The digital money market is constantly evolving, with periods of surging volatility and opportunity. While BTC often dominates headlines, there are phases where altcoins—cryptocurrencies other than Bitcoin—seize the spotlight and outperform the market leader. These periods, known as altcoin seasons, offer traders and investors the potential for significant returns if timed correctly.

One of the key tools to navigate these cycles is the Altcoin Season Index (ASI), which helps gauge when altcoins are gaining momentum relative to BTC. Understanding the ASI and its importance can provide a competitive edge for those seeking to capitalize on the dynamic and fast-paced world of virtual tokens.

Key Takeaways

- The ASI is a tool used to measure altcoin operation relative to BTC, helping investors identify altcoin seasons.

- An altcoin season occurs when 75% or more of the top 50 altcoins outperform BTC.

- Investors can use the ASI to time investments, focusing on altcoins during bullish cycles or shifting to BTC when it dominates.

- While altcoin seasons offer high profit potential, they also come with risks like volatility and price manipulation, requiring careful risk management.

What is an Altcoin Season?

An altcoin season, or Altseason, occurs when at least 75% of the top 50 altcoins outperform BTC. This marks a shift in market sentiment where investors divert their attention from Bitcoin to alternative cryptos in search of better profitability, technological innovation, or the potential of new projects. Altseason is a vital part of the cryptocurrency market cycle, reflecting broader investor sentiment trends and market dynamics trends.

During the altcoin season, BTC’s market dominance—its collective market capitalization share—typically declines. This means investors are placing more capital into altcoins, increasing their market share. Altcoin season is not a fixed event; its duration and intensity can vary and are driven by various triggers and market conditions. However, it offers significant profit opportunities alongside heightened risk and volatility.

Triggers for Altcoin Season

Several factors can trigger an altcoin season, often starting with positive market sentiment. This sentiment could stem from tech advancements, institutional adoption, or endorsements from influential figures. When such events occur, investors seek out altcoins that offer unique features or groundbreaking technology, such as smart contracts or decentralized applications (dApps), which BTC lacks. These innovations can draw investor attention and significantly increase the value of altcoins.

Another key factor is Bitcoin’s dominance ratio. A lower dominance ratio suggests a shift of investor interest from Bitcoin to altcoins. Historically, bitcoin dominance chart periods of declining BTC dominance have coincided with altcoin seasons. Other triggers include regulatory developments, new crypto projects, and large-scale partnerships, which can boost confidence in the altcoin market.

Bullish sentiment also plays a major role. Investors are drawn to altcoins when the overall market shows signs of growth, encouraged by developments like the rise of DeFi or NFTs. During these times, major altcoins such as Ethereum, Cardano, and Solana often see surges in price and market cap.

Key Signs of an Upcoming Altcoin Season

Several indicators suggest an emerging altcoin season. The most telling sign is a decline in BTC dominance, where Bitcoin’s share of the total cryptocurrency market shrinks while altcoins gain market share. Historically, such a sharp decline has been a strong indicator that an altcoin season is on the horizon.

Another key indicator is a surge in altcoin trading volumes. As investors flock to altcoins, trading volumes for these cryptocurrencies tend to spike, reflecting increased market activity. Monitoring the trading volumes of stablecoins like Tether (USDT) or major altcoins like ETH and Cardano can provide insights into whether an altcoin season is approaching.

Additionally, significant price breakouts across multiple altcoins can serve as a sign that the market is transitioning into an altseason. These breakouts often come with increased market volatility, offering both risk and opportunity for investors.

Historical Overview of Altcoin Seasons

Altcoin seasons have played pivotal roles in cryptocurrency market history, which has been marked by periods of explosive growth. Notable altseasons include the 2017-2018 bull run, when Bitcoin’s dominance plummeted from 86.3% to 38.69%. This era was fueled by the ICO boom, with projects like EOS and Tezos gaining massive traction.

The 2020-2021 altseason witnessed a similar surge, driven by the rise of meme coins like Dogecoin and Shiba Inu, as well as the explosion of NFTs. During this time, BTC’s dominance fell from 70% to 38%, while altcoins captured 62% of the market. The pandemic accelerated this shift, with investors flocking to emerging digital assets.

These historical altseasons illustrate the cyclical nature of the cryptocurrency market, where altcoin prices periodically outperform BTC, offering traders significant profit opportunities.

Altcoin Season vs Bitcoin Season

Bitcoin season and altcoin season represent two distinct phases in the cryptocurrency market. Bitcoin season occurs when Bitcoin outperforms altcoins, which is characterized by stability and higher investor confidence in the flagship crypto. BTC season often attracts institutional investors due to its reputation as a safer, more established asset.

Conversely, the Altcoin season is defined by market diversity and innovation. Altcoins often represent new technologies and can deliver outsized returns due to their smaller market capitalizations. However, they also come with increased risk due to their volatility and the speculative nature of many projects.

Both seasons play important roles in maintaining a healthy cryptocurrency market, with Bitcoin offering stability and altcoins promoting growth and innovation.

What is the Altcoin Season Index, and How it Works

The Altcoin Season Index (ASI) is a critical tool for crypto traders and investors, designed to measure the performance of altcoins compared to BTC over a set period. It helps identify shifts in the market by tracking the profitability of the top 50 altcoins relative to Bitcoin.

The altseason index provides investors with valuable insights into the cyclical cryptocurrency market. During altcoin season, investors often seek higher gains from alternative cryptos, while BTC season reflects a focus on Bitcoin as a more stable investment option.

By tracking and analyzing the ASI, traders can time their investments more effectively, shifting their portfolios toward altcoins during bullish altcoin cycles or focusing on BTC when it outperforms. The ASI is a vital indicator for understanding the market’s evolving dynamics and maximizing returns.

How You Can Calculate the Altcoin Season Index

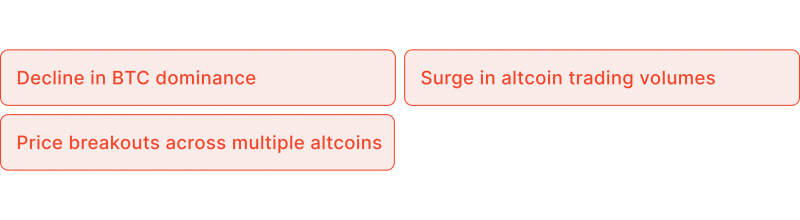

Calculating the ASI involves assessing the market performance of the top 50 altcoins compared to Bitcoin over 90 days. The goal is to determine whether altcoins are outperforming Bitcoin, signaling the onset of an altcoin season.

The calculation focuses on these altcoins’ return on investment (ROI) relative to BTC. If 75% or more of the top 50 altcoins outperform Bitcoin in price appreciation during this time frame, the ASI indicates an altcoin season. Conversely, if Bitcoin outperforms the majority of altcoins, it suggests Bitcoin dominance and signals a Bitcoin season.

To perform this calculation, data is aggregated from market sources, tracking the price movements and percentage returns of both altcoins and BTC. The formula weighs the performance of each asset and compares it to Bitcoin’s growth rate.

The ASI’s fluctuating value allows investors to gauge the market’s sentiment and strategically adjust their portfolios. A rising ASI often signals a shift toward altcoin dominance, while a low index suggests that Bitcoin is maintaining control.

By understanding how to calculate the Altcoin Season Index, traders can better anticipate market cycles and capitalize on shifts in cryptocurrency trends.

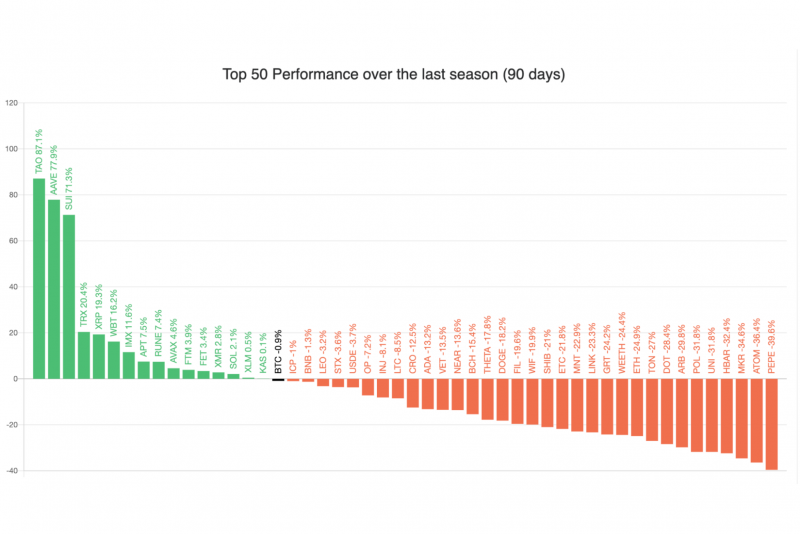

How to Interpret the Altcoin Season Index Chart

The ASI chart is a crucial tool for understanding crypto market cycles and altcoin season cycle. It offers insights into whether BTC or altcoins are driving the market, helping traders and investors make informed decisions. Here’s how to interpret it effectively.

A high index reading, typically 75% or above, indicates an altcoin season. This means that the majority of the top 50 altcoins are outperforming Bitcoin, signaling a shift in investor preference towards alternative currencies. During this time, traders may find opportunities for higher returns by focusing on altcoins with strong fundamentals.

Conversely, when the ASI is low—below 25%—it indicates BTC season, where Bitcoin outpaces altcoins in performance. Bitcoin is seen as a safer bet during this phase, attracting more capital and market attention.

The chart’s oscillations between these two extremes highlight the cyclical nature of the crypto market, often driven by changing investor sentiment, market conditions, and technological innovations. Regularly monitoring the ASI chart allows traders to anticipate shifts in market momentum, enabling them to adjust their portfolios for better performance in either altcoin or BTC-dominated markets.

How to Trade Crypto Using the Altcoin Season Index

Trading cryptos during the altcoin season requires a strategic approach, with the Altcoin Season Index Indicator serving as a valuable tool for guiding investment decisions. The ASI helps traders time their market entries and exits to maximize returns. Here’s how to effectively leverage the index for crypto trading:

1. Research Promising Altcoins: Before investing, conduct thorough research into altcoins with strong fundamentals, innovative technology, and active communities. Projects like Ethereum, Cardano, and Solana are often top performers during altcoin season, thanks to their real-world applications in areas like DeFi and smart contracts.

2. Diversify Your Portfolio: Altcoin season can be volatile, making diversification essential. Spreading investments across a range of altcoins helps mitigate risk while capturing growth across different sectors of the cryptocurrency market.

3. Use Technical Analysis: Incorporate tools like the Relative Strength Index (RSI), support and resistance levels, and moving averages to identify optimal entry and exit points. Timing is crucial during altcoin season as prices can fluctuate rapidly, so these tools can help traders navigate the volatility.

4. Capitaliser sur les préventes et les ICO: Les investissements en altcoins à un stade précoce, tels que les ICO ou les préventes, offrent la possibilité d’acheter des jetons à des taux réduits. L’identification de nouveaux projets prometteurs avant la saison des altcoins peut générer des rendements significatifs à long terme.

5. Monitor the Altcoin Season Index Regularly: Regularly checking the ASI ensures that traders stay updated on market trends. A rising index signals the start of altcoin season, allowing traders to adjust their strategies accordingly, while a falling index may suggest a shift back toward Bitcoin dominance.

By utilizing the ASI, traders can better navigate the dynamic cryptocurrency market, making more informed decisions and optimizing their portfolios for altcoin season success.

Advantages and Risks of Trading with the Altcoin Season Index

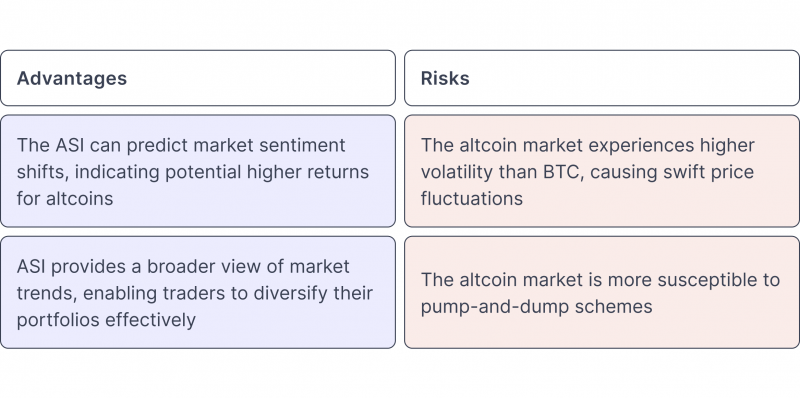

The ASI is a powerful tool for cryptocurrency traders, offering key insights into when altcoins are outperforming Bitcoin. One of the major advantages of using the ASI is its ability to signal shifts in market sentiment, providing a heads-up when altcoins may deliver higher returns than BTC. By tracking this index, traders can strategically allocate their capital to altcoins during bullish cycles, potentially increasing their profits.

Another significant advantage of the ASI is that it offers a broader view of market trends, allowing traders to diversify their portfolios more effectively. Instead of focusing solely on Bitcoin, investors can leverage the ASI to explore high-potential altcoins that are gaining market dominance. This can open up opportunities in newer technologies, such as DeFi or NFTs, where innovation drives value growth.

However, trading with the ASI also comes with considerable risks. Volatility in the altcoin market is higher than in BTC, leading to rapid price fluctuations. While this can create profit opportunities, it also exposes traders to sudden losses.

Additionally, the altcoin market is more susceptible to pump-and-dump schemes, where a coin’s price is artificially inflated and then sold off, leaving late investors with significant losses. Such schemes are often driven by speculative hype, making it crucial for traders to conduct thorough research before investing in lesser-known altcoins.

Risk management is essential when using the ASI. Diversifying investments, staying updated on market news, and not relying solely on the index for decision-making are important strategies. By understanding both the opportunities and the inherent risks of altcoin seasons, traders can make informed decisions and maximize their potential for success.

Is It Altcoin Season Now?

Looking ahead to 2025, many crypto analysts are speculating that an altcoin season could emerge following the impact of the 2024 Bitcoin halving event. Historically, Bitcoin halvings have led to bullish market cycles, often followed by strong altcoin performances. If the trend continues, 2025 could see a significant surge in altcoin activity, with many expecting Ethereum and other major altcoins to lead the charge.

Factors like the growing adoption of DeFi, advancements in blockchain tech, and increased institutional investment in altcoins are likely to contribute to this trend. Some experts also point to potential macroeconomic shifts, such as easing interest rates or favorable regulatory developments, which could further fuel an altcoin season.

While the exact timing is uncertain, 2025 is shaping up to be a pivotal year for altcoins, offering investors potentially lucrative opportunities as market dynamics shift from Bitcoin to alternative currencies.

Final Takeaways

The Altcoin Season Index is an essential tool for traders and investors looking to navigate the cryptocurrency market. It provides a clear, data-driven approach to understanding the shifts in market sentiment between BTC and altcoins. By interpreting this index, investors can make informed decisions on allocating their funds, maximizing profits, and minimizing risks.

While altcoin season offers significant opportunities, it also comes with heightened risks. Understanding the triggers, dynamics, and indicators of altcoin season is crucial for navigating the complex and often volatile cryptocurrency market.

FAQ

What is altcoin dominance?

Altcoin Dominance refers to the metric that measures the market capitalization of all crypto, excluding BTC, as a whole.

What is the Altcoin Season Index?

The ASI measures the performance of the top 50 altcoins in the last 90 days compared to BTC, indicating a current crypto market preference for altcoins.

How do you take advantage of the altcoin season?

To capitalize on the altseason, conduct thorough research, diversify holdings, use technical analysis tools for trade timing, and consider participating in new presales.