The cryptocurrency market has witnessed explosive growth, making it an opportune time to start a crypto exchange. However, this business requires meticulous planning, a solid understanding of the crypto industry, and the proper technological infrastructure.

If you’re intrigued by the potential of the crypto exchange business, you’re not alone. This guide will walk you through the key steps and considerations to successfully start a crypto exchange in 2024.

Key Takeaways

- Launching a successful crypto exchange requires meticulous planning, deep market understanding, and robust security measures.

- Costs can vary significantly depending on factors like development approach, licensing requirements, and security protocols.

- Regulatory compliance is paramount, so choosing the proper jurisdiction for your business is crucial.

- Building a solid business plan, fostering liquidity, and providing exceptional customer support are key differentiators.

Overview of the Crypto Market in 2024

The cryptocurrency market in 2024 continues to show robust growth and innovation. More traditional financial institutions, including banks and investment funds, have welcomed cryptocurrencies, adding them to their portfolios and offering crypto-related financial products. Governments worldwide have implemented more transparent regulatory frameworks, providing more legal certainty for crypto companies and investors. Some regions have become crypto-friendly hubs due to favourable regulations.

Furthermore, DeFi platforms continue to grow, offering financial services like lending, borrowing, and trading crypto without intermediaries. The total value locked (TVL) in DeFi protocols has increased significantly. NFTs have expanded beyond art and collectables into gaming, virtual real estate, and entertainment. Major brands and celebrities are actively participating in the NFT space.

It must be mentioned that several countries have launched or are piloting their CBDCs (Central Bank Digital Currencies), aiming to integrate digital currencies into the mainstream economy.

The total market capitalisation of cryptocurrencies has reached new highs, driven by increased adoption and investor interest. Major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and emerging altcoins contribute to this growth.

Advancements in blockchain technology are ongoing, with developments in scalability (e.g., Ethereum 2.0), interoperability (cross-chain solutions), and privacy (enhanced cryptographic methods). Layer 2 solutions and sidechains are gaining traction to address scalability issues.

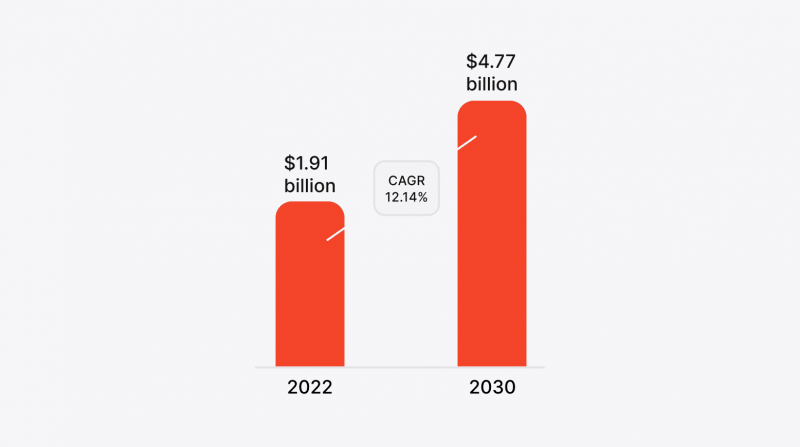

Importance and Opportunities of Starting a Cryptocurrency Exchange

The growing number of cryptocurrency users and investors creates a high demand for reliable and user-friendly trading platforms. Crypto exchanges can provide financial services to unbanked and underbanked populations, especially in regions with limited access to traditional banking.

Crypto exchanges can stimulate economic growth by attracting foreign investment, creating jobs, and fostering technological advancements. They can operate globally, tapping into emerging markets with high growth potential.

Forming alliances with financial institutions, tech companies, and regulatory bodies can enhance credibility and expand the services offered. Utilising advanced technologies like AI for trading algorithms, blockchain for transparency and security, and mobile platforms for accessibility can provide a competitive edge.

The first cryptocurrency exchange was BitcoinMarket, which began operations on 17 March 2010. The site was founded by Bitcoin early adopter Dustin Dollar (USA), who proposed the idea on the BitcoinTalk forum on 15 January 2010.

Steps to Start a Crypto Exchange

Before undertaking the main steps to start your own crypto exchange, conduct thorough market research to understand the current landscape, identify potential competitors (understand their strengths, weaknesses, and strategies, identify gaps and opportunities in the market), and determine your target audience (including demographics, interests, and trading behaviours). Analyse the demand for various cryptocurrencies and trading pairs. This information will guide your business strategy and help you create a unique value proposition.

Step 1. Craft a Compelling Crypto Exchange Business Plan

A well-defined business plan forms the cornerstone of your undertaking and is essential for outlining your vision, strategy, and operational plan. This document should draft your exchange’s unique selling proposition (USP), target audience, competitive analysis, revenue model, marketing strategy, operational plan, and financial projections. This plan will serve as a roadmap and attract potential investors.

Step 2: Choose the Right Type of Exchange

Before starting a crypto exchange, it’s crucial to understand the underlying business model. There are various types of exchanges, including centralised exchanges (CEX), decentralised exchanges (DEX), and hybrid exchanges. Each model has its own set of advantages and challenges.

Centralised Exchanges (CEXs): These platforms act as intermediaries, holding user funds and facilitating trades. Famous examples include Binance and Coinbase.

Decentralised Exchanges (DEXs): DEXs operate on blockchain technology, eliminating the need for a central authority. Users trade directly with each other using smart contracts. Popular DEXs include Uniswap and SushiSwap.

Decide whether you want to build a centralised, decentralised, or hybrid exchange. Centralised exchanges are user-friendly and provide high liquidity but require robust security measures. Decentralised exchanges offer greater privacy and control but can be complex to use. Hybrid exchanges combine features of both and may provide a balanced approach.

Step 3: Define the Legal and Regulatory Requirements

Each country has its own set of laws governing cryptocurrencies and exchanges. Understanding the regulatory framework in the country where you plan to operate is crucial. Determine if the cryptocurrencies you plan to list are considered securities. If they are, you must comply with the securities laws in that jurisdiction. Understand the tax implications of operating a crypto exchange, including corporate taxes, VAT/GST, and taxes on crypto transactions.

For exchanges dealing with international clients, compliance with multiple jurisdictions is necessary. This includes understanding the regulations in each country where your users are located. Familiarise yourself with international standards and guidelines, such as those set by the Financial Action Task Force (FATF), which provides recommendations on combating money laundering and terrorist financing.

Register your business entity in a jurisdiction that is favourable to cryptocurrency operations. This could be a country with clear and supportive crypto regulations. Obtain the necessary licenses to operate a crypto exchange. This can include:

- Money Transmitter License: In many jurisdictions, crypto exchanges are considered money transmitters and require a specific crypto license.

- Crypto Exchange License: Some countries have introduced specific crypto licenses for exchanges (e.g., Malta’s Virtual Financial Assets (VFA) license).

- Payment Services License: If your exchange offers payment services, you might need a payment services license.

Develop and implement robust Anti-Money Laundering policies to prevent illicit activities. This includes monitoring transactions and reporting suspicious activities to relevant authorities. Establish comprehensive Know Your Customer procedures to verify your users’ identities. This typically involves collecting personal information and documentation (e.g., ID, proof of address).

Maintain detailed records of all transactions and user information as required by law. This helps in audits and investigations by regulatory authorities. Conduct regular legal audits to ensure ongoing compliance with all relevant laws and regulations. This can help identify potential issues before they become significant problems.

This step may seem complicated, but feel free to engage with legal professionals specialising in cryptocurrency and financial regulations. They can provide valuable insights and ensure compliance with all legal requirements. Obtain legal opinions on complex regulatory issues, such as the classification of crypto assets and the applicability of securities laws.

Step 4: Determine the Cost to Start a Crypto Exchange and Secure Funding

Launching a successful crypto exchange requires significant financial backing. The cost of starting a crypto exchange can vary significantly based on factors such as technology and development, security, regulatory compliance, marketing, and liquidity provision.

Secure adequate funding to cover the initial setup and operational costs. Consider seeking funding from venture capitalists, angel investors, or through an initial coin offering (ICO). A well-structured crypto business plan will be instrumental in attracting investors.

Step 5. Identify Potential Revenue Streams and Develop a Sustainable Financial Plan

Outline all potential revenue streams, including trading cryptocurrency, withdrawal, listing, deposit, lending and staking fees. List services that can bring you interest rates.

- Charge fees on trades executed on the platform, with different rates for makers (who provide liquidity) and takers (who take liquidity).

- Offer lower fees to high-volume traders to incentivise increased crypto trading activity.

- Charge fees for withdrawing cryptocurrencies from the exchange. These can be fixed fees or variable based on the network conditions (e.g., gas fees for Ethereum).

- Charge projects a fee to list their tokens on the exchange. This revenue stream can be significant, especially for new and popular projects.

- Charge fees for depositing fiat currency into the exchange, mainly if using traditional banking systems.

- Offer margin trading services, where users can trade with borrowed funds and charge interest on the loans.

- Provide lending and borrowing services, earning interest from users who borrow funds.

- Offer staking services where users can earn rewards by locking up their tokens. Charge a fee on the rewards earned by users.

- Facilitate yield farming by providing liquidity pools and charging a fee on the returns generated.

- Offer premium accounts with additional features such as lower fees, advanced crypto trading tools, and priority customer support for a subscription fee.

- Generate revenue through advertising and partnerships with crypto projects and other crypto businesses.

The winning financial plan must include the following:

Revenue Projections: Estimate potential revenue from each stream based on market analysis, user base growth, and industry trends. Use conservative estimates to ensure the financial plan is realistic and achievable.

Cost Analysis: Identify and analyse all costs associated with operating the exchange, including technology infrastructure, regulatory compliance, marketing, personnel, and security. Factor in variable costs such as transaction fees, server, and customer support expenses.

Break-Even Analysis: Calculate the break-even point where total revenue equals total costs. This helps determine the minimum user base and trading volume required for profitability.

Cash Flow Management: Ensure positive cash flow by carefully managing expenses and maintaining sufficient reserves to cover operational costs and unexpected expenses. Plan for periodic financial reviews to adjust the financial plan based on actual performance and market conditions.

Risk Management: Identify potential risks, including market volatility, regulatory changes, and security breaches. Develop mitigation strategies to minimise their impact on the business. Consider insurance options to protect against significant financial losses due to unforeseen events.

Step 6: Choose a Technology Provider

Select a reliable technology provider with experience in building cryptocurrency exchanges. Key features include scalability, security, and a user-friendly interface. Ensure the platform supports multiple cryptocurrencies and trading pairs.

Choose the right technology stack (Programming Languages, Databases) and use blockchain-specific libraries and frameworks like Web3.js, Ethers.js, and BitcoinJ to interact with various blockchain networks.

Infrastructure and hosting are also critical. Use WebSockets for real-time data feeds and updates. Implement monitoring tools like Prometheus, Grafana, and ELK Stack for performance tracking and issue resolution. Use analytics tools for user behaviour analysis and crypto business insights.

Decide which one you prefer: building or purchasing a Trading Platform. Building In-House grants you complete control over features and customisation and offers better security management tailored to specific needs. However, it has higher initial development costs and a longer time to market. Also, it requires a skilled development team and ongoing maintenance.

Purchasing a White-Label Solution advances you with faster time to market, lower initial costs, and reduced development effort. However, it has limited customisation options, and you become dependent on the third-party provider for updates and security fixes.

There is also a Hybrid Approach, where you can combine both methods by purchasing a white-label solution and customising it to meet specific business requirements.

Use end-to-end encryption (E2EE) for data transmission. Encrypt sensitive data at rest using industry-standard algorithms like AES-256. Implement MFA to enhance user account security.

Use cold wallets (offline storage) for the majority of funds to protect against hacking. Keep a smaller portion of funds in hot wallets (online storage) for operational liquidity.

Implement DDoS mitigation solutions and ensure compliance with security standards like ISO/IEC 27001.

By carefully selecting the technology stack, deciding between building or purchasing a platform, ensuring scalability and performance, and implementing robust security measures, a crypto exchange can provide a reliable and secure trading environment for its users.

Step 7: Integrate a Crypto Payment Gateway API

Integrating a crypto payment gateway API is crucial for enabling seamless transactions. A robust payment gateway for crypto exchange ensures efficient deposit and withdrawal processes. Look for providers that offer secure and scalable solutions and support a wide range of cryptocurrencies.

Liquidity is vital for the smooth functioning of a crypto exchange. It ensures traders can buy and sell crypto assets without significant price fluctuations. When starting a crypto exchange, aim to have a diverse range of trading pairs and sufficient liquidity in each pair. Partnering with liquidity providers or market makers can help achieve this. Consider these strategies to ensure adequate liquidity:

- Partner with market makers who are incentivised to provide buy and sell orders, creating a more active trading environment.

- Lower fees can attract more users, leading to higher trading volume and improved liquidity. However, a balance must be found to ensure profitability.

- If you choose a DEX model, create attractive liquidity pools with competitive rewards to incentivise users to deposit their digital assets.

Step 8. Marketing

Define what differentiates your exchange from competitors (e.g., lower fees, superior security, unique features). Develop a strong brand identity that resonates with your target audience, including a logo, colour scheme, and messaging.

Create blog posts, videos, and tutorials that educate users about cryptocurrency, trading strategies, and how to use your platform. Optimise your content for search engines to drive organic traffic to your website.

Utilise platforms like Twitter, Facebook, LinkedIn, and Reddit to engage with the crypto community. Regularly post updates, share news, and interact with users to build a solid online presence. Create and manage active Telegram or Discord groups for real-time communication with your user base.

Partner with influencers in the crypto space to promote your exchange and reach a broader audience. Create an affiliate program to incentivise users to refer others to your platform.

Run targeted ads on social media platforms to reach potential users based on their interests and behaviours. To increase visibility, use display ads on crypto-related websites and blogs.

Partner with new and existing crypto projects to list their tokens on your exchange and co-market to their communities. Collaborate with financial service providers to offer integrated services like fiat on-ramps and crypto loans.

Sponsor or speak at cryptocurrency and blockchain conferences to showcase your platform. Host webinars to educate users about your exchange, trading strategies, and market insights.

Offer sign-up bonuses or free trades to attract new users—Organise trading competitions with attractive prizes to engage users and increase trading activity.

Final Step: Launching the Exchange

Before launching, conduct thorough testing to ensure the platform’s functionality, security, and user experience. Prepare a marketing strategy to create buzz around the launch. Utilise social media, influencers, and industry events to reach your target audience.

On the Launch Day:

- Announce the launch on social media platforms to reach a broad audience.

- Send out email notifications to pre-registered users and subscribers.

- Monitor the platform closely for any technical issues or unusual activity.

- Ensure customer support is readily available to assist users with any questions or problems.

- Offer welcome bonuses or promotional offers to attract new users.

Future Growth and User Acquisition

Your crypto exchange needs a robust business model to thrive in the competitive landscape. Here are some key strategies:

- Offering attractive trading fees can attract users and increase your exchange’s volume.

- Provide a wide range of popular and emerging cryptocurrencies to cater to different investor preferences.

- Cater to experienced traders by offering advanced features like margin trading, staking, and derivatives products (depending on regulations).

- Implement cutting-edge security measures to earn user trust and prevent hacks. Conduct security audits regularly to maintain a strong defence.

- Prioritise user-friendly interface design, intuitive navigation, and efficient order execution to create a seamless trading experience.

- It is paramount to maintain strict adherence to regulations. Invest in a strong compliance team and regularly update your policies to stay ahead of evolving regulations.

- Foster a sense of community around your exchange by engaging with users on social media, hosting educational webinars, and offering loyalty programs.

- Stay at the forefront of technological advancements in the blockchain space and continuously improve your platform with new features and functionalities.

- The crypto market is constantly evolving. Be prepared to adapt your business model and offerings to new trends and user demands.

Remember, building a sustainable crypto exchange business model and fostering a strong community are key differentiators.

The Cost of Starting a Crypto Exchange

The cost of starting a crypto exchange can vary greatly depending on factors such as platform development, licensing and security measures.

Building a platform from scratch is the most expensive option. White-label solutions offer a quicker and more cost-effective approach. Estimated cost is $50,000 – $500,000+ (white-label vs. custom platform).

The cost of acquiring necessary licenses varies based on your chosen jurisdiction and can be approximately $10,000 – $100,000+.

Implementing robust security protocols like multi-factor authentication and cold storage for user funds is essential and can incur significant costs varying from $20,000 to $50,000+.

Other expenses for maintaining a cryptocurrency exchange include ongoing marketing and advertising costs based on your chosen strategy. Additionally, outlays for payment gateway integration, liquidity provision, and customer support should be considered.

- Payment Gateway Integration: Integrating fiat on-ramps and off-ramps allows users to easily convert between cryptocurrencies and traditional currencies. Partnering with a reputable payment gateway provider is crucial.

- Liquidity Provision: Ensuring sufficient liquidity is critical for a healthy exchange. You can achieve this by attracting market makers, offering competitive trading fees, or providing liquidity pools like those in DEXs.

- Customer Support: Building a responsive and knowledgeable team is essential for fostering trust and user satisfaction.

Conclusion

Starting a crypto exchange in 2024 presents a lucrative opportunity but requires careful planning and execution. You can build a successful and secure platform by following these steps and understanding the intricacies of the crypto exchange business. Remember to prioritise security, comply with regulations, and continuously innovate to stay ahead in this dynamic industry.

Starting your own cryptocurrency exchange involves significant planning and investment, but it can be a highly rewarding undertaking with the right approach.

FAQ

How much liquidity should a crypto exchange start with?

You’ll want the average trade in the pool to not cause price swings and slippage.

What is a crypto exchange account?

A cryptocurrency exchange is an online marketplace where users buy, sell, and trade cryptocurrency. Cryptocurrency exchanges work similarly to online brokerages, as users can deposit fiat currency (such as US dollars) and use those funds to purchase cryptocurrency.

Do I need a bank account to exchange crypto?

For storing, sending, and receiving crypto, bank accounts for most wallets are not necessary.

What are the Best crypto exchanges of the year?

After comprehensively reviewing cryptocurrency exchanges, Kraken, Coinbase, and Crypto.com are top picks.