Fiat currencies like dollars, euros, pesos, and rupees have a main unit and a fractional sub-unit. Countries usually divide their main unit into 100 subunits, resulting in two decimal places. Cryptocurrencies, on the other hand, use multiple subunits, leading to confusion about terminology and relative value. The significant growth of digital money adoption makes it crucial to understand the crypto denomination system.

This article breaks down crypto denominations for some popular digital currencies and provides a clear understanding of the crypto denomination system.

Key Takeaways

- Crypto units are standardised measures of value.

- Digital currency units can help fill the gap between traditional fiat currency and digital assets.

- Just like the most popular currencies, altcoins like Stellar Lumens or Cardano use unique crypto denominations.

Crypto Units and Denominations

Cryptocurrency units and denominations are standardised measures of value for digital assets, similar to the dollar in the US or the euro in Europe. There are two main types: base units and derived units.

Base units are the primary measure of value for a digital asset, like Bitcoin (BTC) in Satoshis or ETH in Wei. Derived units are secondary measures of value based on the base units of a digital asset, such as 1 BTC equals 100,000,000 satoshis and 1 ETH equals 10^18 wei. They allow for measuring larger amounts of a digital asset without using too many base units.

Denominations are alternate names for cryptocurrency units, such as Bitcoin’s smallest unit, satoshis, millibitcoins or microbitcoins. They can help bridge the gap between traditional fiat currency and digital assets, prevent precision issues, and simplify mathematical operations.

To better understand crypto units, we should also answer the question, “What is a token decimal?”

Decimals indicate the divisibility of a token, ranging from 0 to 18. They are displayed on-screen as the number of digits after the decimal place.

Bitcoin Units

Bitcoin, the biggest crypto by market cap, effectively addressed key issues like double spending and decentralisation, propelling crypto assets into mainstream recognition.

Bitcoin (BTC) uses a system similar to metric system naming conventions for most of its unit denominations, but the smallest unit, known as a satoshi, has no metric equivalent.

BTC can be broken down into eight decimal places.

There are several named BTC denominations and their values, including algorithmic max, megaBTC, kBTC, decaBTC, bitcoin, deciBitcoin, centiBitcoin, milliBTC, microBTC, Finney, and Satoshi.

However, converting satoshi to BTC has become riskier due to price appreciation. Some have suggested alternative naming standards to represent Bitcoin denominations more clearly, such as the Satcomma Standard and the BTC-Satoshi Hybrid. These alternatives highlight the unique challenge of communicating crypto names, values, and denominations, but neither has gained widespread adoption.

Each denomination has a different value and is useful for different purposes, so it’s crucial to use the right denomination for the value you’re measuring.

BTC to Sats

So, what is Satoshi? Satoshis, or sats, are the smallest unit of the Bitcoin network. The term was coined in 2010 by Ribuck, a BitcoinTalk user, after Satoshi Nakamoto, the creator of Bitcoin. Sats are crucial in Bitcoin’s ecosystem, as they divide BTC into affordable denominations, making them more tenable to the public. Sats function similarly to cents and are also used to pay Bitcoin mining fees, ensuring fast and flexible transactions.

Satoshis is equivalent to one hundred millionths of a single BTC (0.00000001 BTC). With 100 million satoshis in one BTC, even modest investments can result in meaningful satoshi ownership, ensuring individuals with limited financial resources can participate in the cryptocurrency market. Satoshis also play a critical role in the cryptocurrency market, measuring bitcoin price movements and allowing traders to track smaller price movements.

BTC to Finney

The community has proposed calling the second smallest Bitcoin denomination in honour of Hal Finney, the computer scientist who received the first Bitcoin transaction from Satoshi Nakamoto. One Finney is a unit of Bitcoin representing 0.001 BTC thus it would be equivalent to 10 Satoshis, or 0.0000001 BTC.

Hal Finney, a cypherpunk and a pioneer Bitcoin adopter, was the recipient of Satoshi Nakamoto’s first-ever Bitcoin transaction. He introduced the world to Bitcoin in 2009, which became a trillion-dollar asset at its peak. 15 years later, the U.S. Securities and Exchange Commission approved Bitcoin’s first spot exchange-traded fund (ETF).

The term simplifies discussions and pricing for smaller Bitcoin amounts, making transactions more relatable and paying homage to Finney’s significant role in cryptocurrency history.

centiBitcoin, milliBTC, microBTC, and so on

When multiplied by ten, 1 Sats becomes a Finney, followed by microBitcoin, milliBitcoin, centiBitcoin, deciBitcoin, and finally Bitcoin.

The Bitcoin denominations chart below outlines commonly used measurements, ranging from the algorithmic max to the smallest amount (Satoshi).

Ethereum Units

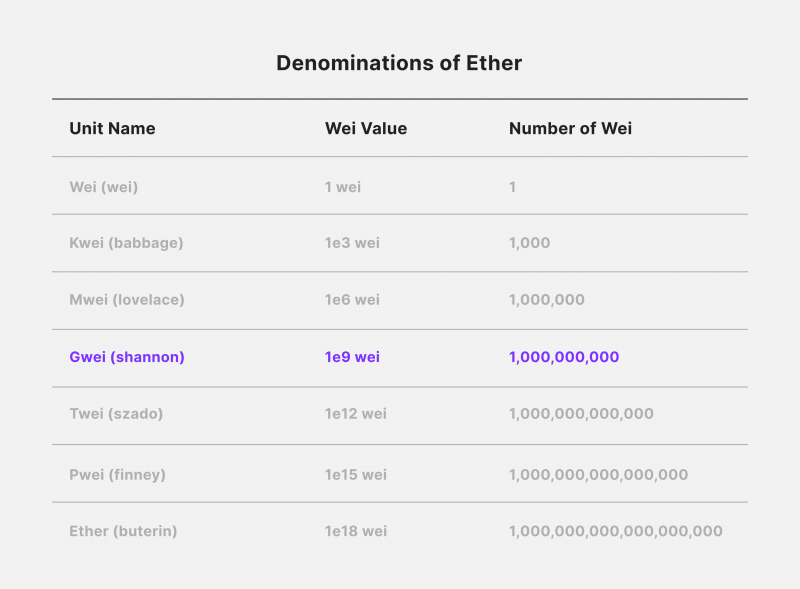

ETH uses a metric system of Ethereum denominations, each with a unique name, as its base unit. The smallest denomination, Wei, is the base unit. Ether also designates a currency unit, 1e18 or one quintillion Wei. It’s important to note that Ethereum is not a currency or a unit.

Ethereum’s cryptocurrency, ether (ETH), can be divided into 18 decimal places, with the smallest being ‘wei’, equivalent to 10^-18 ETH and named after cryptographer Wei Dai. The largest is ‘gwei’, 9 decimal places commonly used for Ethereum network gas prices. The smallest is ‘Shannon’, 9 decimal places, nicknamed after Claude Shannon, a crypto-analyst expert. The closest to ‘pwei’ is 0.001 Ether, named after Hal Finney, the first Bitcoin recipient.

Ethereum units have alternate names based on influential cryptography figures. For example, gwei may be called Shannon after Claude Shannon, an American mathematician and cryptographer. Ethereum’s naming convention is a nod to its founding figures, similar to how $100 bills feature images of Ben Franklin and $5 bills feature Abraham Lincoln.

Below, you can find a chart representing ETH units, including alternate names.

Gwei vs Wei

First of all, let’s talk about what is wei.

The name “Wei” was given to this atomic unit in honour of Wei Dai, the cypherpunk who invented the first cryptocurrency network design in late 1998.

Wei is the smallest unit of Ether in the Ethereum network. It serves as the fundamental unit for microtransactions and enables users to transact even the smallest fractions of the popular cryptocurrency. Wei can be further subdivided into smaller units, such as Kwei, Mwei, and Gwei, each serving a unique purpose.

Gwei, short for Gigawei, represents a billion Wei units and is used for gas fees, which are charges incurred for executing smart contracts or other transactions on the Ethereum blockchain. The Ethereum fee mechanism was reformed in 2021 to provide greater transparency and predictability in gas fee calculations, ensuring network security and incentivising miners for validating transactions.

Converting between Wei and Gwei is a straightforward process, as one can divide an amount of Wei by one billion. To convert Wei to ETH, one must divide the amount of Wei by 10^18, as one Ether consists of 100,000,000,000,000,000 Wei.

Other Tokens Units

Other cryptocurrencies and altcoins like Stellar Lumens (XLM), Cardano (ADA), and Binance Coin (BNB) also have their unique denomitations. Let’s take a quick look at some of them.

Stellar Lumens’s native currency is XLM, with the smallest unit being a stroop (7 decimal places).

Cardano’s native currency, ADA, has a unique denomination system. The base unit is a Lovelace, named after Ada Lovelace, and 1 ADA equals 1,000,000 Lovelaces. Cardano also has two smaller units, micro-Lovelace (uLOV) and nano-Lovelace (nLOV). The Cardano denomination system is designed to represent all values without decimal points, making it easy to understand the amount being discussed.

Binance Coin (BNB) is the native currency for Binance Chain (BC) and Binance Smart Chain (BSC). It was created in 2017 to pay for trading, listing, and withdrawal fees.

There are two types of BNB: ERC-20 BNB and BEP2 BNB, created on the Ethereum blockchain. ERC-20 BNB can be used to pay fees on the Binance exchange, and BEP2 BNB can be used on the Binance DEX exchange. The BNB’s smallest unit is known as Jager (six decimal places), and it is named after the Binance manager in Telegram.

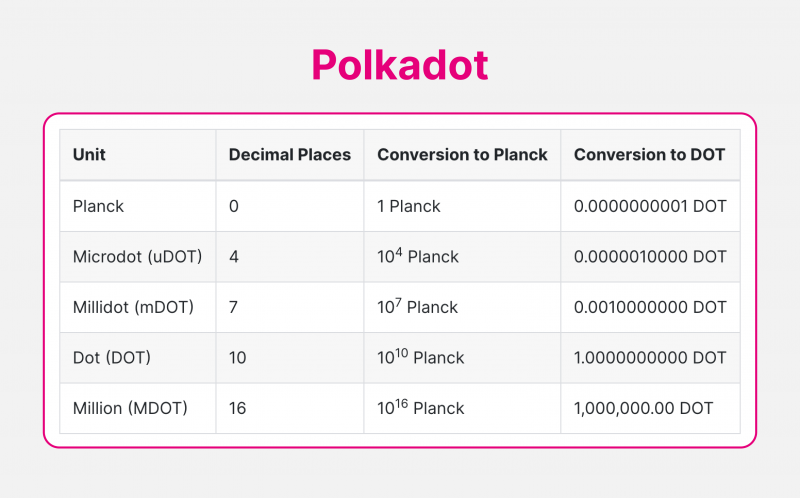

A DOT is a native cryptocurrency on the testnet Polkadot blockchain, a Web3 Foundation-created network for interoperability. Testnet DOTs have 15 decimal places and follow the SI convention, with a Femto as the smallest.

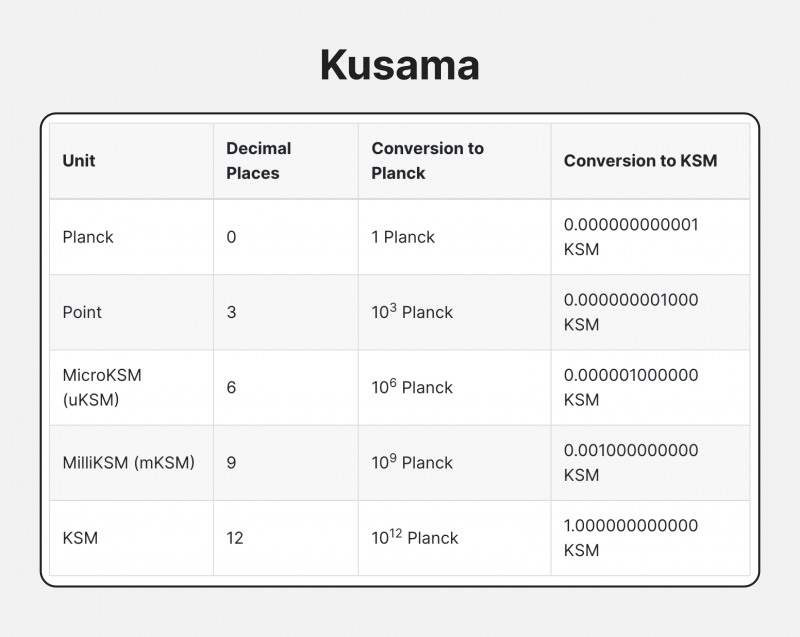

The Kusama token structure changes the smallest unit to 12 decimal places and names it ‘Planck’ after Max Planck, the founding father of Quantum Theory. Smaller denominations include ‘point’, ‘microdot’, ‘millidot’, ‘dot’, and ‘blob‘.

Stablecoins aim to stay as close to the underlying asset as possible to maintain a stable value, with most having 2 decimal places. The Tether and Tezos blockchains refer to their smallest units as ‘cents’, while the USD Coin and Paxos (PAX), ERC20-compliant tokens based on the Ethereum blockchain, have 18 decimal places.

Bottom Line

Crypto denomination and crypto units are terms used to measure digital assets. Understanding these concepts can simplify their use.

Crypto units are crucial for digital currency functionality and widespread adoption, as well as developing Central Bank Digital Currencies (CBDCs). They make virtual money practical for everyday transactions and demonstrate its divisibility and scarcity.

As digital currencies evolve, understanding and using crypto units and coin denominations becomes essential for expanding its role and inspiring various investors and central banks to make crypto available for more users worldwide.