Bitcoin, the world’s first decentralized digital currency, is often heralded as a revolutionary financial tool. While its innovations are undeniable, one critical aspect underpins its utility and the overall functioning of the cryptocurrency market: liquidity.

Understanding Bitcoin liquidity is vital for navigating the often turbulent crypto markets, whether you’re a seasoned investor, an institutional trader, or a crypto novice.

In this article, we will delve into the meaning of Bitcoin liquidity, explore its significance, analyze the factors influencing it, and examine the role of liquidity providers and aggregators in the crypto ecosystem.

Key Takeaways

- Bitcoin liquidity refers to the ease of buying or selling BTC without significantly impacting its price.

- Several factors influence BTC liquidity, including adoption, market structure, regulation, etc.

- Liquidity providers and aggregators are vital in ensuring smooth trading by offering access to deep liquidity.

Liquidity in Financial Markets

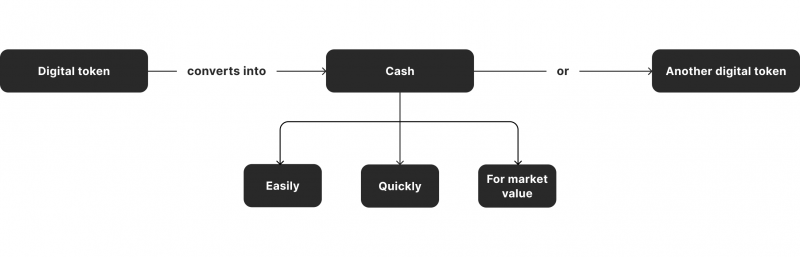

Liquidity, in its simplest form, refers to how quickly and efficiently an asset can be converted into cash without significantly affecting its price. High liquidity indicates a market where many buyers and sellers are readily available, facilitating smooth transactions at stable prices. For example, liquid assets like stocks, bonds, or currencies can be easily traded in traditional financial markets without causing large price fluctuations.

Liquidity ensures market efficiency, reduces transaction costs, and maintains investor confidence. In times of financial crisis, central banks often intervene to maintain liquidity, stabilizing markets. In an illiquid market, transactions become difficult, leading to potential price volatility and increased risk for market participants.

Cryptocurrency and Liquidity

In the cryptocurrency market, liquidity functions similarly. It refers to the ease with which digital assets, like Bitcoin, can be exchanged for fiat currencies or other cryptocurrencies without drastically impacting the asset’s price. High cryptocurrency liquidity enables traders to execute large transactions without significantly moving the market. This creates a more stable and predictable environment, minimizing the risks of sharp price fluctuations, often driven by low liquidity.

Cryptocurrency liquidity is also crucial in distinguishing healthy markets from fragile ones. High trading volumes, numerous active investors, and narrow bid-ask spreads signal a liquid market, making buying or selling assets at predictable prices easier.

On the other hand, low liquidity exposes traders to price slippage, where a transaction is executed at a price significantly different from what was initially expected.

Why Is Liquidity Important?

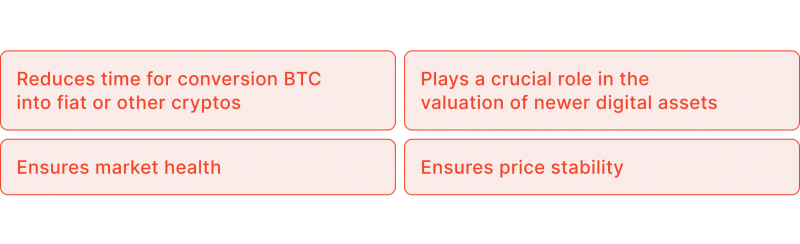

Liquidity is crucial in the cryptocurrency market for several reasons. First, it allows for smoother, more efficient trading by reducing the time it takes to convert Bitcoin or other assets into fiat or other cryptocurrencies. High liquidity minimizes price slippage, ensuring that trades are executed at desired prices.

Additionally, liquidity is a sign of market health. In highly liquid markets, traders can more accurately predict price movements, as market depth ensures that individual transactions have a negligible impact on the asset’s price. Low liquidity, on the other hand, can lead to erratic price swings, making it challenging for traders to enter or exit positions without significant losses.

Liquidity also matters for price stability, particularly for Bitcoin and other emerging digital currencies. Without sufficient liquidity, prices can be easily manipulated by large traders or “whales,” leading to artificial inflation or deflation in asset value. This volatility can discourage the widespread adoption of cryptocurrencies, especially among institutional investors and traditional financial markets.

Lastly, liquidity is essential for the valuation of newer digital assets. Many cryptocurrency exchanges offer incentives like reduced trading fees or liquidity mining to boost liquidity. By doing so, they create an environment that fosters growth and encourages adoption by a broader audience.

How to Measure Bitcoin Liquidity

Bitcoin liquidity can be measured using several key indicators, including trading volume, the bid-ask spread, and market depth.

- One of the most straightforward liquidity indicators is trading volume, which refers to the number of assets traded in a given period. A higher trading volume typically suggests more liquidity, as more buyers and sellers participate in the market.

- Another important measure is the bid-ask spread, which represents the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). A narrow spread signals high liquidity, showing that buyers and sellers are close in agreement on the asset’s value. Conversely, a wide spread can indicate low liquidity, making transactions more costly and risky.

- Market depth is the measure of the supply and demand at various price levels within an order book. A deep market, where ample buy and sell orders across a range of prices, indicates high liquidity, whereas a shallow market is more susceptible to price swings.

What is Bitcoin Liquidity?

Bitcoin liquidity refers to how easily Bitcoin can be exchanged for cash or other cryptocurrencies without drastically changing its price. Since its inception in 2008 by the anonymous creator Satoshi Nakamoto, Bitcoin has grown into the world’s most widely recognized cryptocurrency, commanding a daily trading volume that often exceeds tens of billions of dollars. Despite this, Bitcoin liquidity can fluctuate, and it is not equally distributed across all cryptocurrency exchanges.

A Bitcoin liquidity pool varies depending on the exchange, with some exchanges offering higher liquidity due to larger user bases and more active traders. These platforms often use advanced market-making techniques, like limit orders, to maintain tight bid-ask spreads. However, Bitcoin, like other cryptocurrencies, can experience illiquidity, particularly during heightened volatility.

Factors Influencing Bitcoin Liquidity

Several factors can affect Bitcoin liquidity, making it critical for traders to understand the conditions that influence their trades:

1. Popularity and Adoption: The more widely Bitcoin is accepted as a medium of exchange, the more liquid it becomes. Increased adoption drives greater demand and brings more participants into the market, increasing liquidity.

2. Market Structure: Centralized exchanges, like Binance and Coinbase, and decentralized exchanges, like Uniswap, offer different levels of liquidity. Centralized exchanges often have more liquidity due to more users and market makers, while decentralized ones may have lower liquidity but offer greater flexibility and transparency.

3. Regulation: Legal frameworks and government policies are crucial in Bitcoin liquidity. Regulations that promote market stability and protect investors tend to attract more capital, increasing liquidity. Conversely, strict or unclear regulatory environments may drive away institutional investors, negatively impacting liquidity.

4. Volatility: High volatility can lead to liquidity drying up, as traders may hesitate to enter the market during rapid price fluctuations. On the other hand, stable markets encourage more trading activity, which increases liquidity.

5. Volume: The daily volume of Bitcoin trading has grown significantly over the years, with higher volumes leading to greater liquidity. High-volume exchanges offer deeper markets, making it easier for traders to execute large transactions without causing significant price changes.

Bitcoin Global Liquidity

Bitcoin liquidity isn’t confined to individual exchanges or specific markets. Global liquidity reflects the total amount of money circulating in the world’s financial system that is readily available for investment and trading. As a global asset, Bitcoin is influenced by broader global liquidity trends.

Analysts have observed that Bitcoin’s price often tracks changes in Bitcoin global liquidity, particularly during periods of expansion or contraction in major economies like the United States, China, and the Eurozone. For instance, when central banks inject liquidity into the global financial system (e.g., through quantitative easing), Bitcoin benefits as more capital flows into risk assets.

What are Bitcoin Liquidity Aggregators?

Liquidity aggregators play an important role in maintaining Bitcoin liquidity. These tools combine orders from various liquidity providers, offering traders access to the best available prices from multiple sources. Aggregators streamline the trading process by consolidating bids and asks from different exchanges, minimizing the need for manual price comparisons.

Two primary models of liquidity aggregation are ECN (Electronic Communication Network) and MTF (Multilateral Trading Facility). ECNs allow participants to interact with multiple liquidity pools, while MTFs focus on matching orders within a specific marketplace.

By using a Bitcoin liquidity aggregator, traders can get the best available prices, reducing slippage and ensuring faster trade execution.

Top Crypto Liquidity Providers

Several leading players have emerged as top crypto liquidity providers as the cryptocurrency market matures. These entities supply digital assets to exchanges, ensuring smooth transactions and minimizing price volatility. Some of the top Bitcoin liquidity providers in 2024 include:

- B2BROKER: A well-established player in the crypto liquidity space, B2BROKER provides liquidity solutions to crypto exchanges and institutional clients.

- Galaxy Digital Trading: Known for its expertise in digital assets and institutional-grade trading solutions, Galaxy Digital offers deep liquidity across various cryptocurrencies, including Bitcoin.

- Empirica: A firm specializing in algorithmic trading and market-making services, Empirica helps exchanges maintain liquidity through automated trading strategies.

Choosing the right Bitcoin liquidity provider depends on several factors, including the provider’s reputation, asset coverage, regulatory compliance, and pricing structure. A strong liquidity provider can significantly affect trading efficiency and cost savings.

Final Takeaways

Bitcoin liquidity is a critical aspect of the cryptocurrency’s success and adoption. High liquidity ensures that traders can easily buy or sell Bitcoin without impacting its price, providing stability and fostering market growth.

As Bitcoin continues to evolve, the role of a crypto liquidity provider, aggregators, and exchanges will become increasingly important in shaping its future.

By understanding the dynamics of Bitcoin liquidity and the factors that influence it, traders and investors can make more informed decisions, reducing their exposure to volatility and maximizing their trading opportunities.