In economic markets where digital coins lead the new financial era, terms like bulls, bears and whales are taking centre stage. Today, we will talk about crypto whales, explain their essence and discover the 10 biggest whales in modern reality.

Key Takeaways

- Crypto whales hold significant amounts of cryptocurrency, influencing market dynamics and occasionally manipulating the actions of other traders.

- Prominent figures, institutional leaders and crypto exchange CEOs play pivotal roles in the crypto space. Their strategic decisions, including significant investments and corporate treasury allocations, set precedents and impact market liquidity.

- Tools like WhaleAlert and statistical analyses help monitor whale activities.

Who Are The Crypto Whales?

A crypto whale, simply put, is an entity that owns a significant amount of cryptocurrency. These entities can range from individuals and groups of enthusiasts to investors, organisations, and even blockchain wallets.

Unlike the average trader, crypto whales operate on a massive scale, influencing the market’s volatility and occasionally manipulating the actions of other traders.

The Crypto Whales’ Impact on Market Dynamics

Delving deeper into the complexities of whales, it becomes evident that their impact extends beyond mere Bitcoin ownership. These entities, whether individuals or organisations, often utilise their vast holdings for various strategic purposes. Let’s discuss the leading players.

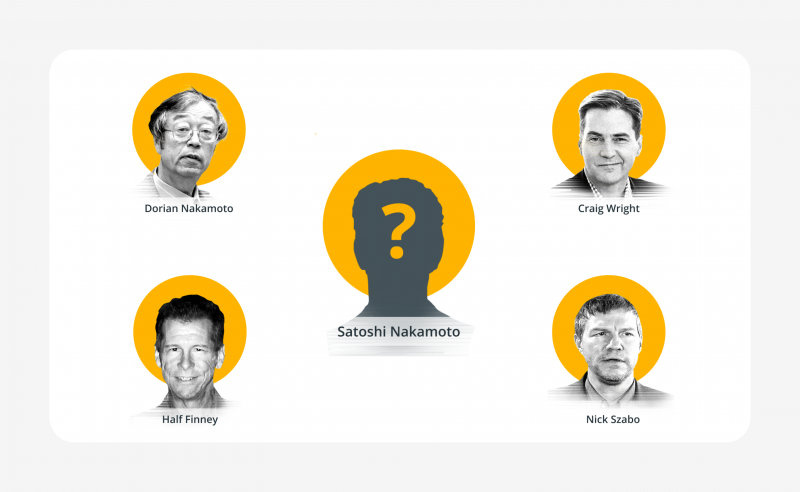

Satoshi Nakamoto’s Influence

Satoshi Nakamoto, the elusive creator of Bitcoin, not only holds a substantial fortune in Bitcoin but also wields significant influence over the broader cryptocurrency community. The mere potential of Satoshi’s Bitcoin holdings entering the market could send shockwaves through prices and investor sentiment.

The decision to keep these coins dormant has sparked debates within the community. Some argue that a sudden release could destabilise the market, while others speculate on the potential positive impact of putting these coins into circulation.

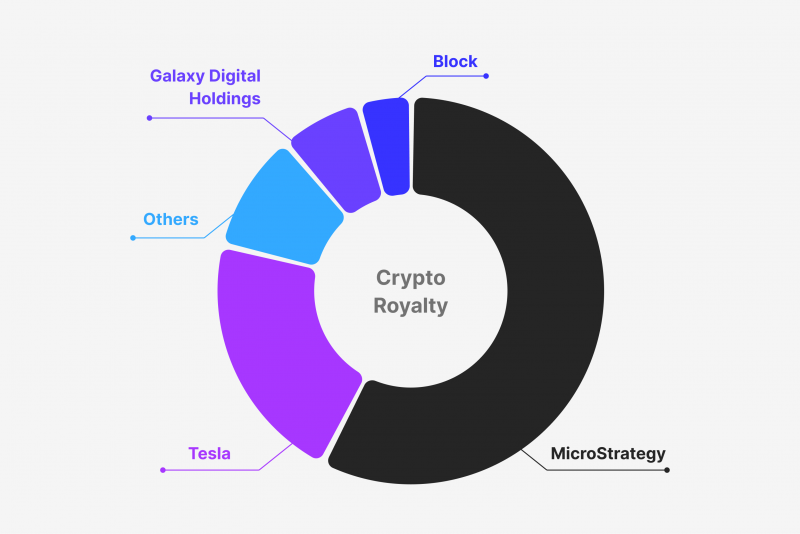

Institutional Whales: MicroStrategy and Tesla

Michael Saylor, the CEO of MicroStrategy, and Tesla, led by Elon Musk, represent a new breed of institutional whales. MicroStrategy’s bold move to allocate a substantial portion of its treasury into Bitcoin holdings, followed by Tesla’s decision to do the same, has reshaped the narrative around corporate treasuries.

These strategic moves have bolstered the companies’ balance sheets and activated discussions about cryptocurrencies’ role as a hedge against inflation and a store of value. The actions of such institutional whales set precedents for other corporations contemplating a similar path.

Largest Crypto Exchanges and Their Leaders

Crypto exchange leaders carry considerable influence. Apart from personal holdings, these leaders guide the direction of major trading platforms, impacting market liquidity and determining the availability of various cryptocurrencies for trading.

Their decisions, whether introducing new listings or changing trading policies, can lead to significant price fluctuations.

The interconnectedness of exchanges with the broader crypto market makes their influence crucial to the ecosystem’s stability.

The Challenges and Importance of Identifying Crypto Whales

Determining the largest cryptocurrency holders is a challenging task due to the inherent anonymity of blockchain transactions. While some well-known figures in the crypto space are recognised as significant players, the exact identity and holdings of many Bitcoin whales remain wrapped in mystery.

In a bid to uncover these mysteries, various tools such as Bitcoin whale trackers, alerts, and statistical analyses are employed. Platforms like WhaleStats and WhaleAlert enable enthusiasts to monitor large movements of cryptocurrencies on the blockchain, providing a glimpse into the activities of these elusive whales.

Identifying the top BTC whales is intriguing, but understanding how they use the market is equally important. The individual who owns the most Bitcoin often has an extensive background in finance and plays a crucial role in determining market trends.

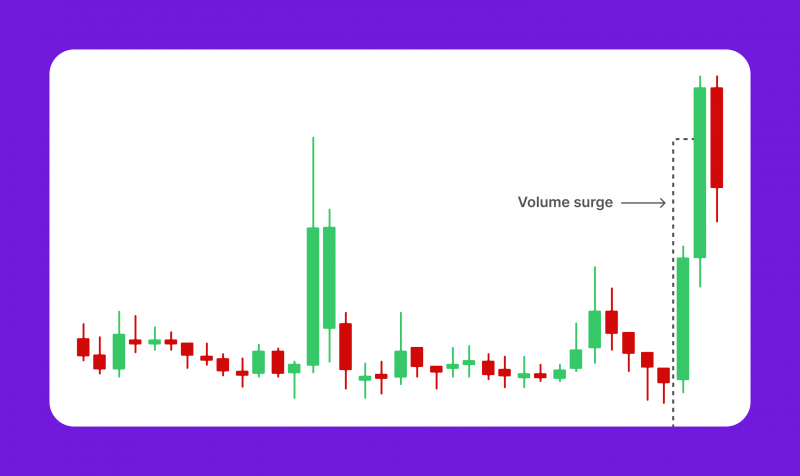

While the actions of most BTC whales often align with strategic investment decisions, the potential for market manipulation cannot be ignored.

The sheer volume of crypto assets at their disposal allows whales to execute trades that can sway prices in their favour. Coordinated movements among whales can sometimes create artificial trends, misleading other market participants.

An infamous case involving Tesla highlights the potential for market manipulation. A false rumour on Twitter about Tesla selling its Bitcoins led to a market collapse. The lesson learned is that tracking whale movements, while informative, should not be the sole indicator of market growth or decline.

Aware of the whales’ influence, traders closely monitor large transactions for potential signals about the market’s direction. However, it’s essential to approach such observations with caution. Genuine market sentiment and long-term trends may differ from short-term fluctuations caused by the actions of a few prominent whales.

Regulatory bodies worldwide are working towards establishing guidelines that ensure a fair and transparent crypto market. When implemented thoughtfully, regulations can help mitigate the risks associated with whale-induced volatility. However, striking a balance between fostering innovation and safeguarding market integrity remains an ongoing challenge for regulators.

Use tools like Whale Alert, Dex Check and Etherscan to identify crypto whales. Then, add their addresses to platforms like DeBank or Zerion to track their on-chain portfolios and transactions easily.

The Titans of the Crypto Ocean – 10 Biggest Crypto Whales

The narrative of Bitcoin whales has evolved over the years. Initially dominated by individual enthusiasts and early adopters, the landscape now includes institutional players, corporations, and blockchain wallets. Here are the 10 Largest Crypto Whales in modern reality:

1. Satoshi Nakamoto – The pseudonymous creator of Bitcoin, Satoshi Nakamoto, is believed to hold approximately 1 million Bitcoins, making him potentially the biggest crypto whale with a staggering value of around $19.2 billion.

2. Changpeng Zhao – As the former CEO of Binance, Changpeng Zhao is considered a significant Bitcoin whale, with his crypto holdings estimated to be around $65 billion, although specific details about his assets are not publicly disclosed.

3. Michael Saylor – An American entrepreneur and one of the largest Bitcoin whales, Michael Saylor owns over 17,732 Bitcoins, valued at more than $1.14 billion. His company, MicroStrategy, also holds a substantial Bitcoin reserve.

4. Chris Larsen – Co-founder of Eloan and Ripple, Chris Larsen holds at least 5.19 billion XRP, amounting to a net worth of approximately $37.3 billion.

5. Brian Armstrong – As the CEO of Coinbase, Brian Armstrong’s personal crypto holdings contribute significantly to his estimated net worth of $6.5 billion.

6. Vitalik Buterin – Co-creator of Ethereum, Vitalik Buterin is a major Ethereum whale with holdings that include approximately 355,000 Ethereum and other substantial coin holdings.

7. Tim Draper – Venture capitalist Tim Draper, known for his significant Bitcoin investment, holds a crypto portfolio estimated to be valued at over $1 billion.

8. Winklevoss Twins – The Winklevoss twins, famous for their early Bitcoin investment, are considered prominent Bitcoin whales, with a portfolio of approximately 70,000 Bitcoins and various other cryptocurrencies.

9. Barry Silbert – Through his Digital Currency Group and Grayscale, Barry Silbert manages a portfolio of crypto assets worth over $28 billion, including Bitcoin and Ether.

10. Jed McCaleb – As one of the co-founders of Ripple, Jed McCaleb holds approximately 3.4 billion XRP, valued at around $1.6 billion.

It’s crucial to note that these Bitcoin whales’ holdings are subject to change due to market fluctuations and their own investment strategies. The highly volatile nature of the cryptocurrency market also leaves room for new whales to appear and reshape the landscape.

Conclusion

The world of Bitcoin whales is ever-evolving, shaped by technological advancements, regulatory developments, and market trends. As blockchain technology continues to gain acceptance, the crypto landscape will likely witness the appearance of new influential players.

Whether these are visionary entrepreneurs, institutional investors, or decentralised autonomous organisations (DAOs), the dynamics of whales will play a pivotal role in shaping the industry’s trajectory. Understanding their motivations, actions, and the broader implications of their influence is crucial for all participants in the crypto-verse.