The world of virtual money trading is fast-paced and unpredictable, with market movements happening in the blink of an eye. In this environment, staying ahead requires more than just intuition or manual strategies—it demands cutting-edge technology.

That’s where artificial intelligence transforms how traders approach the crypto market. From automating complex strategies to analyzing vast datasets in real time, AI offers traders the tools to make wiser, faster, and more accurate decisions.

This article will explore how AI is revolutionizing crypto trading, the advantages and dangers of using AI-powered tools, and how to use AI for trading crypto.

Key Takeaways

- AI trading bots can operate 24/7, executing trades faster and without emotional interference.

- They offer advanced strategies like arbitrage, trend following, and grid trading but are vulnerable to market volatility and technical issues.

- While AI tools can optimize performance through backtesting and data analysis, over-reliance or poor configuration may lead to significant losses.

- Selecting the right AI trading platform, implementing risk management, and continuously monitoring bot performance are essential for successful crypto trading.

AI in Crypto Trading

AI plays a crucial role in online trading, particularly when it involves automated trading systems. This indicates the use of advanced artificial intelligence solutions to efficiently examine large volumes of market data, allowing traders to improve their decision-making speed and accuracy.

AI bots can handle countless daily transactions, far exceeding the number humans can manage. Since cryptocurrency markets operate around the clock, AI systems are particularly advantageous since they can track market movements and trade while the trader is asleep.

Since the early days of AI’s application in finance, dating back to the 1980s, it has evolved to meet the complex demands of modern financial markets.

In crypto, AI is particularly effective in implementing trading techniques like arbitrage and scalping, where speed and precision are essential. Arbitrage involves buying an asset at a lower price on one exchange and selling it at a higher price on another.

At the same time, scalping focuses on executing rapid trades for small profits throughout the day. AI tools automate these processes, allowing traders to react faster to market fluctuations.

Artificial intelligence cryptocurrency trading is widely accepted and legal, with even novice traders accessing AI tools to automate their trading strategies. These AI-powered strategies have become standard practice in professional trading circles, offering a competitive edge in an increasingly dynamic market.

AI Trading Bots

AI trading bots are at the core of AI’s role in crypto trading. These bots are software programs designed to execute trades based on predetermined algorithms. By continuously scanning market data, such as price trends, volume changes, and historical patterns, AI bots can execute buy or sell orders at the optimal moment, often achieving better results than human traders.

These bots can be classified into different types, each serving a specific function:

- Arbitrage Bots: These bots capitalize on price discrepancies between different exchanges, buying low on one platform and selling high on another.

- Market-Making Bots: These provide liquidity to the market by placing buy and sell orders simultaneously, profiting from the spread between the bid and ask prices.

- Trend Following Bots: These bots track market trends and execute trades based on the market’s direction (e.g., buying during an upward trend and selling in a downward trend).

- Grid Trading Bots: These bots place buy and sell orders regularly, profiting from small price movements.

These bots can be tailored to a trader’s specific goals, risk tolerance, and market conditions, making them versatile tools for any crypto trader.

How AI Crypto Trading Bots Work

AI-powered trading bots analyze large datasets, such as historical market data, social media sentiment, and real-time price movements, to identify profitable trading opportunities.

They rely on complex algorithms that quickly react to market signals and execute trades without human intervention. These bots are typically connected to cryptocurrency exchanges through APIs, which allow them to interact with the market, place orders, and manage portfolios.

For example, a typical AI trading bot might monitor Bitcoin prices across multiple exchanges, analyze the price volatility, and execute a buy order if the price drops below a certain threshold.

It may also place a stop-loss order to minimize losses if the price falls further, ensuring the trader’s capital is protected.

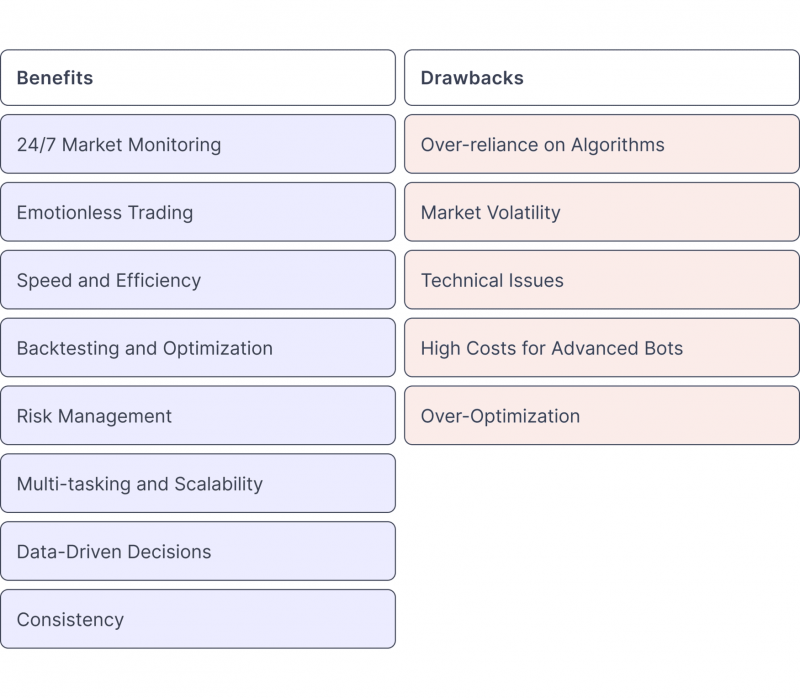

Benefits and Drawbacks of AI in Trading

AI-based tools aid in token trading by analyzing large data sets, identifying patterns, and making data-driven predictions, but they also bear some limitations. Let’s take a closer look at the benefits and drawbacks of these tools.

Benefits

AI trading bots offer several key benefits, particularly for cryptocurrency traders seeking to optimize their strategies and capitalize on market opportunities. Here are the main advantages:

- 24/7 Market Monitoring: AI bots can operate round the clock, capturing trading opportunities even when human traders are offline.

- Emotionless Trading: AI bots eliminate emotional decision-making, often leading to impulsive or irrational trades.

- Speed and Efficiency: AI bots can analyze and execute trades in milliseconds, allowing traders to take advantage of fast-moving markets.

- Backtesting and Optimization: AI tools allow traders to backtest their strategies using historical data, optimizing performance before deploying in live markets.

- Risk Management: Many AI bots have built-in risk management features like stop-loss orders and portfolio diversification.

- Multi-tasking and Scalability: AI bots can handle multiple trading pairs and strategies simultaneously, managing many trades without fatigue or error.

- Data-Driven Decisions: AI bots analyze vast amounts of data, including technical indicators and market sentiment, to identify profitable opportunities that might be missed by manual trading.

- Consistency: These bots stick to a predefined strategy without deviation, ensuring consistent execution of trading rules, regardless of market fluctuations or stress.

Drawbacks

While AI trading bots offer numerous benefits, they also come with certain drawbacks that traders should be aware of:

- Over-reliance on Algorithms: While AI bots can be highly effective, they are not infallible. Poorly designed algorithms or incorrect configurations can lead to significant losses.

- Market Volatility: AI bots may struggle to adapt to sudden market changes or unexpected events, leading to poor trades.

- Technical Issues: Software bugs, API issues, or network disruptions can hinder the performance of AI bots, leading to missed trades or incorrect orders.

- High Costs for Advanced Bots: While some bots are free or low-cost, more sophisticated AI trading bots can be expensive. Additionally, some platforms charge extra fees for API access, trading signals, or advanced bot features.

- Over-Optimization: Backtesting can lead to over-optimized strategies that perform well historically but fail in live markets. Relying solely on historical data can mislead traders about future performance.

AI Strategies: How to Trade Crypto Using AI

AI can significantly enhance cryptocurrency trading procedures by analyzing vast amounts of data to identify trends, patterns, and opportunities that may not be apparent to human traders. Some popular AI-driven strategies include:

- Technical Analysis: AI tools can analyze historical price charts and indicators such as moving averages and relative strength index (RSI) to predict future price movements.

- Sentiment Analysis: AI can process large volumes of data from social media, news outlets, and other sources to gauge market sentiment and predict price shifts.

- Arbitrage: AI bots can scan multiple exchanges to identify price discrepancies and execute arbitrage trades in real time.

- Market Making: AI bots can place buy and sell orders to profit from the spread between bid and ask prices, ensuring liquidity in the market.

How to Use AI for Trading Crypto

To effectively use AI in crypto trading, follow these steps:

- Choose a Reputable AI Platform: Select a reliable AI-powered trading platform with robust tools, transparent data, and a user-friendly interface.

- Develop a Trading Strategy: Decide on a trading strategy that aligns with your goals and risk tolerance, such as arbitrage, scalping, or trend-following.

- Backtest Your Strategy: Use historical market data to backtest your AI strategy and optimize its performance before deploying it in live markets.

- Implement Risk Management: Set stop-loss orders, take-profit levels, and portfolio diversification to mitigate potential losses.

- Monitor and Adjust: Monitor your bot’s performance and adjust your strategy as market conditions change.

How to Choose the Best AI Trading Tool

When selecting an AI crypto trading software, consider the following features:

- Automation: The ability to execute trades 24/7 without human intervention.

- Customizability: Choose a tool to customize trading plans based on your goals and preferences.

- Advanced Analysis: Look for tools that offer comprehensive charting and technical analysis features.

- Multiple Exchange Support: Ensure the bot supports integration with numerous crypto exchanges.

- Risk Management Features: Prioritize bots with features like stop-loss orders and position sizing to protect your capital.

Top 3 Exchanges for AI Crypto Trading

Now that you know what AI trading bots are and how they work, you might wonder where to start using them. There are thousands of exchanges offering different markets, but here are the top three that support crypto algo trading.

Binance

As one of the largest centralized exchanges, Binance is known for its high liquidity and a vast selection of cryptos. The platform offers a range of AI trading tools and supports HFT and grid trading, making it ideal for automated strategies. Its user-friendly interface, advanced features, and global accessibility make Binance a top choice for traders seeking AI-powered crypto solutions.

Kucoin

Kucoin has earned its reputation as a top exchange for AI crypto trading, offering a robust platform with diverse services such as spot trading, derivatives, and P2P fiat transfers.

Known for its low fees and user-friendly interface, Kucoin’s in-house trading bot makes it ideal for automated strategies like grid trading, Smart Rebalance, and Dollar-Cost Averaging (DCA).

Catering to traders across multiple regions, Kucoin provides access to a vast array of cryptocurrencies, making it a preferred choice for AI-powered trading solutions in both volatile and stable markets.

Kraken

Kraken is a top-tier exchange for AI crypto trading, renowned for its robust security, liquidity, and support for advanced trading strategies. Offering spot, margin, and derivatives trading, Kraken integrates seamlessly with AI trading bots, providing tools for automated trading and liquidity management.

Its user-friendly interface, institutional-grade services, and API support make Kraken a preferred platform for traders leveraging AI in crypto markets.

Top 5 AI Trading Bots

Choosing the right AI tools can significantly improve your trading experience, providing precision and efficiency. Here are some of the best AI trading bots you can consider.

Pionex

Pionex stands out as one of the top AI trading bots for crypto traders, offering advanced features catering to beginners and experienced users. With 16 free built-in trading bots, including the popular Grid Trading Bot and Dollar-Cost-Averaging (DCA) Bot, Pionex automates buying and selling strategies to capitalize on market volatility.

It boasts competitive trading fees of just 0.05%, 24/7 operation, and access to over 350 trading pairs. Pionex also integrates with TradingView, making it an innovative choice for traders seeking reliable, AI-driven solutions for crypto trading.

CryptoHopper

CryptoHopper is a leading AI-powered crypto trading bot, designed to automate trades precisely and easily. Compatible with over 75 cryptos and nine major exchanges, CryptoHopper provides many services, including bot backtesting, strategy customization, and algorithmic trading.

Its user-friendly, cloud-based platform is ideal for traders of all levels, offering features like a strategy designer, customizable indicators, and trailing stops. CryptoHopper helps users optimize performance and manage risk by eliminating emotional trading and leveraging technical analysis.

3Commas

3Commas is a top-tier AI trading bot recognized for its versatility and comprehensive set of tools for both manual and automated crypto trading. Supporting 16 major platforms, 3Commas enables traders to deploy strategies across bullish, bearish, or sideways markets.

Its standout features include automated DCA, Grid, and Futures bots that can execute trades at scale, optimizing for price dips and spikes. The platform’s SmartTrade and Terminal tools allow users to automatically set advanced trading triggers, monitor market conditions, and copy professional traders’ strategies.

With detailed performance analysis, 24/7 operation, and strong security measures, 3Commas offers an all-in-one solution for traders leveraging AI for crypto trading success.

GunBot

GunBot is a highly customizable AI trading bot favored by experienced crypto traders for its advanced features and flexibility. Offering over 20 customizable buy and sell strategies, GunBot allows traders to fine-tune their trading approach to match market conditions.

Compatible with major exchanges like Binance and Kraken, it supports unlimited crypto pairs and employs advanced trade optimization techniques. GunBot’s robust algorithmic capabilities make it ideal for those seeking precise control over their trading strategies.

OctoBot

OctoBot is an open-source AI crypto trading bot that stands out for its flexibility and innovation, making it a top choice for both beginners and advanced traders. With over 25,000 active users, OctoBot offers customizable trading strategies, including Smart DCA. It allows users to automate investments and maximize profits.

The platform also integrates ChatGPT’s predictive capabilities, offering AI-powered market insights to enhance trading decisions. OctoBot supports spot and futures markets and lets traders design, test, and deploy their AI-driven strategies. Its robust technical analysis tools and machine learning integration make it a cutting-edge solution for crypto trading.

Bottom Line

AI is reshaping the way crypto traders operate by offering tools that enable the analysis of significant data volumes, automating trading strategies, and facilitating rapid responses to market changes.

While AI crypto trading bots offer numerous advantages, they also have certain risks. Knowing how to use AI for trading crypto and employing robust risk management strategies can help you maximize your chances of success.

FAQ

Is AI trading profitable?

AI trading algorithms offer speed and efficiency, enabling quick execution of trades, capturing market opportunities, and capitalizing on fleeting trends. This can potentially lead to higher profits.

What are the risks of using AI in trading?

AI can be used for market manipulation, leveraging inefficiencies or price manipulation through coordinated trading strategies, and can also be influenced by algorithmic bias in training data.

Is AI trading legal?

AI trading is now legal, but investment firms and stock market traders must ensure compliance with rules and regulations.