in 2015 by Perrin Quarshie, is a decentralised crowdfunding platform that uses blockchain technology to enable institutional and retail investors to invest in real estate. The platform tokenises physical assets, breaking them down into component parts for purchase. With over 100 countries and $77 billion under administration, RealBlocks is known for its simplicity and ability to raise more money through intermediaries and institutional channels.

Indiegogo

Indiegogo is one of the popular crypto crowdfunding platforms founded in 2008 by Danae Ringelmann, offering funding for various projects through ICOs and cryptocurrency payment options. It has partnered with Coinbase to allow creators to receive funding in Bitcoin.

Indiegogo has helped entrepreneurs raise over $1 billion for over 800,000 projects. It offers a marketplace for innovative products and has a global network of early adopters. There are no fundraising targets or deadlines, and projects can apply equity, offer securities, revenue-sharing, or sell cryptocurrency.

Crowdfunder

Crowdfunder is a UK-based crowdfunding platform that offers access to angel investors and venture capitalists who invest in various projects with realistic ideas. It’s the ideal equity crowdfunding option for raising funds by selling debt or equity in a company, allowing entrepreneurs to find reliable investors easily.

Crowdfunder supports various types of projects, including rewards and donation-based ones, with over 300,000 projects raised and a 1 million-supporter community. While charities and non-profits don’t pay platform fees, for-profit projects pay a 5% fee.

GitCoin

GitCoin, founded by Kevin Owocki, in 2017, is a comprehensive cryptocurrency ecosystem for open-source software development. It offers various features like fundraising, tipping, hackathons, project search functions, and GitHub integrations.

It enables developers to work in various languages, like Python, Rust, JavaScript, Ruby, HTML, CSS, and Solidity and allows investors to contribute to projects and technologies during quarterly GitCoin Grants rounds. It has helped thousands of projects grow their open-source ecosystems.

GitCoin has raised $51.8 million and has millions of registered users. Its core community actively participates in funding projects and utilises Quadratic Funding. However, Gitcoin is primarily focused on supporting open-source Web3 projects, and contributions are limited to Quadratic Funding rounds.

Tecra Space

Tecra Space is a decentralised crowdfunding platform that facilitates the exchange of digital assets, patents, and intellectual property rights, offering tokenisation opportunities. It supports businesses and scientific activities affecting digital development, raising funds for technological and scientific projects and facilitating the exchange of digital tokens.

Tecra Space allows developers to list projects based on patents, digital assets, and intellectual property rights and offers various tokenisation options, buyback timeframes, and perks for investors. Projects include video games, decentralised apps, mining operations, and renewable energy services. To start raising funds, users need to open a premium account, create a token, and plan a crowdfunding campaign.

Closing Thoughts

Crypto crowdfunding methods offer various benefits for various fundraising needs. The choice of method depends on business requirements, but the choice of a crypto fundraising platform is equally important to reap benefits in fundraising and business.

To pick the best crypto donation platform, pay attention to its reputation, historical records, and fundraising methods it offers.