The world of crypto is by far the youngest sector in the financial and tradable assets family across the globe. Racking up just a little over a decade since its inception, the crypto industry is in its teenage years. Therefore, cryptos are experiencing sizable price shifts and valuation bumps or decreases far more often than conventional industries.

To put it simply, this sector hasn’t morphed into its final shape, and there are numerous opportunities to reap profits from the highly uncertain crypto conditions. Bull runs are on the top of the list for lucrative crypto gains, and by all accounts, the next crypto bull run is all but inevitable. Let’s explore the nature of a bull run and how you can profit from its emergence.

Key Takeaways

- Bull runs signify the massive upward movement of prices within the crypto market.

- Bull runs signal that the market has more demand than supply and that the price growth will be sustained for an extended period.

- There have been two major bull runs in the crypto field – in 2017 and 2021. Both trends ended in crypto winters for different reasons.

- The following crypto bull run is all but here, and there are several important steps to consider in the upcoming investment frenzy.

What is the Crypto Bull Market?

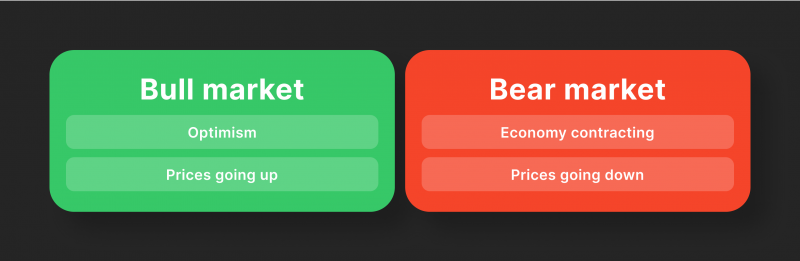

A bull market is a fascinating term tied to another crypto market phrase – the crypto bears. Both phrases were coined to describe the massive shifts in the crypto space, whether significant gains in valuation or enormous price drops.

The bull market is named after the bull’s horns thrusting upwards, symbolising the increasing price trend and aggressive investments. On the other hand, the bearish market is named after the bear’s claws coming down, visualising a downward motion of prices and investment activities.

The bull run is not exclusive to the crypto markets; it is a famous phrase in the entire trading landscape. Aside from the rising prices and active investment patterns, bull runs also signal that the market demand far outweighs the current supply.

Additionally, to classify as a bull run, the entire market appreciation must happen over time. In other words, small price spikes that last a few days do not qualify as bull runs. As for the bearish market, everything is in reverse order – investments falter, demand plummets, and prices go down.

Exploring the Crypto Bull Runs History

The blockchain industry has experienced several crypto bull markets in recent years. Filtering out the lesser cases, two significant previous bull runs happened in 2017 and 2021. In both cases, flagship crypto assets like Bitcoin, Ethereum and other popular altcoins have witnessed unprecedented value spikes, racking up growth numbers that haven’t been seen in conventional trading sectors.

First Bull Run

The reason behind the 2017 bull run was quite straightforward – it was the coming out party for the Bitcoin and cryptocurrency market in general. Before 2017, most of the general public was unaware of blockchain technology or virtual currencies. Once the public became educated about this subject and understood the potential price gains from holding crypto tokens, the market blew up in several weeks.

The retail investors researched the crypto growth numbers and swiftly realised that this sector could yield unparalleled returns. Soon, the entire public was swept up in the crypto fever, starting a global movement of aggressive investments. As a result, the crypto scene became an overnight sensation.

The Second Bull Run

In 2021, the world was still in recovery from the devastating COVID-19 pandemic. However, the interest rates worldwide decreased to encourage spending and improve global economic conditions. Combined with the recently surging popularity of NFTs, the crypto market returned and once again appreciated beyond the wildest expectations. Another significant force here was the emphasis on promising projects that explored the metaverse and Web 3.0 concepts. However, the industry suffered heavy losses shortly after the ridiculously profitable 2021.

How Long Does a Crypto Bull Run Last?

Normally, a bull run should last anywhere from a few months to an entire calendar year. The last bull run was approximately seven months, helping Bitcoin and other flagship cryptos reach unprecedented valuation heights.

The length of a bull run depends on various factors, including the economic, political and business conditions that revolve around the current climate. For example, the 2021 bull run was heavily influenced by the relaxed and subsequently tightened interest rates supervised by the FED, USA’s primary financial authority.

Once the interest rates were increased to combat the onset of inflation, the crypto bull run of 2021 came to a screeching halt. On the other hand, the failing NFT and Web 3.0 projects also resulted in the downfall of the crypto bull run. In the end, most currencies fell to their former prices. Some coins even plummeted further, with Bitcoin going as low as $20,000 at its low point.

When is the Next Crypto Bull Run?

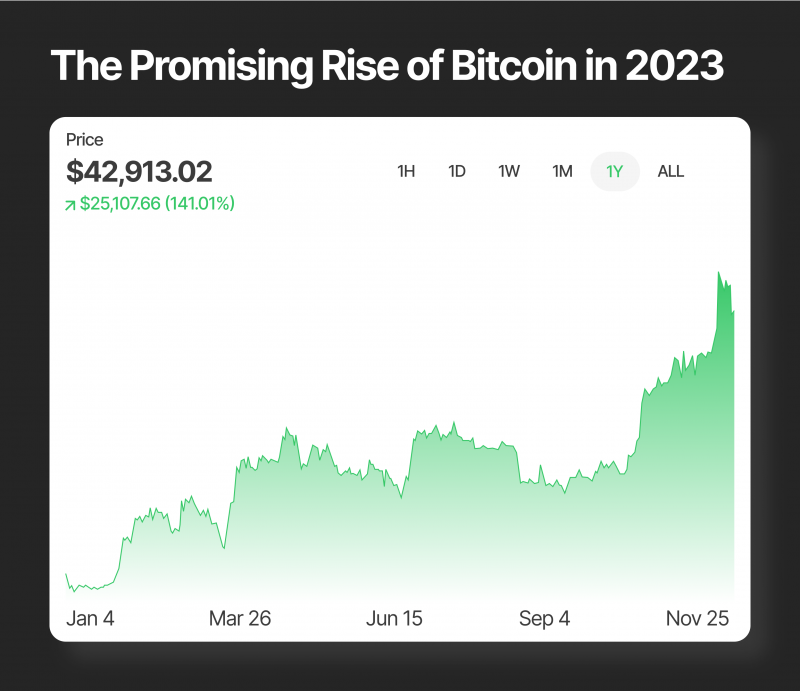

The crypto industry has recovered impressively after the 2022 collapse and a subsequent bear market. The market trends slowly shifted from hype-driven and questionable projects to fintech solutions, payment tokens and value-driven startups. As of December 2023, the next crypto bull market run is already on the horizon, with Bitcoin going up as high as $41,000 in the last few weeks.

Other altcoins are following suit, and the market is preparing for an aggressive investment run. While the economic and political factors have been quite challenging in the last two fiscal periods, the start of 2024 is promising regarding reduced inflation, relaxed interest rates and increased investment spending.

In short, all signs indicate an imminent bull run that may have already been triggered in December. The momentum accumulated by Bitcoin has been impressive thus far, gaining 120% growth valuation in most of the current year, and many experts believe that the trend will continue to grow stronger in the coming year. Some experts even go as far as to claim that Bitcoin could be worth $100,000 by the end of 2024.

Which Bull Run Token is the Most Promising?

Usually, the most obvious choice for bull run investments is Bitcoin itself, closely followed by Ethereum. These significant coins are the most backed and protected from various market dangers, including volatility and, in some instances, bankruptcy. However, several attractive alternatives exist if your risk tolerance levels are higher and you wish to enrich your crypto portfolio with potential moonshot projects.

Both Solana and Cardano are great candidates for bull run investments, backed by innovative technology and tangible utilities. They do not share the biggest weakness of Bitcoin, which is the speculative nature and lack of any real-life benefits.

Solana is gaining significant traction thanks to the resurgence of value-driven NFT and Web 3.0 projects. However, both investments are risky and could result in substantial losses if the bull run turns bearish due to unforeseen consequences.

While many believe that only bull markets are profitable in the crypto landscape, numerous traders can benefit from bearish trends if they invest in short options.

How to Prepare for the 2024 Crypto Bull Run

There are numerous strategies that go well with the current bull market. Investors generally follow two distinct methodologies – the rising tide of investments and the law of averages.

The former implies buying low and selling high. Investors should enter the bull market immediately and implement candlestick analysis to get close to a market shift. Once the prices are likely to reach the apex position, it is time to sell and reap the profits.

Conversely, the law of averages states that no bull run will sustain its top prices forever, and the market will likely come down at some point. In this instance, investors are motivated to purchase short options and simply wait out the bull run. This strategy is much longer but has proven a safer choice considering the historical data of crypto market bull runs.

Regardless of the strategy, there are several steps you should take to aptly prepare for the bull run and remain in the loop of the hectic market developments. Let’s explore.

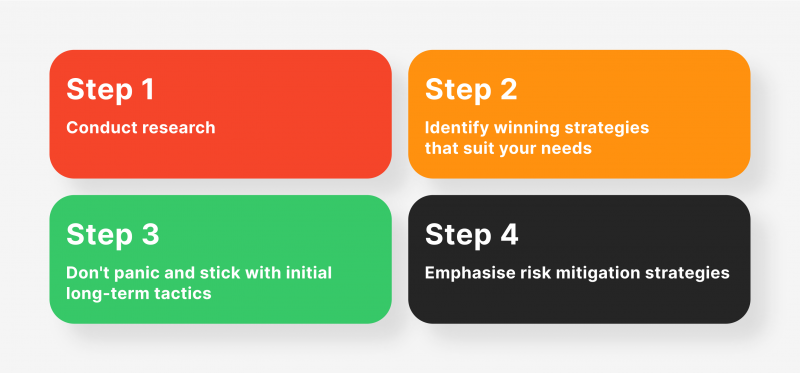

Step # 1 – Conduct Thorough Research

Every bit of business in the crypto sector starts with diligent and comprehensive research of potential investments and corresponding strategies. As a young market still being actively developed and nurtured, the crypto industry presents a lot of vital information you should learn daily.

Bull runs are no different, requiring full-stop research and market sentiment analysis. First, you should be aware of the false bull run possibilities, where the price trends and investment patterns only spike for a short time. Without research, you might falsely assume the bull run is in full swing.

Secondly, it is well documented that the most value-driven and vetted crypto projects have the best chance to withstand the inevitable bearish market after the bull run. So, it is imperative to research each of the altcoins very carefully. While Bitcoin, Ethereum, and stablecoins are well-publicised and transparent, other lesser-known coins will require more extensive and diligent research. Although this process might be time-consuming, it is worth the effort and acts as an excellent tactic to mitigate risks. Acquiring valuable insights will help you understand the market better and employ timely adjustments to your tactics.

Step # 2 – Identify Your Preferred Strategy

As discussed above, two general directions for strategies are long and short approaches, but there are many variations between these extremes. Theta gang strategies, social trading options and even arbitrage opportunities could be lucratively utilised during a bull run. So, it is important to choose your preferred strategy or a potent mix of several different tactics that complement each other well.

Before committing to any single technique, you should carefully examine a technique’s type and functionality. Numerous beginner traders suffer losses due to not understanding their chosen trading mechanisms or strategies completely. Thus, it is crucial to educate yourself on the intricacies of complex trading strategies and grasp their nature completely.

Theta gang strategies are a good example, requiring precise timing and execution to reap profits. If traders don’t understand the correct signals and triggers needed to execute the theta gang wheel, they will lose their entire investment. The high stakes of bull markets further amplify the risks associated with misunderstanding the complex trading tools and approaches. Therefore, trading strategies during a bull run should be studied carefully and comprehensively.

Step # 3 – Don’t Panic Due to Fluctuations

Arguably, the most crucial skill in any trading sector is having appropriate patience and staying calm in the face of market volatility. While bull runs tend to have positive trends, the road toward growth can become bumpy at a moment’s notice.

The candlestick charts are a good representation of such fluctuations and should be carefully studied since not all downward trends signal the start of a bearish trend.

Sometimes, the bumps and roadblocks are due to free market movements caused by the mass investment strategy changes. Thus, it is prudent to stay patient during uncertain times and have a firm understanding of your trading timeframe.

Not all strategies will yield positive results immediately, and you must exercise patience within reason. Naturally, research and awareness are still necessary here, as sometimes the market volatility could be a legitimate cause for concern.

Step # 4 – Employ Risk Mitigation Strategies

Finally, the bull runs are highly uncertain market shifts that have numerous inherent risks tied to them. Risk mitigation is crucial when entering a bull market, as the price movements are charged beyond normal expectations.

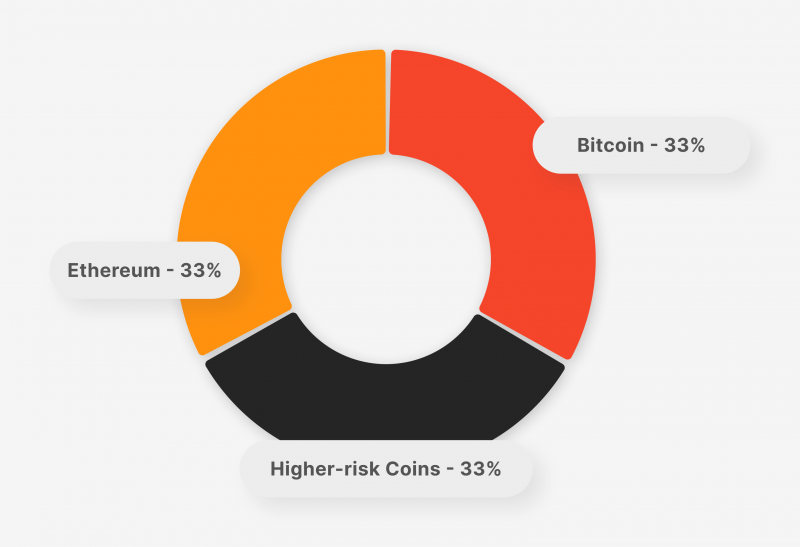

Therefore, even a tiny market adjustment could cause a ripple effect that instantly reverses your bull run profits. Therefore, diversifying your crypto portfolio and employing other risk mitigation strategies is necessary.

Bull runs are more favourable to certain crypto coins than others. In many cases, it is prudent to have a portfolio that has a healthy balance of established flagship coins and experimental altcoins. It is also great to separate assets by their sectors or technological qualities.

For example, utility-based and speculative tokens could be an excellent opportunity to diversify your portfolio. This way, even if one asset class falters, the other investments will not be affected adversely.

Closing Remarks

Bull runs are fascinating events that thoroughly sweep the crypto market, shaking up the foundations and testing the resilience of the flagship coins. By all accounts, the next crypto bull run is in its early stages, and 2024 could be the year of exponential growth.

While the situation is exciting for crypto investors, it is important to stay diligent, conduct thorough research and stay in the loop of the latest events. After all, bull runs could be extremely dangerous if mishandled or taken lightly, leading to irreversible portfolio losses in worst-case scenarios.

FAQ

Which is the greatest crypto bull run round?

The 2021 bull run was by far the most significant crypto price growth in history, helping Bitcoin to reach the unprecedented $70,000 mark. However, the following crypto winter was arguably even more devastating.

Has the crypto bull run started?

While there are early signs of growth, the crypto bull run has yet to enter the main phase, as the current crypto growth numbers are promising but do not qualify as bullish market trends.

How can I prepare for the next crypto bull run?

From ample risk mitigation strategies and diversification methods to ongoing research and trading know-how, bull runs require various skills to be mastered.