Cryptocurrencies have changed the way people deal with money. Users and businesses are switching to blockchain-based currencies to send and receive funds around the world, benefiting from the advanced characteristics of decentralised ecosystems.

It is not necessary to work in the DeFi sector to utilise these features. In fact, other industries have started integrating crypto payments into their structures. The travel industry benefited from this transition, providing BTC payments and managing user requests through blockchain technology.

The travel and hospitality sectors are primarily involved in online transactions and booking systems, and cryptocurrencies can massively contribute to the growth of these businesses.

So, how can travel industry leverage crypto payments? Where to find the best transaction processing gateways?

Key Takeaways

- Crypto payments enable travel agencies to receive transactions faster, promoting more transparent and secure destination management.

- Using blockchain in the travel and hospitality sector improves the communication between travellers and destinations, boosting confidence and trust.

- Smart contracts ensure user data and personal documentation are stored securely in the blockchain without being tampered with.

Understanding Blockchain Payments

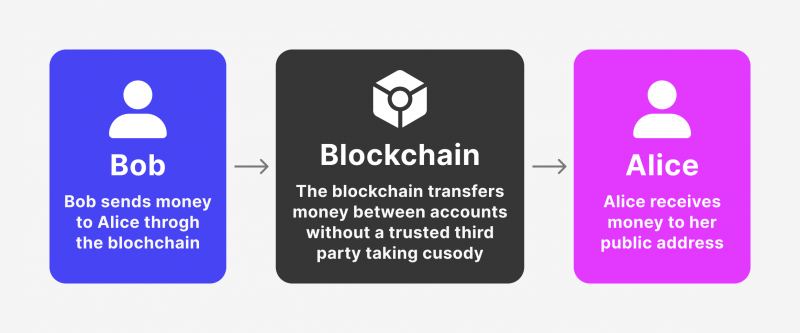

Blockchain payments utilise the decentralised economy to facilitate online transactions without relying on centralised banks and traditional payment methods. Digital wallets play a major part in this process, where cryptocurrencies and private keys are stored.

Bitcoin and Ethereum are the oldest digital currencies with the most prominent ecosystems and use cases. Bitcoin witnessed the most significant valuation, while the Ethereum network has undergone massive security, speed, and interoperability developments.

Stablecoins have become more popular, providing reliable monetary solutions that preserve value and minimise volatility risks. Businesses increasingly use stablecoins to manage their funds, which applies to travel and hospitality industries that deal with online transactions and bookings.

How Crypto Payments Shape The Travel Industry?

Travel and tourism play a major role in some countries’ economies, attracting visitors from all over the globe to visit attractions and increase currency inflows to improve the local economy.

For a long time, the travel sector has used the Internet to request destination information, manage bookings, pay online, verify documents, and issue loyalty rewards to travellers.

However, the advent of decentralisation and blockchain technology has the potential to take the industry to a new level, streamlining operations and boosting transparency.

Simply put, online booking companies can use cryptocurrencies to facilitate instant bookings and the blockchain to verify and safely store user data.

Current Challenges in Travel and Hospitality

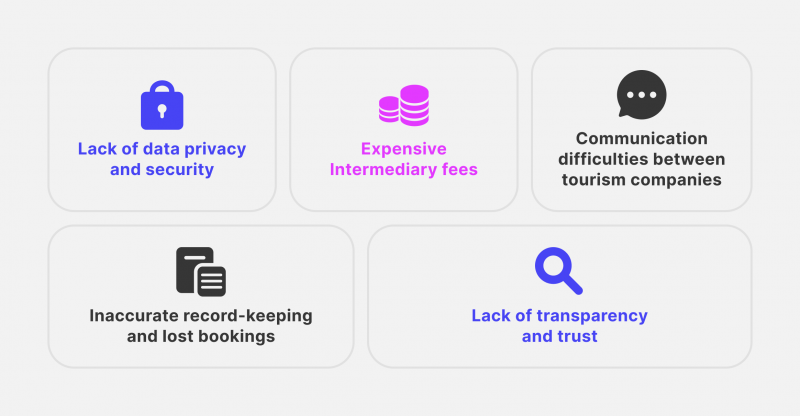

The massive digitalisation of the travel and hospitality sectors has led to a huge increase in the number of OTAs (online travel agencies) and DMSs (destination management systems). However, this development has brought some challenges and complexities to today’s business.

- Low customer privacy and data security as most online booking platforms verify ID documents without proper security protocols.

- Involving multiple payment and exchange institutions for cross-border transactions that involve currency conversion.

- Increased fees coming from the increased number of payment and service intermediaries.

- Complicated paperwork and verification are required to issue loyalty rewards or bonuses.

- Lack of communication between OTAs and hotels.

Why Use Cryptocurrencies in The Travel Industry?

Businesses in different industries increasingly use cryptocurrencies to cater to changing user preferences and offer elevated security systems to transact overseas. Here are five reasons why receiving cryptocurrencies can improve your travel business performance.

Fast Payments

Crypto payments are faster and more reliable than traditional payment methods. Blockchain-based payments are automated and faster than credit card transactions that go through multiple processing and clearing intermediaries, causing prolonged settlements.

Additionally, bank transfers face delays during weekends and holidays, which does not occur in decentralised economies because there is no human factor as the technology relies on smart contracts.

Secure Transactions

Banks collect various personal and occupational information and store it in online databases, increasing the risk of exposure and data leaks. In addition, multiple third-party service providers might access the data to verify these details before passing any transaction.

On the other hand, Web 3.0 wallets do not require personal information to be submitted and can be launched only with private addresses and keys.

Global Reach

Cryptocurrencies are global, and coin prices are almost the same everywhere. On the contrary, sending fiat money across borders faces exchange rates, local currency restrictions and limitations on some internet utilities.

As such, businesses can receive Ethereum from anywhere in the world and store it as ETH or any other currency of their choice without losing value after conversions.

Lower Costs

The lack of financial intermediaries and the ability to overcome currency exchanges lowers the total cost of transacting with cryptocurrencies.

Therefore, users can send money without paying substantial service charges, and businesses can finalise settlements without paying bank handling and commission fees.

In fact, banks are profitable organisations and gain from charging fees, while decentralised ecosystems only imply gas fees, which are used to develop the blockchain network.

Minimising Chargeback Frauds

One of the biggest challenges for e-commerce stores and online businesses is the chargeback scam, where customers fraudulently request a refund for their purchase.

In most cases, the payment processor provider issues the refund at the merchant account’s expense, causing financial losses and reputation damage.

However, crypto payments are immutable, where transactions are registered on the blockchain and cannot be reversed.

Blockchain Use Cases in the Travel & Hospitality Industry

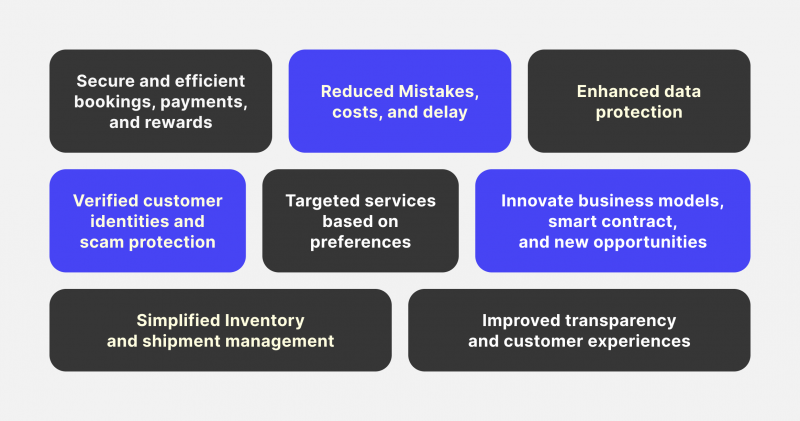

Harnessing the DeFi ecosystem for the travel industry does not only entail paying with cryptocurrencies and storing digital assets. Other Web 3.0 innovations can be used to improve the industry, such as:

Smart Contracts

In current booking and reservation practices, human force is employed to process requests and communicate with hotels and destinations, and there is a chance that when a reservation is requested, the order can be confirmed without being actually booked at the hotel.

However, smart contracts are automated tools that execute when certain conditions are met. As such, when a reservation is requested that matches the destination price and specification, it gets actually reserved without being altered or cancelled.

Identity Verification

Smart contracts can be deployed to carry out document verification much faster. This minimises human error and does not allow for favouritism or illegal practices.

Moreover, identity documents can be stored in a safe blockchain environment without revealing their content to network participants, which is what zero-knowledge proofs provide.

ZK-proofs are security protocols that allow verification while concealing details. They include zk-SNARKs and zk-STARKs, which use cryptographic masks to hide payment details and sender/receiver addresses.

Loyalty Programs

A report revealed that current loyalty programs in the travel industry are ineffective because they are hard to earn and involve lengthy procedures, which makes users uninterested in these benefits.

However, blockchain’s capabilities enable businesses to streamline these programs, simplifying the delivery of loyalty points and bonuses.

How Travel Agencies Can Start Accepting Crypto?

With the increasing trend to adopt digital payments and decentralised transactions in the travel and hospitality industries, now is your chance to keep up with the latest developments and boost your business. Here’s how you can start.

- Do your research on the most reliable crypto payment providers and inspect their license, reputation and coverage area.

- Determine the features and currencies you want to support. BTC and ETH are top currencies, while stablecoins like USDT and USDC are becoming more popular.

- Check out the pricing policies and fee scheme before creating your wallet.

- After the registration, integrate the gateway’s API into your website structure to facilitate crypto payments.

Conclusion

The travel industry is central to many countries, and adopting the most advanced technologies contributes to local economic growth. The recent trends in crypto payments and storing funds in stablecoins have reached the hospitality industry, funding new ways for travellers to pay for destinations and for businesses to receive settlements faster.

Additionally, blockchain technology can improve customer satisfaction by providing a faster and safer identity verification process that relies on smart contracts.

Using blockchain-based tools to transact and manage destinations can massively increase your reach, attract more customers, and boost your business growth.