The high popularity of cryptocurrency technologies has generated a lot of concepts to a greater or lesser extent, revealing their valuable properties and characteristics in practice.

Representing a completely new model of financial assets, the work of which is based on the system of distributed registers, crypto innovations have gained words not only within the framework of exchange trading but also in the context of the payment solutions sector for businesses.

As a result of mastering these technologies, a conceptual direction of their application appeared for the possibility of mutual settlements using digital assets, called crypto payment processing.

This article aims to shed light on what crypto payment processing is and how it works. You will also learn what advantages and disadvantages it has. Ultimately, we will examine some technical aspects of the crypto payment processing functioning.

Key Takeaways

- Crypto payment processing provides a fast and convenient way to deal with digital assets, regardless of the blockchain networks and payment channels used.

- Cryptocurrency processing is a complex step-by-step algorithm that includes verification, hashing, creating a digital signature for a transaction, and so on.

- The most important and complex step in the processing of crypto transactions is verification, which combines a certain number of validations depending on the blockchain network.

What is Crypto Payment Processing?

The idea of cryptocurrency processing emerged in the midst of the popularisation of crypto innovations affecting different areas of the financial sector and a number of others, including the gaming industry, decentralised finance and various blockchain projects, which aim to simplify, accelerate and unify the processes of interaction between different systems and elements within the same infrastructure.

In this case, the role of cryptoprocessing is a fundamental concept underlying the use of digital assets (coins) to enable payments in different forms and between different interacting entities.

Crypto payment processing is a closed system of mathematical calculations carried out based on payment algorithms — a unique program code, which is the basis of all modern payment systems and allows carrying out all types of operations related to digital payments, including those that work with the use of fiat currencies.

Such a system ensures the smooth processing of transaction operations within a single cryptocurrency payment gateway, which links the seller’s terminal, the buyer’s terminal and several other elements involved in processing.

Therefore, due to the mechanism mentioned above, cryptocurrency processing is a modern and promising method of making mutual settlements between individuals and giant corporations, offering many advantages of practical application, which will be discussed below.

A crypto processing system may offer additional options, such as an inbuilt crypto wallet for storing digital assets and fiat currencies.

Considerable Advantages of Crypto Payment Processing

Despite its novelty and perhaps the complexity of its use in individual cases, digital payment processing crypto technology is gaining momentum in practical applications in digital banking, commerce, and many other areas of business of any format and scale.

Thus, thanks to the numerous advantages’ crypto processing offers a completely new format for making payments for goods and services or carrying out crypto transactions, both local and international. Let’s consider the main ones.

1. Security

The crypto payment processor provides a high level of security in matters concerning transactions between different crypto addresses and blockchain networks. Through advanced data encryption techniques, the crypto payment processor blocks outside access to request any payment information about the transaction.

This helps to provide a secure environment within which crypto transactions go through multiple stages of processing before becoming finalised, namely verification, in several stages, distribution and execution.

On the other hand, security is provided due to the decentralised nature of cryptocurrency assets, and logically, most of the systems and services providing work with them in the context of different needs.

The decentralised nature of cryptocurrencies, in the vast majority of cases, excludes the possibility of data theft due to the work of the distributed registry system of those networks between which the transaction is carried out.

2. Efficiency

Crypto processing of payments is a highly efficient method of working with any payment system. Firstly, payment processing provides ideal conditions for working with different types of assets, both digital and fiat currency, to increase the level of convenience of payments and conversion, if necessary.

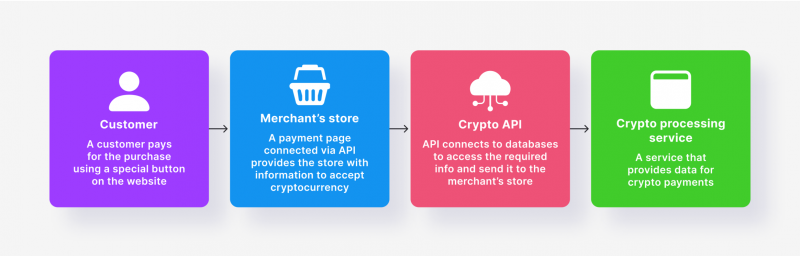

Secondly, the efficiency of cryptocurrency payment processing is ensured due to its versatility expressed in the possibility of practical application in any ready-made infrastructure of the company providing access to payment protocols, including due to the presence of API connection, which allows the use of third-party systems and applications to create symbiosis and increase the overall productivity of the system of payment channels and protocols.

3. Global Accessibility

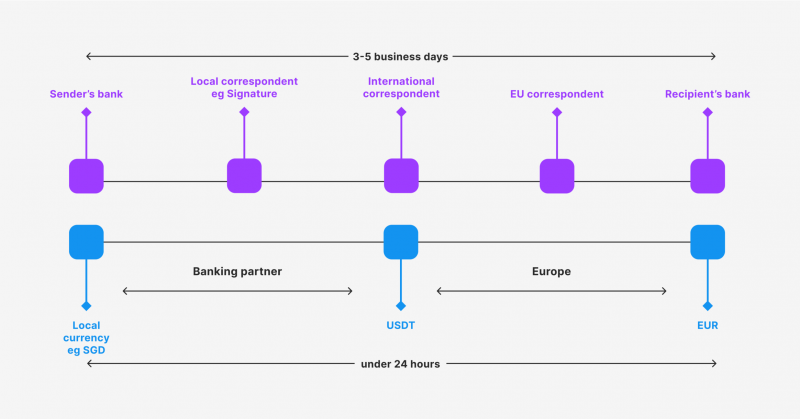

Crypto processing systems offer a universal method of making any kind of payment using digital currencies. This implies the convenience of using such solutions both within the local market (country, region, city) and for interaction with companies located in different parts of the world while providing all the same advantages.

Any cryptocurrency processor today supports a multi-currency function, supporting most existing crypto-assets and fiat currencies to work within the payment framework. Moreover, individual companies offer additional features and solutions to enhance the processor’s capabilities when working with international transactions through a crypto payment gateway.

4. Reduced Costs

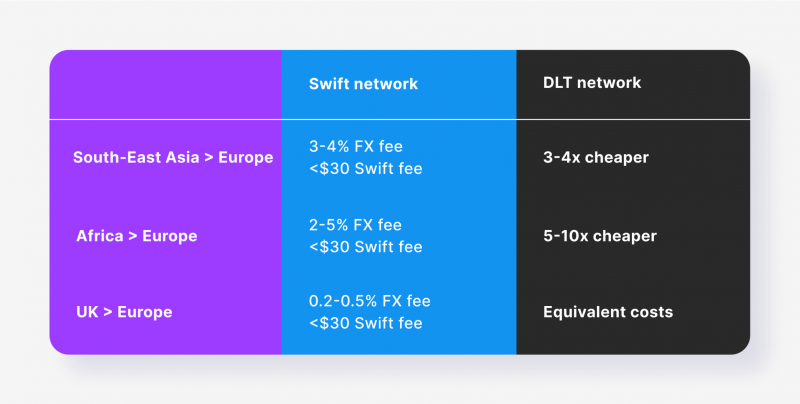

Cryptocurrency payment gateways offer the long-awaited advantage of low transaction fees when it comes to accepting crypto payments. This is made possible by the fact that every blockchain network, by its very nature, has a complex infrastructure that supports sophisticated payment protocols for exchanging payment information in the form of transactions.

Therefore, working with a crypto payment gateway, it is possible not only to significantly reduce transaction fees within the work of any blockchain network but also to save on minor costs associated with the maintenance of merchant accounts and terminals when it comes to working with classic payment systems.

5. Easy Implementation and Exploitation

When it comes to accepting cryptocurrency payments, convenience and ease of use are the least important roles in working with a cryptocurrency payment gateway. Even though technically, the process of processing transactions (payments) conducted with the use of digital assets is quite complex and includes a lot of invisible for both buyers and sellers flowing operations, the practical use of these systems does not cause difficulties because many components work automatically and do not require special knowledge and experience in interacting with cryptocurrency payment instruments.

On the other hand, there are companies offering services of leasing crypto payment processing infrastructure working under the White Label model, which gives an opportunity to use all the advantages of the solution for a certain fee with subsequent implementation of the solution for other companies interested in B2B crypto payments.

Significant Disadvantages of Crypto Payment Processing

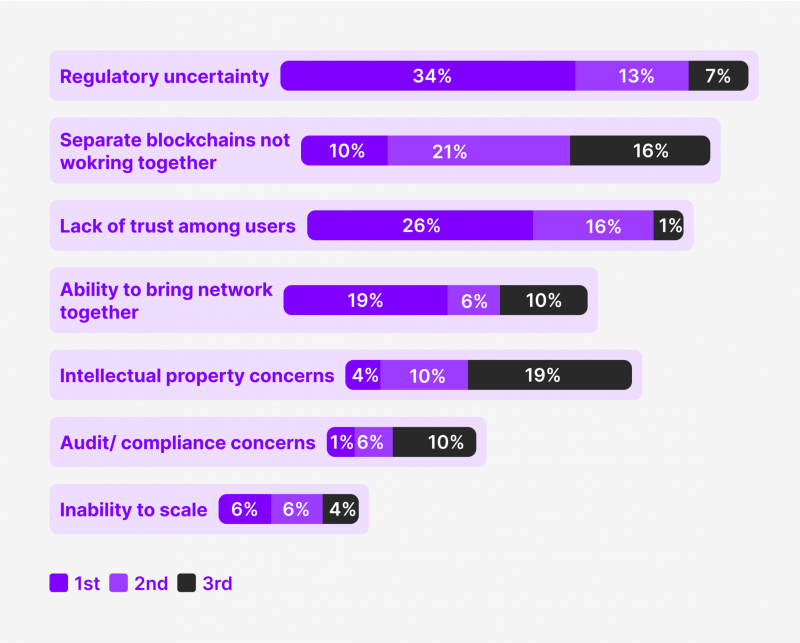

Despite such an impressive list of strengths that crypto processing possesses, this technology is not the object of unprecedented attention from individuals and legal entities for the purpose of its practical application in personal needs. This is due to the presence of a number of factors restraining its active adaptation and implementation on a large scale. The main ones are as follows:

1. Regulation

The sphere of cryptocurrency innovations and projects is a new area of the financial system that is flourishing and developing in the modern world. Due to the possibility of their multifaceted application in many processes of the modern economy and other spheres of human activity, they form the basis for the transformation of many habitual operations, including digital payments.

However, at the same time, the lack of information and experience in the practical use of this technology creates specific difficulties and obstacles due to excessive attention and research on the part of regulatory bodies whose activities are aimed at limiting its use, including preventing infringement of the interests of companies whose developments and solutions have the risk of losing the trust and interest of their customers due to the lack of novelty and practicality.

2. Digital Asset Volatility

Despite the fact that the process of processing transactions with digital currencies is an effective and universal tool for working with payments in the digital business, unfortunately, they do not provide protection from one of the most unpleasant phenomena of the crypto market, strongly affecting the price of a particular asset — volatility.

However, today, some practices allow potential risks to arise in working with virtual coins, namely their deposit, withdrawal, transfer, conversion and conventional storage. For this purpose, classical asset allocation (diversification) is used, as well as the use of various built-in crypto analytical tools and solutions that help at least partially protect the volatile nature of this market and its assets.

3. Complexity

As noted above, despite its simplicity of use, technically, crypto processing is a rather complex concept, which requires knowledge of information technologies, namely programming, mathematical analysis and related sciences, including the development of applied digital solutions, etc., to understand all the intricacies of crypto processing solutions and ensure their smooth, uninterrupted operation.

As a rule, this applies to the personnel developing such solutions, as the quality and reliability of their operation depend on the correct understanding of all aspects of their work.

4. Lack of Standards

Today, any activity related to cash and payments and their use is strictly regulated by different financial institutions designed to ensure the standardisation and unification of processes and operations within the working framework with payment services, systems, and solutions. This helps to ensure compliance with the regulatory framework, the purpose of which is to prevent the occurrence of acts of illegal use.

The crypto sphere currently lacks a regulatory component, which means that there is no standardised approach to ensuring the working conditions of payment systems, gateways, bridges, crypto payment processors and other elements involved in the processing of crypto payments.

5. Underdeveloped Infrastructure

Once again, the novelty of the technology is a stumbling block on the way to realising its full potential. The imperfection of methods of practical application of crypto innovations to accept payments forces the development of new forms of ensuring the smooth operation of all systems and elements of the processor to avoid failures and errors fraught with negative consequences.

Technical Part of the Crypto Payment Processing

It is time to understand in more detail and delve into the technical nuances of crypto payment processing in order to have an idea of its characteristics and capabilities embedded in its concept. This will help form a complete picture of understanding the technology and applying different approaches to ensure the system’s high efficiency.

To begin with, processing cryptocurrency transactions has a consistent algorithm of actions or steps that are invariable in all cases except for individual circumstances beyond the system’s regular operation. Therefore, let’s briefly go through the main stages of this process, the first step of which consists of the following:

#1 Payment Request

As a simple example of a situation where one company needs to receive a crypto payment from another company, the first step is for the crypto payment system to send a request to receive the payment. This request includes a large amount of information related to the details of the payment itself, i.e. amount, type of asset used for payment, date, etc., and also related to the payment gateway data to identify the blockchain network it is working with quickly. Once the processor receives all the necessary information from the transacting party, it generates a payment address.

#2 Payment Address Generation

At this stage, the crypto-processing platform generates a digital crypto address to receive payment. Since many digital assets and blockchain networks are standard in digital payments, the address generation process is unique because no two addresses for the same coin are the same in different networks. This avoids fraudulent activities related to the theft of funds.

This process is well depicted in the framework of crypto payments on any of the currently existing crypto platforms, where after selecting the network from which the transfer will be made, the system automatically generates an address consisting of letters and numbers, which will be used to conduct the transaction on another platform.

#3 Payment Gateway Activation

A crypto gateway is a complex mechanism involved as an intermediate link in the processing of digital payments. Its role is the primary processing of incoming/outgoing transactions for the validity of the original data, as well as the identification of secondary parameters that determine the origin of the transaction if it is received, such as the address from which it was conducted, the blockchain network, the name of the organisation or platform that conducted it, etc.

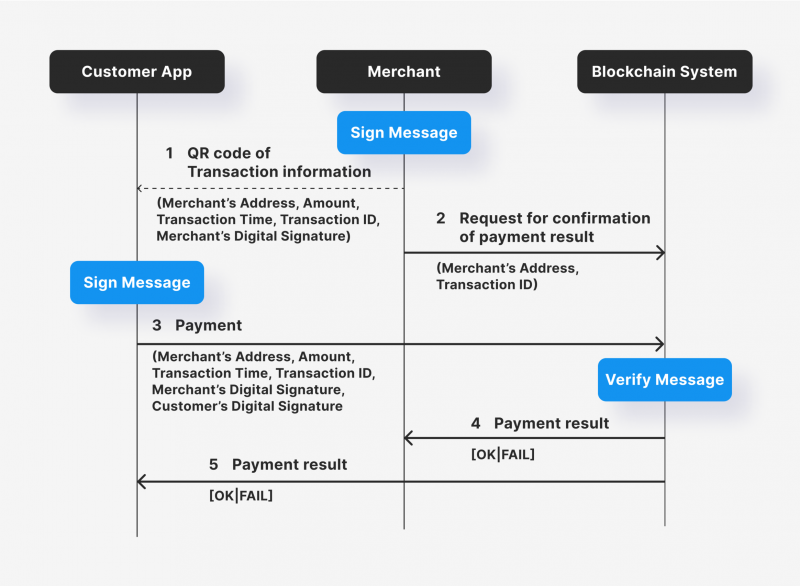

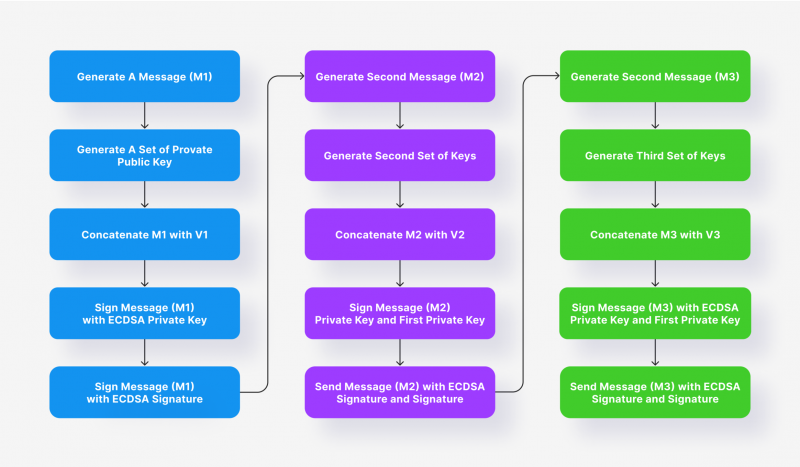

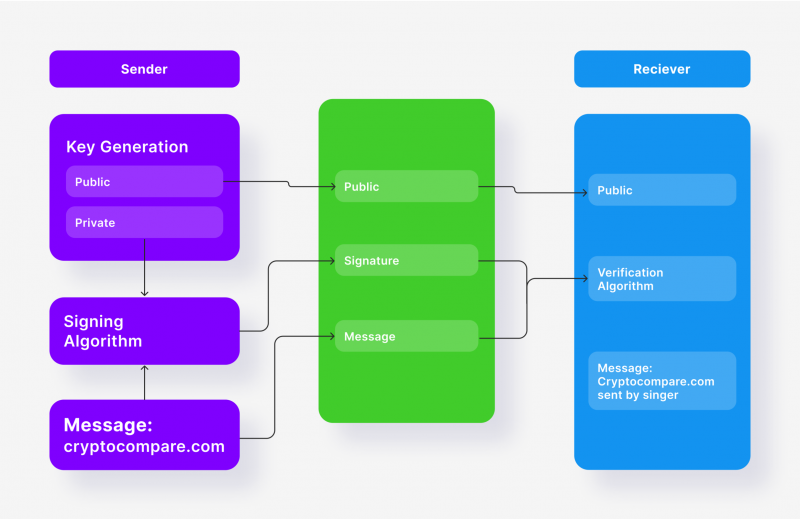

#4 Transaction Digital Signature

Digital signatures are a way of confirming the authenticity and integrity of a digital document or transaction. In cryptocurrencies, a digital signature is created by applying a mathematical algorithm to transaction data using the sender’s private key. The resulting signature is attached to the transaction and transmitted to the network.

The signature proves that the owner of the private key actually sent the transaction and has not been tampered with. Each signature is unique to a particular transaction and cannot be reused or replicated. This ensures that the transaction cannot be fraudulently duplicated or altered.

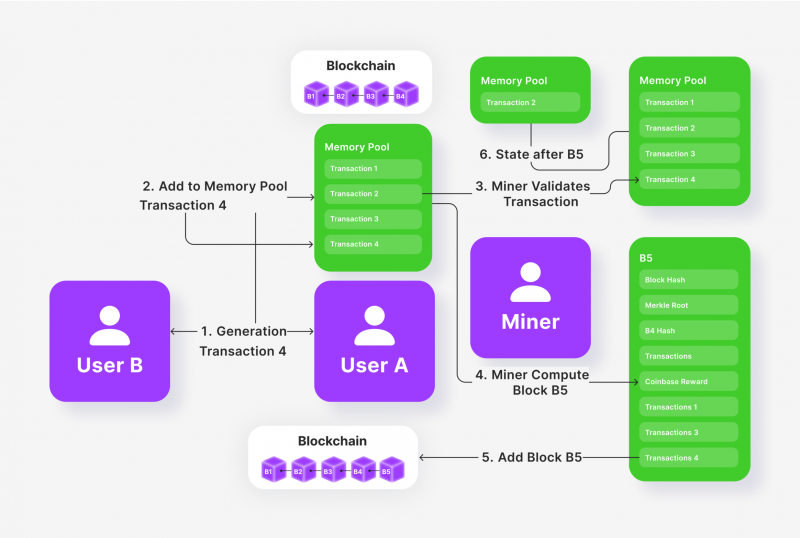

#5 Memory Pool

A mempool, or memory pool, is a fundamental mechanism in digital ledger technology, initially popularised by Bitcoin and later adopted by Ethereum and other blockchain networks. It acts as a dynamic middle ground or “waiting room” for unconfirmed transactions, playing a crucial role in the sequencing and including transactions in the blockchain registry.

Each node in the blockchain network maintains its own mempool that stores information related to unconfirmed transactions.

This decentralised approach means as many mem pools as nodes, each receiving and storing transactions at different times and having various capacities depending on its hardware.

Consequently, other nodes may have different sets of pending transactions at any given time, leading to differences in the size of mempools and the number of transactions in the network.

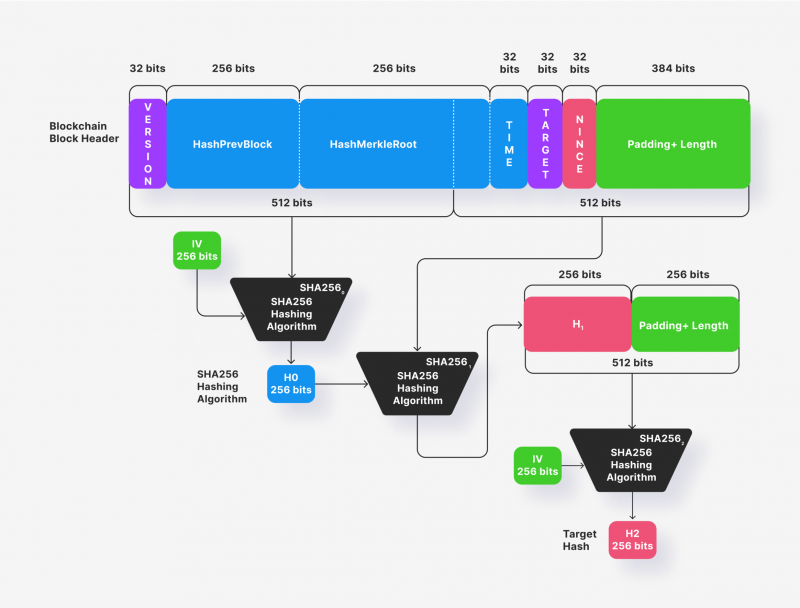

#6 Hashing and Embedding in Block

Hashing is a mathematical function that converts input data of any size into a fixed-size string of characters or hash. Each hash is unique, and any change in the input data will result in a different hash. Therefore, extracting the original data from the hash is impossible, which prevents all sorts of problems associated with data loss or intentional alteration.

Each transaction on the blockchain is represented as a unique hash that serves as its identifier. This hash has a fixed length and is created by processing the transaction data using an algorithm, after which the hash is included in the next block to protect the latter by a cryptographic hash function.

#7 Payment Verification

This stage is probably the most important and capacious one because here, there is a multi-level verification of digital currency transactions, which provides a full analysis of their input and output parameters.

The verification process is divided into an equal number of confirmations, depending on the blockchain network chosen for the payment. For example, the Bitcoin network requires two confirmations, while the Ethereum network requires 14 confirmations, regardless of the crypto payment gateways that process them.

Conclusion

Crypto payment processing has become a real breakthrough solution for companies experiencing difficulties working with classic payment systems due to their disadvantages, mostly high commissions.

This technology offers many advantages and significantly expands the boundaries of what is possible in using digital assets as payment for services and wares of modern business corporations, creating a favourable ground for its development in the future.

FAQ

What is crypto payment processing?

Crypto processing is a set of systems working on the basis of software code to carry out various kinds of transactions with crypto assets, including deposits, withdrawals, transfers, etc.

How is crypto payment processing structured?

The concept of crypto processing is based on a model of payment protocols that form channels that act as bridges between different blockchains to transfer payment information and funds, whether crypto or fiat.

How do you use a crypto processing system within business processes?

A crypto-payment gateway can be implemented into a company’s infrastructure using modern programming techniques to maximise its efficiency.

What are the advantages of digital coin processing?

Crypto processing provides high transaction security, reduced fees and global access to different markets.

What should be considered when working with a crypto payment processor?

First of all, it is worth paying attention to the range of digital assets that will be available for work, as well as other options and characteristics that will directly affect the process of making payments.