In DeFi, access to real-time data on token prices, liquidity, and trading volumes across multiple decentralized exchanges (DEXs) is essential for traders looking to make wise decisions.

DEX Screener is a powerful tool that addresses this need by providing comprehensive data on various crypto tokens traded across blockchain networks. Whether you’re a seasoned trader or a newcomer, understanding how to utilize DEX Screener effectively can significantly enhance your trading strategy.

This article explores what DEX Screener is, its features, and how you can use it to boost your trading efficiency.

Key Takeaways

- DEX Screener provides real-time data on token prices, liquidity, and trading volumes across multiple DEXs.

- It features advanced charting tools and customizable alerts, helping traders make informed decisions.

- The platform supports over 80 blockchain networks, allowing users to monitor many tokens, including new pairs.

- DEX Screener is free, user-friendly, and trusted for its direct on-chain data without relying on external APIs.

What is DEX Screener and How Does It Work?

DEX Screener is a widely-used crypto analysis platform that provides real-time data on trading activity across multiple DEXs, including major ones like Uniswap, PancakeSwap, and SushiSwap.

Launched to meet the growing demand for accurate and timely data in the DeFi sector, DEX Screener aggregates on-chain data from decentralized exchanges across various blockchain networks, including ETH, Solana, BNB Chain, Arbitrum, and Avalanche, among others.

The platform’s appeal lies in its ability to track over 5,000 tokens across more than 80 layer 1 and layer 2 blockchain networks. This breadth of coverage allows traders to monitor the performance of popular tokens as well as long-tail altcoins that may not be featured on other platforms.

DEX Screener operates by aggregating real-time data from DEXs across multiple blockchain networks. It pulls on-chain data directly from over 80 blockchain ecosystems, including Ethereum, BNB Chain, and Solana, to provide insights into token prices, liquidity, and trading volume.

This decentralized approach ensures accuracy, as it does not rely on external APIs or third-party sources, allowing traders to trust the data they receive.

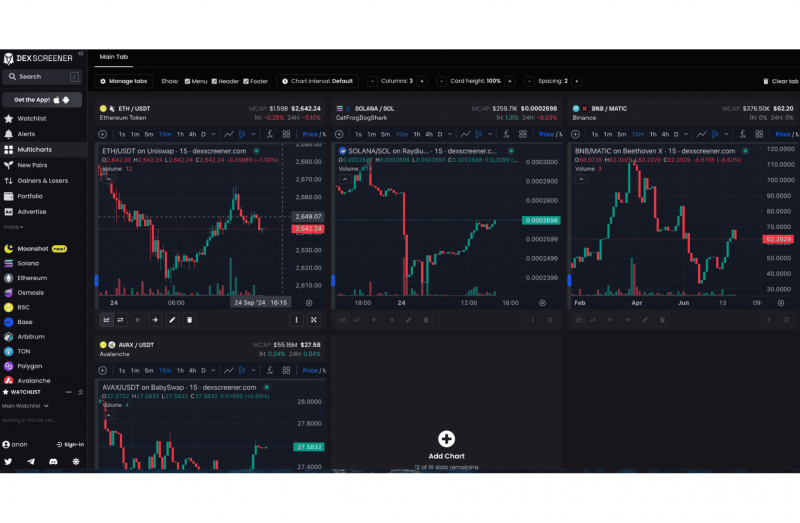

A standout feature is its ability to display multicharts, allowing users to track up to 16 different tokens simultaneously. This multichain analysis makes it easier for traders to manage their portfolios across various DEXs. The platform’s mobile-friendly design also ensures accessibility, making it an essential tool for traders who want to stay updated on the go.

DEX Screener Key Features

DEX Screener is a popular tool among crypto traders, analysts, and DeFi enthusiasts for its advanced charting tools, liquidity tracking, market analysis, and historical data, which help traders make informed decisions about established cryptocurrencies and emerging projects.

- Real-time Data: The platform delivers up-to-the-minute data on token prices, trading volumes, liquidity, and market capitalization across various blockchain networks.

- Advanced Charting Tools: DEX Screener uses TradingView charts, allowing users to apply technical indicators such as moving averages (MA), relative strength index (RSI), and Bollinger Bands. These tools help users identify potential price trends, significant market movements, and trading opportunities.

- Liquidity Tracking: Traders can monitor the liquidity levels of specific token pairs across different DEXs, ensuring they can execute trades with minimal slippage.

- Custom Alerts: Users can set up custom alerts based on specific tokens, price levels, or trading volumes. These alerts notify traders of significant market changes, enabling them to act quickly.

- New Pair Listings: The platform highlights the latest token pairs listed on various DEXs, allowing traders to get in early on promising projects.

- API Access for Developers: DEX Screener provides an API that developers can integrate into their own applications, facilitating real-time data access and monitoring.

- Cross-Chain Support: The platform supports a vast array of blockchain networks, allowing users to track tokens and pairs across multiple chains.

DEX Screener Key Components

DEX Screener has lots of essential components that help you analyze data comprehensively. Let’s review them below.

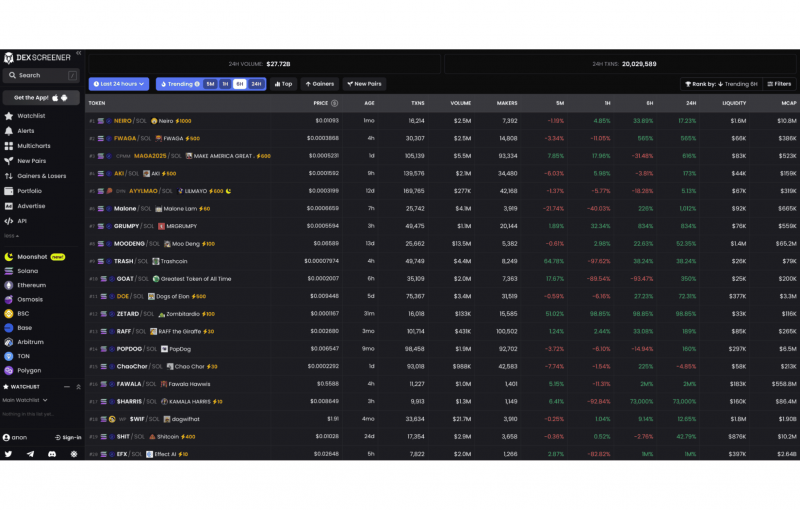

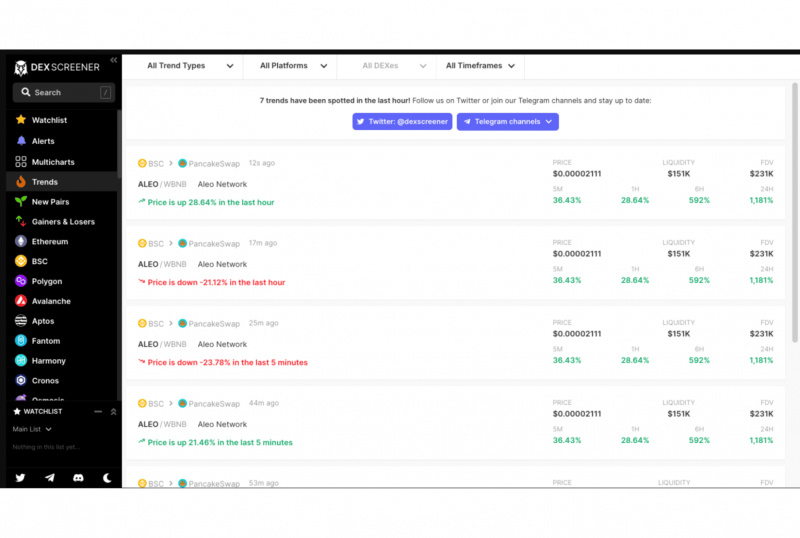

Trends Section

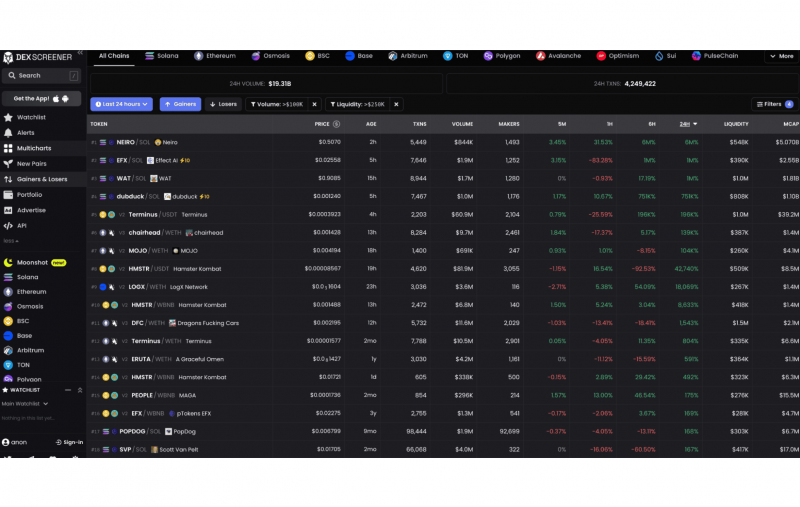

DEX Screener’s “Trends” section offers a broad overview of current market movements. This section allows you to explore trending tokens and trading pairs across over 80 blockchain networks. You can customize this view based on price changes, trading volumes, or the latest listings, which is especially useful for identifying early market trends.

The “Trends” tab can be filtered by various factors such as platform (e.g., Ethereum, Avalanche, Polygon) and time frame, ranging from five minutes to 24 hours. This makes it easy to detect short-term spikes or long-term market shifts, ensuring you can adjust your strategies based on real-time data.

DEX Screener Chart

One of DEX Screener’s standout features is its charting system. TradingView’s MultiChart tool allows users to create custom dashboards with up to 16 different charts. This feature is ideal for comparing price movements across various tokens and spotting patterns like head and shoulders, double tops, or triangles, which can signal potential price reversals.

While DEX Screener provides a wide range of indicators and chart customization options, it lacks some of the advanced indicator functionalities found on other platforms. Nevertheless, the charting tools available are sufficient for most traders, particularly those focused on DEX activity.

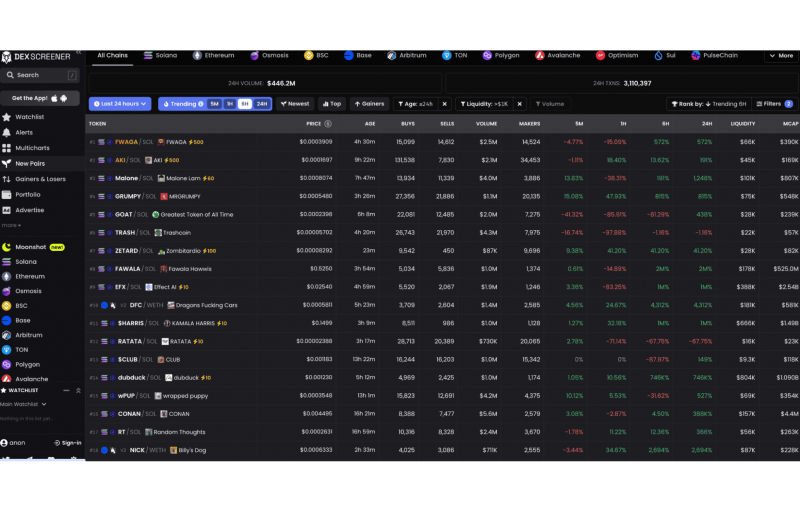

New Pairs Section

The “New Pairs” section is an invaluable tool for traders interested in discovering emerging tokens. This feature provides real-time information on the latest token pairs added to various DEXs, including essential details such as price, listing time, volume, liquidity, and price change.

By monitoring new token pairs, traders can identify opportunities in early-stage projects before they gain widespread attention. You can filter these pairs based on parameters like pair age, liquidity, and FDV, focusing only on the tokens that meet your investment criteria.

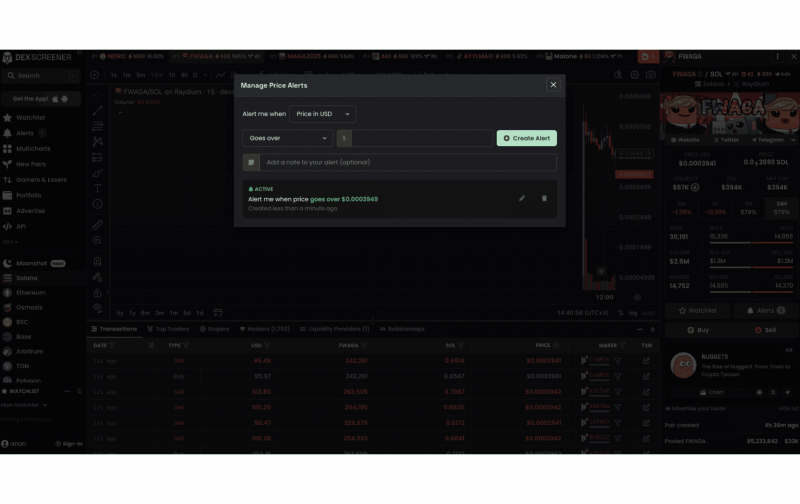

Price Alerts

Price alerts are another crucial feature of DEX Screener, designed to keep you informed of important market changes without constantly checking the platform. You can easily set up alerts based on price thresholds or percentage changes for any trading pair.

Once an alert is set, DEX Screener will notify you when the selected price condition is met, enabling swift action. For instance, you can set alerts for a token when its price falls below a certain level, indicating a potential buying opportunity, or when it hits a peak, signaling the right time to sell.

Alerts can be enabled or disabled as needed, giving you control over your trading notifications.

Gainers & Losers Section

To spot market leaders and laggards quickly, the “Gainers & Losers” section of DEX Screener provides a real-time snapshot of the best and worst-performing tokens across multiple blockchain networks. By filtering through various factors such as liquidity, FDV, pair age, and transaction volume, you can customize your view to focus on tokens that align with your trading strategy.

This feature is particularly useful for short-term traders looking to capitalize on sudden market movements. A rapid surge in volume, for example, could indicate growing interest in a particular token, which may lead to further price increases.

DEX Screener API

DEX Screener offers an API for developers or advanced traders who want to build custom tools or integrate data into their existing applications. The API allows users to gather data on networks, token pairs, and trading activity. By leveraging this API, you can automate data retrieval, conduct in-depth analysis, or enhance your trading algorithms.

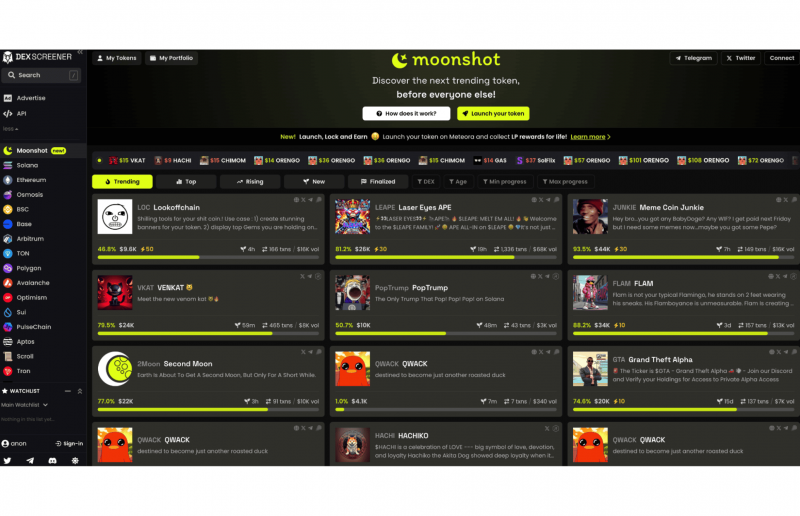

Moonshot DEX Screener

Moonshot Dexscreener is a unique feature on the platform that allows users to launch their own tokens on the Solana blockchain. The process is straightforward, requiring users to enter the token ticker, description, and social media links. Once the token is live, users can trade it on DEXs like Raydium or Meteora. If the token reaches a market cap of over 432 SOL, it will be migrated to a larger DEX, providing additional exposure.

This feature is especially useful for developers or teams looking to create and distribute their tokens without the need for a central exchange.

Is DEX Screener Safe?

DEX Screener prioritizes user security by sourcing data directly from blockchains, eliminating vulnerabilities associated with third-party APIs. The platform utilizes a custom-designed indexer to analyze and store raw blockchain logs, enabling the provision of screeners and charts.

Additionally, the platform respects user privacy, offering options to request data deletion and ensuring no data is shared with external parties.

However, users should be aware that, like any platform in the decentralized space, DEX Screener is not immune to risks such as market manipulation or liquidity issues. Thorough research is essential to mitigate these risks when trading in the DeFi sector.

Why Use DEX Screener?

DEX Screener offers numerous benefits, making it an essential tool for traders in the DeFi space. Here’s why you should consider using DEX Screener:

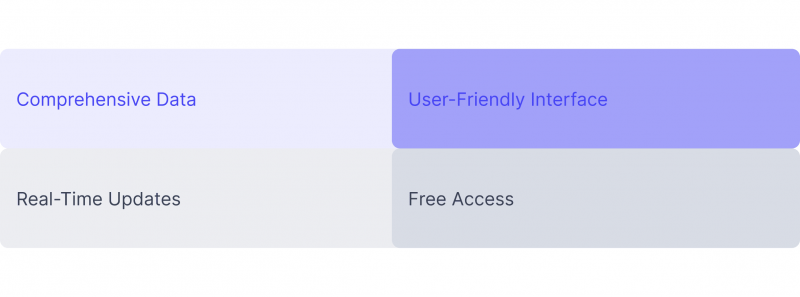

- Comprehensive Data: With access to over 5,000 tokens and 80+ blockchain networks, DEX Screener offers unparalleled coverage of the DeFi market.

- User-Friendly Interface: The platform is designed to be intuitive, making it accessible to both beginner and advanced traders. The customization options allow users to focus on the data that matters most.

- Real-Time Updates: In the fast-paced world of cryptocurrency, having access to real-time data is critical. DEX Screener’s ability to deliver timely and accurate information gives traders a competitive edge.

- Free Access: Unlike other trading platforms requiring subscriptions or token holdings, DEX Screener is entirely free to use. This makes it an attractive option for traders who don’t want to commit to premium services.

How to Use DEX Screener for Technical Analysis

One of the core functions of DEX Screener is its technical analysis capability. It provides charts for every token traded on the DEXs it monitors. You can filter data by network, exchange, liquidity, and volume, making it easy to analyze even long-tail altcoins with low liquidity.

DEX Screener integrates TradingView’s advanced charting tools, giving users access to indicators like MA, RSI, and Bollinger Bands. These tools are essential for tracking price trends, market momentum, and potential breakouts.

DEX Screener also allows users to display up to 16 different charts simultaneously. However, unlike some platforms, it doesn’t allow the direct comparison of multiple pairs on the same chart.

For traders looking to customize their analysis further, DEX Screener’s layout can be adjusted with different timeframes and chart types, such as candlestick and line charts. This flexibility makes it easy to monitor short-term and long-term market movements and respond accordingly.

How to Use DEX Screener for Fundamental Analysis

Beyond technical analysis, DEX Screener also provides tools for fundamental analysis. Traders can review critical metrics such as market capitalization, fully diluted valuation (FDV), and liquidity for tokens traded on DEXs. These insights allow traders to gauge the overall strength and sustainability of a token project.

Another useful feature for fundamental analysis is the news section. DEX Screener pulls relevant headlines from major crypto news outlets like Cointelegraph, Coindesk, and Decrypt. Access to this information can help you stay updated on the latest industry developments and how they might affect specific tokens or the broader market.

DexTools vs. DEX Screener

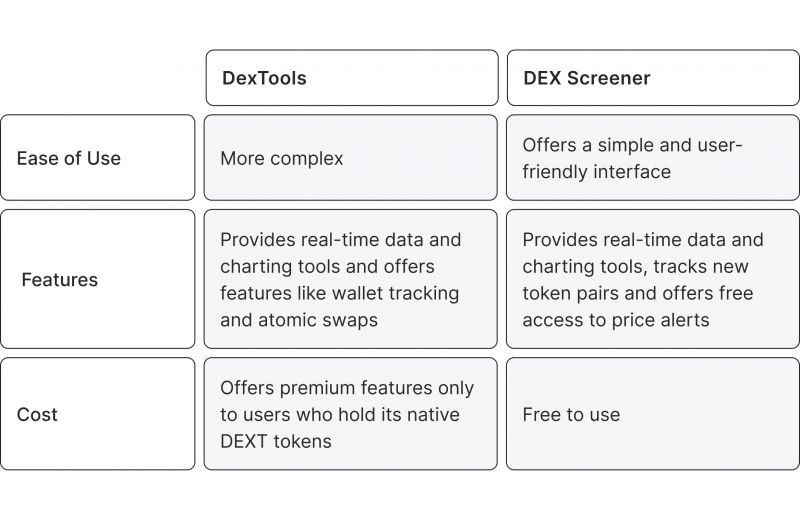

DEX Screener and DexTools are both prominent platforms in the DeFi trading space, but they cater to slightly different user bases. While DEX Screener emphasizes simplicity and accessibility, DexTools offers a more detailed interface with additional features for advanced traders.

- Ease of Use: DEX Screener is known for its user-friendly interface, making it ideal for traders who prioritize simplicity. DexTools, on the other hand, offers more advanced features, such as wallet tracking and a “Trust Score” for assessing project credibility.

- Features: Both platforms provide real-time data and charting tools, but DexTools takes it a step further by offering features like wallet tracking and atomic swaps. However, DEX Screener shines in its ability to track new token pairs and its free access to price alerts.

- Cost: DEX Screener is completely free to use, whereas DexTools offers some premium features only to users who hold its native DEXT tokens.

Other DEX Screener Alternatives

While DEX Screener is a widely-used tool in DeFi, offering a clean, ad-free experience and many useful features, several alternatives provide similar functionalities with unique offerings. Depending on their needs and preferences, these alternatives cater to different types of traders.

DexGuru is one of the top alternatives, known for its modern and intuitive design. It delivers real-time liquidity insights across various cryptos, making it appealing to both experienced traders and newcomers. Its sleek interface provides a streamlined user experience, allowing users to conduct in-depth market analysis efficiently.

Another popular option is DEXView, developed by the team behind Pinksale.Finance. DEXView focuses on core DEX screening features, offering essential tools for tracking token performance and analyzing liquidity trends. Unlike DexGuru, it does not introduce many new features but prioritizes simplicity and reliability.

Each platform offers basic tracking and analysis capabilities, similar to DEX Screener, but with distinctive elements catering to different user preferences. Choosing between these tools depends on the specific features you prioritize: advanced analytics, ease of use, or additional perks tied to platform tokens.

Final Takeaways

DEX Screener is an invaluable tool for traders navigating the complexities of DeFi. It offers real-time data on token prices, liquidity, and trading volumes across multiple blockchain networks, making it indispensable for both novice and experienced traders. The platform’s intuitive interface, extensive cross-chain support, and free access make it convenient for everyone.

Moreover, DEX Screener’s commitment to user security by sourcing direct on-chain data without relying on external APIs further enhances its credibility. While other platforms offer similar services, DEX Screener stands out for its comprehensive data coverage and ease of use.

Whether you are conducting technical analysis or tracking market trends, DEX Screener provides the tools necessary to succeed in the fast-paced DeFi environment.

FAQ

How does DEX Screener work?

The platform offers real-time data from multiple DEXs and chains, updated every 5 minutes. Its intuitive interface, customizable settings, and filters enable simultaneous monitoring and data analysis, saving analytics and other data.

Does DEX Screener charge any fees?

The DEX Screener tool is a free, open-source tool that allows users to track wallet activity and build apps without fees.

How Does the DEX Screener ensure safety?

The platform enhances user safety by obtaining real-time data directly from blockchain sources, reducing risks of third-party APIs and hacker interventions, thus enhancing security and trust.

What are the risks associated with using DEX Screener?

DEX Screener provides comprehensive monitoring of DEXs, but users must be cautious of potential risks like market manipulation and liquidity challenges.