The blockchain trilemma is the assumption that decentralised systems are capable of providing only two of three benefits at any given time in terms of security, scalability and decentralisation.

Layer 1 blockchains such as Bitcoin have faced the problem of scalability, that is, the degree of throughput expressed as a measure of the speed and efficiency of processing transactions over a while.

As the number of users and simultaneous payment operations increase, operating on a Layer 1 blockchain can become very slow and expensive.

To develop the scalability of Bitcoin, Layer 2 blockchains (solutions) were invented, the most popular of which are currently Liquid and Lightning Networks.

This article will do a comparative analysis of liquid vs lightning networks and explain how each is organised.

Key Takeaways

- Liquid Network is Bitcoin’s sidechain for fast, cheap and confidential transactions and the issuance of digital assets such as stablecoins, tokenised shares and other financial instruments.

- The Lightning chain protocol is a Bitcoin scaling system that is one of the solutions to the problem of its limited bandwidth. It can be used to conduct almost instantaneous coin transfers with minimal fees.

What is Liquid Network?

Liquid Network is a layer 2 sidechain that allows digital assets to be settled and issued on the Bitcoin blockchain. These can be stablecoins, security tokens and other financial instruments.

Liquid Network enables BTC traders to make faster, more private settlements and enjoy many other technological innovations in exchange for operating under a different security model.

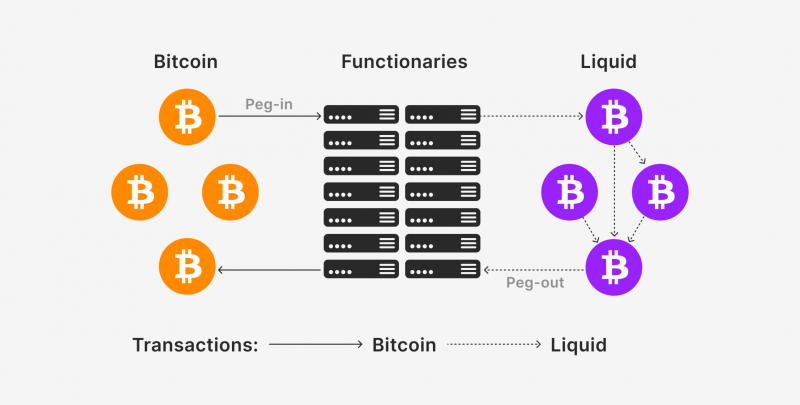

Liquid is a sidechain that allows for Bitcoin transfers in and out of the system through a cryptographic peg. When Bitcoin is pegged into Liquid, it’s called Liquid Bitcoin (LBTC).

The Liquid ledger moves forward, and custody of the underlying Bitcoin is controlled by a federation. As long as over two-thirds of its members remain honest, the system will remain secure.

The Liquid chain can support the creation of new assets that are native to the sidechain. These assets can be exchanged via multi-asset transactions in a secure and atomic manner.

Additionally, all assets on the network, including Liquid Bitcoin and Issued Assets, have consistent one-minute block times and are cryptographically confidential concerning asset types and transaction amounts.

The Liquid chain also supports Bitcoin Script and protocols built on top of it, such as the Lightning project, as well as script extensions that enable advanced features like covenants, keytrees, and more.

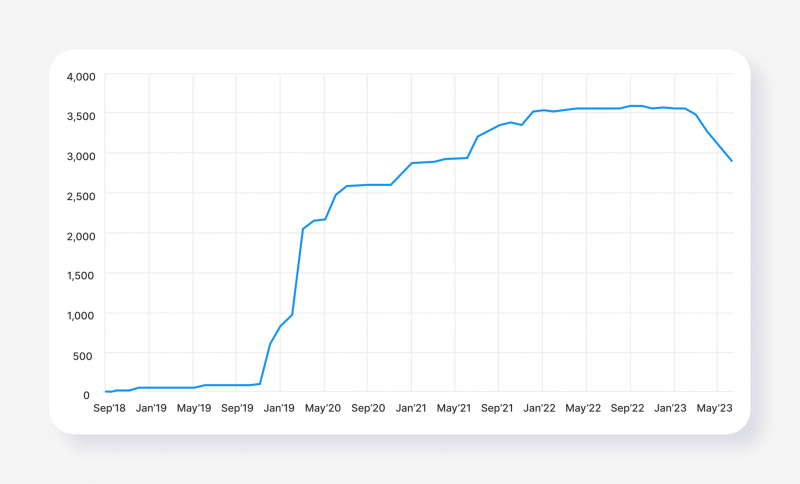

The Liquid Network project has a token. It is called L-BTC and is pegged to BTC in a 1:1 ratio. As of this writing, there are approximately 3,570 L-BTC in circulation. The primary and most profitable way to use the token is on the Lightning chain, which provides relatively high transaction speed and throughput compared to the Bitcoin distributed ledger.

In addition, Liquid Network users can also use L-BTC in other applications that support Liquid Network, such as for loans or purchasing security tokens.

The Liquid chain is based on the Lightning Network. As a Liquid Network, the Lightning system provides lightning-fast and extremely cheap BTC transactions but has more limited functionality than the first network.

What is Lightning Network?

Lightning Network is another Layer 2 scaling solution that addresses the scalability issues of the Blockchain, the leading coin on the market. It provides instant and low-cost asset transactions, making them more efficient and accessible to users. Compared to Bitcoin network transfers, Lightning network transactions are private, occurring offline, and only the total result is recorded on the BTC blockchain.

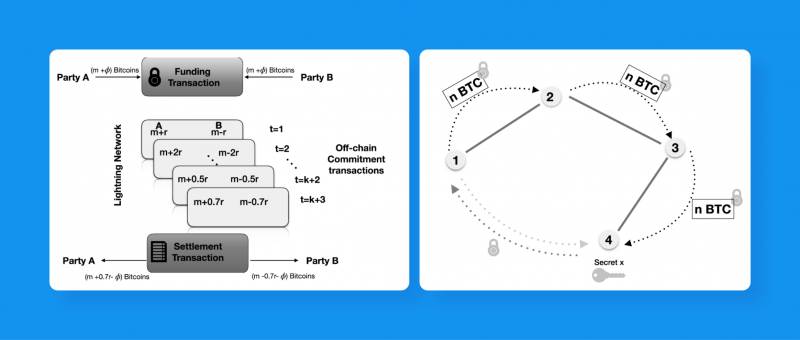

The Bitcoin Lightning Network uses the Multisig mechanism to ensure the security of payment channels. Participants need to lock funds and set up payment channels. As a result, they can make fast and inexpensive payments within the channel without sending transactions to the Bitcoin blockchain every time.

A payment channel is a relationship between participants outside the Bitcoin blockchain that is achieved by signing a series of transactions within the channel and then processing them to the particular lighting wallet.

The Bitcoin Lightning system uses payment channels based on Hashed Timelock Contracts (HTLC) to implement a routable multi-junction payment channel system. The HTLC implementation requires a complex transaction script defined in a scripting language to meet the hashing and time-blocking conditions.

This script will initialise when a payment channel is opened and run at payment time. In this way, the Lightning Network in the Bitcoin network ensures the efficiency and security of inter-network payments.

Liquid vs Lightning Networks — How Different Are They?

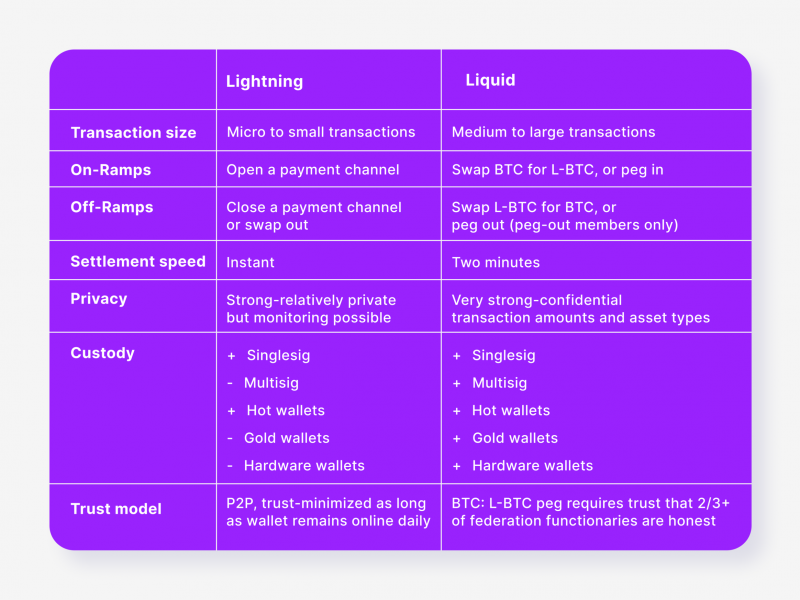

While both scalability solutions for the Bitcoin chain discussed above aim to push the boundaries of Bitcoin’s capabilities and make transactions within its network faster and more efficient, they differ in several ways that highlight their specific features and practical applications. Below is a comparative analysis of each of them by each criterion.

1. On- and Off-Ramps

The opening and closing of Lightning channels represent the inputs and outputs of Lightning. Thus, several users must add a multi-signature address to transact in this network. Once the funds are received, they can only be accessed with the private keys of both users of the payment channel, provided both signatures are present.

To complete a transaction in the Lighning network, a fully synchronised BTC node and a concurrent Lighning node will need to be started, which must be functional in the network as long as the payment channel is open.

To create Liquid Bitcoin (L-BTC), it’s needed to initiate an on-chain transaction similar to creating a Lightning channel. It’s required to transfer BTC to a Bitcoin address and temporarily lock them.

The output of this operation can be used to unlock an equivalent amount of L-BTC on the Liquid Network, which can be transacted according to Liquid’s protocol rules.

2. Trust Model

The Lightning sidechain enables transactions to be secured by the Bitcoin chain without being directly broadcasted to it. Whenever there is a change in channel balance, both users of a Lightning channel co-sign it, and either user can choose to broadcast a settlement transaction whenever they want.

Suppose both parties constantly monitor the channel state via their node or wallet service. In that case, this makes Lightning highly trust-minimised since neither channel’s users need to rely on each other to transact.

Liquid’s trust system is built around a federation of 15 hardware security modules (HSMs) connected to host servers called functionaries. For the BTC: L-BTC two-way peg to operate effectively, it requires at least two-thirds of the Federation functionaries to act honestly.

Although some level of trust is still necessary, the distributed Federation model is far more trustworthy than the trust model that most traders rely on, where they have to entrust their funds to a single exchange.

3. Speed

Payments through the Lightning chain are speedy. As they don’t need confirmation on the blockchain, they can happen as quickly as your internet connection allows, potentially allowing millions of transactions per second. Therefore, if channels are available to process the desired payment size, the rapidity of transactions is one of the most significant advantages of using Lightning.

Liquid ledger produces blocks to verify transactions, making transactions slower than Lightning. However, it is still faster than the Bitcoin blockchain. New Liquid blocks are generated every minute, which is ten times faster than the Bitcoin block. To consider a transaction settled, two confirmations are necessary. This means that Liquid transactions take approximately two minutes.

4. Custody

Users of the Lightning chain must keep their keys online until a channel is closed. This requires ongoing monitoring and rolling backups. Although there have been no known hacks, attackers can steal sensitive information and private keys when nodes are online.

It is worth noting that multisig Bitcoin storage cannot be done on Lightning, which means that funds can only be controlled by a single key. This is not the best option for storing large amounts of Bitcoin or for institutions that do not want a single individual to have complete control over their funds.

Liquid allows users to store their keys offline in cold storage, providing an added layer of security. This means funds can only be stolen with physical access to the private keys.

Additionally, Blockstream Green enables Liquid users to utilise a hardware wallet, which keeps their L-BTC private keys permanently offline, providing even more protection for their funds.

Multisig is also supported by Liquid, which is similar to BTC. This feature enhances security for individual users and enables institutions to establish shared control over their L-BTC wallet.

5. Transaction Size

The Lightning system is designed to handle small to medium-sized operations. To send payments, users must find a pathway of Lightning channels through the network connecting them to the recipient.

However, the size of payment that each Lightning channel can process is limited by the size of the initial funding transaction used to create it. As transaction size increases, it becomes less likely that a complete pathway from buyer to seller will be found, making the Lightning chain less reliable for large transactions.

The Liquid Network is designed for processing medium to large transactions. Unlike Lightning, Liquid operates via a sidechain, a unique blockchain that allows users to transact with tokens that can be exchanged for BTC called Liquid Bitcoin (L-BTC).

Users can perform transactions of any size on the Liquid Network. Theoretically, up to 21 million BTC can be transacted. Moreover, recipients do not need to prepare any channels in advance; they can receive as much as the sender can send.

6. Privacy

The Lightning project offers users a higher level of privacy than on-chain operations with BTC. This is because Bitcoin on-chain transactions can be monitored in real-time. Lightning payments are routed through multiple nodes, making it impossible for the receiver or relay node to determine the exact source of the transaction.

In contrast to on-chain payments, Lightning payments do not leave a permanent record on an immutable blockchain. This feature poses a significant challenge for an attacker attempting to compromise the transaction’s privacy, requiring them to forward the transaction to deanonymise it. Such a process renders it virtually impossible to recover any information later.

The Liquid Network has a unique cryptographic protocol developed by Blockstream known as Confidential Transactions that ensures the confidentiality of the transferred funds and assets. Thus, unlike a Lighting system, the amount and type of transferred asset are not disclosed to anyone except the sender and the receiver.

Conclusion

The conducted liquid vs lightning network comparative analysis shows that each of these BTC layer 2 solutions has its own advantages and disadvantages, as well as peculiarities of functioning within the framework of use in practice to ensure a single goal – to increase the throughput capacity of the BTC network and improve its flexibility in the issues of transaction processing speed and costs.